KEYTAKEAWAYS

- VC investments in blockchain dropped by 70% in the last year, reflecting a cautious approach in a volatile market.

- Andreessen Horowitz is expanding its crypto focus globally, launching its first office outside the US in the UK.

- Sequoia Capital has significantly reduced its crypto fund, emphasizing a shift towards seed-stage opportunities amid market challenges.

CONTENT

INTRODUCTION

Transformative technological advancements and the marriage of traditional venture capital with the dynamic world of blockchain technology have captured the attention of investors and enthusiasts alike. The blockchain industry, once considered a niche domain, has now garnered substantial interest from large-scale venture capital firms.

This article delves into the intriguing convergence of traditional venture capital and the blockchain sector, shedding light on the recent investments that have solidified this union. Prominent VC powerhouses such as Andreessen Horowitz, Sequoia Capital, and Greylock Partners have made substantial forays into the blockchain landscape, ushering in a new wave of financial support and credibility.

By examining the specific investments made by these industry giants, we gain valuable insights into the evolving nature of venture capital’s relationship with the blockchain industry. Also, you can see how VCs lowered their investments in the crypto space, as the market witnessed a downturn in 2022 and still struggles to recover.

VC INVESTMENTS IN BLOCKCHAIN COMPANIES DROP

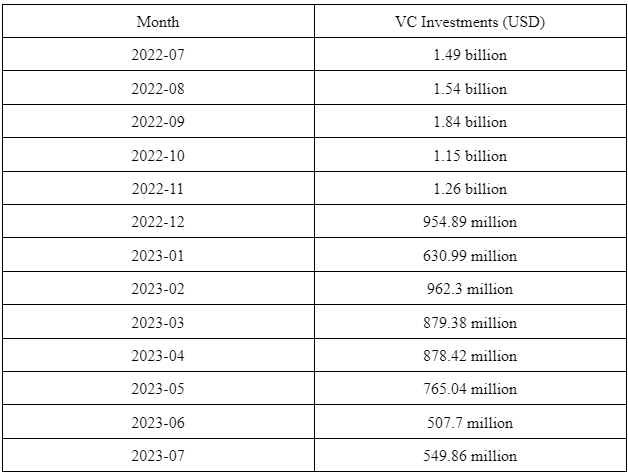

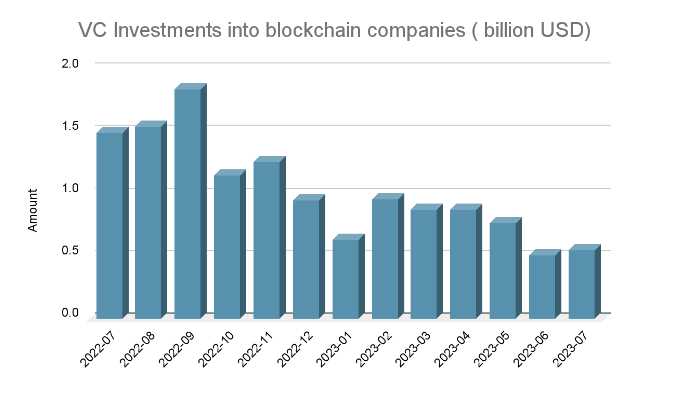

In terms of VC investments into blockchain-related entities during the last year, some of the latest data is negative. As the table below shows, the figures fell 70% over 12 months. In July 2022, the digital asset space managed to raise approximately $1.49 billion in 149 rounds.

Risk appetite has clearly decreased, given in July 2023 the aggregate amount of allocated capital is around $549 million. The trend shouldn’t be surprising, as the industry is vulnerable when cryptocurrency prices enter a bear market.

(Source: https://www.rootdata.com/dashboard)

Bitcoin, the largest cryptocurrency in the market, is trading more than 50% below the all-time high. The situation is worse when it comes to the altcoins space, where valuations have tumbled even 90% in some cases.

Still, the blockchain remains a technology with a high growth potential. The trend over the last year clearly points to a softening of investments and despite that, some of the traditional brands in the VC space continued to make acquisitions.

(Source: https://www.rootdata.com/dashboard)

WHAT DO TRADITIONAL VCS THINK ABOUT BLOCKCHAIN?

Andreessen Horowitz

With over $35 billion in assets under management, Andreessen Horowitz (a16z) is one of the largest venture capital firms in the world. Among others, blockchain represents a key focus, especially since in June it made an impressive move.

More specifically, it will open its first office outside the United States. Based on the company’s claims, the main goal is to take advantage of the welcoming environment for crypto entrepreneurs in the United Kingdom. The situation in the US remains uncertain, given the SEC shows reluctance when it comes to digital assets.

Sriram Krishnan, former Twitter employee and a16z general partner, will relocate to London and lead the new office. Additionally, the VC firm wants to launch its first crypto startup school in the UK. This is a bid to identify new talent in the cryptocurrency and broader Web3 space. Back in 2019 the company also launched a coaching school for entrepreneurs wanting to learn how to build a blockchain business.

Sequoia Capital

Specialized in seed, early and growth stage investments in private tech companies, Sequoia Capital is a VC firm that has slashed its crypto fund by more than 65%. This is another major player in the industry, with over $85 billion in assets under management.

Anonymous sources suggest Sequoia trimmed its crypto fund from $585 million down to $200 million. Additionally, it has also halved its ecosystem fund, which provides capital to other venture funds, to $450 million.

According to a Sequoia spokesperson, the decision to reduce funding for blockchain-related businesses is backed by several important reasons:

“We made these changes to sharpen our focus on seed-stage opportunities and to provide liquidity to our limited partners. The crypto fund will primarily focus on new company formation, with the opportunity to supplement these investments from our seed, venture, growth, and expansion funds as the companies mature.”

Sequoia launched two blockchain-related funds in February 2022 and since then the industry has been in a decline, making investments challenging. As a result, the company is now looking to invest in younger startups, given that late-stage companies like FTX, Voyager, and Three Arrows Capital went bankrupt.

Greylock Partners

In April this year, San Francisco-based DEX infrastructure provider 0x Labs closed a $70 million Series B financing round. This was led by Greylock Partners, a VC firm with over $3.5 billion in assets under management.

Greylock is well-known for investing in popular companies such as Airbnb, Discord, Nextdoor, and Okta. Last year, it also backed Pinata’s $3.5 million seed round in the NFT infrastructure provider Pinata.

Although its primary focus is on technology, Greylock Partners looks like another VC entity reluctant to make large blockchain investments, given the structural downfall of the industry seen during the last year. However, given it is based in Silicon Valley and has a wide network of connections worldwide, one should not rule out new blockchain-based acquisitions in the near future.

SUMMARY

In conclusion, the intersection of Traditional Venture Capital (VC) firms and the blockchain industry presents a nuanced landscape as evidenced by recent investments. The sector faced challenges with the decline in cryptocurrency prices and the unfortunate demise of certain blockchain-based projects. However, amidst these setbacks, the continued engagement of industry stalwarts like Andreessen Horowitz, Sequoia Capital, and Greylock Partners underscores a positive sentiment.

Their ongoing investments highlight the enduring potential they perceive within the blockchain space. This commitment not only showcases their confidence in the technology’s long-term viability but also emphasizes its capacity for innovation and growth. Despite the mixed outcomes due to market fluctuations, the involvement of these prominent VC players signifies that the blockchain industry remains a dynamic and evolving realm with opportunities that continue to intrigue and captivate visionary investors.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!