KEYTAKEAWAYS

-

Web3 is moving from transaction driven growth to long term operations, and financial infrastructure has become unavoidable.

As digital assets enter daily operations, organizations now need systems that can explain onchain activity in a way auditors and regulators can accept.

-

TRES Finance approaches crypto accounting as a data problem, not a ledger problem.

By prioritizing raw data capture and flexible interpretation, TRES adapts better to protocol changes, though at the cost of higher complexity and enterprise focused positioning.

-

The Fireblocks acquisition strengthens institutional reach but introduces new strategic trade offs.

While tighter integration may improve efficiency, TRES’s long term independence and pace of innovation will shape its role in the broader Web3 finance stack.

- KEY TAKEAWAYS

- WHEN WEB3 MOVES FROM TRADING TO OPERATIONS

- TRES FINANCE STARTS WITH DATA, NOT ACCOUNTING

- REGULATION AND AUDIT PRESSURE DRIVE REAL DEMAND

- COMPETITION REFLECTS DIFFERENT DESIGN PHILOSOPHIES

- THE FIREBLOCKS ACQUISITION CHANGES THE CONTEXT

- A PRACTICAL ANSWER, NOT A FINAL STANDARD

- DISCLAIMER

- WRITER’S INTRO

CONTENT

WHEN WEB3 MOVES FROM TRADING TO OPERATIONS

For many years, Web3 infrastructure focused on one main goal: executing transactions. Faster block times, lower fees, and better liquidity shaped most technical progress. In short, success meant moving assets quickly and cheaply.

However, this focus is starting to change.

Since 2024, more organizations have treated digital assets as long term operating resources rather than short term trading tools. Foundations now manage multi year treasuries. Exchanges must explain cross chain fund flows to auditors. At the same time, stablecoins increasingly support payments, settlements, and daily operations.

As a result, the main challenge has shifted. The question is no longer whether a transaction works. Instead, the real issue is what happens after the transaction finishes.

Onchain data is transparent and verifiable. However, it is not easy to understand. A single transaction can represent several economic actions at once. In addition, many DeFi interactions span multiple protocols and asset states. Because of this, finance teams struggle to classify these activities. Auditors face the same problem when they review reports.

This gap exposes a structural weakness in Web3. The industry lacks a reliable layer that can translate onchain activity into traditional financial language.

TRES FINANCE STARTS WITH DATA, NOT ACCOUNTING

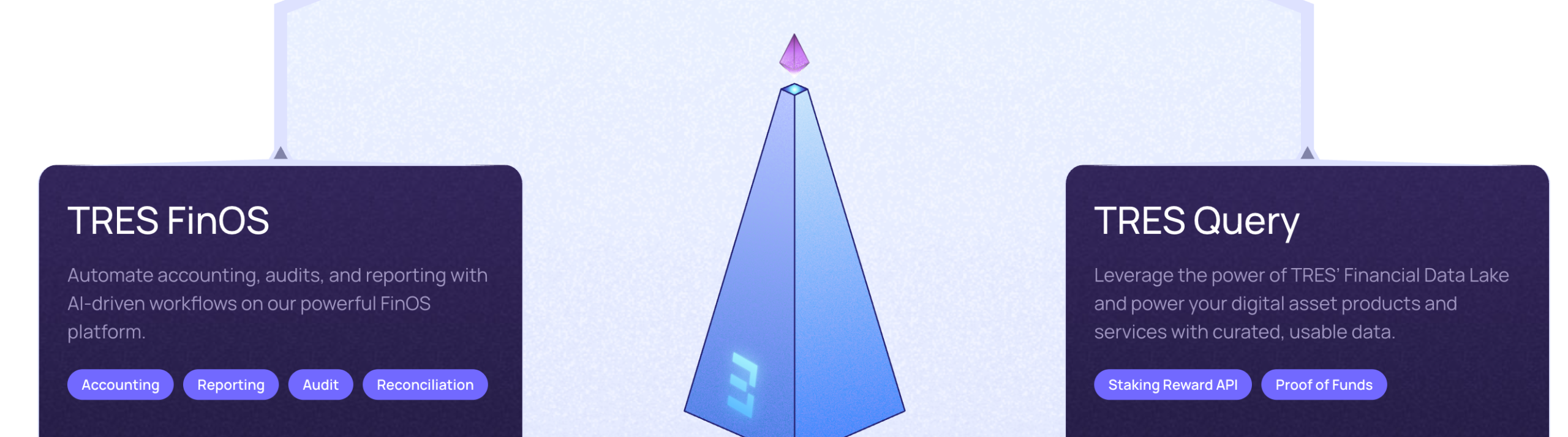

TRES Finance often appears as a crypto accounting platform. While this label is partly accurate, it misses the core idea behind the product.

