KEYTAKEAWAYS

- The prediction market focuses narrowly on whether H.R.3633 itself becomes law, meaning broader regulatory progress or alternative bills would still resolve the contract as No

- Republicans largely support the Clarity Act for regulatory certainty and innovation, while Senate Democrats remain cautious due to investor protection, agency authority, and financial stability concerns

- With the bill stalled in Senate committee and elections approaching, calendar risk dominates, making No more attractive at current prices unless clear bipartisan momentum emerges

- KEY TAKEAWAYS

- FROM POLICY FRAMEWORK TO MARKET BET

- THE CASE FOR YES: WHY SUPPORTERS BELIEVE THE BILL CAN PASS

- THE CASE FOR NO: WHY SKEPTICISM REMAINS STRONG

- HOW POLITICS AND TIMING SHAPE THE ODDS

- INTERPRETING THE PRICE: WHY I CURRENTLY LEAN NO

- WHAT WOULD CHANGE MY BET TO YES

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Prediction markets are pricing the odds that the Digital Asset Market Clarity Act becomes law in 2026, weighing political support, procedural risks, and strict resolution rules.

In the first article, we established why the Digital Asset Market Clarity Act has become one of the most closely watched pieces of crypto legislation in recent years. We walked through its core structure, the way it categorizes digital assets, why that classification matters for institutions, and where the bill currently stands in the legislative process. In short, the Clarity Act aims to reduce regulatory uncertainty, has already passed the House, and is now stalled at a critical Senate committee stage.

This second article shifts the lens from policy design to probability. The question is no longer whether the Clarity Act is important, but whether it will actually become law—and whether the market is pricing that outcome correctly. That question is now being actively traded on prediction markets, where participants are forced to translate legislative complexity into a binary outcome: Yes or No.

