KEYTAKEAWAYS

-

Sei blockchain’s TVL surpasses $683 million, led by top protocols Yei Finance, Takara Lend, and Sailor, reflecting strong DeFi ecosystem momentum.

-

Yei Finance dominates Sei’s TVL with over 50% market share, driven by lending features, NFT integrations, and strategic liquidity incentives.

-

Sei’s technical innovations like Twin-Turbo Consensus and upcoming Giga upgrade position it as a high-performance DeFi chain rivaling Solana and Ethereum.

CONTENT

Sei blockchain, a high-performance Layer-1 chain designed specifically for decentralized finance (DeFi) and trading applications, has rapidly emerged in the crypto space thanks to its impressive transaction speed and parallel processing capabilities.

It is often compared to other high-throughput blockchains such as Solana.

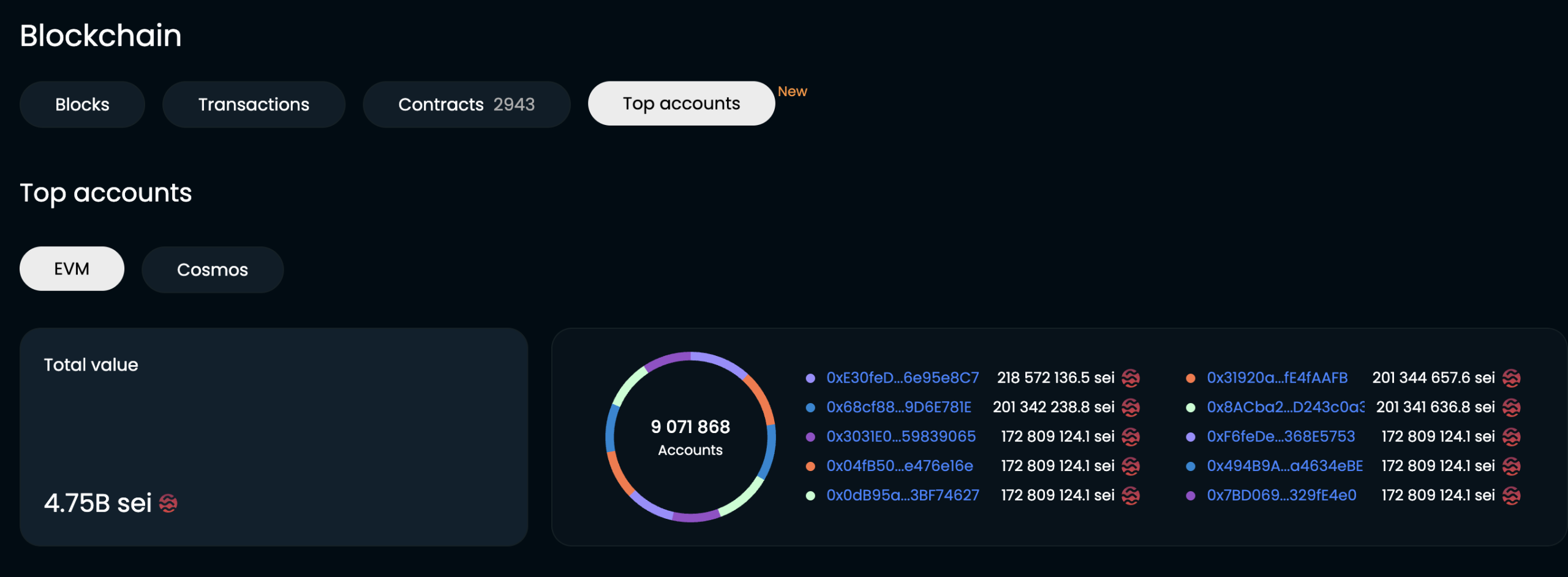

According to DefiLlama data, as of July 16, 2025, the total value locked (TVL) in the Sei ecosystem has reached approximately $683.73 million, showcasing strong growth momentum in the DeFi sector.

