KEYTAKEAWAYS

- Polymarket data shows a 74% probability of Bitcoin falling below $70,000 in February, reflecting strong bearish sentiment.

- Longer-term markets suggest rising risks of BTC dropping below $65,000 or even $55,000 in 2026.

- Prediction market signals now diverge sharply from bullish calls by analysts like Tom Lee and institutions such as Standard Chartered and Bernstein.

CONTENT

Bitcoin faces rising downside risks as Polymarket shows growing odds of a drop below $70,000, contrasting sharply with bullish Wall Street forecasts.

BITCOIN MAY FALL BELOW $70,000 IN FEBRUARY

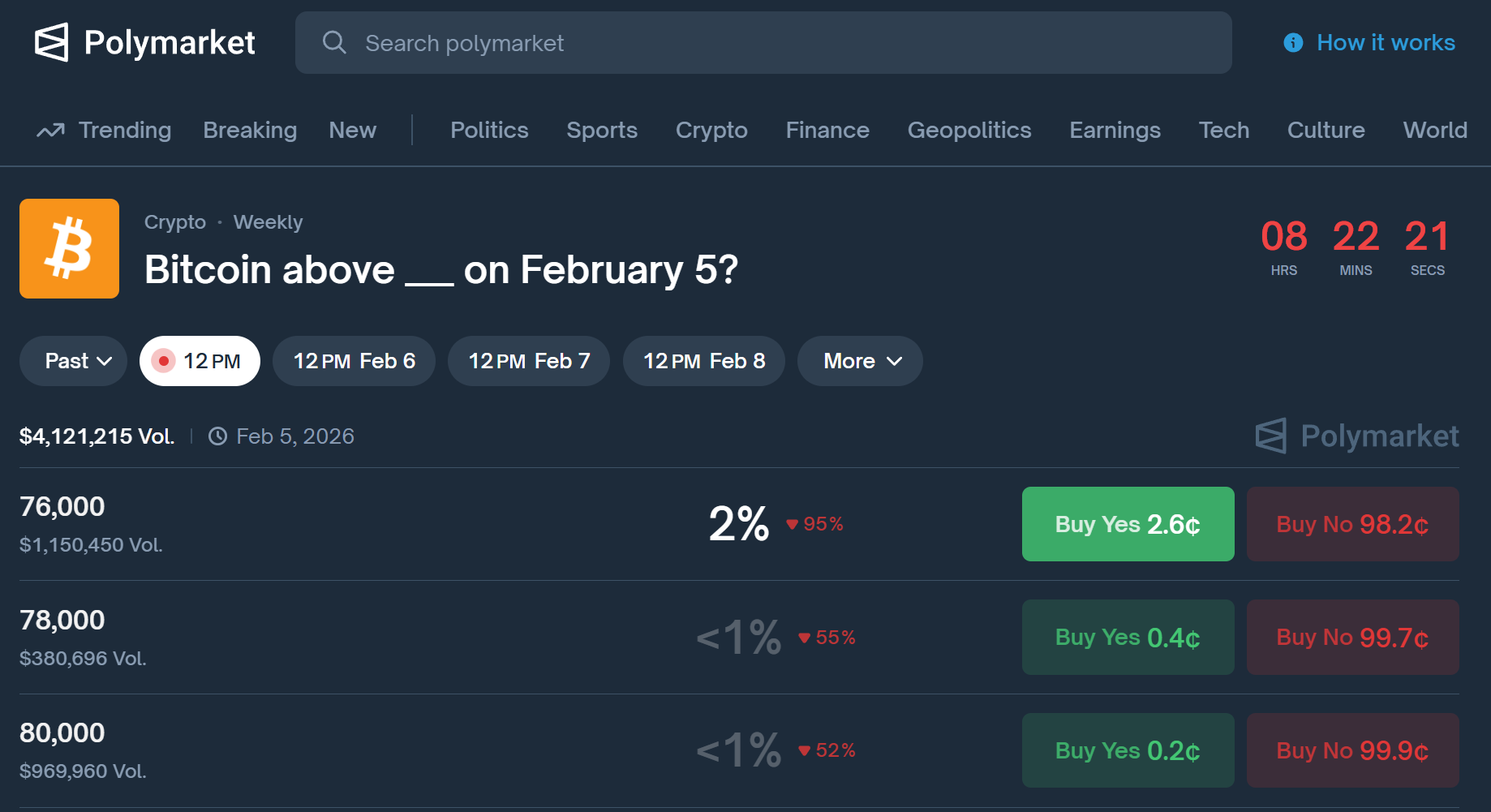

Polymarket is a decentralized prediction platform that is highly popular among crypto speculators.

According to the current market forecast on Polymarket’s “What price will Bitcoin hit in February?” market, the probability that Bitcoin will drop below $70,000 before March 1 has surged to 74%, up sharply from just 9% at the beginning of the month. Around $1.64 million has been wagered on this outcome, reflecting traders’ growing pessimism. Meanwhile, ETF outflows and the breakdown of macroeconomic correlations have further intensified overall market concerns.

BITCOIN COULD FALL BELOW $65K BY THE END OF 2026

Another longer-term market, “What Will Bitcoin’s Price Be in 2026?”, suggests that Bitcoin has an 80% chance of dropping to $65,000 this year—about 11% below its current level of $73,000.

Some traders are betting on an even worse scenario. The probability of Bitcoin closing below $55,000 has climbed to 59%, while the odds of a rebound to $100,000 have fallen from 80% at the start of the year to 55%.

COLLECTIVE WISDOM VS. WALL STREET: WHOSE PREDICTIONS ARE MORE ACCURATE?

Since early October, sentiment in the crypto market has remained weak. A sudden weekend crash at that time triggered billions of dollars in liquidations, severely shaking investor confidence. A new wave of sell-offs last weekend has further deepened market pessimism. Currently, the total crypto market capitalization stands at around $2.5 trillion, well below its peak of over $4 trillion in October.

From the perspective of prediction markets, collective wisdom stands in sharp contrast to the bullish narrative long promoted by Wall Street crypto advocates, who claim that “digital assets are about to make a comeback.” For example, well-known Wall Street analyst Tom Lee predicted in November that Bitcoin could rebound to between $150,000 and $200,000, a forecast that failed to materialize. Although firms such as Standard Chartered and Bernstein lowered their projections late last year, they still expect Bitcoin to rise significantly by the end of this year, with both maintaining a year-end target of around $150,000.