KEYTAKEAWAYS

- China's real estate crisis affects its economy, GDP, and currency market, requiring careful policy balancing.

- The challenge lies in stimulating the domestic economy while preventing capital outflows and managing the yuan's depreciation amidst global economic changes.

CONTENT

Following the shocking default by Evergrande Real Estate at the end of 2021, this week, China’s exemplary property developer, Country Garden, has been hit by reports of a credit default. Eleven corporate bonds were announced to be suspended from trading starting from August 14th, totaling a balance of 15.7 billion Chinese Yuan. A bondholder meeting is being arranged, and interest payments have encountered difficulties since August 6th. Moreover, Country Garden issued a profit warning on August 10th, reporting a loss of 55 billion Chinese Yuan in the first half of 2023, a significant deterioration compared to a loss of 6.1 billion Chinese Yuan in 2022. This article explores the implications of the crisis unfolding at Country Garden within the context of the broader Chinese real estate market.

COUNTRY GARDEN’S ORIGINS

Country Garden was established in 1992 as a major property developer in China, specializing primarily in real estate. In 2007, it became publicly traded and was listed on the Hong Kong Stock Exchange. At one point, it was designated as an exemplary builder by Beijing authorities. In the 2023 rankings of Chinese property developers, it ranked just below Poly and Vanke.

However, starting from 2022, as the Chinese property market underwent a reversal, Country Garden’s circumstances took a downturn. In September of that year, it experienced a downgrade by S&P, going from BB+ to BB. Then, in August of the current year, it faced further downgrades by international credit rating agency Moody’s, plummeting from Ba3 all the way to the Caa1 default level. Even though there hasn’t been a major default event thus far, the company is now on the brink of debt negotiations as its bond payments come due. This situation marks yet another major real estate developer encountering issues following the Evergrande crisis.

WHAT HAPPENED WITH EVERGRANDE?

