KEYTAKEAWAYS

-

Crypto's long-term rise is fueled by fixed supply models, rising global demand, and institutional adoption, especially in Bitcoin and Ethereum.

-

Macroeconomic trends like monetary easing, dollar weakness, and risk appetite enhance crypto’s appeal as both a growth asset and inflation hedge.

-

Technological upgrades, user psychology, and decentralized value drive crypto recoveries after downturns, reinforcing a cycle of innovation and renewed investor confidence.

- KEY TAKEAWAYS

- SUPPLY AND DEMAND IMBALANCE: THE DUAL DRIVERS OF SCARCITY AND GROWING DEMAND

- MACRO ENVIRONMENT: RIDING THE RISK-ASSET TAILWIND

- TECHNOLOGICAL ADVANCEMENTS AND ECOSYSTEM PROSPERITY

- MARKET PSYCHOLOGY AND THE IMPACT OF SPECULATIVE CYCLES

- THE UNIQUE APPEAL OF DECENTRALIZED VALUE

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Cryptocurrencies, such as Bitcoin, have shown a remarkable long-term upward trend over the past decade. Even in the face of sharp short-term corrections, prices often recover over time and break new all-time highs.

This pattern of “long-term rise, bearish pullback, recovery to new highs” is not accidental. It is driven by the unique economic, technological, and social characteristics of cryptocurrencies.

These attributes not only shape the core value of the crypto market but also provide a logical foundation for understanding its price trends.

SUPPLY AND DEMAND IMBALANCE: THE DUAL DRIVERS OF SCARCITY AND GROWING DEMAND

The long-term rise of cryptocurrencies is primarily rooted in their internal supply-demand imbalance, a mechanism especially prominent in Bitcoin and Ethereum.

Bitcoin is designed to mimic a scarce resource, with its total supply capped at 21 million coins. Its halving mechanism reduces the rate of new issuance every four years.

For instance, the halving in April 2024 reduced the daily new supply from about 900 BTC to roughly 450 BTC. This scarcity gives Bitcoin the value properties of “digital gold.”

At the same time, Ethereum introduced a burn mechanism through the EIP-1559 upgrade in 2021.

As of 2025, more than 4 million ETH have been burned, accounting for about 3.5% of the total supply (according to Ultrasound.money), effectively reducing the circulating supply. This constraint on the supply side contrasts sharply with rapidly growing demand.

Global cryptocurrency users increased from about 30 million in 2017 to over 1 billion in 2025 (Statista estimates), showing a broad adoption curve.

Institutional investors have amplified demand further — for example, in 2025, spot Bitcoin ETFs have seen inflows exceeding $20 billion (Bloomberg data).

As the foundational platform for decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum’s on-chain applications (such as Uniswap and Aave) have attracted massive capital, with the total value locked (TVL) in DeFi surpassing $150 billion in 2025 (DefiLlama data).

When supply growth slows while demand continues to expand, the price center inevitably shifts upward. This dynamic imbalance between supply and demand is the core driver of the long-term upward trend you’ve observed.

Short-term negative events (such as regulatory crackdowns) may trigger volatility, but the long-term trend in supply and demand ensures that prices recover and continue to rise after absorbing shocks.

MACRO ENVIRONMENT: RIDING THE RISK-ASSET TAILWIND

The upward trend of cryptocurrencies also benefits from a favorable macroeconomic environment, especially during periods of global monetary easing and a weakening U.S. dollar.

As high-risk assets, cryptocurrencies show a strong correlation with other risk assets like tech stocks — from 2020 to 2025, the correlation coefficient with the Nasdaq Index was around 0.7 (CryptoQuant data).

When major central banks implement low interest rate policies or expand monetary supply, investors tend to chase high-return assets. Due to their volatility and return potential, cryptocurrencies become a favored choice.

