KEYTAKEAWAYS

-

Trump family became the biggest winner, amassing over $5 billion in book wealth from WLFI’s token launch — their largest financial windfall since Trump’s presidency.

-

Justin Sun strategically holds 3 billion WLFI, framing it as a political investment to secure ties with Trump rather than a short-term profit play.

-

On-chain whales harvested massive gains, with some selling aggressively while others used Falcon Finance’s stablecoin protocol as a disguised liquidity exit channel.

CONTENT

Over the last 24 hours, the spotlight of the crypto market was firmly fixed on WLFI’s long-awaited Token Generation Event (TGE). The launch turned into a fast-moving, high-stakes game — with major political families, crypto whales, and retail participants each playing very different roles.

A LAUNCH WITH UNEXPECTED SUPPLY SHOCK

Prior to launch, the market expected WLFI’s initial circulating supply to hover around 5 billion tokens. Instead, the WLFI team disclosed that over 24.6 billion tokens would circulate from the start. The surprise addition of nearly 20 billion tokens triggered a wave of skepticism, dragging WLFI’s pre-launch price from $0.35 down to under $0.30.

Yet the fear was short-lived. At 20:00 Beijing time, WLFI went live. On-chain, its price quickly touched $0.458, while centralized exchanges reflected similar enthusiasm — peaking at $1.1 on Gate.io and nearly $0.48 on Binance an hour later. Early investors walked away with outsized gains, with first-round participants seeing 30x returns and second-round participants enjoying about 9x.

TRUMP FAMILY EMERGES AS BIGGEST WINNER

No matter how the market spins it, the Trump family walked away as the undeniable MVP. According to The Wall Street Journal, their holdings translated into over $5 billion in book wealth after WLFI’s debut — likely their single largest financial windfall since Trump’s presidency.

Public disclosures revealed that Trump personally held 15.75 billion WLFI tokens — about 15.75% of total supply — worth more than $3.6 billion at current market prices. While the team insists that founder allocations remain locked, few believe such holdings cannot be partially monetized through intermediaries like Alt 5 Sigma Corporation, which previously announced new share issuances tied directly to WLFI.

This success builds on the Trump family’s earlier crypto ventures, such as TRUMP-branded tokens, where profits reportedly exceeded $350 million. WLFI now surpasses decades of real estate assets to become their most lucrative bet.

JUSTIN SUN PLAYS THE POLITICAL LONG GAME

Tron founder Justin Sun also made headlines. Reports confirmed he held roughly 3 billion WLFI (3% of supply), and on launch day, he claimed 600 million tokens worth $138 million. Sun, however, publicly vowed not to sell in the short term.

For Sun, WLFI is less a speculative play and more a political investment. His participation is seen as a strategic “donation” to secure favor with the Trump circle, a move that could safeguard Tron’s regulatory position and aid Huobi or Tron’s U.S. ambitions. Sun’s payoff may not come from immediate profits, but from influence and access down the line.

