KEYTAKEAWAYS

- PayPal's user base and wide acceptance make it a dominant player in the global payment market, despite recent stock volatility.

- Facing competition from tech giants and fintech firms, PayPal maintains its edge through trust and comprehensive services.

- PayPal's venture into cryptocurrencies with PYUSD stablecoin signifies its adaptability and commitment to innovation in digital payments.

- KEY TAKEAWAYS

- INTRODUCTION TO PAYPAL

- PAYPAL STOCK PRICE ANALYSIS

- PAYPAL’S FINANCIAL STRENGTH

- COMPETITIVE LANDSCAPE: PAYPAL VS. APPLE

- PAYPAL’S ADVANTAGES AND CHALLENGES

- PAYPAL’S FINANCIAL HEALTH

- PAYPAL’S BLOCKCHAIN INNOVATION: PYUSD STABLECOIN

- CONCLUSION: PAYPAL’S FUTURE IN DIGITAL PAYMENTS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

INTRODUCTION TO PAYPAL

With the development of the Internet, the boundary between countries has been eliminated, making cross-border sales more effortless than ever. However, many sellers looking to expand internationally have concerns about cross-border payment and transaction issues. We will discuss the payment giant ‘PayPal’ in this article since many sellers rely on PayPal’s payment mechanism for receiving and making payments in cross-border transactions.

But what exactly is PayPal? Is PayPal worth investing in? What are its stock price, financial health, competitiveness, and pros and cons? Today, let’s explore the ins and outs of PayPal.

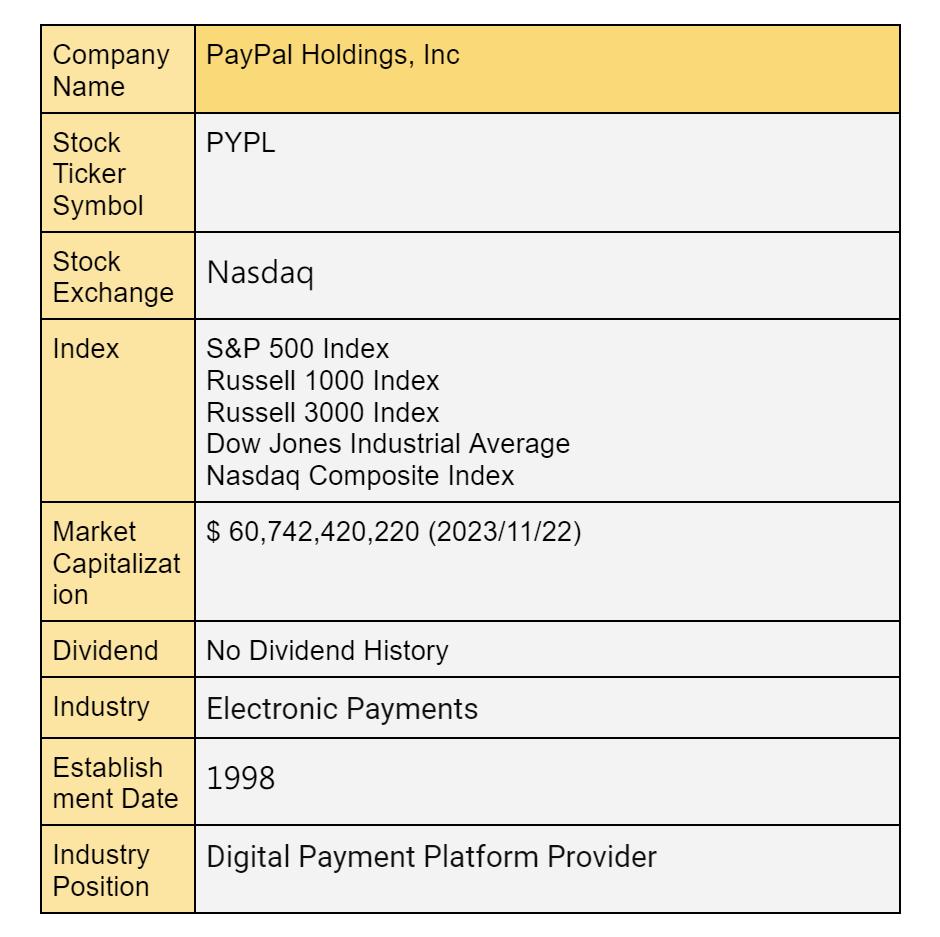

PayPal Holdings, Inc. Profile

PayPal’s primary business is to provide digital payment solutions for global users and enterprises. It lets users securely make online payments by connecting bank accounts, credit cards, or PayPal accounts. The platform is widely used in e-commerce, online marketplaces, and personal fund transfers.

The core functionalities of PayPal include online payments, shopping cart integration, digital wallets, and transfer services, which support transactions in multiple currencies. The company’s services aim to streamline the payment process, enhance payment security, and improve convenience.

With the advancement of technology and changes in payment methods, PayPal has actively engaged in applying cryptocurrency and blockchain technology. It began supporting the purchase, holding, and selling of cryptocurrencies since 2020, further expanding its payment ecosystem.

