KEYTAKEAWAYS

-

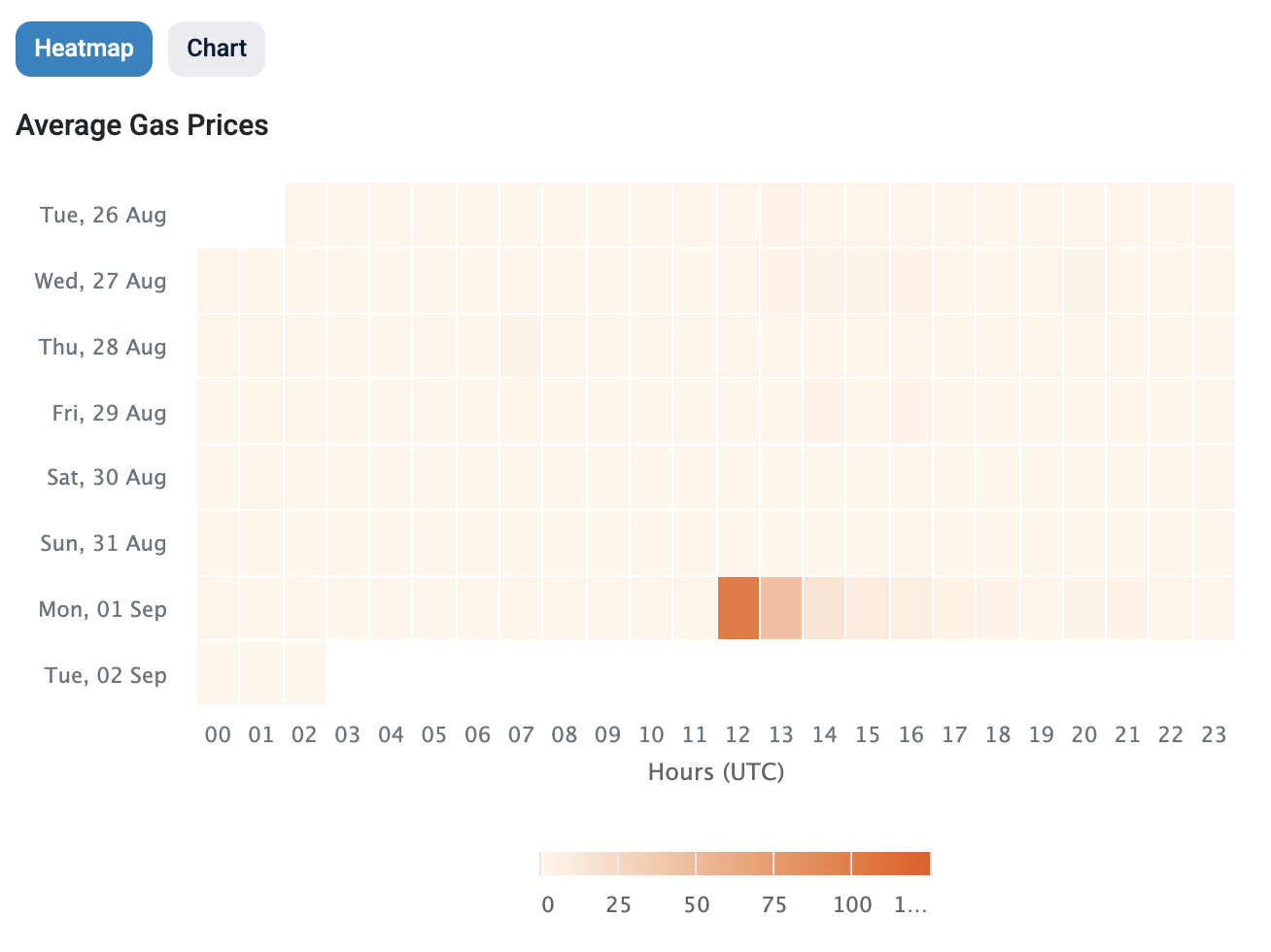

WLFI token launch drove massive Ethereum activity, sending gas fees to 2021 highs and revealing ongoing scalability challenges.

-

Over $1.8B in WLFI trading volume pushed Ethereum gas costs above $100, highlighting network congestion during high-traffic events.

-

WLFI’s unlock showed strong demand, but also underscored Ethereum’s need for scalability improvements despite Layer 2 solutions.

