KEYTAKEAWAYS

- The latest FOMC decision signaled patience, not easing, forcing markets to reprice interest rate expectations amid persistent inflation and cautious Federal Reserve policy guidance.

- Gold benefited from rising macro uncertainty, while Bitcoin declined from 89,631 to 88,649 as tighter liquidity expectations weighed on crypto risk appetite.

- Beyond the Fed, risks such as a U.S. government shutdown and escalating geopolitical tensions increase volatility and reinforce the need for disciplined risk management.

- KEY TAKEAWAYS

- LATEST FOMC MEETING DECISION AND INTEREST RATE POLICY BACKGROUND

- JEROME POWELL PRESS CONFERENCE AND FED POLICY SIGNALS

- INTEREST RATE EXPECTATIONS AFTER THE FOMC MEETING

- GOLD PRICE REACTION TO THE FOMC AND MACRO UNCERTAINTY

- BITCOIN PRICE DECLINE AFTER THE FOMC DECISION

- WHY GOLD OUTPERFORMED BITCOIN AFTER THE FOMC MEETING

- ADDITIONAL MACRO RISKS BEYOND THE FOMC

- RISK MANAGEMENT AND MARKET OUTLOOK AFTER THE FOMC

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The latest FOMC meeting paused rate cuts, reshaping market expectations. Bitcoin slipped, gold surged, and rising macro risks now dominate the outlook.

Just hours before the FOMC meeting, I wrote an article titled “[How to Read Fed Rate Cut Signals: Decoding Tonight’s FOMC Meeting Through Market Data]”, which provided a simple analysis of the magnitude and depth of interest rate cuts.

At the end of the article, I gave a clearly bearish conclusion, and at the same time, I opened short positions in BTC and long positions in gold.

Now that the FOMC meeting is over, the market reaction is exactly as we predicted. Let’s take a closer look.

LATEST FOMC MEETING DECISION AND INTEREST RATE POLICY BACKGROUND

The Federal Reserve’s most recent Federal Open Market Committee (FOMC) meeting delivered a decision that markets broadly anticipated, yet the implications proved far more complex. Policymakers voted to keep the federal funds target rate unchanged at 3.50%–3.75%, extending a pause that followed multiple rate cuts throughout 2025. While the headline outcome avoided a surprise, the broader message was anything but neutral.

This meeting effectively confirmed that the Federal Reserve is not prepared to accelerate monetary easing. Officials emphasized the need for sustained, convincing evidence that inflation is moving decisively toward the 2% target before adjusting policy further. As a result, investors were forced to reassess expectations that had increasingly leaned toward a faster and smoother rate-cutting cycle.

The timing of the decision also mattered. Global markets are already operating under elevated uncertainty, with resilient U.S. economic data reducing the urgency for stimulus, while fiscal and geopolitical risks continue to accumulate. Against this backdrop, the Fed’s pause signaled caution rather than reassurance.

JEROME POWELL PRESS CONFERENCE AND FED POLICY SIGNALS

In the post-meeting press conference, Chair Jerome Powell reinforced a message of patience and restraint. He described the U.S. economy as solid, pointing to steady growth and a labor market that has stabilized without showing signs of sharp deterioration. At the same time, Powell acknowledged that inflation remains above target and that progress has been uneven across sectors.

Notably, Powell avoided offering explicit guidance on the timing of future rate cuts. He stressed that monetary policy decisions will remain data-dependent and that the committee is prepared to maintain current rates for longer if inflation pressures persist. This absence of forward commitment was interpreted by markets as a signal that easing is not imminent.

Powell also reiterated that the Federal Reserve does not target asset prices. Its focus, he emphasized, remains firmly on price stability and maximum employment. While this stance aligns with long-standing Fed principles, it arrived at a moment when financial markets were increasingly dependent on expectations of looser liquidity.

