KEYTAKEAWAYS

- Funding momentum is fading, ETF inflows remain minimal, and open interest shows traders reducing exposure, signaling weakening bullish conviction and a market lacking strong directional appetite.

- Order-book pressure caps upside near resistance zones, while strong bids lower offer support, creating a tight range where liquidity—not sentiment—drives short-term price action.

- Macro conditions such as DXY softness help limit downside, yet without fresh capital entering the market, Bitcoin’s short-term outlook remains weak and vulnerable to catalysts.

- KEY TAKEAWAYS

- FUNDING RATES ARE LOSING MOMENTUM

- OPEN INTEREST SHOWS A MARKET WITHOUT DIRECTION

- ETF FLOWS FAIL TO PROVIDE SUPPORT

- DXY OFFERS SUPPORT BUT NOT ENOUGH

- ORDER BOOK LIQUIDITY SHOWS SELL PRESSURE OVERHEAD

- SHORT-TERM STRUCTURE: WEAK BULLS, PASSIVE BEARS

- WHY THE NEXT MACRO CATALYST MATTERS

- TOWARD A STRUCTURED RATING MODEL

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Bitcoin weakens as funding cools, ETF flows stall, and order-book pressure builds. Key indicators show limited breakout potential and a short-term tilt toward downside.

FUNDING RATES ARE LOSING MOMENTUM

Over the past week, Bitcoin’s short-term tone has shifted from constructive to noticeably softer, and the clearest evidence of this shift appears in funding rates. At first glance, funding remains marginally positive — with the 7-day rate at 0.1008%, the 1-day at 0.0144%, and the current reading sliding to 0.0048% — which normally suggests that long positions still dominate. Yet the trend matters more than the static snapshot. Each timeframe shows a clear deceleration, signalling that bullish conviction is fading rather than strengthening.

This change in momentum does not automatically imply that the market is turning bearish; instead, it suggests a softening of the long side without any corresponding rise in aggressive short interest. To understand whether the decline in enthusiasm is structural or merely temporary, one must turn to the second major indicator: open interest.

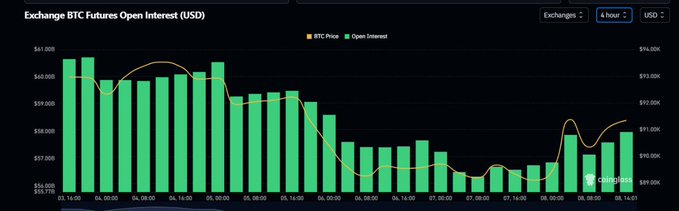

OPEN INTEREST SHOWS A MARKET WITHOUT DIRECTION

Open interest (OI) serves as a direct reflection of how much capital remains committed to the market, whether through long or short positions. Recent charts show OI contracting as both sides unwind exposure. After the latest downturn, positioning only experienced mild replenishment and fell far short of signaling new directional bets.

The pattern resembles a market that is not confident enough to chase upside but equally uncertain about initiating fresh downside exposure. when both sides are moving without clear differentiation, it becomes nearly impossible to distinguish who’s leading.

This indecision is precisely what OI reflects: a market waiting for a catalyst, unwilling to commit, and for now, choosing to reduce risk rather than build it.

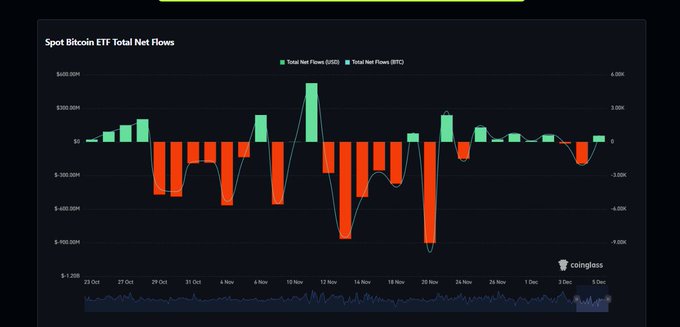

ETF FLOWS FAIL TO PROVIDE SUPPORT

If any indicator could have changed the short-term dynamic, it would have been ETF flows. These products have consistently shaped Bitcoin’s medium-term trends, while daily net inflows and outflows often serve as highly responsive short-term signals.

However, the past week shows ETF flows hovering close to zero. Even though inflows technically remain positive, the scale is so small that it barely registers as real support. In effect, ETFs are not participating in price formation.

That lack of incremental demand becomes particularly important in periods where directional conviction is thin. When funding declines, OI stagnates, and ETFs stand aside, price action becomes dominated by the order book rather than fresh capital. This shift explains why intraday moves have increasingly resembled liquidity-driven fluctuations rather than trend-driven rallies.