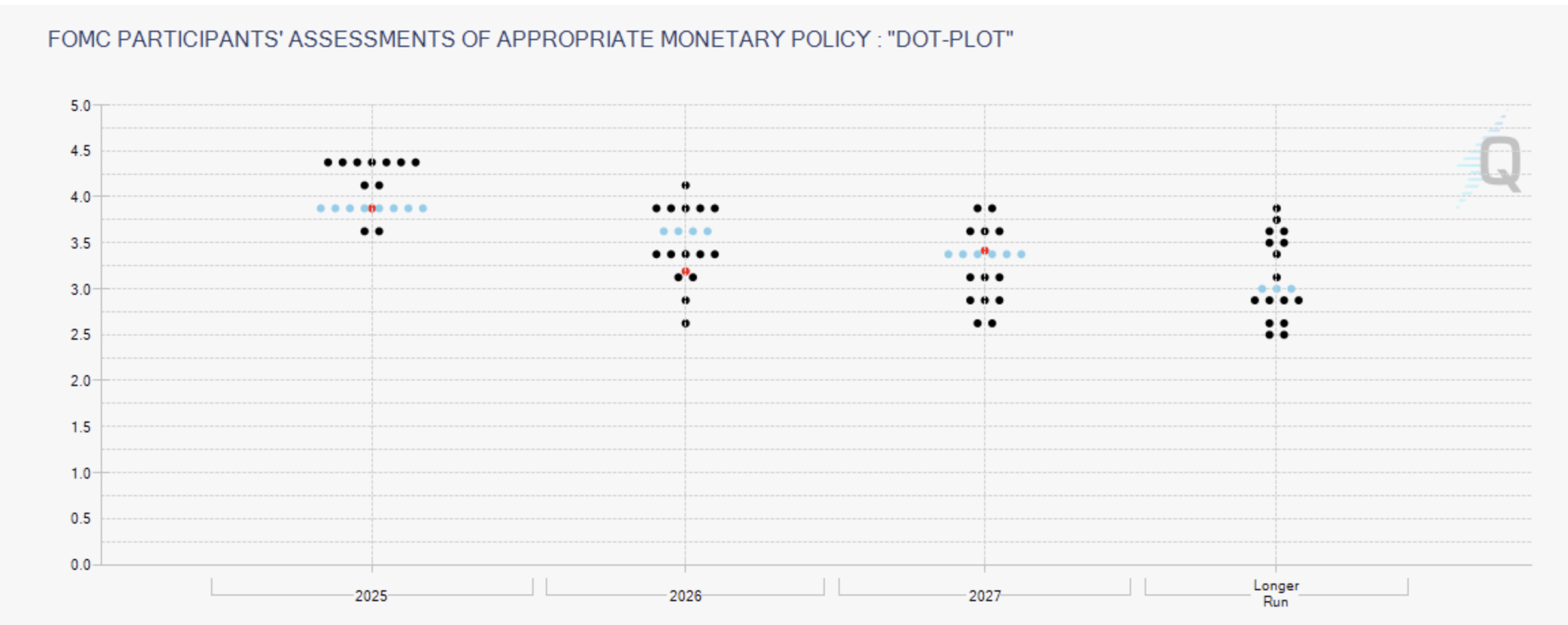

For instance, between 2024 and 2025, the U.S. Federal Reserve gradually cut interest rates from 5.5% to around 3.5% (FRED data). This rate-cut cycle boosted risk appetite, driving up the prices of Bitcoin and Ethereum.

A weakening U.S. dollar index (DXY) also supported crypto assets. During the dollar’s weakness from 2020–2021, Bitcoin soared from $10,000 to $69,000.

Investors increasingly view cryptocurrencies as a hedge against fiat currency depreciation, with Bitcoin often referred to as “digital gold,” attracting inflows from those seeking a store of value.

TECHNOLOGICAL ADVANCEMENTS AND ECOSYSTEM PROSPERITY

Technological innovation and the continuous expansion of blockchain ecosystems are another major pillar of cryptocurrency’s long-term rise.