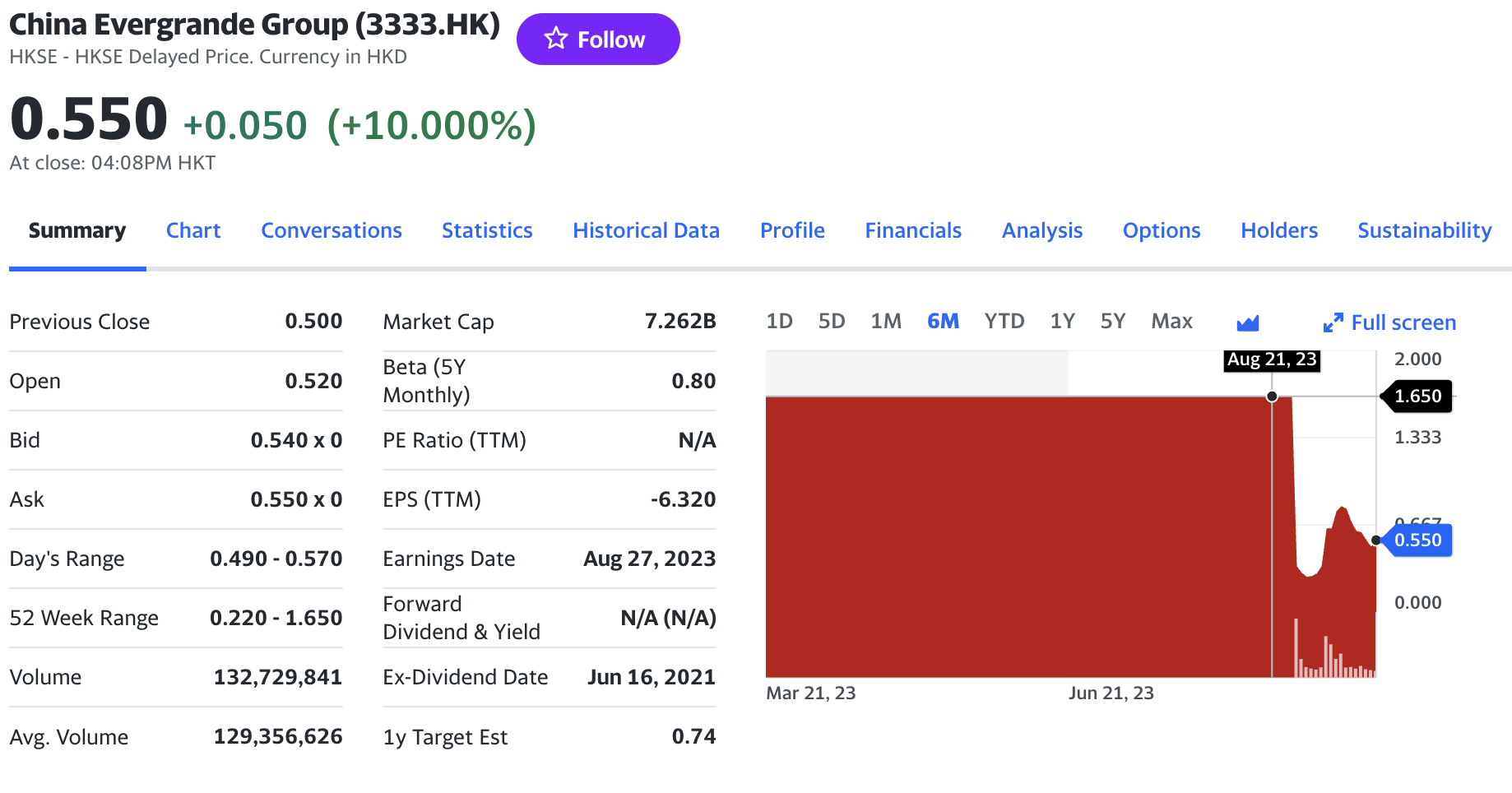

On the evening of August 10th, Evergrande Real Estate released multiple announcements revealing a dire financial situation for the year 2022, with a staggering loss of approximately -52.7 billion Chinese Yuan. As of the end of 2022, its current liabilities amounted to about 1.68 trillion Chinese Yuan, while the company only had 9.2 billion Chinese Yuan in cash on its balance sheet. This meant that its total assets of 1.47 trillion Chinese Yuan would not be sufficient to cover its total debts of 1.83 trillion Chinese Yuan.

Facing financial difficulties and an inability to raise funds from creditors and investors, Evergrande could only rely on government policies for potential rescue. However, factors such as weakened household incomes following China’s COVID-19 restrictions and expectations of falling property prices have made the road to recovery in the Chinese real estate sector a long and challenging one.

Source: Yahoo Finance

IS CHINA’S REAL ESTATE SECTOR IMPORTANT?

Real estate investment in China accounts for 13% of the country’s GDP (Gross Domestic Product), and when considering the entire supply chain, the total input can reach 25%-30%. The health of the real estate sector also indirectly affects China’s economic indicators. However, the real estate industry in China has been in a slump due to the impact of the pandemic. One of the most direct measures to address this has been the reduction of reserve requirements and interest rates, providing abundant low-cost capital to help real estate developers alleviate debt pressures. It also allows individuals to access loans at lower rates, stimulating the desire to purchase homes. The recent storm involving Evergrande may prompt the People’s Bank of China to further reduce reserve requirements and interest rates in Q3 to support the real estate sector.

Source: Statista

CHALLENGES IN CHINA’S CURRENCY MARKET

Given that loose monetary policies can stimulate the real estate market, why is the People’s Bank of China (PBOC) hesitant to act? The reason lies in the ongoing global capital flow back to the United States amid the tightening of monetary policy there. If China were to intensify its interest rate stimulus policies, it would lead to a rapid depreciation of the Chinese yuan. Therefore, the PBOC finds itself in a delicate situation where it needs to stimulate the domestic economy while preventing capital outflows. The best approach is to provide liquidity while conditionally relaxing domestic financing. With the yuan continuously depreciating, the United States may no longer need to raise interest rates to counter China’s actions. For the PBOC, currency decisions are far more critical than managing the supply and demand of the real estate market.

CRISIS AND OPPORTUNITY AMID THE EVERGRANDE STORM

While the recent turmoil in the Chinese real estate market shares some similarities with the 2008 subprime crisis, it also differs significantly. One key distinction is that Chinese mortgage products have lower liquidity in international markets, which means they are unlikely to cause systemic shocks to the global financial system. Although there are short-term disruptions, the correction in Chinese property prices could alleviate pressure on homebuyers. This, in turn, might redirect excess idle capital into general consumer spending. China’s economic recovery may be slow, especially in the face of U.S. trade and economic pressures, but it remains an essential global economic powerhouse. Perhaps the impact of the real estate industry’s turbulence will ultimately redirect funds into other sectors, making the post-storm recovery something to look forward to.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!