This article will take a deep dive into the top three protocols by TVL on the Sei blockchain, exploring their functions, contributions to the ecosystem, and their significance for Sei’s future development—offering a coherent narrative of the vibrancy and potential of Sei’s DeFi landscape.

SEI BLOCKCHAIN: A PERFORMANCE PIONEER FOR DEFI

Built on the Cosmos SDK, Sei blockchain is optimized for DeFi and trading scenarios.

It features a parallelized Ethereum Virtual Machine (EVM) compatibility layer, sub-400 millisecond block finality, and potential throughput of up to 200,000 transactions per second (TPS).

Its core innovation lies in the “Twin-Turbo Consensus,” a mechanism that combines high throughput with low latency, enabling it to handle complex on-chain transactions without compromising efficiency.

Additionally, the upcoming Giga upgrade is expected to boost performance further, aiming for a throughput of 500 million gas per second.

This would make Sei’s speed and cost performance comparable to Web2 applications, all while preserving decentralization.

These technical advantages have attracted a large number of developers and capital, laying the groundwork for Sei’s DeFi ecosystem—exemplified by the top five TVL protocols.

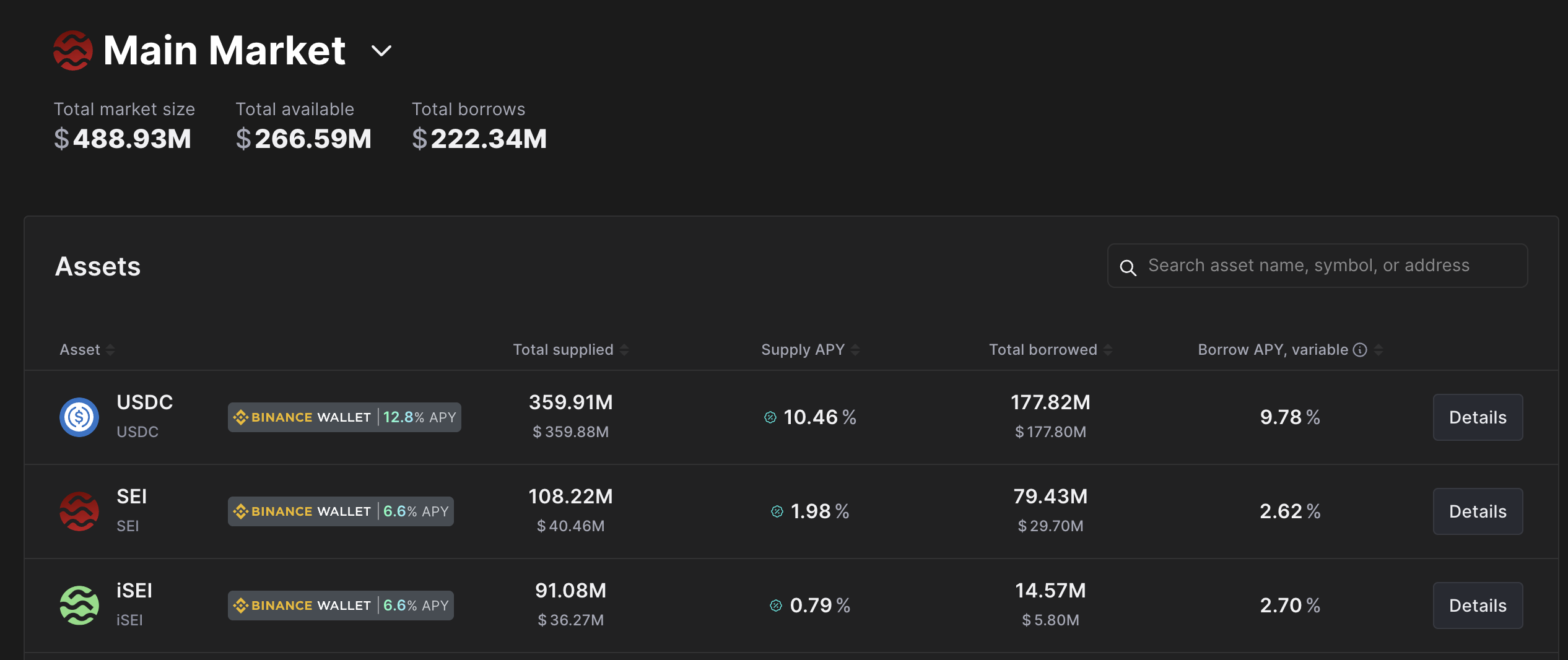

YEI FINANCE: A MAINSTAY OF THE MONEY MARKET

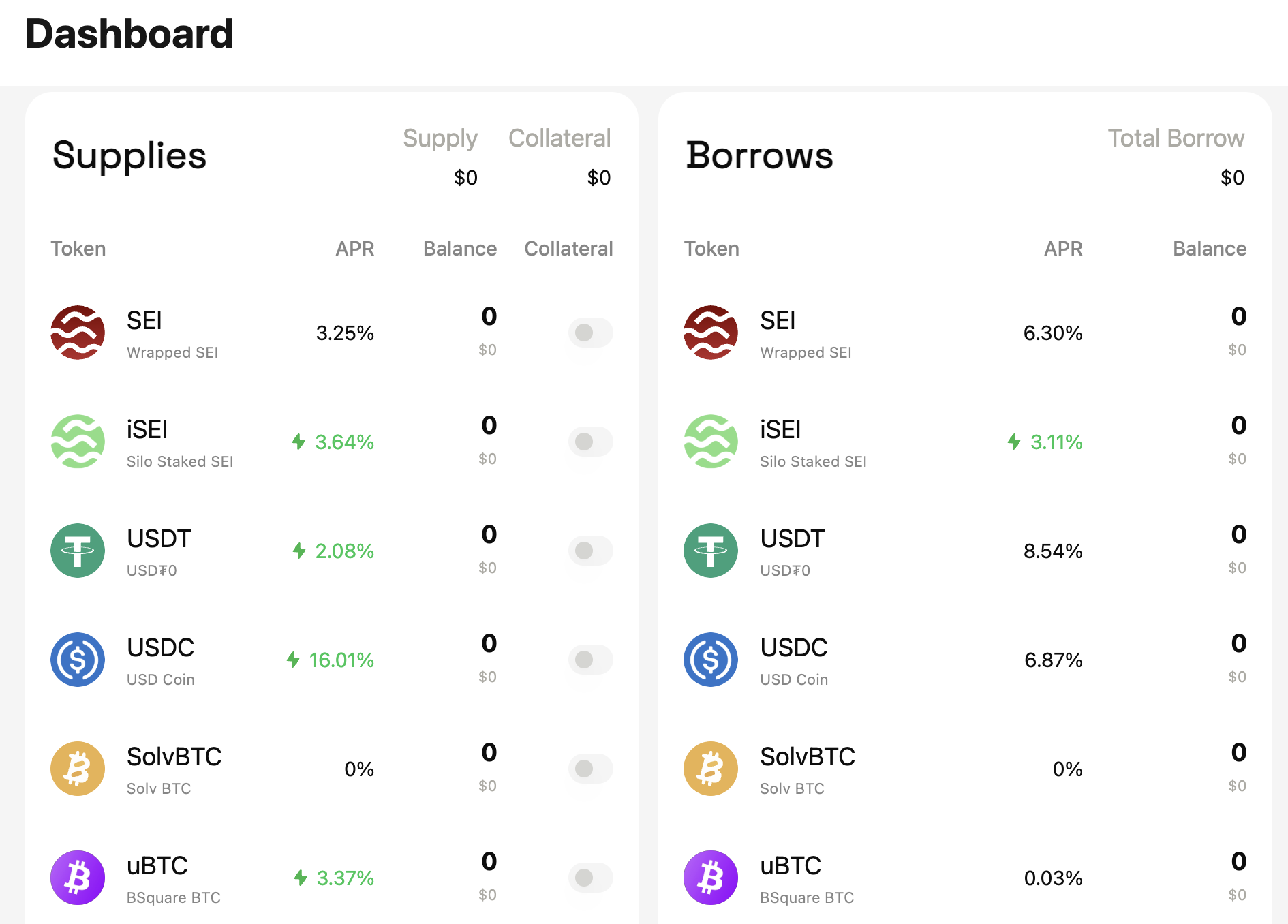

Yei Finance ranks first in the Sei ecosystem with a TVL between $381 million and $386 million, accounting for more than 50% of the total network TVL.

It serves as a cornerstone of Sei’s DeFi scene. As a non-custodial decentralized money market, Yei Finance offers overcollateralized lending, dynamic interest rate adjustments, and diversified yield opportunities such as staking and liquidity mining.

Its success stems not only from Sei’s high throughput and low latency but also from carefully designed incentive programs.

For instance, in late 2024, Yei Finance attracted a massive influx of users through the YeiSwap Private Beta and integration events with YeiLiens NFTs, propelling its TVL from $60 million to nearly $400 million.

Furthermore, the protocol secured $2 million in funding, bolstering its market position.

Its community-driven model and continuous liquidity incentives have not only boosted user engagement but also injected steady capital into the Sei ecosystem, becoming a key engine for TVL growth.

TAKARA LEND: A BENCHMARK FOR LENDING EFFICIENCY

Takara Lend holds the second position with a TVL of approximately $98.43 million and stands as another major player in the lending sector within Sei’s ecosystem.

As a decentralized, open-source money market, Takara Lend focuses on digital asset lending, fully leveraging Sei’s high-performance architecture to offer fast and low-cost transaction experiences.

Its design emphasizes liquidity and user efficiency, delivering a streamlined interface and seamless on-chain operations.

Takara Lend’s consistent performance highlights Sei’s strength in handling high-frequency financial transactions. Its synergy with Yei Finance further solidifies Sei’s leading role in the lending market.

By providing reliable lending avenues, Takara Lend appeals to investors seeking capital efficiency and contributes significantly to the diversification of the Sei ecosystem.