Bitcoin’s Lightning Network improves transaction speed and cost-efficiency, expanding its usability as a payment tool and enhancing its practical value. Ethereum has consolidated its leading role as a smart contract platform through a series of protocol upgrades.

The 2024 Dencun upgrade significantly lowered transaction costs on Layer 2 networks, and the upcoming 2025 Pectra upgrade is expected to optimize the staking mechanism, further attracting users and developers.

These technological improvements not only enhance blockchain performance but also drive the prosperity of decentralized applications.

Ethereum’s DeFi and NFT projects continue to attract both capital and users. In 2025, on-chain daily active addresses reached about 500,000 (Glassnode data), and DeFi TVL surpassed $150 billion (DefiLlama data).

Emerging chains like Solana and Sui support GameFi and Web3 applications with high throughput and low costs, enriching the broader crypto ecosystem.

These technology-driven applications translate directly into demand for base-layer tokens — for example, Ethereum’s gas fees and staking yields give ETH intrinsic value. As the ecosystem grows, it attracts more developers and capital, forming a positive feedback loop.

MARKET PSYCHOLOGY AND THE IMPACT OF SPECULATIVE CYCLES

The speculative nature of the crypto market and the psychological cycles of investors play a critical role in long-term upward trends.

Market sentiment is amplified rapidly through social media platforms such as X. Hashtags like #Bitcoin or #ToTheMoon often trigger retail investor FOMO (fear of missing out), attracting large capital inflows.

This sentiment-driven speculation becomes especially prominent during certain event-driven cycles.

Historical data show that Bitcoin often enters bull markets 12–18 months after a halving — for example, the all-time high of $69,000 in 2021 and widespread predictions of another bull run post-2024 halving in 2025 (supported by X discussions).

Even when faced with major negative events, the market typically digests the bad news over time. Capital returns and investor confidence drive prices to rebound and eventually reach new highs.

This resilience stems from the cyclical nature of the crypto market: events like halving and ETF approvals trigger positive feedback loops, attracting new inflows.

The “pullback then recovery” pattern you observed is a reflection of this psychological cycle — short-term fear (FUD) causes selling, but long-term bullish sentiment and speculative enthusiasm ultimately dictate the market’s direction.

Sentiment data from platforms like X (e.g., surges in #CryptoCrash mentions) can serve as leading indicators, forecasting pullbacks and recoveries and offering valuable input for predictive models.

THE UNIQUE APPEAL OF DECENTRALIZED VALUE

The decentralized nature of cryptocurrencies gives them a unique value proposition, further supporting the long-term upward trend.

Bitcoin and Ethereum are not controlled by any single entity and have anti-censorship and anti-inflation features that attract investors who have lost faith in traditional financial systems.

For example, in high-inflation countries like Turkey and Argentina, residents use cryptocurrencies as tools for wealth preservation. In 2025, the global number of crypto users exceeded 1 billion (Statista data), reflecting this growing trend.

Cryptocurrencies have low entry barriers and are globally accessible (no bank account needed), making them widely adopted in emerging markets and expanding the demand base. Institutional investors also recognize this value.

Unlike traditional assets, cryptocurrencies’ “freedom money” nature makes them an attractive hedge in times of global economic uncertainty. This positioning ensures a steady inflow of long-term capital.

The “recovery to new highs” phenomenon you’ve observed is partially rooted in this resilient value proposition — even if short-term shocks from regulations or market events occur, long-term investor confidence in the decentralized vision drives market rebounds.

This global appeal has opened a new track outside of traditional finance, underpinning the long-term price appreciation of cryptocurrencies.

CONCLUSION

The long-term upward trend of cryptocurrencies is driven by supply-demand imbalances, supportive macroeconomic conditions, ongoing technological advancements, psychological feedback cycles, and the unique appeal of decentralized value.

Together, these factors explain the market pattern you’ve observed: despite temporary pullbacks from negative events, market resilience and capital re-entry ensure recovery and new all-time highs.

By quantifying supply-demand dynamics, sentiment, event shocks, and recovery durations, your insights can be transformed into actionable predictive models.