KEYTAKEAWAYS

- Since December 17, 2025, large Bitcoin holder cohorts have increased balances by more than 56,000 BTC, while smaller retail wallets have shown net distribution.

- This divergence suggests an ownership rebalancing process, with supply moving toward holders with longer time horizons and greater liquidity capacity.

- While methodology varies across data providers, the trend highlights a possible shift from retail-driven volatility toward more institutionally influenced market structure.

CONTENT

On-chain data shows large Bitcoin holders accumulating while retail wallets reduce exposure, signaling a potential structural shift in Bitcoin ownership toward longer-term, institution-aligned holders.

Large Holders Are Buying While Retail Takes Profit

On January 7, 2026, on-chain data highlighted a sharp behavioral split in Bitcoin ownership: wallets labeled “whales and sharks” (commonly defined as addresses holding 10 to 10,000 BTC) increased their collective holdings by 56,227 BTC since December 17, 2025, while small retail wallets (often proxied as <0.01 BTC) reduced exposure and took profits.

This matters because it frames Bitcoin’s current market not as a simple price-driven cycle, but as an ownership rebalancing process in which large holders are willing to absorb supply during consolidation, even when broader sentiment is mixed and smaller cohorts are de-risking.

Why This Pattern Is Treated as a Market-Structure Signal

The “whales accumulate as retail sells” setup is often treated as a market-structure signal because it implies that marginal supply is increasingly being held by entities with longer time horizons, deeper liquidity buffers, and less sensitivity to short-term volatility, which can reshape how Bitcoin behaves during drawdowns and breakouts.

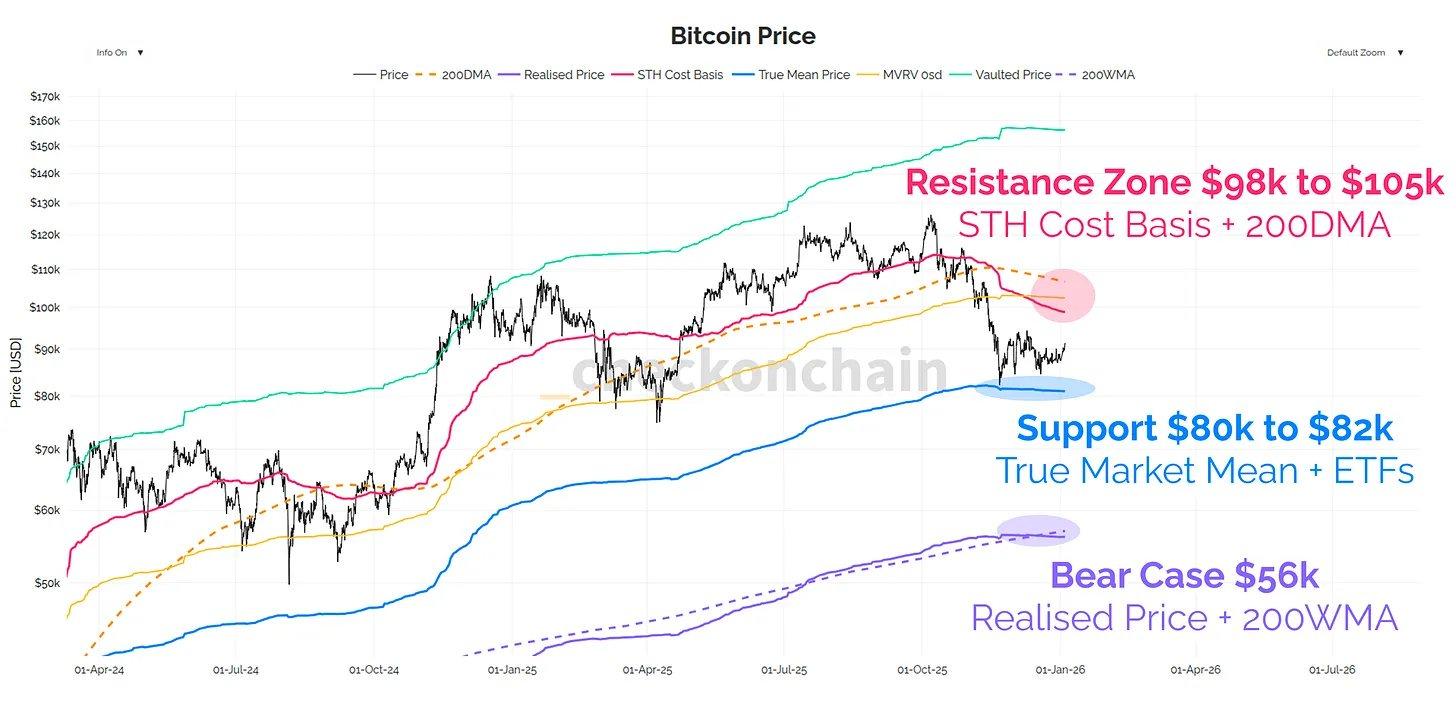

A late-December Glassnode-based view reported that large holders (e.g., 1,000–10,000 BTC cohorts) were among the primary accumulators around the $80,000 price region, reinforcing the idea that, at least during that window, bigger balance sheets were acting as a stabilizing bid rather than a source of forced selling.

The Macro Implication: Bitcoin Ownership Keeps Institutionalizing

If this accumulation trend persists, the macro implication is straightforward: Bitcoin’s ownership base continues to institutionalize—not only through regulated products like ETFs, but also through large-holder balance growth that concentrates supply in fewer hands, often associated with funds, treasury allocators, high-net-worth entities, and custodial structures.

In practical market terms, that kind of concentration can reduce “weak hand” supply in the short run, but it can also increase the market’s sensitivity to what large holders decide to do at key levels, meaning volatility can shift from retail-driven noise to institution-driven repositioning.

A Critical Caveat: “Whale Accumulation” Can Be Misread

Because “whale balances” are derived from address clustering heuristics, exchange wallet movements, and cohort definitions that differ across data vendors, headline accumulation numbers can sometimes be overstated or misinterpreted—especially when exchange-related flows distort who “really” owns coins.

A recent CryptoQuant-cited rebuttal argued that once exchange-related distortions are filtered out, large holders may still be distributing rather than accumulating, and that overall whale balances can continue to trend down depending on methodology and cohort selection.

The editorial takeaway is not that one side is definitively “right,” but that the most rigorous interpretation treats the 56,227 BTC figure as a cohort-based signal from a specific data definition (Santiment’s whale/shark cohorts) rather than an absolute statement about every large holder in the system.

What To Watch Next

If you want to validate whether this is truly a structural shift (and not a measurement artifact), the cleanest next indicators are: whether large-holder cohorts keep trending up across multiple vendors, whether exchange balances continue to fall (supporting the idea of net accumulation), and whether retail-sized cohorts keep distributing during sideways price action, which historically tends to happen when risk appetite is returning unevenly rather than uniformly.

For now, the most defensible, data-grounded conclusion is narrow but important: since December 17, 2025, one widely referenced cohort definition shows a material net increase in large-holder balances, occurring alongside retail profit-taking, which is exactly the kind of divergence that often appears during ownership transitions rather than late-stage speculative blow-offs.

Read More:

Morgan Stanley’s Bitcoin and Solana ETF Filings Signal a New Institutional Phase