KEYTAKEAWAYS

-

Bitcoin is no longer priced through a single coherent framework. Inflation hedge, risk asset, digital gold, and reserve asset narratives are now applied simultaneously, causing structural failure in price discovery.

-

Rising correlation with equities and synchronized volatility show that Bitcoin pricing is increasingly driven by institutional risk models and portfolio mechanics rather than adoption, scarcity, or on-chain fundamentals.

-

Until the market converges on one dominant identity, Bitcoin is likely to remain unstable, with price movements shaped more by positioning and correlations than by long term conviction.

- KEY TAKEAWAYS

- A MARKET THAT NO LONGER KNOWS WHAT IT IS PRICING

- ONE ASSET FOUR MUTUALLY EXCLUSIVE IDENTITIES

- BITCOIN AS AN INFLATION HEDGE

- BITCOIN AS A LEVERAGED RISK ASSET

- BITCOIN AS DIGITAL GOLD

- BITCOIN AS AN INSTITUTIONAL RESERVE ASSET

- WHY NO VALUATION MODEL FITS THE CURRENT PRICE

- WHEN INSTITUTIONS CANNOT DEFINE THE ASSET

- VOLATILITY SYNCHRONIZATION AND THE LOSS OF PRICE DISCOVERY

- ON CHAIN ACTIVITY AND THE PRICE DISCONNECT

- FOUR PATHS THE MARKET WILL EVENTUALLY FORCE

- WHEN BITCOIN CANNOT ANSWER WHAT IT IS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

A MARKET THAT NO LONGER KNOWS WHAT IT IS PRICING

Entering early February 2026, Bitcoin has been trading around the low $70,000 range. Yet price is not the core issue. Volatility alone does not explain what the market is experiencing. What has broken is something more fundamental: the logic used to price Bitcoin.

Across recent months, Bitcoin has failed every role investors expected it to play. When equities weakened and risk appetite declined, Bitcoin did not behave as a safe haven. When liquidity tightened and growth expectations deteriorated, it also failed to show a stable risk asset profile. In moments when Bitcoin was supposed to rise, it fell. In moments when it was supposed to fall, it still fell.

This pattern is not coincidence. It reflects a market that no longer agrees on what Bitcoin actually is.

Bitcoin is now traded through multiple narratives at the same time. Each narrative implies a different role, a different investor base, and a different valuation framework. As these narratives collide, price loses its anchor. The result is not volatility driven by fundamentals, but instability driven by confusion.

ONE ASSET FOUR MUTUALLY EXCLUSIVE IDENTITIES

Bitcoin currently exists in four different conceptual buckets. None of them are wrong in isolation. The problem is that they cannot coexist.

The market is attempting to price Bitcoin simultaneously as an inflation hedge, a leveraged risk asset, digital gold, and an institutional reserve. Each identity demands different behavior under stress. When all four compete for dominance, price discovery collapses.

This is not diversification of narratives. It is fragmentation of meaning.

BITCOIN AS AN INFLATION HEDGE

Bitcoin’s earliest value proposition was simple. Fixed supply protects purchasing power. When governments expand balance sheets and debase currencies, Bitcoin should rise.

In theory, this narrative remains powerful. In practice, price behavior tells a different story.

During periods of heightened inflation concern, Bitcoin has failed to demonstrate consistent sensitivity to monetary debasement. In 2025, when inflation fears were most pronounced, gold rose more than 60 percent while Bitcoin declined by double digits. Around inflation data releases, Bitcoin’s response has been erratic. Sometimes it rises on CPI surprises. Other times it falls on similar signals.

This inconsistency matters. A hedge that only works sometimes is not a hedge. It is a trade.

Part of the issue lies in how inflation is interpreted. Markets often conflate consumer price inflation with monetary expansion. Bitcoin appears more sensitive to liquidity conditions than to inflation metrics themselves. When liquidity tightens, Bitcoin struggles regardless of inflation prints. When liquidity expands, Bitcoin rallies even if inflation remains elevated.

This behavior suggests that Bitcoin is not currently priced as protection against currency debasement, but as a high beta instrument tied to liquidity cycles.

BITCOIN AS A LEVERAGED RISK ASSET

From a market mechanics perspective, Bitcoin increasingly trades like a leveraged risk asset.