INTEREST RATE EXPECTATIONS AFTER THE FOMC MEETING

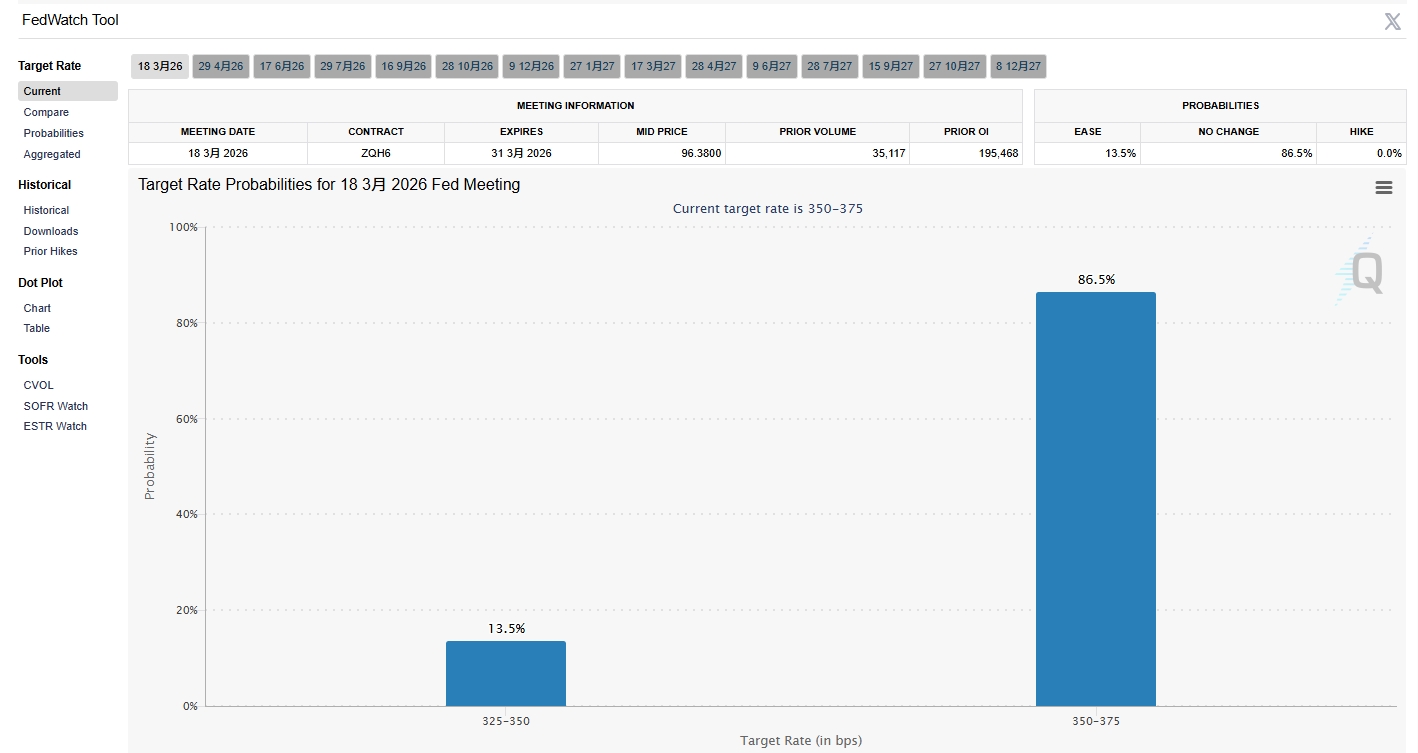

Before the meeting, futures markets reflected meaningful expectations for rate cuts in the coming months. Following the Fed’s statement and Powell’s remarks, those expectations were noticeably scaled back. The shift did not eliminate the prospect of future cuts, but it raised the threshold for action.

This adjustment mattered because markets respond not only to policy moves, but also to changes in expectations. Even without an interest rate hike, the signal of a prolonged pause can tighten financial conditions by supporting the U.S. dollar, keeping real yields elevated, and dampening risk appetite.

In effect, the Fed reinforced the view that liquidity conditions will remain constrained in the near term. For assets sensitive to monetary expansion, this represented a clear headwind.

