KEYTAKEAWAYS

-

Market cap in crypto is calculated as price multiplied by circulating supply, providing a standardized way to compare cryptocurrencies beyond misleading unit prices.

-

Understanding market cap helps investors assess relative size, liquidity, volatility, and risk, while avoiding common misconceptions such as equating low price with undervaluation.

-

Market cap is a foundational but incomplete metric, best used alongside supply dynamics, liquidity, and fundamentals for long-term crypto investment strategies.

- KEY TAKEAWAYS

- Introduction: Understanding what does market cap mean in crypto

- How market cap is calculated in crypto markets

- Why market cap matters for crypto investors

- Common misconceptions about market cap in crypto

- Featured Table: Market Cap Categories in Crypto

- what does market cap mean in crypto for long-term strategy

- Conclusion: what does market cap mean in crypto as an investment framework

- DISCLAIMER

- WRITER’S INTRO

CONTENT

What does market cap mean in crypto explains how market capitalization works, why it matters for valuation, risk, and liquidity, and how investors can use it to make more informed crypto investment decisions.

Introduction: Understanding what does market cap mean in crypto

What does market cap mean in crypto is one of the most frequently asked questions by beginners entering the cryptocurrency market, yet it is also one of the most misunderstood concepts among retail investors. Market capitalization, commonly shortened to market cap, is often treated as a simple ranking metric, but in reality it carries deeper implications about valuation, liquidity, risk perception, and market structure. In crypto, where thousands of digital assets coexist with vastly different supply models and use cases, understanding what does market cap mean in crypto is essential for making informed decisions.

At its most basic level, market cap represents the total value of a cryptocurrency’s circulating supply multiplied by its current price. While this definition appears straightforward, its interpretation in crypto markets differs significantly from traditional equities. Crypto assets trade continuously, have transparent on-chain supply data, and often experience extreme volatility. As a result, market cap in crypto is not just a snapshot of value, but a reflection of collective market expectations at a specific moment in time.

Many investors mistakenly assume that a low price means a coin is “cheap” or that a high price means it is “expensive.” This misconception arises from ignoring market cap entirely. Understanding what does market cap mean in crypto helps investors avoid these pitfalls by focusing on overall valuation rather than unit price. Whether evaluating Bitcoin, Ethereum, or emerging altcoins, market cap provides a standardized lens for comparison.

In this guide, we will explore what does market cap mean in crypto from multiple perspectives, including how it is calculated, how it differs from traditional finance, why it matters for investment decisions, and what its limitations are. By the end, you will have a structured, practical understanding of market cap as a core analytical tool in crypto markets.

