KEYTAKEAWAYS

-

Gold’s recent outperformance reflects late-cycle capital concentration, not a permanent shift away from Bitcoin’s store of value thesis.

-

Bitcoin’s recovery depends on macro capital rotation, while Ethereum’s long-term growth is tied to institutional adoption, AI integration, and on-chain finance.

-

Dominant digital asset treasury structures may amplify upside exposure by combining staking yield, balance sheet strength, and capital market access.

CONTENT

At Consensus Hong Kong 2026, Tom Lee delivered a clear and disciplined message. The crypto market is not facing structural decline. It is experiencing a temporary dislocation. Gold has outperformed over the past year, while Bitcoin and Ethereum have struggled. However, this divergence does not signal the end of the digital asset thesis. Instead, it may mark the late stage of a capital rotation cycle.

GOLD’S SURGE AND THE LIQUIDITY DISTORTION

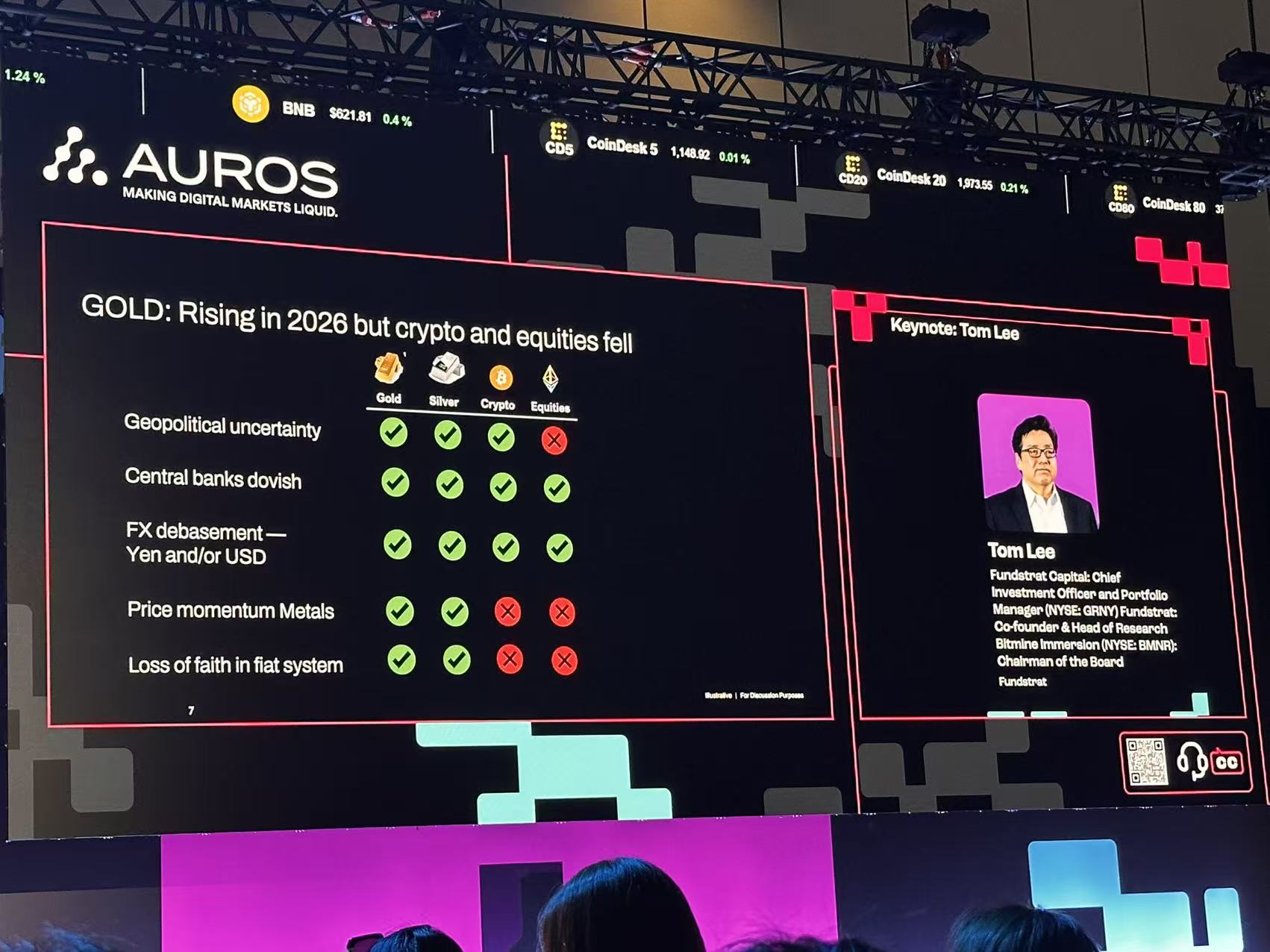

Gold delivered strong gains in 2025, while Bitcoin corrected sharply. This contrast led many investors to question the store of value narrative. Tom Lee broke the rally into several drivers. Geopolitical uncertainty increased demand for safe assets. Central banks shifted toward easier policy. Currency debasement concerns remained elevated. Precious metals developed strong price momentum. In addition, some investors lost confidence in parts of the fiat system.

The key issue is scale. Gold’s total market value is now around forty one trillion dollars. That size changes market behavior. When an asset of that magnitude moves quickly, it affects global liquidity conditions. Margin requirements and portfolio rebalancing can force selling in other assets. Bitcoin’s weakness cannot be viewed in isolation. It occurred in an environment where gold absorbed large pools of capital.

Yet history tells a more complex story. Over the past fifty years, gold has underperformed inflation nearly half the time. Since Bitcoin was created, it has rarely lost purchasing power relative to inflation. The long term data suggests that Bitcoin has been more consistent as a store of value, even if short term performance differs. Tom Lee’s argument is that gold’s strength may represent a late cycle premium rather than a permanent shift in value perception.

