KEYTAKEAWAYS

- The Fed’s third consecutive rate cut revealed rare internal dissent, weakening confidence in forward guidance and signaling a more unpredictable easing trajectory in the coming months.

- Powell’s shift to a data-dependent, neutral tone removed expectations of smooth rate reductions, increasing uncertainty around economic momentum, inflation behavior, and policy consistency.

- Trump’s push for a new Fed Chair and dissatisfaction with slow easing amplify political risks, complicating medium-term rate expectations and challenging crypto and broader market stability.

- KEY TAKEAWAYS

- THE POLICY MOVE WAS MORE THAN A 25BP CUT

- THE DOT PLOT SENT A SHARPER MESSAGE

- POWELL’S SHIFT TO A NEUTRAL, CAUTIOUS FRAMEWORK

- THE POLITICAL FRONT: TRUMP PUSHES FOR FASTER EASING

- WHY MARKETS ARE CALM SHORT TERM BUT FACING HIGHER RISK AHEAD

- A PERIOD DEFINED BY UNCERTAINTY

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The Fed’s latest rate cut exposed deep internal divisions, rising political pressure, and growing uncertainty over future easing, signaling a more volatile path for markets and monetary policy.

THE POLICY MOVE WAS MORE THAN A 25BP CUT

The Federal Reserve cut its benchmark rate by 25 basis points on December 10, marking the third consecutive reduction and a cumulative 75-basis-point adjustment since September. However, the decision was far more consequential than the headline number suggested. Beneath the surface, the meeting exposed widening fractures within the Federal Open Market Committee, intensifying political pressure, and a rapidly deteriorating consensus over how monetary policy should evolve.

Three dissenting votes emerged, the most seen in a single meeting since 2019. One governor has now opposed the last three decisions, and another has dissented twice in a row, indicating that Powell’s ability to keep the committee unified is weakening. When internal cohesion erodes, the clarity of the Fed’s policy direction suffers. Investors rely on a shared vision within the committee to interpret future rate paths, and the December meeting signaled that this reliability is slipping.

Central to the disagreement is a difficult macroeconomic dilemma: inflation has stopped making meaningful progress, yet employment indicators continue to soften. In typical cycles, data points in one direction—either clearly toward easing or tightening. But with price pressures holding firm while job growth slows, policymakers are divided. Tighten too little and risk letting inflation become entrenched; ease too aggressively and risk accelerating unemployment. Historically, such intense internal division has occurred only during periods of major economic uncertainty.