FROM POLICY FRAMEWORK TO MARKET BET

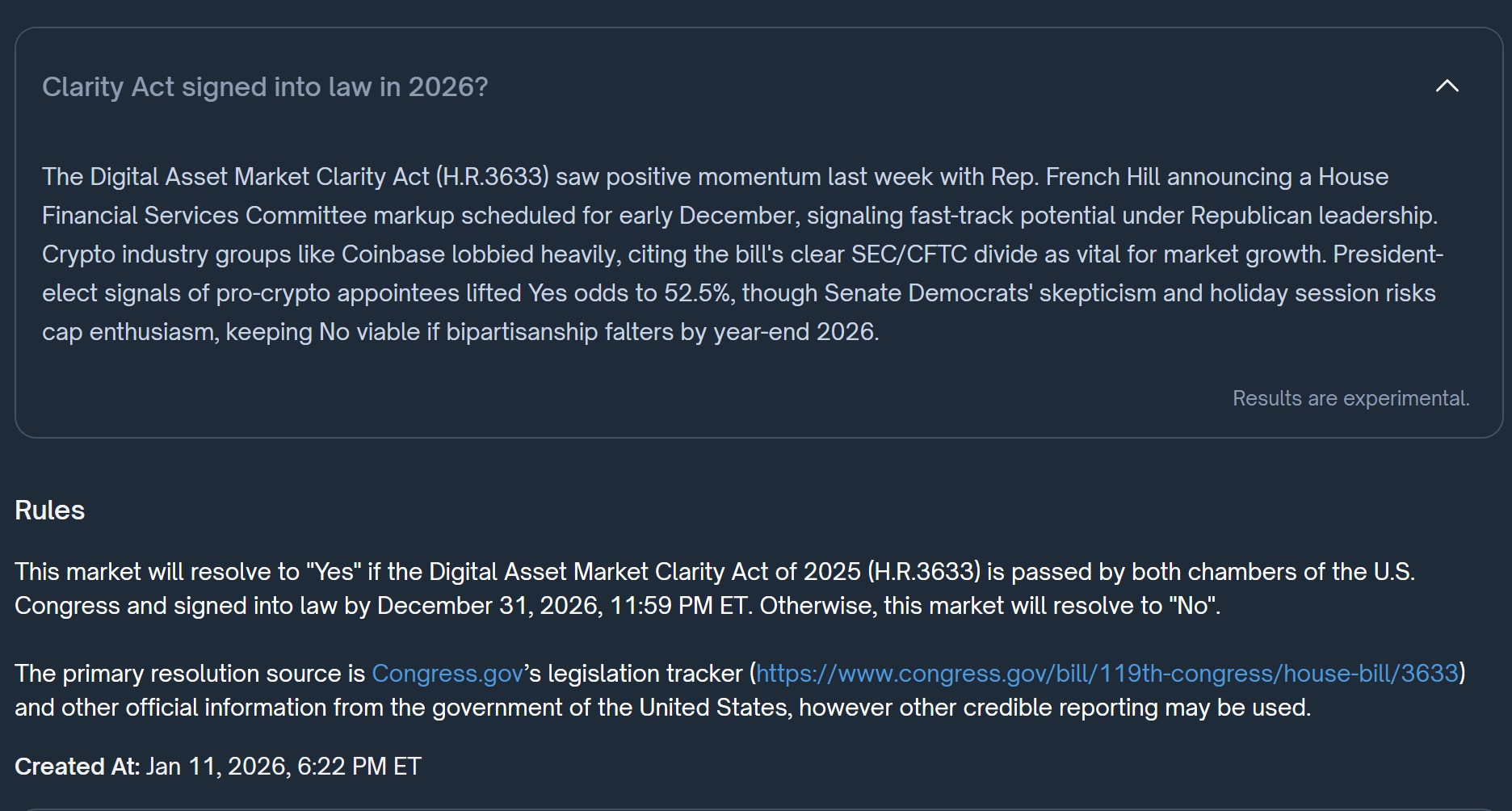

Prediction markets thrive on specificity. In this case, the contract does not ask whether U.S. crypto regulation will improve, or whether lawmakers are becoming more supportive of digital assets. It asks something far narrower and far more unforgiving: will the Digital Asset Market Clarity Act of 2025, identified explicitly as H.R.3633, pass both chambers of Congress and be signed into law by December 31, 2026?

That framing is crucial. It means that broad regulatory progress is not enough. A similar bill, a revised package, or a Senate-led alternative that becomes law under a different number would still result in a “No” outcome for this market. Participants are not betting on direction; they are betting on procedural success.

Against that backdrop, the current pricing—roughly 53 cents for Yes and 48 cents for No—suggests a market that sees passage as slightly more likely than not, but far from assured. The tight spread itself reflects how balanced the risks are.

Clarity Act signed into law in 2026?

THE CASE FOR YES: WHY SUPPORTERS BELIEVE THE BILL CAN PASS

Those leaning toward a Yes outcome generally anchor their view in three arguments: political alignment, industry pressure, and strategic timing.

First, Republican lawmakers have been the most consistent champions of market-structure legislation for digital assets. Their support is not purely ideological, but it aligns with a broader narrative around innovation, competitiveness, and limiting what they view as regulatory overreach. From this perspective, the Clarity Act is a way to replace enforcement-driven uncertainty with statutory boundaries. Clear rules, even strict ones, are preferable to open-ended discretion.

Second, industry lobbying has been unusually coordinated. Large exchanges, asset managers, and infrastructure providers have spent years arguing that ambiguity—not volatility—is the main reason institutional capital remains cautious. The Clarity Act directly addresses that pain point by clarifying whether assets fall under SEC or CFTC jurisdiction. For many market participants, that clarity alone justifies compromise on other fronts.

Third, supporters point to momentum. The bill has already cleared the House, which is not trivial. House passage signals that a substantial bloc of lawmakers is willing to put their names on a crypto market framework. In legislative terms, that puts the Clarity Act past the stage where most bills quietly die. If Senate leadership can align on amendments that preserve the bill’s core while addressing key objections, proponents argue that passage in 2026 remains plausible.

From this angle, the current Yes price looks reasonable. It reflects optimism that bipartisan pragmatism could prevail once the costs of continued uncertainty become too high.

THE CASE FOR NO: WHY SKEPTICISM REMAINS STRONG

At the same time, there are equally compelling reasons why many traders—and many lawmakers—remain cautious.