BITCOIN’S RESET AND CAPITAL ROTATION

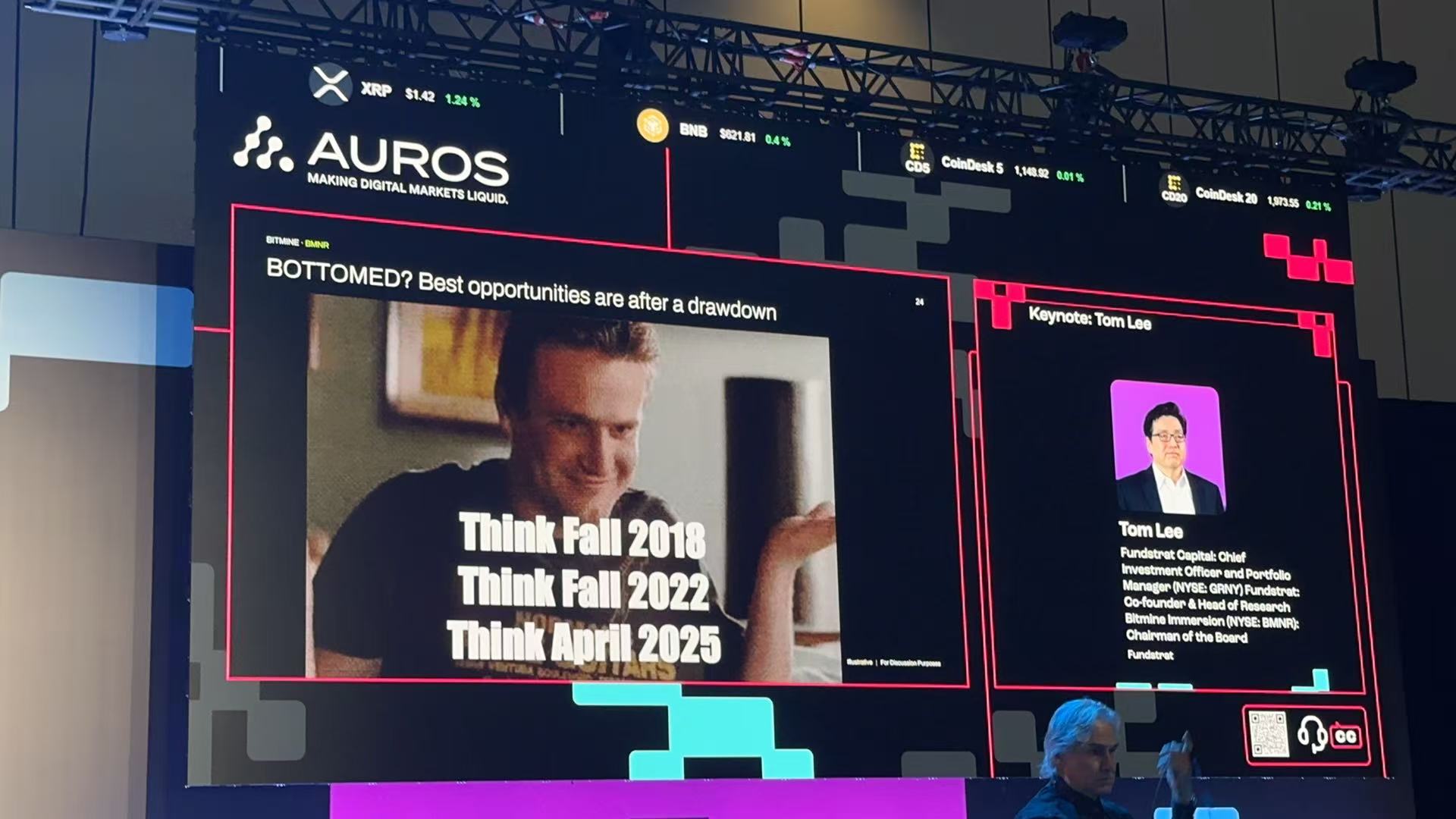

For the crypto market to recover, Bitcoin must stabilize first. Tom Lee believes that Bitcoin’s rebound is closely linked to gold’s momentum cooling. These two assets do not operate as simple substitutes. They respond differently across macro cycles. In defensive phases, gold absorbs fear. In expansion phases, capital searches for growth and asymmetry. That is where Bitcoin becomes attractive again.

From a relative valuation perspective, Bitcoin’s market value compared with gold remains historically low. If macro stability improves and liquidity pressures ease, asset allocators may rebalance toward higher beta exposures. The store of value narrative for Bitcoin has not disappeared. It has been overshadowed by capital flows. When long term hedging demand returns, scarcity and programmability will matter again.

Tom Lee does not anchor his thesis to a single date. Instead, he highlights structural conditions that are beginning to align. Policy uncertainty is gradually narrowing. Institutional investors are reassessing portfolio construction. As that process unfolds, Bitcoin may reenter the center of the allocation discussion.

ETHEREUM’S CYCLICAL RESILIENCE AND WALL STREET’S SHIFT

If Bitcoin represents macro positioning, Ethereum represents infrastructure and utility. Since 2018, Ethereum has experienced multiple drawdowns greater than fifty percent. Each time, it eventually recovered. That pattern reflects strong network fundamentals rather than speculative noise.

Stablecoin growth continues to expand on chain settlement activity. Large financial institutions are exploring public blockchain integration, even if internal debates remain. Public chains offer security, neutrality, and network effects that private systems struggle to replicate. Ethereum remains the most credible candidate for large scale institutional deployment.

Artificial intelligence introduces another structural driver. Decentralized execution combined with smart contracts can create economic layers for AI coordination. In parallel, the creator economy is shifting toward direct digital ownership. Blockchain infrastructure ensures transparent compensation and programmable royalties. These developments reinforce Ethereum’s long term positioning.

