KEYTAKEAWAYS

-

TokenFi reframes token issuance from a one time event into a repeatable capability, shifting the focus from speed and speculation to structure, safeguards, and long term asset survivability.

-

By embedding compliance and real world asset logic directly into its workflow, TokenFi positions itself away from meme driven launch platforms and closer to infrastructure that can support durable on chain assets.

-

TokenFi’s community driven origins create productive tension rather than weakness, forcing continuous execution while providing real early usage that many RWA focused platforms struggle to achieve.

- KEY TAKEAWAYS

- THE PROBLEM WITH HOW CRYPTO LEARNED TO ISSUE TOKENS

- TOKENFI AND A DIFFERENT ASSUMPTION ABOUT TOKENIZATION

- WHEN SPEED CEASES TO BE A COMPETITIVE ADVANTAGE

- REAL WORLD ASSETS AS A FORM OF SELF DISCIPLINE

- COMMUNITY ORIGINS AND STRUCTURAL TENSION

- THE QUESTION THAT WILL DEFINE TOKENFI

- DISCLAIMER

- WRITER’S INTRO

CONTENT

THE PROBLEM WITH HOW CRYPTO LEARNED TO ISSUE TOKENS

For most of crypto’s history issuing a token has been treated as a moment rather than a system.

From ICOs to DeFi liquidity mining to the recent wave of meme launch platforms the industry focused on speed and access. Each cycle lowered barriers and shortened timelines. But none of them truly addressed a deeper issue. If tokens are meant to represent long lived assets or economic rights how should they actually be created and maintained.

This was never just a technical problem. It was a structural one.

As issuance became easier responsibility quietly disappeared. Contracts were deployed faster but rarely understood. Assets appeared overnight but vanished just as quickly. The industry learned how to create tokens but never learned how to sustain them.

This unresolved gap set the stage for a different kind of platform to emerge.

TOKENFI AND A DIFFERENT ASSUMPTION ABOUT TOKENIZATION

TokenFi enters this gap with a fundamentally different assumption.

Instead of treating token issuance as a one time action TokenFi approaches tokenization as an ongoing capability. Something that needs rules safeguards and repeatability. This single assumption places it outside the dominant launch culture of the previous cycle.

Rather than asking how fast an asset can be issued TokenFi asks whether it should exist at all and under what constraints. That shift reshapes the entire product philosophy. Security compliance and structure are not add ons. They are part of the default workflow.

TokenFi is not designed to maximize volume in a short window. It is designed to support assets that are expected to exist beyond their initial moment of attention.

WHEN SPEED CEASES TO BE A COMPETITIVE ADVANTAGE

The explosion of launch platforms after 2024 revealed a hard truth. When creating tokens becomes frictionless tokens themselves lose meaning.

Platforms optimized for speed solved one problem. They made issuance accessible. But they also turned assets into disposable objects whose value depended almost entirely on short lived attention. Markets did not become more efficient. They simply eliminated projects faster.

TokenFi chose a deliberately slower path.

Configuration became more detailed. Security checks became visible. Compliance logic was introduced where others avoided it. These decisions made the platform less attractive to purely speculative behavior.

In the short term this limits growth. In the long term it acts as a filter.

As the market matures launch platforms are splitting into two categories. Those designed to maximize activity and those designed to support assets meant to persist. TokenFi clearly aligns with the second group.

REAL WORLD ASSETS AS A FORM OF SELF DISCIPLINE

Many projects treat real world assets as a growth narrative. TokenFi treats them as a constraint.

Tokenizing real assets forces uncomfortable realities into the open. Legal ownership matters. Identity matters. Jurisdiction matters. Transfers cannot always be permissionless. Mistakes have consequences outside the blockchain.

Most platforms avoid these frictions. TokenFi builds directly into them.