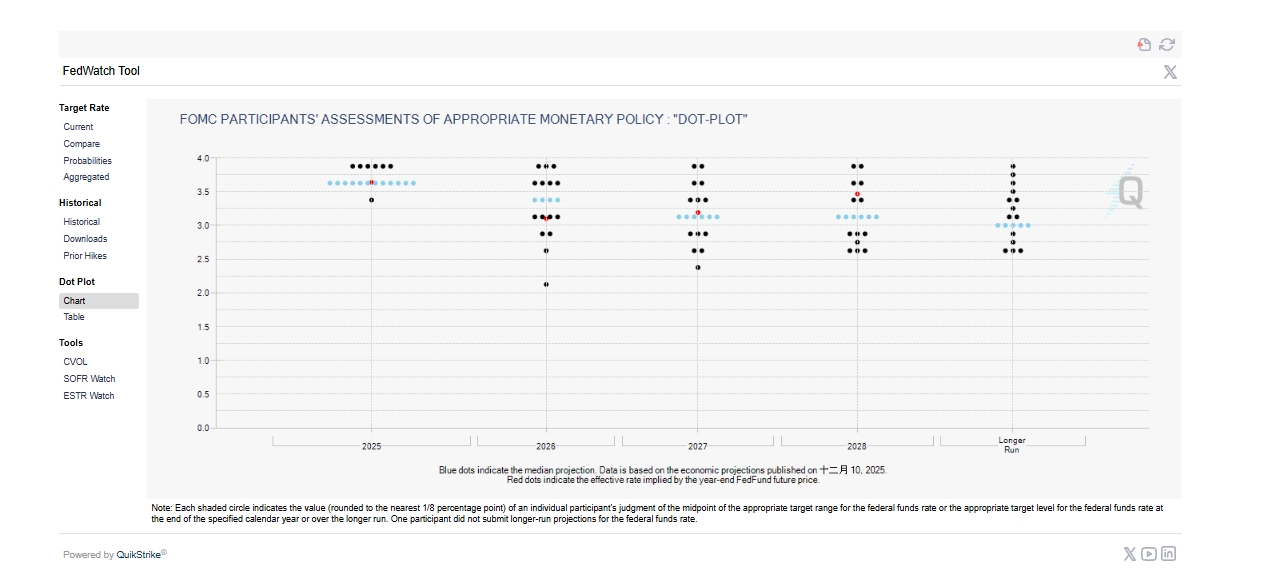

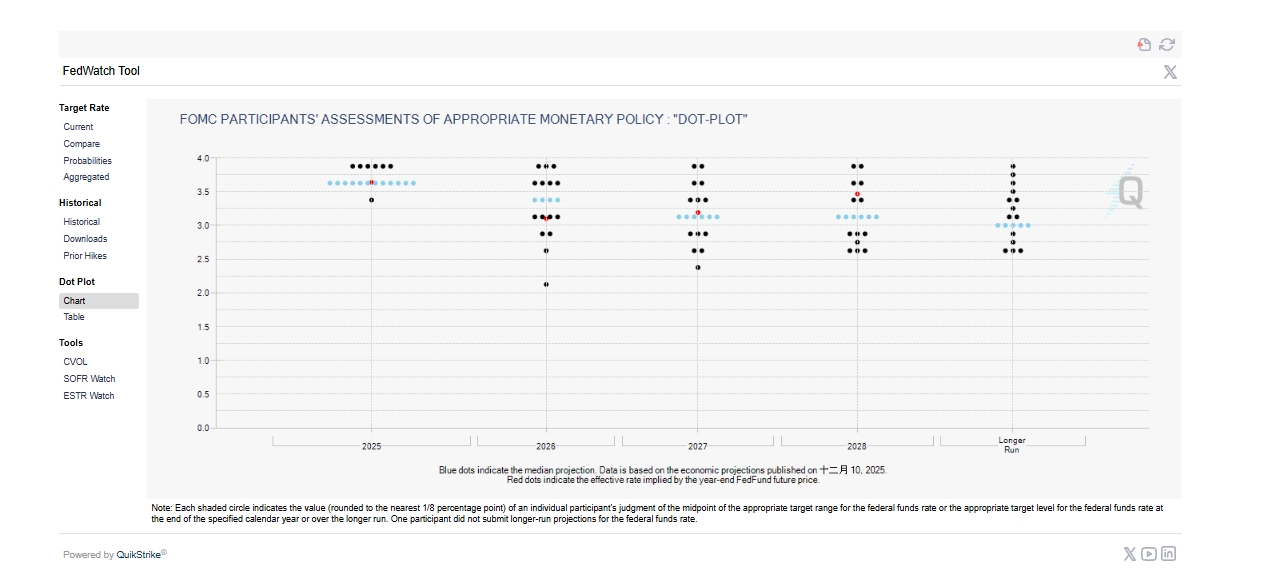

THE DOT PLOT SENT A SHARPER MESSAGE

If the dissent was not enough, the updated dot plot pushed markets further toward caution. The projections now indicate only one rate cut in 2026 and another in 2027, leaving the long-run policy rate near 3 percent. This represents a noticeably more restrictive outlook than investors had anticipated. That the projections barely shifted from September’s update—despite softer labor-market data—highlights how far apart committee members have become.

A slower easing trajectory means the Fed is unwilling to commit to a smooth or consistent downward trend in rates. Instead, policymakers appear concerned either that the economy cannot sustain rapid easing or that inflation remains too persistent to justify it. Regardless of the cause, the message is clear: future accommodation will not follow the predictable, linear pattern seen in past cycles.

