KEYTAKEAWAYS

CONTENT

On May 6, 2025, the U.S. Securities and Exchange Commission (SEC) delayed its decision on Canary Capital’s spot Litecoin ETF application.

This shows that while Bitcoin (BTC) and Ethereum (ETH) spot ETFs have already been approved, the SEC remains very cautious about approving ETFs for other cryptocurrencies.

WHY THE SEC IS CAUTIOUS ABOUT NEW CRYPTO ETFS

The SEC wants to protect investors and prevent market manipulation. That’s why it is taking more time to review crypto ETF applications.

Recently, the SEC postponed several decisions, including Litecoin (May 6), Solana and XRP (April 29), Grayscale Hedera, Bitwise Dogecoin, and even ETH staking and BTC/ETH in-kind redemption models.

The SEC is asking companies to provide more data to show that the crypto markets are safe and reliable.

Public feedback is also requested during comment periods, showing how seriously the SEC takes these decisions.

BTC and ETH are seen as “commodities,” not “securities,” so it was easier for them to get approved.

But coins like XRP and Solana have faced legal issues in the past, which makes approval harder.

Also, the SEC relies on market data from regulated exchanges like the Chicago Mercantile Exchange (CME). Litecoin, for example, doesn’t have a strong futures market like BTC or ETH, so it’s harder for the SEC to monitor.

Still, Litecoin has a long history and is similar to Bitcoin, so some analysts believe it might be the first altcoin ETF to be approved.

Bloomberg analyst James Seyffart thinks LTC has the best chance among altcoins.

Also, the 2023 court victory by Grayscale forced the SEC to approve BTC ETFs, showing that legal pressure can speed up change.

THE LONG JOURNEY OF BTC SPOT ETFS

The road to BTC ETF approval was long. The Winklevoss twins first applied in 2013, but the SEC rejected it many times over concerns about fraud and liquidity.

In 2021, BTC futures ETFs were approved because they used data from CME, which is a regulated exchange.

In 2023, Grayscale won a lawsuit against the SEC, which forced the agency to reconsider its position. In early 2024, the SEC approved 11 BTC spot ETFs, including ones from BlackRock and Fidelity.

These ETFs showed that BTC spot prices closely follow futures prices, and the market had good monitoring systems.

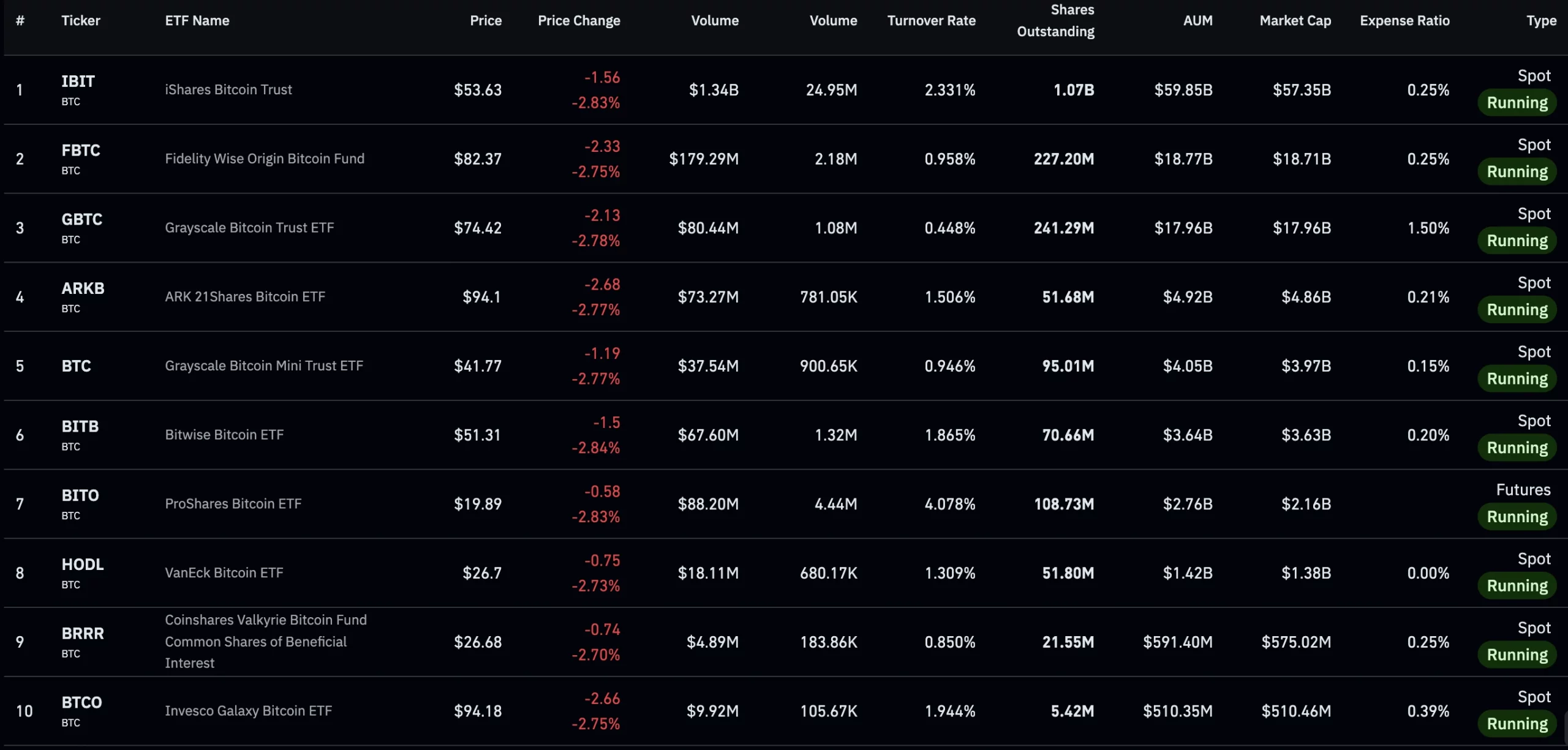

After approval, over $50 billion flowed into BTC ETFs, helping push BTC prices to multi-year highs and boosting confidence in the market.

ETH SPOT ETFS MOVED FASTER

ETH ETFs were approved more quickly. Applications started in 2022, but there was debate about whether ETH was a security.

After BTC ETFs were approved in January 2024, ETH applications also gained momentum, using similar arguments based on CME futures.

On May 23, 2024, the SEC approved 8 ETH ETFs, and they began trading in July. The SEC confirmed that ETH is a commodity and accepted CME’s data as reliable.

About $15 billion flowed into ETH ETFs. However, because these ETFs didn’t include staking rewards, they attracted a bit less attention than BTC ETFs.

WHAT’S NEXT?

The SEC is trying to find a balance between innovation and safety. Litecoin’s ETF may be approved by September 2025, as it’s seen as more stable and Bitcoin-like.

But coins like Solana and XRP still face legal and monitoring issues.

Changes in leadership or laws—like the new SEC chairman or the passing of FIT21—might speed up approvals.

Also, if CME or other regulated exchanges support more crypto futures, the SEC may feel more confident in approving new ETFs.

Investors should pay attention to SEC comment periods and final decision deadlines (usually 240 days after application), as these are chances to spot investment opportunities early.

From the 10-year struggle to approve BTC ETFs to the fast-track approval of ETH, the crypto ETF story shows both market progress and regulatory caution.

The SEC’s careful approach adds stability to the industry, and upcoming ETFs like Litecoin’s may bring even more growth.

In the future, stronger cooperation between regulators and markets will help bring digital assets further into the mainstream financial system.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!