TRES does not start by improving ledgers. Instead, it begins with a different assumption. In a multi chain environment, onchain data must first become structured before accounting can work at all.

This difference matters.

Traditional accounting systems rely on stable data formats. Bank records, invoices, and balance sheets change slowly. Therefore, software can apply fixed rules with confidence. In contrast, Web3 evolves quickly. Protocols upgrade often. New asset types appear regularly. Non EVM chains follow entirely different data models.

Because of this, TRES chose a flexible approach. The system captures raw blockchain data first. Then it applies interpretation rules later. When protocols change, the platform can reprocess historical data instead of losing context.

In practice, this design improves long term adaptability. However, it also raises costs. The system requires heavy engineering effort and constant maintenance. As a result, TRES fits large and complex organizations better than small teams.

REGULATION AND AUDIT PRESSURE DRIVE REAL DEMAND

The rise of TRES also reflects broader regulatory changes.

Over the past two years, regulators and accounting bodies have pushed digital assets into formal reporting frameworks. New rules require companies to report crypto holdings at fair value. In addition, audit standards have become stricter.

Because of this shift, companies must now explain onchain activity to auditors who do not think in crypto native terms. Blockchain explorers and manual spreadsheets no longer meet audit expectations.

Here, TRES offers a practical advantage. The platform focuses on outputs that auditors can accept. It connects onchain records to familiar compliance workflows. For large institutions, this matters more than design simplicity.

At the same time, this focus narrows its audience. Smaller projects may find the cost and complexity unnecessary. Therefore, TRES does not aim to serve every Web3 user.

DePINSim and the Shift Toward Software Defined Connectivity

COMPETITION REFLECTS DIFFERENT DESIGN PHILOSOPHIES

Several companies now operate in the crypto finance tooling space. Each one defines the problem differently.

Some tools extend traditional accounting software to support digital assets. Others emphasize payments and treasury automation. Meanwhile, some platforms focus on valuation and reporting.

TRES follows a distinct path. It treats onchain data as a long term asset that deserves full preservation. Interpretation remains flexible over time. This approach contrasts with systems that prioritize immediate compatibility with existing accounting tools.

Neither model is perfect. Flexible systems adapt better to change. Simpler systems reduce operational friction. Over time, the market will test which balance works best.

THE FIREBLOCKS ACQUISITION CHANGES THE CONTEXT

In early 2026, Fireblocks acquired TRES Finance. This move attracted attention for a clear reason.

Fireblocks controls custody and transaction execution. TRES explains what those transactions mean in financial terms. Together, they form a more complete operational stack.

In theory, this integration reduces delays between execution and reporting. It may also simplify infrastructure for institutional clients.

However, acquisitions also introduce uncertainty.

One possible outcome is deeper integration and faster adoption. Another is tighter alignment with the Fireblocks ecosystem, which could limit flexibility for external users. There is also a risk that innovation slows as priorities shift inside a larger organization.

At this stage, none of these outcomes is certain. The acquisition represents a strategic direction rather than a final result.

A PRACTICAL ANSWER, NOT A FINAL STANDARD

Viewed more broadly, TRES Finance highlights a key transition in Web3. As the industry matures, financial operations become unavoidable.

TRES provides one of the more institutionally acceptable solutions available today. It does not define the future of Web3 finance. Instead, it reflects what regulators, auditors, and large organizations currently accept.

Its long term role will depend on several factors. These include product independence after acquisition, continued support for new chains, and future regulatory changes.

For now, TRES stands as a practical response to a structural problem. It shows how onchain activity can coexist with offchain financial systems, even if the final form of that relationship remains unsettled.