SAILOR: THE TRADING ENGINE OF THE DEX ECOSYSTEM

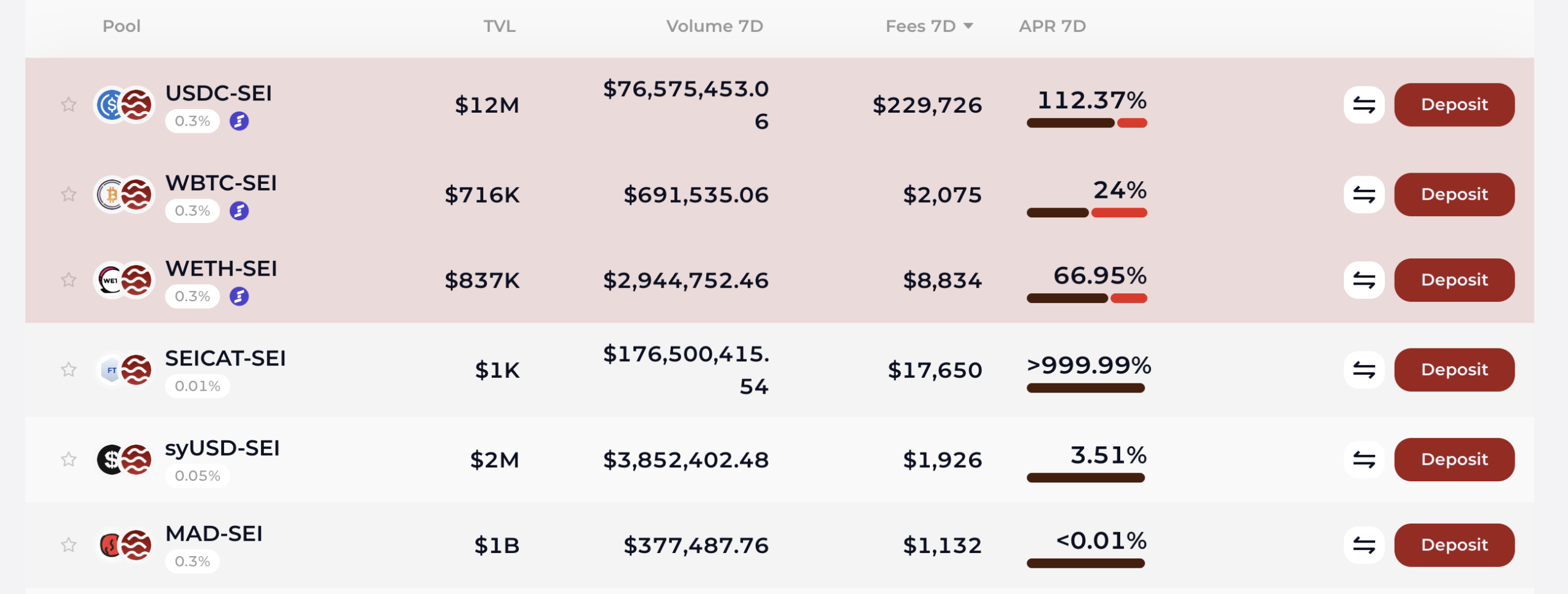

Sailor, the main decentralized exchange (DEX) on Sei, ranks third with a TVL between $83.24 million and $86.79 million, making it an essential trading hub in the ecosystem.

Sailor supports efficient token swaps and generates an annualized trading fee income of up to $14.78 million, reflecting high activity within Sei.

Thanks to Sei’s parallel processing and low latency, Sailor delivers a trading experience close to that of centralized exchanges while maintaining the security and transparency of decentralization.

This high-performance experience has attracted a large number of traders and liquidity providers, driving up Sei’s on-chain trading volume.

Sailor’s success not only enhances the ecosystem’s liquidity but also contributes to the overall growth of Sei’s TVL through stable trading volume and fee income.

As the liquidity center of the ecosystem, Sailor offers users a convenient token exchange platform and provides a foundation for integration with other DeFi protocols.

GROWTH DRIVERS AND FUTURE OUTLOOK OF THE SEI ECOSYSTEM

Sei blockchain’s TVL has surged from $60.8 million at the beginning of 2024 to nearly $684 million in July 2025—an increase of over 10 times—highlighting the explosive development of its DeFi ecosystem.

This achievement is rooted in its technical edge, ecosystem diversity, and strong community support.

Sei’s parallelized EVM and Twin-Turbo Consensus enable it to excel in handling high-frequency transactions and complex financial scenarios, spurring the rapid growth of protocols like Yei Finance and Sailor.

At the same time, a diversified layout of lending, DEXs, and liquid staking protocols meets various user needs—from yield seekers to liquidity providers—offering rich use cases within the ecosystem.

Support from institutions and the community further fuels Sei’s momentum. Canary Capital’s SEI ETF application and Sei Labs’ continued investment in ecosystem projects signal strong market confidence in Sei’s potential.

Although the SEI token experienced a 30% price drop in May 2025, the network’s 900,000 active addresses and steadily growing TVL demonstrate its resilience and expanding user base.

Looking ahead, the Giga upgrade is set to enhance Sei’s performance even further, potentially making it competitive with leading chains like Solana or Ethereum in the DeFi space.

Ongoing innovation from protocols like Yei Finance and Takara Lend, along with emerging players such as SiloStake and Dragon Swap Sei, will inject new vitality into the ecosystem.

However, rapid growth also comes with risks, including smart contract vulnerabilities and market volatility. Users should exercise caution by choosing reputable protocols and monitoring real-time data from platforms such as DefiLlama.