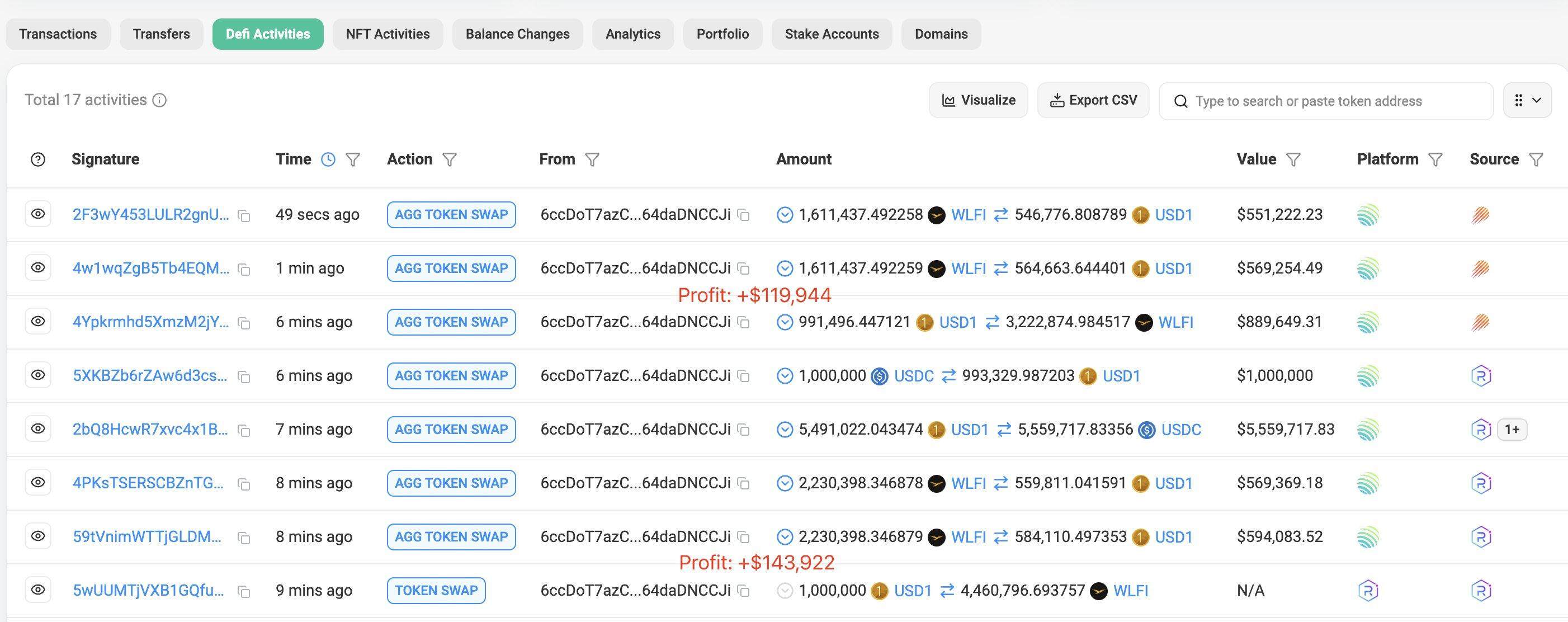

WHALES HARVEST GAINS — AND SEEK LIQUIDITY

On-chain whales, meanwhile, treated WLFI’s launch as a lucrative harvest. Addresses like 6ccDoT pulled in profits of $263,000 in just 10 minutes of trading. Gas fees spiked to over 129 Gwei, but that didn’t deter whales from moving tokens to exchanges like Binance for exits.

Early presale investors sold aggressively. One whale, moonmanifest, claimed 200 million unlocked WLFI (purchased at $0.015) and sold 10 million the next morning for $2.1 million. Others liquidated even faster — according to monitoring, 4 of the top 10 holders sold part or all of their allocations within half an hour of TGE. OTC platforms like Whales Market facilitated millions in block trades.

At the same time, whales may have found a safety valve. DWF Labs partner Andrei Grachev announced that their stablecoin protocol Falcon Finance would accept WLFI as collateral. Using WLFI, investors can mint USDf stablecoins — essentially providing an alternative “exit channel” without direct market selling. As Odaily’s analysts note, this creates a disguised liquidity backdoor: whales can mint, hedge, and slowly cash out without crashing prices outright.

LOOKING AHEAD

WLFI’s launch delivered everything from political drama to DeFi innovation. The Trump family secured billions, Justin Sun played the long game, and whales found multiple ways to lock in profits. With governance proposals now surfacing — including token buybacks using Protocol Owned Liquidity (POL) fees — WLFI’s trajectory remains volatile but strategically important.

For now, WLFI’s debut has already reshaped narratives around crypto, politics, and wealth distribution. Whether it sustains momentum or collapses under whale exits will determine if its launch was just another hype cycle — or the beginning of a new era where political power and crypto finance intersect at an unprecedented scale.