KEYTAKEAWAYS

- Regulatory Philosophy - Focuses on Hong Kong choosing stability over speed through bank-level standards

- Institutional Screening - Explains the ecosystem transformation from Web3 inclusivity to institutional control

- Strategic Positioning - Frames the cooling as deliberate positioning for long-term global competitiveness

CONTENT

Concise summary highlighting the shift from euphoria to strategic cooling in Hong Kong’s stablecoin regulation.

Preface

Since RWA became a hot narrative in 2025, I have been conducting research in this sector.

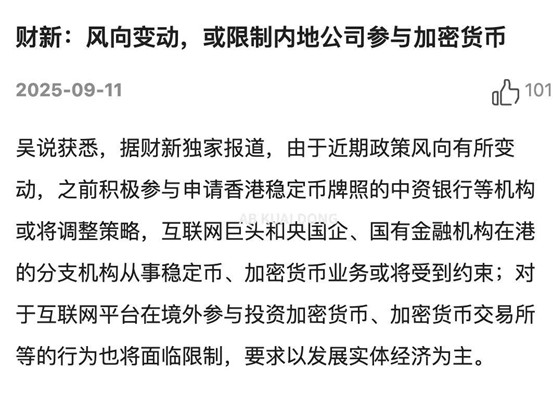

When the RWA trend swept from on-chain to off-chain, reaching even those of us deep in mainland China through everyday conversations, I briefly believed that policy was about to take a major turn.

During the summer, Hong Kong’s stablecoin narrative attracted intense attention within crypto circles, particularly in Chinese-speaking communities, with discussions widespread enough that related videos even appeared on TiTok.

However, looking back from Q4, one cannot help but feel the loneliness and desolation of a northern late autumn.

From the “policy window” at the beginning of the year to the “licensing rush” mid-year, and now to “cooling and observation,” within just a few months, market sentiment shifted from euphoria to composure, and regulatory attitudes transformed from openness to prudence, as if changing with the seasons.

Those entrepreneurial teams that initially believed policy would “loosen the tap” ultimately found themselves shut out, while traditional financial institutions re-emerged at the forefront of this institutional reorganization.

Why did Hong Kong’s stablecoin regulation undergo such a rapid transformation from “hot” to “cold” in such a short time? Was it market retreat caused by regulatory stalling, or a strategic rhythm behind deliberate cooling?

Does the policy “pause button” signify emerging risks, or the beginning of a new strategic deployment?

These questions not only concern Hong Kong’s position in the Web3 landscape but also reflect a larger epochal proposition:

Against the backdrop of accelerating financial digitalization and geopolitical competition, how should Hong Kong balance “innovative freedom” and “institutional trust”?

This article attempts to examine the evolution of Hong Kong’s stablecoin policy over the past several months from three dimensions—policy trajectory, market reaction, and institutional logic—analyzing the deeper reasons behind regulatory tightening and assessing its impact on the local ecosystem and international competitive landscape.

I believe this cooling is neither accidental nor erroneous, but rather a necessary self-calibration in Hong Kong’s process of constructing an “institutionalized digital financial system.”

The following chapters will unfold sequentially through four logical points—phenomenon observation, causal analysis, deep impact, and risks versus opportunities—attempting to answer three core questions:

- Why did Hong Kong’s regulatory attitude shift from open to prudent in the short term?

- Is this “cooling” a natural result of market cycles or an inevitable product of institutional thresholds?

- Will strict KYC and high capital requirements weaken Hong Kong’s competitiveness in the Web3 ecosystem?

These questions concern not only Hong Kong’s policy positioning but will also determine the institutional landscape of Asian crypto finance. Note that the article’s goal is neither to praise regulation nor to criticize the market, but to understand market choices from different perspectives.

Chapter 1: Phenomenon Observation—Market Overheating and Policy Contraction

After the Stablecoin Issuance Ordinance officially took effect in August, Hong Kong’s financial market experienced a rare surge of excitement.