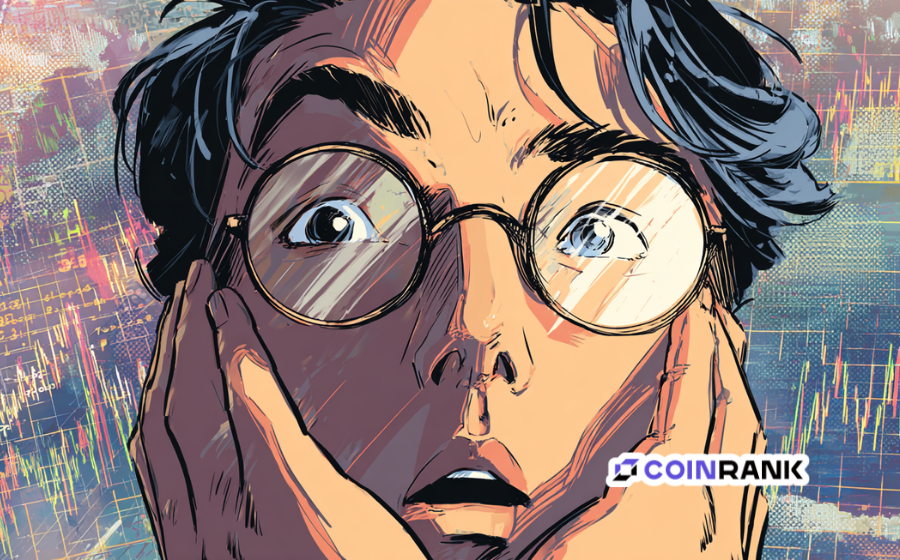

Figure 1: Top Market Cap Coins

How market cap is calculated in crypto markets

The basic formula behind crypto market capitalization

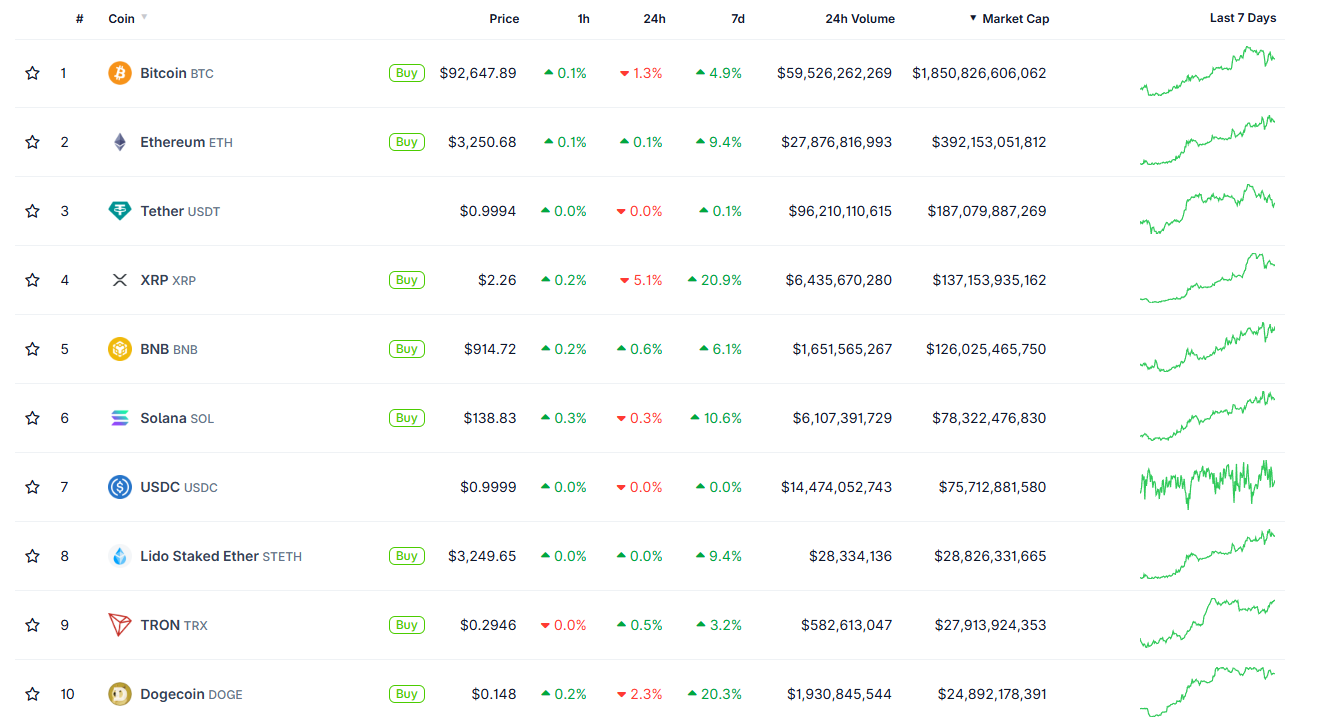

Figure 2:formula behind crypto market capitalization

To understand what does market cap mean in crypto, it is essential to start with the calculation itself. The formula is simple:

Market Cap = Current Price × Circulating Supply

In crypto markets, circulating supply refers to the number of coins or tokens that are currently available and tradable on the market. This excludes locked tokens, unmined coins, or assets held in long-term vesting contracts. Because blockchain data is transparent, circulating supply figures are often more visible than in traditional markets, although interpretation can still vary by data provider.

This formula allows investors to compare cryptocurrencies with vastly different price levels. For example, a token priced at $0.10 with a large supply may have a higher market cap than a token priced at $1,000 with a much smaller supply. Understanding what does market cap mean in crypto prevents investors from equating low price with undervaluation or high price with overvaluation.

Another important nuance is that crypto prices can change rapidly, causing market cap to fluctuate significantly within short periods. Unlike stock markets with fixed trading hours, crypto markets operate 24/7. As a result, market cap is a dynamic metric that reflects real-time market sentiment rather than a static valuation.

Circulating supply vs total supply vs fully diluted value

When analyzing what does market cap mean in crypto, investors must distinguish between circulating supply and total or maximum supply. Circulating supply is used in market cap calculations, but many projects have additional tokens scheduled for future release. This introduces the concept of fully diluted valuation (FDV), which estimates market cap if all tokens were in circulation.

FDV can provide insight into potential future dilution, but it should not be confused with current market cap. A project may appear small based on market cap but carry significant inflation risk if a large portion of its supply has yet to enter circulation. Understanding these distinctions is critical for interpreting what does market cap mean in crypto beyond surface-level rankings.

Why market cap matters for crypto investors

Market cap as a tool for comparing cryptocurrencies

Figure 3:Different Types of Cryptocurrencies by Market Cap

One of the primary reasons investors care about what does market cap mean in crypto is its role as a comparative metric. Market cap allows investors to assess the relative size of different cryptocurrencies regardless of their individual token prices. This is especially important in a market where token denominations vary widely.