GOLD PRICE REACTION TO THE FOMC AND MACRO UNCERTAINTY

Gold emerged as one of the clearest beneficiaries of the post-FOMC environment. Following the decision, gold prices continued to strengthen, reflecting a renewed demand for safety amid policy uncertainty.

Unlike growth-oriented or speculative assets, gold does not depend on economic expansion or earnings momentum. It tends to perform well when investors seek protection against inflation risks, geopolitical tension, or policy ambiguity. The Fed’s cautious tone, while not overtly hawkish, reinforced concerns that restrictive conditions could persist longer than anticipated.

In addition, broader macro factors amplified gold’s appeal. Ongoing debates over U.S. government funding and rising geopolitical tensions have increased demand for traditional safe-haven assets. In this context, gold’s role as a store of value has regained prominence.

For research on gold, please refer to my article written on January 6, 2026. After writing that article, I also bought spot gold and low-leverage long contracts.

Gold, silver, and other precious metals have recently seen a sharp rise in prices, causing some investors to hesitate to buy at these high levels. For investment advice regarding current price points, please stay tuned for my upcoming posts.

Why Gold Is Surging: Central Banks, Sanctions, and Trust-1

Gold Front-Runs QE as Bitcoin Waits for Liquidity-2

BITCOIN PRICE DECLINE AFTER THE FOMC DECISION

Bitcoin’s response stood in contrast to gold. In the hours following the FOMC decision, BTC declined from approximately 89,631 to 88,649, reflecting a modest but clear risk-off reaction.

While the move was not dramatic, it was significant in context. Bitcoin had already been trading within a fragile range, and the Fed’s messaging removed a potential catalyst for near-term upside. With expectations for imminent rate cuts reduced, traders showed less willingness to maintain aggressive long exposure.

This reaction underscored a persistent reality: despite its long-term narrative as a hedge against fiat debasement, Bitcoin still behaves like a liquidity-sensitive risk asset during periods of monetary uncertainty. When prospects for easing diminish, crypto markets often experience short-term pressure.

WHY GOLD OUTPERFORMED BITCOIN AFTER THE FOMC MEETING

The divergence between gold and Bitcoin reflects structural differences in investor behavior. Gold is widely held as a defensive asset, often gaining when confidence in monetary or fiscal stability weakens. Bitcoin, by contrast, occupies a more complex position between a macro hedge and a speculative asset.

Institutional investors frequently adjust gold exposure as part of broader risk management strategies. Crypto allocations, however, remain more tactical and sensitive to short-term shifts in liquidity expectations. As a result, gold can rally during uncertainty even as Bitcoin consolidates or declines.

This divergence does not invalidate Bitcoin’s long-term thesis, but it highlights the importance of macro timing. In the short run, liquidity conditions continue to play a dominant role in crypto price action.

ADDITIONAL MACRO RISKS BEYOND THE FOMC

The FOMC decision does not exist in isolation. Several additional risks are converging, adding pressure to an already fragile market environment.

One key concern is the potential for a U.S. government shutdown. Ongoing fiscal negotiations have raised the risk of funding disruptions, which could undermine investor confidence and increase volatility across financial markets.

At the same time, geopolitical tensions remain elevated. Developments involving U.S.–Iran relations have reintroduced uncertainty into energy markets and global security dynamics. Any escalation could complicate the inflation outlook while weighing on growth expectations.

These overlapping risks make markets more vulnerable to negative surprises and reduce tolerance for speculative positioning.

RISK MANAGEMENT AND MARKET OUTLOOK AFTER THE FOMC

Taken together, the latest FOMC meeting reinforced a message of caution. The Federal Reserve remains focused on inflation control, even at the cost of maintaining restrictive conditions longer than markets would prefer. Meanwhile, fiscal uncertainty and geopolitical risks continue to cloud the outlook.

Gold may continue to benefit from this environment, particularly if uncertainty intensifies. Bitcoin and the broader crypto market, however, are likely to remain volatile, with short-term moves driven by shifts in liquidity expectations and macro headlines.

In such conditions, disciplined risk management becomes essential. While long-term narratives remain intact, the near-term landscape favors patience and vigilance over aggressive positioning.

The above viewpoints are referenced from Ace