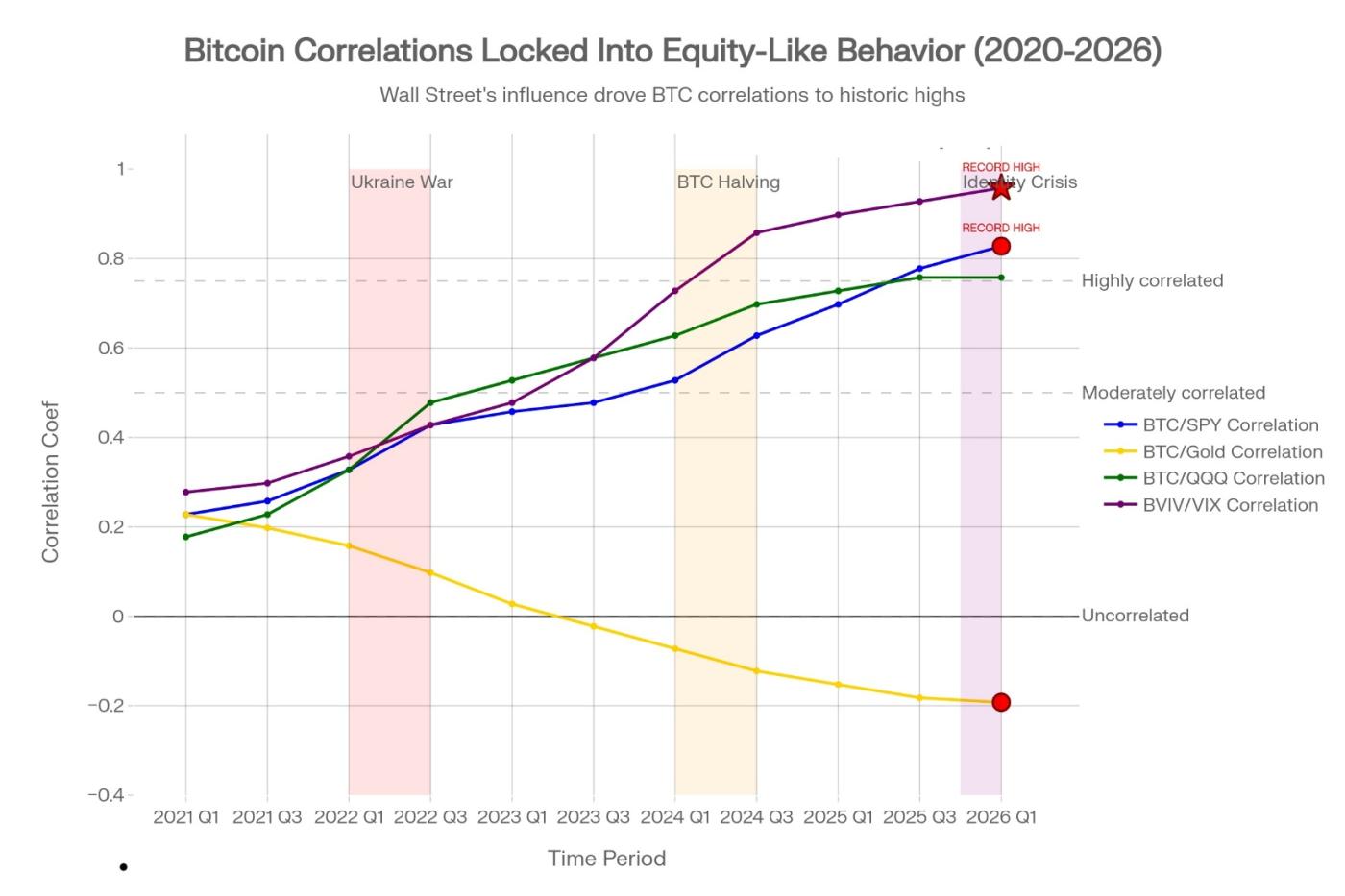

Since 2025, Bitcoin’s rolling correlation with the Nasdaq has frequently exceeded 0.6 and, during periods of liquidity stress, has briefly approached 0.7. This is a structural shift from earlier cycles, when correlations were materially lower and more unstable.

This correlation is not ideological. It is mechanical.

As institutional participation increased, Bitcoin was absorbed into the same risk management frameworks used for equities, commodities, and derivatives. Portfolio managers do not ask what Bitcoin represents philosophically. They ask how it behaves statistically.

When growth expectations weaken or liquidity tightens, these models reduce exposure to high volatility assets. Bitcoin, regardless of narrative, is treated as one of them.

Unlike technology stocks, Bitcoin generates no revenue, no earnings, and no cash flow. If priced purely as a risk asset, it lacks the fundamental anchors that support equities. That makes its downside sharper and its recoveries more dependent on liquidity rather than growth.

The more Bitcoin is traded this way, the weaker its original differentiation becomes.