PAYPAL STOCK PRICE ANALYSIS

(Source: TrendingView)

Believe that investors who entered the stock market in 2020 have heard of PayPal, the stock that once outperformed the S&P 500 index. However, with the rise in interest rates and the exit of QE, today’s PayPal has returned to its initial starting point. Since the beginning of this year, PayPal’s stock price has fallen by 48.34%, a decline far higher than the volatility of the U.S. S&P 500 index. The chart above shows that the return of the S&P 500 index from 2020 to 2023 is an incredible 34.87%, which may also be the most apparent expression of investors questioning the company’s prospects.

But to be fair, is PayPal performing below expectations? In fact, it depends on what perspective investors use to think about PayPal’s situation. The performance of the current year, 2023, must be significantly reduced compared to the period during the pandemic. From the performance perspective, PayPal is definitely not as exceptional as expected. Its revenue growth in the fiscal years 2020 and 2021 was 21% and 18%, respectively. However, investors must understand that this is because the company benefited from the historically high demand for online shopping and digital payments driven by the pandemic, which caused such astonishing growth in revenue. Such revenue is not usual.

Although PayPal’s business has shown a significant slowdown in the short term, has the company’s long-term outlook changed? Is PayPal’s stock price worth buying for investors? First, it can be understood that the attractiveness of PayPal lies in the fact that its excessively high stock price has now fallen, and the company’s valuation has also stabilized. Its current price-to-earnings ratio is about 14.7 times, much lower than the five-year average.

Second, when the relationship between PayPal and eBay finally ended, the company’s business had stabilized. The impact of eBay on PayPal’s revenue had dropped to a minimum in 2023, and it is expected that after 2024, this impact will completely disappear, and PayPal will fully enter the normal track.

PAYPAL’S FINANCIAL STRENGTH

Additionally, the other key advantage that makes PayPal worth investing in is the cash flow generated by the scale of its payment network. With nearly 450 million users on its platform, PayPal’s payment network scale is unmatched by other fintech companies. Particularly widely accepted in North America and Europe, PayPal has created a high barrier to entry for other fintech companies, and the large number of merchants accepting PayPal payments is a crucial competitive advantage.

Through these strengths, PayPal generates substantial free cash flow every quarter. In the latest quarter, Q3 2023, the net cash flow for PayPal was $9.6 billion, with a cash ratio of approximately 26%. The vast payment network scale and customer base serve as a moat for PayPal’s business, helping the company generate stable and predictable free cash flow.

Looking back at the historical data for 2022, PayPal alone processed an astounding total payment volume of $13.6 trillion, rivaling the largest credit card providers since the 1960s, such as MasterCard and Visa, and the established American Express founded in the 19th century.

COMPETITIVE LANDSCAPE: PAYPAL VS. APPLE

As mentioned earlier, PayPal is a leading financial technology service provider. However, macroeconomic pressures on the fintech industry and disappointment in the market regarding PayPal’s inability to sustain its brilliant revenue during the pandemic have led to a continuous decline in its stock price. Nevertheless, the company’s core business for long-term investors still appears robust, and the stock price has fallen to attractive levels. The digital payment market also seems poised for long-term growth, with businesses increasingly shifting towards online transactions, offering potential benefits to PayPal.

Investors should know that despite establishing a position in various corners of the fintech service industry, PayPal faces fierce market competition. Competitors in the form of specialized fintech and financial service providers, including Block and JPMorgan Chase, challenge PayPal with their payment products, potentially putting pressure on PayPal’s profit margins.

The competition from tech giants Apple and Alphabet is also worth noticing, as they have introduced their digital wallets and payment services. Although digital payments and other fintech service categories seem ready to benefit from long-term growth trends, PayPal’s performance in maintaining growth in the face of competition is something investors must regularly monitor.

The primary reason that PayPal can dominate the payment market is the trust people have placed in it for over 20 years, considering it the most straightforward, fastest, and most flexible way to transfer funds and make online purchases. However, Apple Pay, introduced at the end of 2014, has emerged as a formidable competitor. Apple’s mobile payment service allows users to add credit cards to their digital wallets on their devices, facilitating payments at millions of physical and online merchants. When Apple Pay was launched, Apple CEO Cook explicitly stated his intention to claim a share in the vast payment sector.

This is not just a casual statement from CEO Cook. Along with significant progress, Apple Pay holds a 28% usage rate among the 1,500 most prominent merchants in North America and Europe, second only to PayPal. More importantly, Apple claims that 85% of U.S. retailers accept Apple Pay. This nearly ubiquitous service is outstanding for the payment sector, considering Apple Pay has only been operational for less than a decade.

Apple Pay’s relative advantage over PayPal lies in its widespread adoption, with Apple Pay currently available on up to 2 billion active devices worldwide. While Apple Pay is only integrated into four products—iPhone, Apple Watch, Mac, and iPad—investors must not underestimate Apple’s prowess as a software service provider. Apple is constantly finding ways to increase user adoption further.