POWELL’S SHIFT TO A NEUTRAL, CAUTIOUS FRAMEWORK

Jerome Powell’s press conference reinforced the sense of uncertainty. Unlike earlier meetings, he offered no suggestion of further cuts. He described current policy as being in a “good place,” noting that rates now sit within the neutral range. This shift is significant. A Fed that views policy as neutral is signaling that it sees no immediate need for additional easing and intends to respond to data rather than commit to a predetermined direction.

Powell emphasized repeatedly that the Fed is not following a set path and will instead make decisions meeting by meeting. This represents a meaningful departure from the smooth, multi-quarter easing cycle that markets had expected. In practical terms, Powell hinted that the rate trajectory could become uneven: periods of no movement followed by cuts, or even pauses, depending on how inflation and employment evolve.

This approach reflects the broader environment of confusion. With committee members sharply divided, inflation stuck above target, job growth slowing, and political scrutiny intensifying, Powell walked a tightrope. He avoided sparking panic while offering no roadmap. The absence of forward guidance now becomes a source of market volatility in itself.

THE POLITICAL FRONT: TRUMP PUSHES FOR FASTER EASING

Political pressure added yet another layer of complexity. President Donald Trump openly criticized the rate cut as too small, arguing that it should have been at least double the size. Because the president cannot directly instruct the Fed, public statements become his channel of influence. His dissatisfaction with the pace of easing has become increasingly visible.

More significantly, Trump announced that he is accelerating the selection of a new Fed Chair. Powell’s term ends in May 2026, leaving him only three more meetings to shape policy. Kevin Warsh has emerged as the leading candidate, though Christopher Waller, Michelle Bowman, and BlackRock’s Rick Rieder remain in the mix. Given Trump’s unpredictable approach to personnel decisions, markets cannot assume stability until the official nomination is made.

The impending transition magnifies policy uncertainty. Markets must simultaneously interpret Powell’s remaining decisions and anticipate the policy framework of his successor. If Trump ultimately chooses someone more aligned with his preference for aggressive easing, the entire rate path beyond 2026 could shift abruptly.

WHY MARKETS ARE CALM SHORT TERM BUT FACING HIGHER RISK AHEAD

Despite the deeper concerns, markets initially welcomed the rate cut. Powell’s reassurance that no one on the committee is considering rate hikes helped fuel a relief rally. Equities gained ground, and volatility eased. Yet this optimism is likely temporary.

The medium-term picture is now far more complicated. With the Fed divided and Powell avoiding firm commitments, the easing path is less predictable than at any point in this cycle. That unpredictability often translates into broader market volatility. Moreover, the upcoming leadership change introduces a political variable that investors cannot price with confidence.

For Bitcoin and other digital assets, predictability of liquidity conditions is critical. While the confirmed rate cut may support short-term sentiment, the lack of clarity surrounding the next stages of monetary policy could extend the current consolidation phase. Instead of a clean upward trend, crypto markets may face a more prolonged period of sideways trading as participants wait for clearer signals.

Investors will now need to monitor two parallel forces: Powell’s remaining decisions and the political evolution surrounding the next Fed Chair. Both will shape market expectations, especially as each month’s economic data reshapes the debate.

A PERIOD DEFINED BY UNCERTAINTY

The December meeting was more than a routine policy adjustment. It exposed an institution wrestling with contradicting economic forces, growing political influence, and weakening internal alignment. It also set the stage for a turbulent transition that could reshape the future of U.S. monetary policy.

Short-term conditions remain stable, but structural uncertainty is rising. The Fed is moving away from a predictable easing cycle and into a volatile, data-dependent phase. With inflation still sticky, unemployment softening, and leadership soon to change, the path ahead is less clear than at any time in recent years.

Until clarity returns—whether through improved data, internal consensus, or a new chair—markets, including Bitcoin, may continue to trade in a choppy and uncertain environment.

Read More:The Rise of Tempo and the Reinvention of Global Payment Infrastructure