KEYTAKEAWAYS

- From clout to coins – Traditional off-platform deals are inefficient. Tokenizing posts creates transparent, fair incentives for creators, curators, and platforms.

- The memecoin analogy – Social posts mirror memecoin lifecycles, rising fast and collapsing to zero. Tokenization enables markets to capture long-term cultural value.

- A market-driven economy – By merging financial alpha with information alpha, content markets evolve into open ecosystems where value is determined competitively.

CONTENT

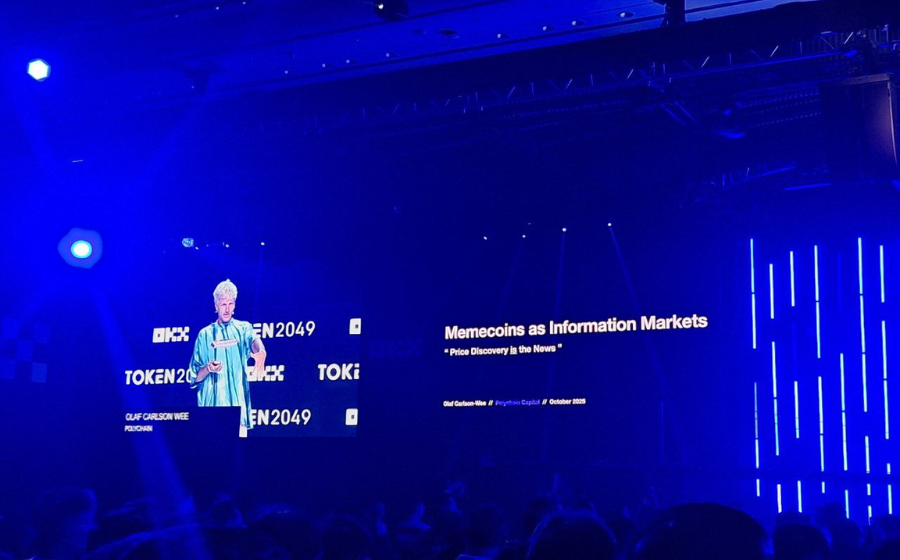

Rethinking content monetization: what if every post became a coin? By aligning creators, curators, and markets, we can turn attention into a sustainable economy.

INTRODUCTION

In today’s digital economy, content creators are the backbone of platforms, yet the way they are compensated remains inefficient and unfair. Platforms control the algorithms that define “popularity,” and creators are paid based on visibility shaped by these opaque systems. Most monetization still happens off-platform—through brand sponsorships, paid reposts, or influencer products. This raises a critical question: Can we reimagine content markets so that posts themselves become tradeable assets, just like coins?

THE PROBLEM WITH CLOUT AS MONEY

Today, influencers mainly monetize clout through external “derivative contracts” such as brand partnerships. This creates:

➤ Inefficient markets

one-off deals are slow, illiquid, and costly.

➤ No platform benefit

most transactions occur externally, leaving platforms with no direct value.

➤ Underpaid curators

those who surface valuable content remain unrewarded.

As a result, clout is converted into money only indirectly and inefficiently.

📌 From Clout to Monetization

Although platforms like X (Twitter) and YouTube have started paying creators directly through tipping and revenue shares, most influence is still monetized off-platform. The real challenge is: how can we bring monetization into the platform itself—transforming visibility into a transparent, efficient, and fair financial mechanism?

📌 Posts as Tradeable Assets

The disruptive idea is simple: What if every post could be traded like a coin?

- Markets, not algorithms, would determine the value of content.

- Fans and curators could “invest” by buying or reposting, creating a price signal backed by real money.

- Incentives between creators, curators, and audiences would finally align.

This would transform short-lived attention into a sustainable financial mechanism.

>>> More to read: 【Token2049 Singapore】The Rise Of Digital Asset Treasuries

THE MEMECOIN ANALOGY

The lifecycle of social posts is strikingly similar to that of memecoin prices:

✅ TikTok posts rise and fall in popularity just like memecoin spikes and collapses.

✅ Every post, like every memecoin, eventually trends toward zero.

✅ But if posts were tokenized, markets could competitively bet on their future value, turning a zero-sum lifecycle into an ecosystem of discovery and curation.

🔎 Memecoin Markets vs. Content Markets

When speaking with traders who deal in memecoin daily, the number one source of alpha is “following profitable wallets.” This reveals an on-chain social graph based on financial alpha—users follow and copy profitable addresses.

This mirrors the content economy: following creators who produce viral posts is essentially the same as tracking profitable wallets. In other words, copy-trading coins is like reposting content.

Crypto Twitter can be seen as a crude version of this mechanism—people follow both content and alpha, attempting to monetize their following by promoting assets. If posts truly became coins, content graphs and financial graphs would merge into one system, introducing real financial risk and reward.

➡️ From Memecoin Markets to Content Markets

The parallels become clear:

- Memecoin traders generate alpha by following profitable wallets.

- Content investors can do the same by following accounts that consistently resurface valuable posts.

- Over time, financial alpha and information alpha converge, creating a market-driven content economy.

>>> More to read: 【Token2049 Singapore】World Liberty at TOKEN2049: Vision, Challenges, and Next Steps

POSITIVE EXTERNALITY: ORGANIZING GLOBAL INFORMATION

If every post is tokenized, competitive markets betting on future value create a powerful externality:

- Instead of simply measuring popularity, markets actively organize and filter global information.

- Timeless posts—such as iconic tweets, ancient memes, or resurfaced viral content—can gain renewed relevance and cultural value.

- Permissionless DeFi can be layered on top, bringing liquidity and financial innovation into social media.

✏️ Example Application

Imagine a system where:

▶ Posting costs $1 and mints a coin representing that post.

▶ Each repost invests $1 into the coin.

▶ Creators and early investors share future investment returns.

▶ Automated portfolio management removes the need to “sell” at the right time.

▶ Following a creator allows you to automatically invest when they repost.

▶ The earlier you back a piece of content, the higher your potential upside.

This model rewards creators, curators, and early believers who help surface valuable content.

📜 Conclusion

This proposal reframes the economics of content:

- Today, platforms dictate value through opaque algorithms.

- Tomorrow, competitive markets could assign value through open participation.

- By turning posts into coins, creators, curators, and audiences align under a transparent incentive system.

Ultimately, this vision transforms content monetization from a hidden, inefficient process into a market-based mechanism for organizing the world’s information.

>>> More to read: 【TOKEN2049 Singapore】The Rise Of Digital Asset Treasuries