KEYTAKEAWAYS

- Japan’s rate hike confirmed policy normalization, but analysts argue it will not derail crypto markets, instead reinforcing medium-term mean reversion and selective accumulation opportunities ahead.

- Analysts like Garrett Jin and Arthur Hayes highlight ETH relative undervaluation, yen dynamics, and liquidity trends, supporting long-term bullish narratives while acknowledging short-term volatility risks.

- Despite growing confidence and bold price targets, disciplined investors should avoid high leverage, wait for pullbacks, and build positions gradually to manage risk effectively better.

CONTENT

Japan’s rate hike reignited bold crypto calls. Analysts see long-term upside, but discipline matters: selective buying, patience, and avoiding high leverage remain key.

JAPAN’S RATE HIKE AS THE MACRO BACKDROP

The Bank of Japan’s decision to raise its benchmark interest rate from 0.5% to 0.75 was widely expected, yet it still serves as an important macro backdrop for current market discussions. This move marked Japan’s highest policy rate in roughly 30 years and represented the first rate hike in 11 months, following the previous adjustment in January 2025. More notably, the BOJ reiterated that further hikes remain possible if economic growth and inflation continue to align with its forecasts.

On its own, the decision did not shock global markets. However, it acted as a catalyst for renewed debate—particularly among macro traders and crypto analysts—about liquidity, currency dynamics, and the next major directional move for risk assets.

Why Japan’s Rate Hike Won’t Derail the Crypto Bull Market

ANALYSTS STEP FORWARD: BOLD CALLS RETURN

Almost immediately after the announcement, several high-profile analysts and traders took to X to share increasingly confident market views. Their interpretations varied in detail, but most converged on one theme: Japan’s rate hike does not derail the broader bullish thesis and may even strengthen it.

Garrett Jin, often referred to as the “1011 insider whale,” argued that Ethereum is approaching a relative bottom when measured against traditional risk benchmarks. According to Jin, the ETH-to-Nasdaq 100 ratio has repeatedly found support near 0.11, a level he views as a long-term floor. From his perspective, this suggests Ethereum is undervalued relative to U.S. tech equities and positioned to outperform in the coming months.

Jin projects a potential rebound in the ratio toward the 0.16–0.22 range. If realized, that move would imply roughly 50% to 100% upside for ETH relative to the Nasdaq 100. His argument rests heavily on mean reversion, noting that prolonged divergence between highly correlated assets rarely persists.

MEAN REVERSION AND CORRELATION AS THE CORE LOGIC

A recurring point among analysts is the strong historical correlation between Ethereum and U.S. growth equities, particularly large-cap technology stocks. Garrett Jin emphasized that while short-term dislocations can occur, structural forces tend to pull these assets back into alignment over time.

From this viewpoint, Japan’s tightening cycle does not negate the case for mean reversion. Instead, it highlights how asymmetric current positioning may be. Analysts argue that if global liquidity conditions stabilize—or loosen elsewhere—assets like Ethereum could close the performance gap quickly.

This logic has resonated with many market participants, especially those who believe that recent underperformance reflects temporary macro noise rather than a breakdown in fundamentals.

POSITIONING, TRACK RECORDS, AND MARKET ATTENTION

Garrett Jin’s views carry additional weight due to his prior positioning. In October, he publicly disclosed rotating more than $4.2 billion worth of Bitcoin into Ethereum, a move that drew widespread attention. At the time, he stated that both BTC and ETH were poised for a strong rally, citing price targets of $106,000 for Bitcoin and $4,500 for Ethereum.

The consistency of his narrative—combined with the scale of his capital movements—has made his commentary a focal point in recent discussions. For many traders, this reinforces the perception that large players are positioning for upside rather than preparing for systemic downside.

Still, conviction does not eliminate risk.