The regulator’s original intention was to establish trust boundaries, but the market misread it as an opening signal.

Within just a few weeks, almost every institution related to virtual assets began evaluating whether to “rush in early.”

According to data released by the HKMA, the ordinance received nearly forty letters of intent in its first month, covering banks, payment institutions, technology groups, and local startups.

Standard Chartered Bank, HKT, and Animoca Brands announced preparations for Hong Kong dollar stablecoin cooperation; Ant International, WeLab, and JD Technology also successively expressed hopes to become among the first issuers.

Orders for law firms and accounting firms surged, and the capital market even exhibited excitement over “regulatory arbitrage.” In August, Hong Kong almost treated “stablecoins” as the engine for the next wave of financial innovation.

This enthusiasm did not stem from regulatory guidance but was a typical case of “narrative-driven” momentum.

After experiencing the virtual asset volatility of 2023-2024, the market generally craved policy certainty. The ordinance’s implementation was misread as “official backing”—implying that risks had been absorbed and the regulatory environment was clear.

However, the HKMA’s actual intent was never so optimistic.

The ordinance’s institutional design strictly followed “financial infrastructure” standards, with emphasis on constraints rather than stimulus.

In early September, market enthusiasm began cooling rapidly. The HKMA issued supplementary notice requests to the first batch of applicants, requiring submission of reserve asset structures, liquidity test reports, and independent custody agreements. This round of detailed review made applicants realize that regulatory thresholds were not as negotiable as imagined.

Guotai Junan International decided to suspend its project after internal meetings, BOC International’s fintech department reduced investment, and Cyberport-incubated Transcend Pay and Amber Tech directly withdrew applications. Law firms generally estimated that for an institution to meet ordinance requirements, initial compliance costs could reach eight figures in Hong Kong dollars.

What followed was a reversal in public sentiment.

In mid-September, the Hong Kong Economic Journal first proposed the term “regulatory cooling period,” while the Hong Kong Economic Times analyzed reasons for the licensing rush’s decline with the headline “From Innovation Window to Compliance Track.”

In early October, HKMA Deputy Chief Executive Darryl Chan stated at a fintech forum: “Our goal has never been to issue more licenses, but to issue the right licenses.” This statement was seen as the official tone-setter and completely reversed market expectations—regulation would not pursue quantity, much less prioritize speed.

Thus, Hong Kong’s stablecoin narrative entered its second phase: from “policy dividend” to “regulatory test.”

Throughout this process, capital, sentiment, and confidence ebbed simultaneously. Business for lawyers, auditors, and compliance consultants did not decrease, but meeting topics changed from “how to apply” to “how to wait.”

Investors began shifting attention from stablecoins to more stable areas such as RWA, digital bonds, and custody services.

The market came to understand that the HKMA aimed to build not an “innovation center” but a “trust firewall.”

This rhythm change was not accidental.

Hong Kong’s policy mechanism has always emphasized “establishing institutional boundaries first, then opening market space.” After implementing the stablecoin ordinance, regulatory authorities adopted a “prudent trial” strategy, advancing the application process in stages, with each batch of applications requiring additional liquidity and governance stress tests.

The HKMA stated in an October public document: “The significance of the licensing system lies not in quantity but in maintaining system credibility.” This means Hong Kong’s stablecoin market will maintain a long-term structure characterized by low speed, small quantity, and high quality.

Within just two months, the market completed an emotional reversal and a cognitive correction.

Initial optimism was based on misunderstanding; subsequent composure stemmed from reality.

Hong Kong’s regulatory logic never changed; it was just that the market finally learned to understand it—stablecoins are not a new growth story but an extension of the old order.

The process from hot to cold was essentially the process of regulation regaining discourse power. The retreat of the boom was not failure but a deliberate contraction: it filtered out short-term speculators and retained institutions truly capable of bearing institutional responsibility.

The “cold” of this phase is Hong Kong’s starting point for institutional reconstruction.