BITCOIN AS DIGITAL GOLD

The digital gold narrative is emotionally compelling. It frames Bitcoin as a modern version of humanity’s oldest store of value.

But digital gold must pass a simple test: independence during crisis.

In early 2026, gold reached new historical highs as risk aversion increased. Bitcoin, meanwhile, experienced sharp drawdowns. During this period, Bitcoin’s correlation with gold turned negative, briefly reaching around minus 0.25.

Gold functions as a hedge because it decouples when fear rises. Bitcoin did not.

This failure does not mean Bitcoin can never become digital gold. It means it is not functioning as one now. The market continues to price Bitcoin based on short term risk dynamics rather than long term store of value logic.

As long as Bitcoin trades alongside risk assets during stress, the digital gold narrative remains aspirational rather than operational.

BITCOIN AS AN INSTITUTIONAL RESERVE ASSET

Another powerful narrative suggests Bitcoin is becoming a strategic reserve for corporations and governments.

If true, this would fundamentally change Bitcoin’s behavior. Reserve assets are held across cycles. They are accumulated during drawdowns. They are not traded for quarterly performance.

Institutional behavior does not yet support this claim.

ETF flow data over the past year shows activity dominated by arbitrage, basis trades, and volatility strategies rather than persistent net accumulation. During periods of heightened volatility, institutional participants tend to reduce exposure to meet risk constraints.

A reserve asset does not get sold because volatility rises. Bitcoin still does.

Until institutions demonstrate behavior consistent with reserve management rather than trading, this narrative remains incomplete.

WHY NO VALUATION MODEL FITS THE CURRENT PRICE

Each identity implies a different fair value.

As an inflation hedge or digital gold, Bitcoin justifies a higher long term valuation. As a leveraged risk asset, valuation compresses significantly. As a reserve asset, price should rise slowly with declining volatility.

Bitcoin currently sits in the middle of these frameworks. It satisfies none of them fully. It contradicts none of them decisively.

This is not equilibrium. It is unresolved consensus.

Markets are not pricing Bitcoin based on conviction. They are pricing it based on uncertainty.

WHEN INSTITUTIONS CANNOT DEFINE THE ASSET

This identity crisis is not limited to retail investors. Large institutions face the same ambiguity.

When an asset cannot be clearly classified, institutions default to correlation based models. These models assume historical relationships persist. When those relationships shift, rebalancing becomes unavoidable.

This process is mechanical, not discretionary. Algorithms do not ask whether Bitcoin adoption is rising. They react to volatility thresholds, drawdown limits, and correlation matrices.

As a result, Bitcoin’s price increasingly reflects risk management constraints rather than its underlying utility or scarcity.

VOLATILITY SYNCHRONIZATION AND THE LOSS OF PRICE DISCOVERY

One of the most critical shifts is volatility synchronization.

By early 2026, Bitcoin’s volatility showed a correlation of approximately 0.88 with the VIX index. In 2020, that figure was closer to 0.2. Bitcoin volatility has been absorbed into the same system that governs equity risk.

When volatility spikes, risk models reduce exposure across asset classes simultaneously. Bitcoin is no longer an independent volatility source. It is part of a unified risk basket.

This erodes genuine price discovery. Bitcoin price moves increasingly reflect portfolio adjustments rather than changes in adoption or usage.

ON CHAIN ACTIVITY AND THE PRICE DISCONNECT

Perhaps the clearest evidence of broken pricing lies on chain.

During periods when Bitcoin price struggled, network fundamentals showed resilience. Lightning Network capacity expanded sharply. Transaction activity stabilized. Long term holders remained largely inactive.

Usage improved. Price weakened.

This disconnect indicates that price is no longer responding primarily to utility. It is responding to positioning.

FOUR PATHS THE MARKET WILL EVENTUALLY FORCE

This situation cannot persist indefinitely. Markets demand clarity.

Bitcoin will be forced into one dominant role.

It may mature into a true reserve asset It may be fully accepted as a high volatility risk asset It may re establish itself as a hedge against monetary debasement Or it may lose its strategic allocation role altogether

The transition will not be smooth. Each attempted narrative will create volatility until one prevails.

WHEN BITCOIN CANNOT ANSWER WHAT IT IS

Bitcoin’s current struggle is not random. It reflects a failure to define identity in an institution dominated market.

As long as Bitcoin is traded as everything at once, it will function as nothing in particular. It will hedge when it should not. It will fall when it should protect. It will follow risk assets when it should diverge.

This is not temporary noise. It is structural.

The market will eventually impose an answer. One narrative will dominate. Others will fade.

Until that moment arrives, understanding what Bitcoin is not may matter far more than believing what it might one day become.