JAPAN, THE YEN, AND GLOBAL LIQUIDITY DEBATES

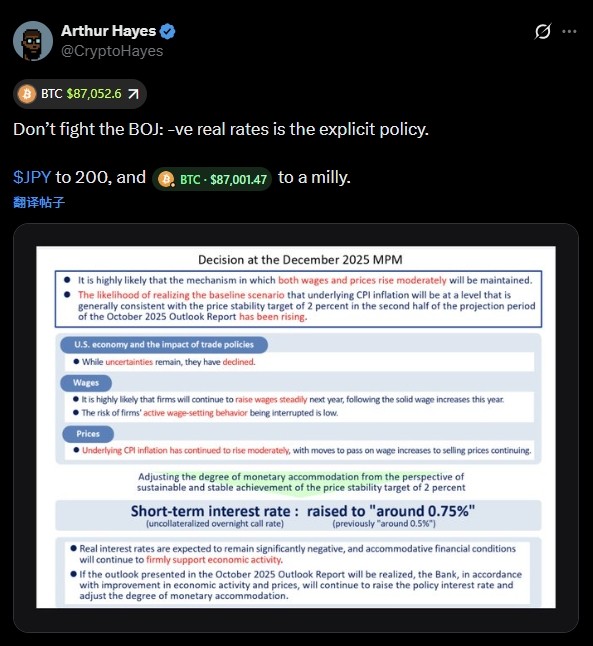

Beyond crypto-native voices, macro-focused commentators have also weighed in. Arthur Hayes offered a particularly blunt interpretation of Japan’s policy stance. He argued that investors should not underestimate the BOJ’s tolerance for negative real rates, suggesting that Japan’s tightening does not represent a true shift toward restrictive monetary policy.

According to Hayes, the yen’s structural weakness remains intact, and betting aggressively on sustained yen strength may be misguided. He framed Japan’s rate hike as a symbolic adjustment rather than a decisive reversal, reinforcing his long-term bullish stance on hard assets and Bitcoin in particular.

While Hayes’ projections are intentionally provocative, his broader point echoes a common sentiment: Japan’s policy moves are unlikely to drain global liquidity in a meaningful way.

THE DANGER OF UNIFORM CONFIDENCE

As these perspectives gained traction, market sentiment began to tilt decisively toward optimism. Analysts aligned around similar conclusions, price targets circulated widely, and confidence returned quickly after weeks of uncertainty.

This is precisely where risk begins to build—not necessarily in the macro environment, but in trader behavior. When narratives become crowded and conviction becomes universal, markets grow more fragile. Price corrections in such environments are often driven not by fundamentals, but by positioning.

Japan’s rate hike did not trigger volatility, but it sharpened expectations. And elevated expectations can be just as destabilizing as bad news.

LONG-TERM BULLISHNESS DOES NOT REQUIRE IMMEDIATE ACTION

From a broader perspective, many analyst arguments are internally consistent. Structural trends supporting digital assets remain intact: ongoing financial digitization, sovereign debt pressures, and the gradual integration of blockchain infrastructure into traditional markets.

However, acknowledging a positive long-term trajectory does not require aggressive short-term positioning. Macro trends unfold over extended timeframes, and markets rarely move in straight lines.

Periods following widely anticipated policy decisions often see consolidation, pullbacks, or renewed volatility as traders reassess risk. Ignoring this dynamic can turn a correct thesis into a poorly timed trade.

https://x.com/CryptoHayes/status/2001866538316407198

MY VIEW: OPTIMISTIC, BUT SELECTIVE

My own conclusion aligns partially with the analysts, but with important caveats. I remain optimistic about the long-term direction of crypto markets and believe the broader setup remains constructive rather than bearish. Japan’s rate hike does not fundamentally alter that outlook.

At the same time, I see little justification for urgency. This is not an environment that rewards high leverage or emotional entries. Volatility remains a feature, not a bug, and short-term dislocations are still likely.

Rather than chasing price or following bold calls blindly, I believe a more disciplined approach makes sense: waiting for moments of weakness, scaling into positions gradually, and maintaining flexibility.

WHY LEVERAGE IS THE REAL RISK HERE

If there is one clear takeaway, it is this: leverage matters more than direction. Even if analysts are ultimately right, excessive leverage leaves no room for error. Macro headlines, currency moves, or unexpected data can all trigger sharp, temporary drawdowns.

Low leverage—or no leverage at all—extends an investor’s time horizon and allows participation in long-term trends without being forced out by short-term volatility.

In contrast, high leverage converts uncertainty into fragility.

CONCLUSION: CONFIDENCE WITH DISCIPLINE

Japan’s rate hike provided context, not clarity. Analysts have responded with confidence, compelling narratives, and ambitious targets. Many of their arguments are reasonable, and some may prove correct.

Still, markets do not reward certainty—they reward patience. Long-term optimism can coexist with short-term caution, and conviction is most effective when paired with restraint.

In this phase, I remain constructive on the broader outlook, open to selective accumulation, and firmly opposed to excessive leverage. The opportunity is there—but timing, discipline, and risk management will ultimately determine who benefits from it.

The above viewpoints are referenced from @Web3___Ace