Chapter 2: Causal Analysis—Regulatory Logic and Market Misalignment

The turning point in Hong Kong’s stablecoin policy was not an emotional “policy tightening” but a logical repositioning.

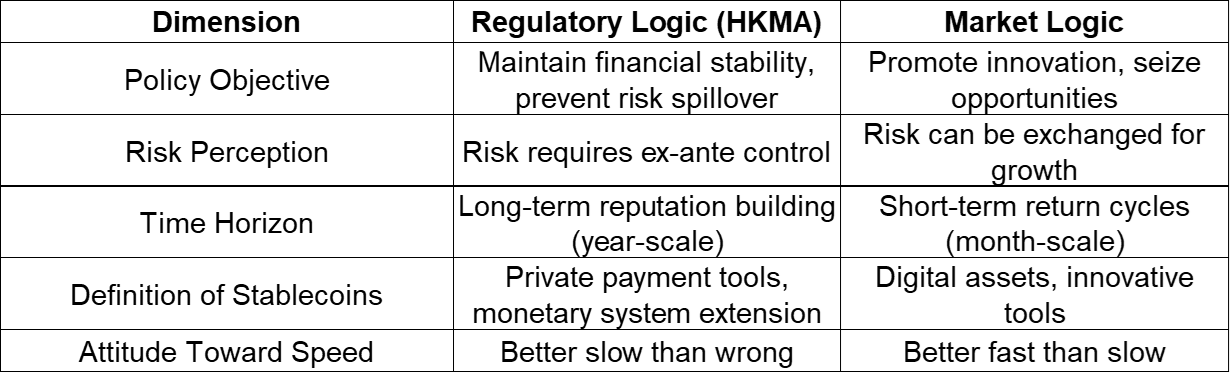

The HKMA and the market stood on different coordinate systems from the beginning: the former prioritizes “systemic stability” as its primary objective, while the latter prioritizes “innovative efficiency.”

Both logics are correct, but they cannot coexist within the same timeframe.

From the regulator’s perspective, stablecoins are not “fintech products” but rather a form of “currency substitute.”

Internally, the HKMA defines them as “private clearing instruments with exchange relationships to the Hong Kong dollar system,” meaning their stability directly affects monetary policy and banking system security.

Therefore, regulation’s task is not to encourage issuance but to prevent mismatch risk expansion. Chapter 4 of the ordinance stipulates that issuers must maintain full reserves, daily redemption capacity, and accept third-party independent custody and regular audits.

This standard far exceeds the market’s early expectations of a “virtual asset licensing system” and more closely resembles a “banking supervision” framework.