The first is procedural risk. The Clarity Act is currently stuck at the Senate committee level, which is where complex financial legislation most often stalls. Committee delays are not just scheduling issues; they usually signal unresolved disagreements over scope, authority, or political optics. Every delay compresses the remaining timeline and increases the odds that the bill becomes collateral damage to unrelated priorities.

The second is partisan asymmetry. While Republicans largely frame the bill as pro-innovation, many Senate Democrats approach it through a different lens. Their skepticism is not necessarily anti-crypto, but risk-focused. Concerns around investor protection, systemic stability, and anti-money laundering enforcement carry significant weight. For lawmakers who prioritize those issues, any framework perceived as weakening the SEC’s role or accelerating financialization without sufficient safeguards raises red flags.

Stablecoins, DeFi oversight, and the treatment of tokenized securities have all surfaced as pressure points. Even small wording choices can shift how authority is distributed between agencies, and those shifts can have long-term implications beyond crypto. As a result, hesitation is rational, not obstructionist.

The third risk is calendar-driven. Legislative time is not continuous. Congressional recesses, holiday sessions, and election cycles all disrupt momentum. As 2026 progresses, attention will increasingly turn toward year-end politics and the midterm election environment. In that context, controversial financial legislation becomes harder to prioritize, not easier. A bill that does not clear committee early risks being perpetually postponed.

Finally, and most importantly for traders, there is the resolution risk baked directly into the contract. Even if Congress passes a crypto market structure law in 2026, the outcome still resolves to No unless that law is H.R.3633. If Senate negotiators choose to advance a revised version under a different bill number, or merge it into a broader legislative package, the policy outcome could be positive while the bet still loses.

This single condition alone justifies a meaningful discount on Yes probabilities.

HOW POLITICS AND TIMING SHAPE THE ODDS

The next several months matter less for headlines than for signals. A rescheduled committee markup, visible bipartisan co-sponsorship, or explicit Senate leadership endorsement would all materially shift expectations. Conversely, silence, repeated postponements, or public fractures among industry supporters would reinforce the No case.

Holiday recesses further complicate the picture. They shorten the legislative calendar and dilute focus. Even a well-supported bill can lose momentum if it fails to align with the rhythms of Congress. By the time lawmakers return, priorities may have shifted.

Elections add another layer of uncertainty. As political incentives change, so do legislative trade-offs. What looks achievable in early 2026 can feel risky by year-end, especially if crypto regulation becomes a campaign talking point rather than a technical policy discussion.