THE RISE OF DOMINANT DATS AND MARKET MULTIPLIERS

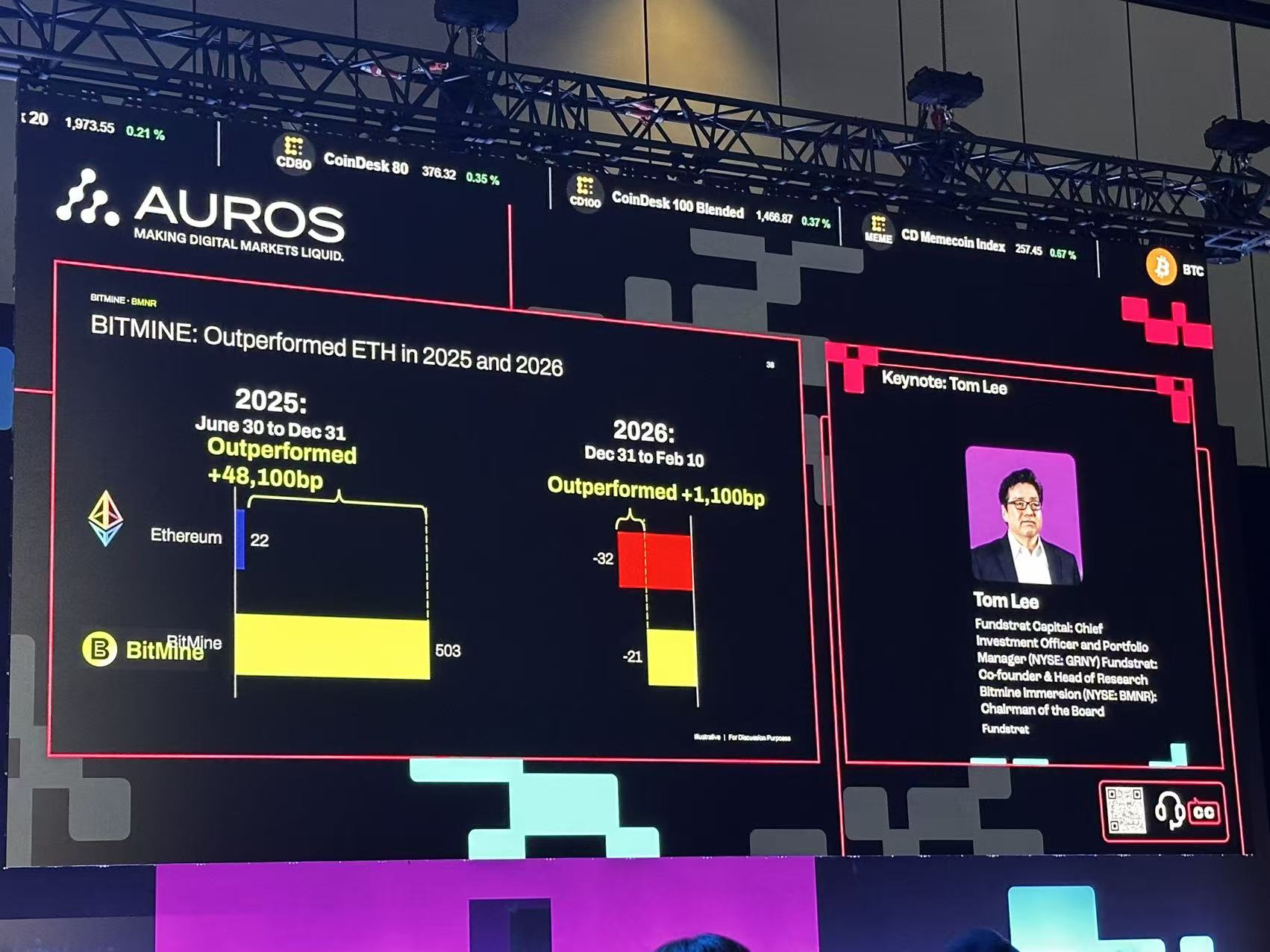

Tom Lee also discussed the emergence of dominant digital asset treasury structures. These entities hold and actively manage crypto assets within public market vehicles. The model focuses on optimizing staking yield, expanding asset per share exposure, and accessing capital markets efficiently.

Ethereum staking provides recurring yield. As price appreciation compounds with staking rewards, returns can accelerate. Historical ratios between Bitcoin and Ethereum offer a framework for valuation scenarios. If Bitcoin reaches higher price ranges, Ethereum’s implied valuation rises accordingly. Public market exposure vehicles may amplify that movement through capital structure dynamics.

The effectiveness of this model depends on financial discipline. Strong balance sheets, transparent holdings, and consistent yield generation are critical. As digital assets mature, these treasury structures may become bridges between traditional finance and decentralized networks.

Tom Lee’s central conclusion remains straightforward. The market is undergoing reallocation, not collapse. Gold’s dominance may be closer to its peak than many assume. Bitcoin and Ethereum continue to hold structural advantages. In periods of pessimism, long term positioning often begins. Digital assets remain early in their lifecycle, and the next expansion phase is already forming beneath the surface.