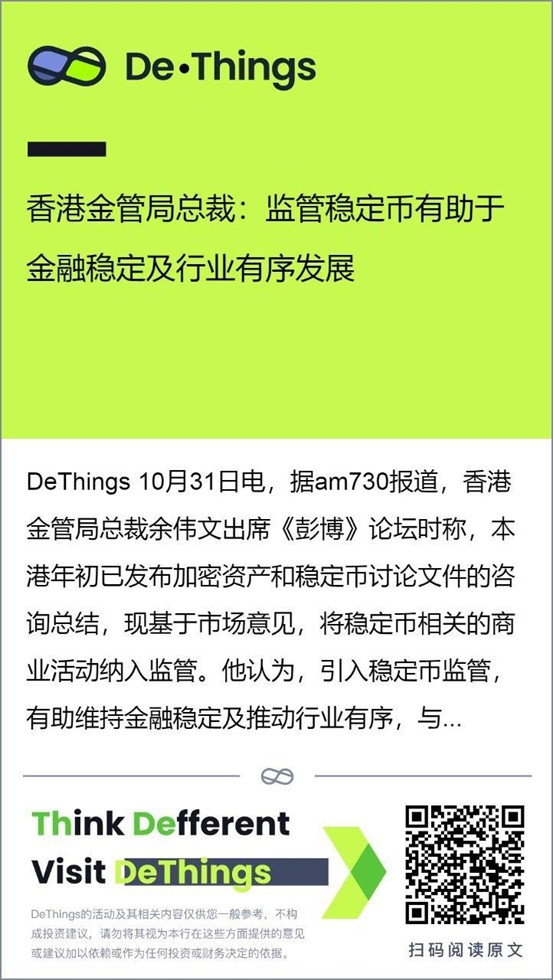

HKMA Chief Executive Eddie Yue emphasized in an August 2025 interview with the South China Morning Post: “We will not allow any stablecoin without redemption capacity to be issued in Hong Kong. Regulation exists to prevent stablecoins from becoming shadow banking.” This statement nearly encapsulates the HKMA’s policy philosophy—regulation does not slow innovation but ensures innovation does not threaten systemic trust.

However, the market understood a completely different story.

In the eyes of entrepreneurs and investors, the stablecoin ordinance symbolized “policy opening.” It provided a clear compliance path and seemed to herald renewed prosperity in the Web3 sector. Many fintech companies interpreted it as a signal of “government support for the crypto economy,” even viewing licenses as new asset narrative tools.

This optimistic sentiment drove August’s licensing rush but also planted seeds of cognitive bias.

The core conflict between the two logics can be simplified in the following table:

From an institutional logic standpoint, the HKMA’s direction contains no contradiction.

It continues Hong Kong’s longstanding “risk-based regulation” tradition: set institutional ceilings first, then leave experimental space for the market.

This approach resembles that of the UK’s FCA and Singapore’s MAS—the difference being that Hong Kong’s capital market is highly open with concentrated liquidity; once regulatory errors occur, risk contagion speed will far exceed other regions.

The HKMA’s “caution” is essentially a defensive response to the financial system’s high leverage characteristics.

But for the market, this “institutional rationality” is perceived as “missed opportunity.” Entrepreneurial teams are more accustomed to rapid trial-and-error in ambiguous zones rather than waiting for approval within compliance frameworks.

Investment institutions hoped policy would create high-liquidity windows like Hong Kong’s 2017 fintech experiment, not erect high barriers.

This misalignment in timing and mindset caused regulation’s “prudence” to be perceived in the short term as “conservatism” and misread as policy contraction.

In fact, Hong Kong’s legislative path is closely related to its macro strategy.

Over the past three years, Hong Kong has gradually constructed a complete crypto asset regulatory system through exchange licensing, custody systems, and tax guidance. The stablecoin ordinance is the final and most sensitive link in this system.

The HKMA knows well that if it “fumbles” at this stage, the institutional credibility established earlier will suffer systemic damage.

Therefore, the regulator chose to firmly bet on safety in the trade-off between speed and security.

Policy-level misalignment was further amplified at the implementation level.

Entrepreneurs focus on application cycles, license numbers, and capital thresholds; regulators focus on information disclosure, liquidity coverage ratios, and cross-border exchange risks.

Both are “pushing Hong Kong forward,” but not in the same direction.

The market pulls outward, regulation contracts inward—this tension constitutes the entire logic of the cooling cycle.

This misalignment is not necessarily bad.

It brought Hong Kong back to a long-neglected proposition—innovation must be built on institutional trust, not narrative momentum.

Regulation gained certainty, the market lost speed, but certainty itself is capital’s scarcest asset.

Through high-standard access requirements, the HKMA reshaped the market pricing method for “trust”: institutions able to issue stablecoins in Hong Kong in the future will necessarily possess sound financial capacity, governance architecture, and international reputation.

The essence of cooling is not regulation suppressing innovation but Hong Kong proactively calibrating innovation rhythm. The misalignment between regulation and market is not contradiction but rebalancing.

In this process, Hong Kong lost short-term momentum but gained long-term credit.

Read More:

The Stablecoin Hype Fades: Hong Kong’s Moment of Regulatory Composure 2