PAYPAL’S ADVANTAGES AND CHALLENGES

PayPal’s Advantages:

- High Global Market Share: PayPal’s most significant advantage lies in its user base. Virtually all foreign businesses and e-commerce platforms support PayPal payments.

- Convenient Foreign Currency Conversion: PayPal supports over 20 currencies, allowing users to store various currencies in the same account. During payments, users can choose which currency to use. Additionally, online currency conversion is supported, although the exchange rates may not be very attractive.

- Secure Information and Transactions: Another significant advantage of PayPal is its security. It is generally recognized for its information security. PayPal also provides purchase protection, allowing users to initiate a process to refund in disputes such as non-receipt of goods.

PayPal’s Disadvantages:

- High Transaction Fees: While PayPal primarily charges recipients fees, these fees can be pretty high. The total costs, including currency conversion and transferring to a foreign account, may result in a 7-8% loss.

- Unfavorable Exchange Rates: Additionally, even though the online currency conversion feature is convenient and transparent, the exchange rates offered by PayPal are often less favorable than those provided by credit card issuers.

PAYPAL’S FINANCIAL HEALTH

Over the past few years, PayPal has made several mistakes. One of the most significant errors may be PayPal’s eagerness to make overly optimistic performance commitments in its guidance, which ultimately went unfulfilled, leading to market penalties on its stock.

In the second-quarter financial report released in early August, PayPal’s adjusted operating profit margin narrowed from 22.7% in Q1 to 21.4%. This was due to the company having to allocate more funds to handle bad loans issued by merchants.

However, PayPal announced its latest Q3 financial results in November 2023, and the number showed some positive signs. Apart from profits exceeding expectations, it also raised its full-year financial forecast. Symptoms of a turnaround from the trough emerged, causing PayPal’s stock price to surge nearly 4% after hours.

Alex Chriss, PayPal’s newly appointed CEO, who took office just last month, stated that the company would continue to leverage its existing assets and market position advantages, focusing on priority development goals. Meanwhile, PayPal also announced that former EY CFO Jamie Miller would assume the role of the new CFO.

Many securities analysts also express that PayPal’s fundamentals remain strong, giving PayPal a ‘buy’ rating with a target price set at $92. After facing numerous challenges over the past two years, PayPal’s better-than-expected financial results in this instance suggest that the worst may be over. During the COVID-19 pandemic, lockdowns were implemented worldwide, leading to the rise of digital payments and propelling fintech stocks like PayPal. However, with the post-pandemic business battle just beginning, whether PayPal can emerge as a future winner remains to be seen. Investors can continue to monitor financial reports and changes in the digital payment industry.

PAYPAL’S BLOCKCHAIN INNOVATION: PYUSD STABLECOIN

PayPal entered the cryptocurrency market at the end of 2020, allowing customers to buy, hold, and sell specific quantities of cryptocurrencies, including Bitcoin. However, following the New York State Department of Financial Services’ directive to Paxos to cease issuing Binance USD, PayPal suspended related operations and concurrently confirmed the development of a stablecoin.

Fast forward to August 7, 2023, PayPal announced the launch of its stablecoin, PayPal USD (PYUSD). This stablecoin is issued by Paxos Trust (formerly the issuer of BUSD), fully backed by deposits in U.S. dollars, short-term government securities, and similar cash equivalents. It will gradually become available to PayPal customers in the United States.

PayPal plans to introduce the PYUSD stablecoin, initially launching it on its payment app Venmo. The service will cater to the growing Web3 developer and application community, allowing users to exchange the stablecoin for U.S. dollars or other cryptocurrencies anytime. To ensure the stablecoin’s fund backing, PayPal will provide monthly reserve reports audited by an independent third-party accounting firm. This measure aims to eliminate concerns about unsecured tokens and instill market trust in the stablecoin’s value.

CONCLUSION: PAYPAL’S FUTURE IN DIGITAL PAYMENTS

Yet, PayPal has recently encountered new challenges in the payment industry by introducing PYUSD stablecoin based on blockchain technology, aiming to achieve faster, cheaper, and more global payment services. Even in the face of a turning point in payment history, PayPal emphasizes its consistent commitment to enable customers to pay in the simplest and fastest way possible.

Currently, PayPal’s stock price has experienced a significant drop from its peak. Regardless of investors’ valuation method, PayPal’s stock price is undervalued. To some extent, the market seems to penalize PayPal for its surge in 2020-2022. Looking ahead, a brand new payment system is gradually emerging, with blockchain being the only innovative technology capable of providing an entirely new payment experience. To meet customer demands and offer real solutions, PayPal utilizes the PYUSD stablecoin to represent its position in the stablecoin sector. The company commits to providing customers with the convenience, trust, and confidence they have always sought.

PayPal reaffirms its neutral stance, not adhering to specific ideologies but focusing solely on meeting customer demands for more manageable payments. PayPal believes in the fluidity of money, emphasizing speed, affordability, and global accessibility, aligning with what customers seek.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!