KEYTAKEAWAYS

- Market correction triggered sharp drops across major assets, yet long-term performance still favors ETH, with whales accumulating heavily during the recent decline.

- On-chain evidence shows large entities increasing exposure to ETH, signaling confidence and patience rather than panic, even in accelerated selling conditions.

- ETH remains the strongest performer from yearly lows, doubling in value despite volatility, suggesting opportunities may favor those willing to act with conviction.

CONTENT

A personal reflection on the latest market drop, whale accumulation patterns, year-to-date performance, and why Ethereum may now be entering a rare buying zone.

MARKET REALITY HITS HARD

When I woke up today, the first thing I saw wasn’t sunlight—it was red candles everywhere.

Bitcoin fell roughly 6.1%, Ethereum dropped about 9.2%, and BNB slipped another 4.3% from the previous close. It felt like one of those days when the market reminds everyone that we’re not driving the bus; we’re just passengers holding on.

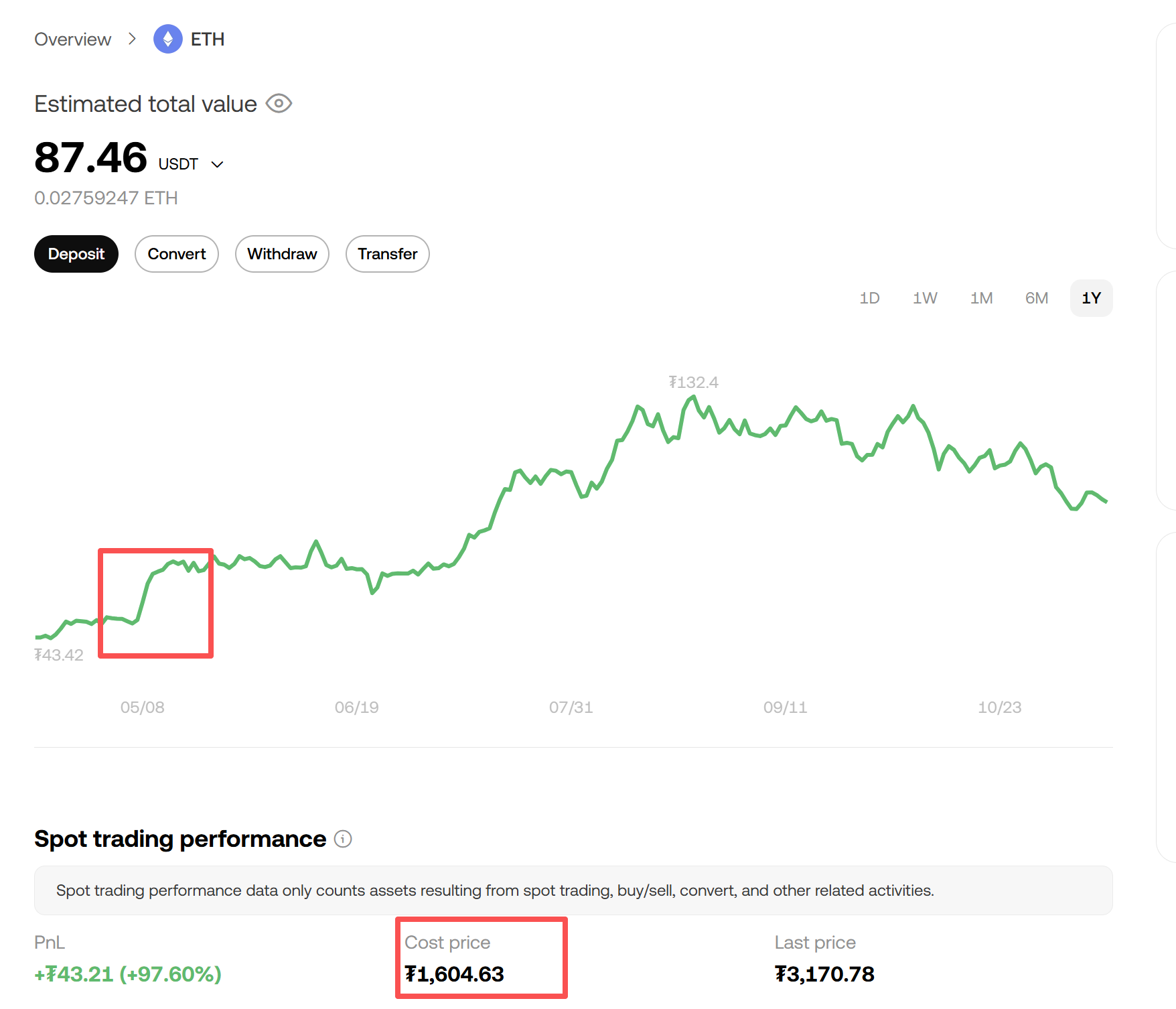

But then I opened a wallet I had almost forgotten existed. In it was Ethereum bought back in May at around $1,600. Even after this sharp sell-off, that position is still up more than 100%. That realization changed the way I viewed today’s market action.

WHY ETH IS DRAWING SMART MONEY

While retail sentiment turned fearful, something different happened behind the scenes: large holders continued buying, calmly and consistently.

Over the past 12 hours, on-chain activity showed whales significantly increasing their ETH exposure. ETH entered what I call the strike zone earlier than BTC or BNB, simply because its decline was steeper and faster, creating what many see as a more attractive entry level.

Several large players demonstrated this behavior:

- The group known as “Seven Siblings” continued accumulating, with their latest purchase totaling 2,211 ETH for around $7 million at an average of $3,166. Since November 4, they have accumulated 44,008 ETH with an estimated average entry of $3,477, totaling roughly $152.99 million.

- The whale who once borrowed 66,000 ETH to short flipped from bearish to bullish. They recently purchased 19,508 ETH worth about $61.03 million, then followed hours later with another 16,937 ETH worth around $53.91 million. Their cumulative position now stands at approximately 422,175 ETH valued at around $1.34 billion.

- A new address, 0x9973, believed to be linked to Bitmine, received 9,176 ETH worth approximately $29.14 million from a Galaxy Digital OTC wallet.

Whales didn’t panic. They accumulated.

WHO’S STILL WINNING THIS YEAR?

To get some context, I compared the lowest price of the year for BTC, ETH, and BNB with where they sit today:

BTC: +23.8% from its low

ETH: +104.2% from its low

BNB: +68.0% from its low

Even after being the hardest-hit asset recently, Ethereum remains the best performer from the yearly bottom. What’s more surprising is that these lows weren’t long ago—they were just seven months back.

THE HUMAN SIDE OF THE MARKET

There’s a quote I’ve heard:

“The happiest feeling is when the train you missed comes back to pick you up.”

But there’s a darker version:

“The most painful feeling is when the train returns, the doors open—and you realize you still don’t have a ticket.”

Today feels like one of those moments when the market quietly asks:

“So… are you ready this time?”

MY NEXT MOVE

Warren Buffett once said if people had a lifetime punch card with only 20 investment decisions available, they would think far more carefully and act far less often. That rule forces clarity and conviction.

Today, I punched my first hole—not out of confidence that timing is perfect, but because sometimes the best moments never feel comfortable. They feel uncertain, emotional, inconvenient, and difficult. Yet those are often the moments people later look back on and say, “That was obvious.”

If you’ve been waiting, hesitating, second-guessing yourself, or watching from the sidelines, remember:

Markets rarely punish patience.

They punish hesitation.