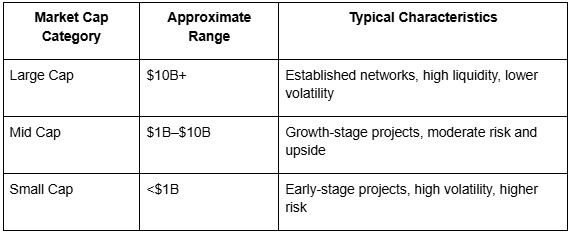

For example, Bitcoin and Ethereum dominate the market by market cap, reflecting their established networks, liquidity, and adoption. Smaller market cap assets, often referred to as mid-cap or small-cap coins, may offer higher growth potential but also carry greater risk. By understanding market cap categories, investors can align their portfolios with their risk tolerance and investment horizon.

Market cap also influences market perception. Assets with higher market caps are generally perceived as more stable and less susceptible to manipulation, while low market cap assets can experience dramatic price swings from relatively small capital inflows. Understanding what does market cap mean in crypto helps investors contextualize volatility rather than reacting emotionally to price movements.

Liquidity, risk, and market cap dynamics

Market cap is closely linked to liquidity, although the two are not identical. Higher market cap cryptocurrencies tend to have deeper order books, higher trading volumes, and more active markets. This reduces slippage and allows investors to enter or exit positions more efficiently.

However, market cap alone does not guarantee liquidity. Some assets may have inflated market caps due to thin trading or concentrated ownership. Therefore, understanding what does market cap mean in crypto requires combining it with other metrics such as volume, distribution, and on-chain activity.

From a risk perspective, market cap can act as a proxy for maturity. Large-cap cryptocurrencies are often considered lower risk relative to small-cap assets, but they may also offer lower upside potential. Smaller market cap projects may deliver outsized returns but carry higher probabilities of failure. Market cap thus becomes a foundational tool for portfolio construction and risk management.

Common misconceptions about market cap in crypto

Why a low token price does not mean a crypto is undervalued

One of the most persistent misunderstandings around what does market cap mean in crypto is the belief that a low-priced token is inherently undervalued. This misconception ignores the role of supply. A token with billions of units in circulation can have a low unit price while still carrying a high market cap.

This misunderstanding often leads investors to chase “cheap” coins without considering total valuation. Market cap corrects this bias by shifting focus from unit price to aggregate value. Understanding what does market cap mean in crypto helps investors avoid narratives driven by psychological price anchors rather than fundamentals.

Another related misconception is assuming that a coin can easily reach the price level of another asset without accounting for market cap implications. For example, expecting a low-cap token to reach the same price as Bitcoin often implies an unrealistic total valuation. Market cap analysis grounds expectations in mathematical reality.

Market cap manipulation and its limitations

While market cap is useful, it is not immune to manipulation. In crypto markets, low liquidity assets can experience sharp price increases from relatively small trades, temporarily inflating market cap. This can create misleading impressions of value or adoption.

Therefore, understanding what does market cap mean in crypto also involves recognizing its limitations. Market cap reflects price multiplied by supply, not necessarily real capital invested or sustainable value. Investors should treat market cap as a starting point for analysis rather than a definitive measure of worth.

Featured Table: Market Cap Categories in Crypto

what does market cap mean in crypto for long-term strategy

Understanding what does market cap mean in crypto is especially important for long-term investors. Market cap influences how much capital is required to move an asset’s price and shapes expectations around growth potential. Large-cap assets may grow steadily as adoption increases, while smaller-cap assets may experience exponential growth or collapse entirely.

For long-term strategies, market cap should be evaluated alongside fundamentals such as network usage, developer activity, token economics, and regulatory positioning. Market cap alone does not determine success, but it provides context for interpreting these factors. Investors who understand what does market cap mean in crypto are better equipped to build balanced portfolios and avoid speculative traps.

Market cap also evolves over time. Assets can move between categories as networks grow or decline. Tracking market cap trends rather than static rankings allows investors to identify emerging leaders and fading projects. In this sense, market cap is both a snapshot and a narrative tool that reflects the evolving structure of the crypto market.

Conclusion: what does market cap mean in crypto as an investment framework

What does market cap mean in crypto is not simply a definition, but a framework for understanding value, risk, and market behavior in digital asset markets. Market cap provides a standardized way to compare cryptocurrencies, cut through misleading price narratives, and anchor expectations in economic reality. It helps investors distinguish between perceived affordability and actual valuation, and between speculative excitement and structural growth.

At the same time, market cap should never be used in isolation. It is most powerful when combined with liquidity metrics, supply dynamics, and fundamental analysis. Understanding what does market cap mean in crypto allows investors to contextualize volatility, assess risk more accurately, and construct portfolios aligned with their long-term goals.

As crypto markets continue to mature, market cap will remain one of the most widely referenced metrics. However, its true value lies not in rankings alone, but in the insight it provides into how markets collectively price belief, utility, and future potential. For anyone serious about navigating crypto markets, mastering what does market cap mean in crypto is a foundational step toward informed and disciplined investing.