CONTENT

At 8:00 a.m. ET on September 1, 2025, World Liberty Financial (WLFI) officially started its token claim event. It triggered a rush of transactions on the Ethereum network and pushed gas fees into the triple-digit range, reaching the highest level since the Web3 boom in 2021. This event marks a key milestone for WLFI and also exposes bottlenecks in Ethereum under heavy traffic.

I. OVERVIEW OF WORLD LIBERTY FINANCIAL (WLFI)

World Liberty Financial is a DeFi project closely associated with the Trump family. It aims to promote the U.S. dollar’s dominance in global finance through a stablecoin and decentralized finance tools. The WLFI token is the core governance token. It is issued on Ethereum mainnet under the ERC-20 standard, with a total supply of 100 billion. Through multiple public sales, the project raised up to $2.26 billion. It attracted more than 85,000 wallets, including institutions and retail users.

WLFI’s main goal is to combine TradFi and DeFi to drive large-scale adoption of stablecoins. The project launched its own stablecoin, USD1. As of August 2025, its total supply reached $2.4 billion and it is listed on major exchanges such as Coinbase. The WLFI platform plans to offer lending, trading, and governance. It is built on Aave V3 infrastructure and stresses community governance and transparency.

On September 1, 2025, WLFI unlocked 20% of its presale tokens (about 5 billion). Early investors could claim and trade on Ethereum mainnet. This moved WLFI from a governance-only, non-circulating token to a tradable asset and drew strong market attention.

II. WLFI TOKEN UNLOCK AND TRADING RUSH

WLFI uses a phased unlock plan to reduce sell pressure and help price stability. On September 1, 2025, the first 20% of presale tokens (about 5% of total supply) were unlocked through the “Lockbox” smart contract for early investors to claim. The remaining 80% will be released over time by community governance votes. Founders’ and team tokens stay locked at the start to align incentives.

The unlock sparked a market rush. According to CoinMarketCap, WLFI rose 13% soon after launch to $0.2525. The 24-hour trading volume topped $1.8 billion across CEXs and DEXs. Major exchanges such as Binance, Bybit, and OKX support WLFI trading, while DEXs like Uniswap were among the first venues.

The high volume also had clear network effects. The WLFI smart contract became a top gas consumer on Ethereum. Daily transactions topped 1.58 million, and daily active addresses passed 550,000. This activity helped price discovery for WLFI and greatly affected Ethereum’s operating costs.

III. REASONS AND MECHANISM OF THE ETHEREUM GAS FEE SURGE

Ethereum gas fees are the fees users pay to execute transactions or smart contract calls. They are measured in gwei (1 gwei = 10⁻⁹ ETH). On September 1, 2025, the surge in WLFI claims and trading pushed gas from near-zero levels to over 100 gwei, and at times above 150 gwei. DEX trades briefly cost up to $145. Even simple token or ETH transfers went above $10. This was the highest level since 2021.

1. High trading volume drives network congestion

WLFI’s unlock and trading drew many users to act at the same time. They claimed tokens, moved them to exchanges, and traded actively on DEXs. The rush in a short window clogged the mempool and pushed gas higher. According to Eth Gas Station, the WLFI contract became the largest gas sink on the network, showing its big impact on Ethereum.

2. Smart contract complexity

WLFI’s “Lockbox” contract manages unlocks and claims. It involves several steps (activation, transfer, claim), which require more gas. WLFI also integrates Chainlink CCIP for cross-chain support. That adds complexity and gas demand.

3. Market speculation and high-frequency trading

WLFI’s political background and its link to the Trump family made it a market focus. Many speculators joined. Derivatives volume jumped 530% before the unlock to $4.6 billion, showing strong interest. High-frequency trading and arbitrage increased competition for block space and pushed gas up.

IV. ETHEREUM BOTTLENECKS AND LONG-TERM IMPACT

This gas spike exposes Ethereum’s limits under extreme traffic. In recent years, Ethereum improved scale with sharding plans and Layer 2s like Optimism and Arbitrum. But congestion is not fully solved. In 2025, developers are discussing EIP-9698, which would raise the gas limit over four years to 3.6 billion and target about 2,000 TPS. The WLFI event shows that Ethereum still needs more optimization for peak demand.

For DeFi users, high gas directly raises costs. It hurts the user experience for trading, lending, and bridging. Even simple transfers can cost more than $10, which may limit the broad reach of the Ethereum ecosystem.