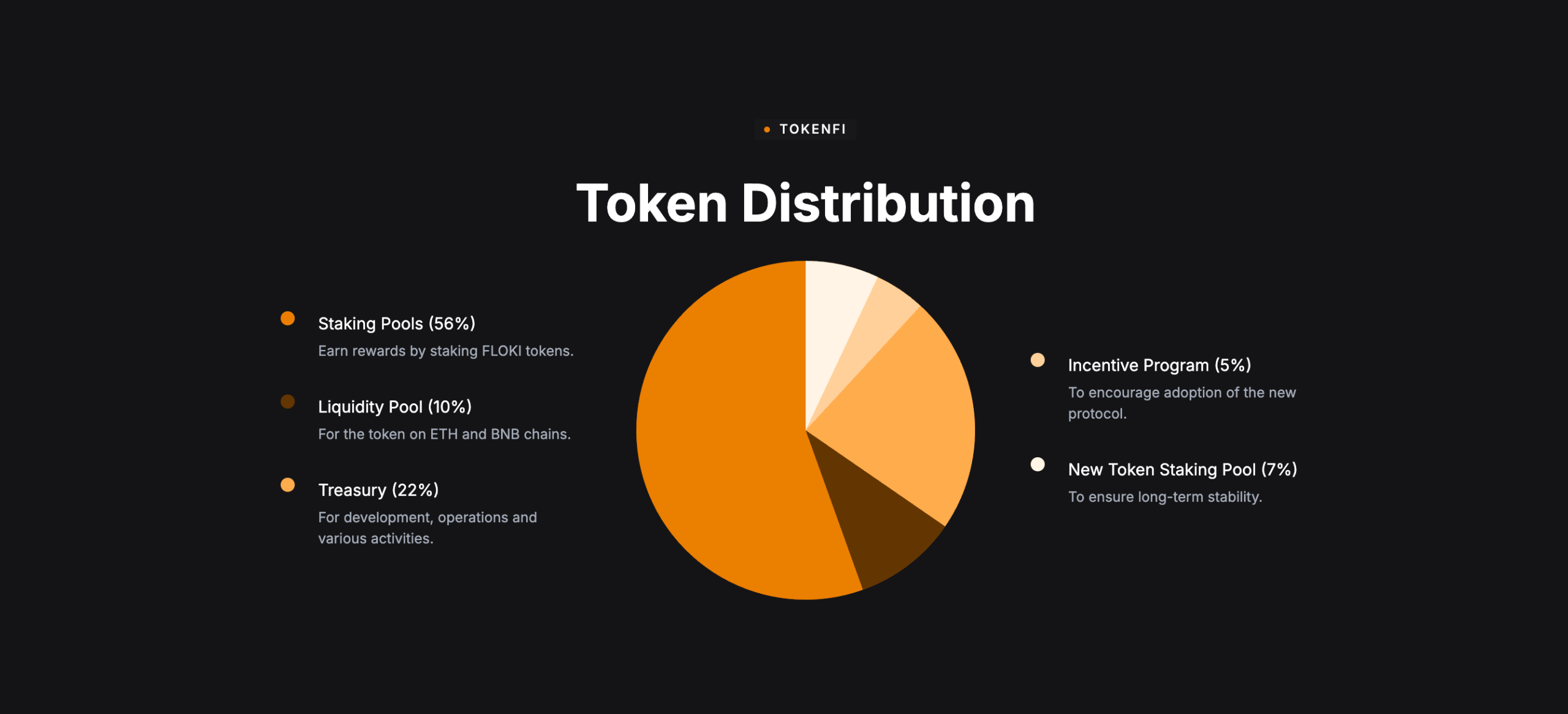

By supporting compliant token standards and identity aware transfer logic TokenFi limits what can be created on its platform. This is not an accident. It is a form of self regulation. Once real assets are involved the platform itself must be trusted.

This pushes TokenFi away from experimentation and toward infrastructure. It is no longer just a tool that deploys contracts. It becomes a system that intermediates responsibility.

COMMUNITY ORIGINS AND STRUCTURAL TENSION

TokenFi’s origins are often framed as a weakness. A project that emerged from a meme driven ecosystem is assumed to lack credibility.

In practice this creates tension rather than disqualification.

Starting from an existing community solves a problem many infrastructure projects never overcome. Early usage. Immediate feedback. Real users interacting with real tools. This does not guarantee success but it removes the illusion of adoption.

At the same time it forces discipline. Expectations are immediate. Market reactions are unforgiving. Delivery matters more than promises.

This tension prevents TokenFi from remaining theoretical. It must continually prove that structure and usability can coexist.

THE QUESTION THAT WILL DEFINE TOKENFI

TokenFi will not ultimately be judged by short term market performance.

The real question is simpler and more difficult. Will people continue to use it when issuance is no longer fashionable. When attention shifts elsewhere. When only durable systems remain relevant.

If token creation becomes a repeated workflow rather than a speculative event TokenFi’s role changes. It becomes quiet. Embedded. Easy to overlook.

That is what infrastructure looks like when it works.

Some systems only reveal their importance after the noise disappears.