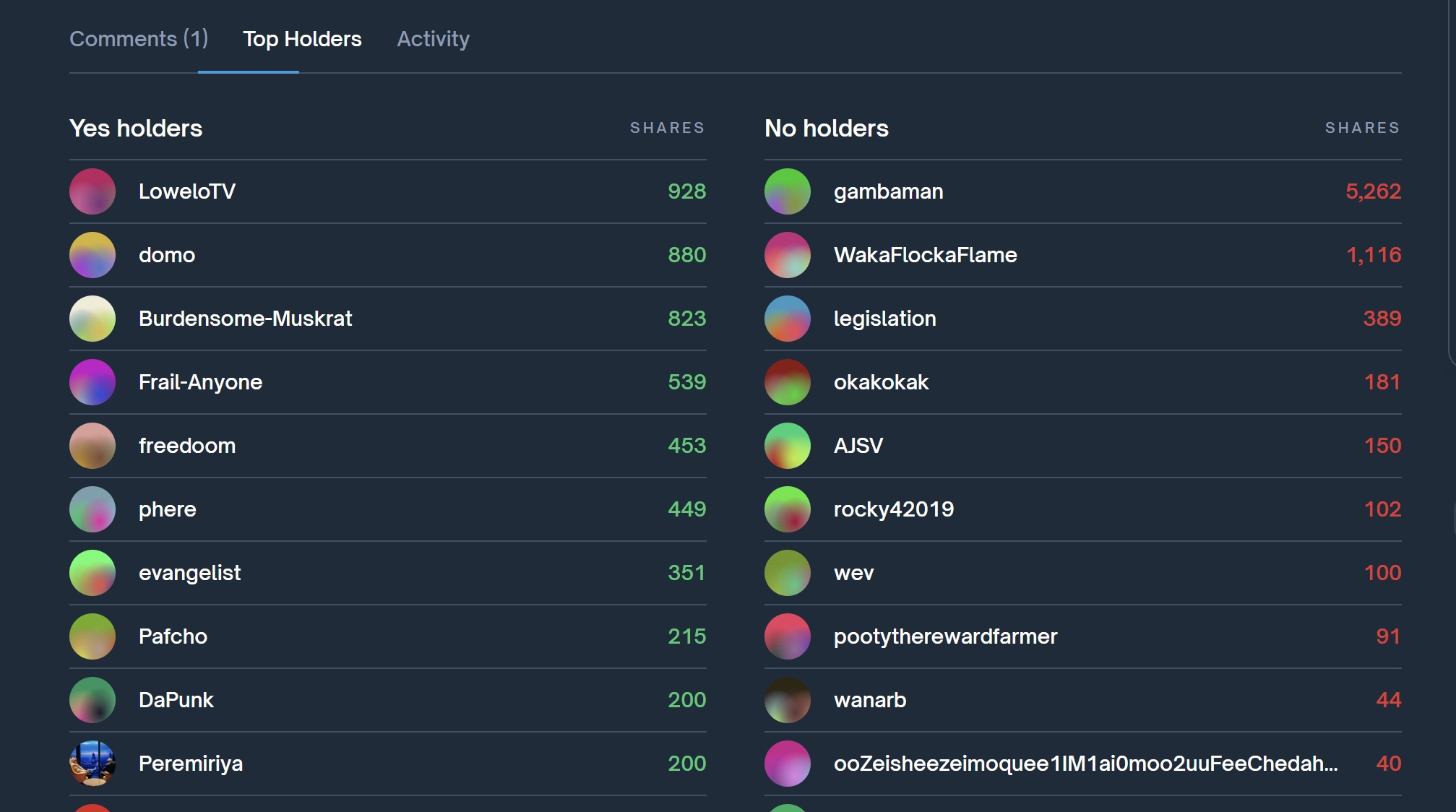

INTERPRETING THE PRICE: WHY I CURRENTLY LEAN NO

At current prices—Yes at 53 cents and No at 48 cents—I would personally lean toward No. That does not mean I believe the Clarity Act is doomed. It means I believe the probability that H.R.3633 specifically completes the full legislative journey by the end of 2026 is lower than the market-implied threshold.

The No side benefits from multiple overlapping failure modes: procedural delay, partisan stalemate, calendar compression, and the possibility of an alternative bill number becoming law. Each risk alone might be manageable. Together, they justify skepticism.

In probability terms, I would need stronger confirmation before paying a premium for Yes.

WHAT WOULD CHANGE MY BET TO YES

That said, this is not a fixed view. I would reassess quickly if certain conditions were met.

The most important would be a successful Senate committee markup explicitly advancing H.R.3633. That single event would eliminate the largest bottleneck and signal that compromise has been reached on the most contentious issues.

A second catalyst would be clear bipartisan alignment, especially visible support from influential Senate Democrats. That would reduce the risk that the bill becomes trapped in partisan negotiation.

Finally, explicit confirmation that H.R.3633 will remain the legislative vehicle—rather than being replaced by a new Senate bill—would dramatically reduce resolution risk.

If those signals emerged, the Yes price would likely rise, but so would the underlying probability. At that point, the balance of risk could justify switching sides.

For now, the prediction market is doing what it does best: forcing participants to confront the difference between policy importance and procedural success. The Clarity Act may well define the future of U.S. crypto regulation. Whether it does so under this exact bill number, on this exact timeline, remains the question the market is still trying to answer.

Read More:

Why Gold Is Surging: Central Banks, Sanctions, and Trust-1

Solana in 2026: From Meme Speculation to Real Revenue

Messari 2026 Crypto Theses: Why Speculation Is No Longer Enough (Part 1)