DXY OFFERS SUPPORT BUT NOT ENOUGH

The U.S. Dollar Index (DXY) has recently been moving in a direction that typically favors Bitcoin. As the dollar weakens or consolidates at lower levels, BTC often benefits from the inverse relationship. Indeed, part of Bitcoin’s resilience earlier in the week can be attributed to this supportive backdrop.

Yet even a friendlier dollar cannot offset the internal weakness across crypto-specific indicators. After December 5, DXY entered a choppy phase, reducing the clarity of that inverse signal. At the same time, the deterioration in funding, positioning, and ETF flows weighed more heavily on sentiment than any marginal help from the broader macro environment.

Thus, while DXY explains why BTC has not broken down aggressively, it cannot by itself reverse a structure that is increasingly tilting toward mild short-term weakness.

ORDER BOOK LIQUIDITY SHOWS SELL PRESSURE OVERHEAD

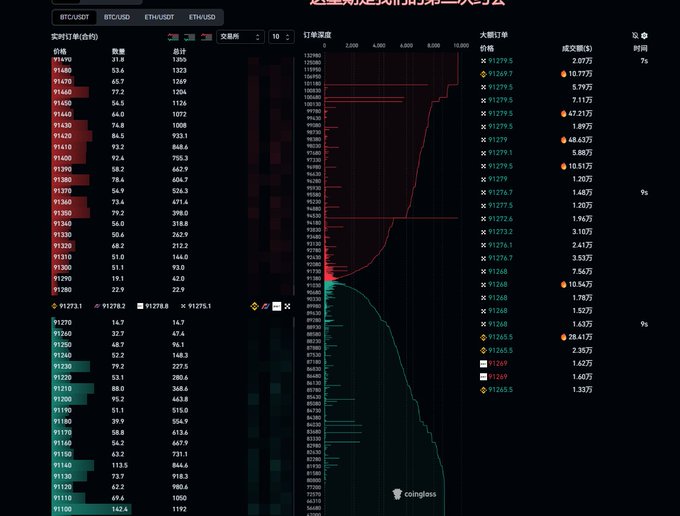

The next piece of the puzzle comes from order-book dynamics. Real-time liquidity shows that buy-side depth is comparatively weak; there is no visible cluster of strong bids providing meaningful support at current levels. Meanwhile, sell-side pressure stands out far more clearly.

The imbalance becomes even more pronounced on heatmap data. Between 91,800 and 92,200, a dense zone of sell liquidity forms a clear overhead barrier. In contrast, the strongest concentration of buy interest sits materially lower — around 89,400, where a large liquidity wall appears.

This configuration creates a well-defined trading corridor: resistance above, support below, and little incentive for the market to break through either boundary without fresh capital. Because longs are cooling and ETFs are not stepping in, the probability of an upside breakout diminishes. Conversely, the strong liquidity at 89,400 increases the likelihood of demand absorption and short-term rebounds if price drifts lower.

SHORT-TERM STRUCTURE: WEAK BULLS, PASSIVE BEARS

When combining all signals — funding, OI, ETF flows, DXY, order-book depth, and heatmap positioning — Bitcoin currently sits in a structure best described as:

“Upward pressure capped, downside supported, but with a short-term bearish tilt.”

This does not constitute a breakdown, nor does it resemble the beginning of a sharp trend reversal. Instead, it reflects a market struggling to generate continuation. Bulls are not strong enough to drive price higher, and bears are not strong enough to force a decisive collapse. The absence of ETF inflows is particularly important because, in the current cycle, sustainable rallies have almost always required institutional demand to provide follow-through.

In other words, the market is tired, indecisive, and increasingly mechanical — driven not by narrative or capital flows, but by liquidity pockets and passive order behavior.

WHY THE NEXT MACRO CATALYST MATTERS

The upcoming rate-cut meeting may inject some short-term volatility into BTC, but even its potential upside influence should be interpreted carefully. Liquidity conditions remain thin, and sentiment appears fatigued.

Even if a dovish signal provides temporary relief, the broader environment will not shift overnight; structural demand still needs to re-enter. The more interesting scenario arises if the market perceives the outcome as disappointing. In that case, sentiment could snap quickly, breaking the current stalemate and offering clarity — potentially to the downside, where the path of least resistance currently lies.

Paradoxically, a failed “good news” event might be exactly what ends the recent sideways drift.

TOWARD A STRUCTURED RATING MODEL

Given the fragmented nature of current signals, it becomes increasingly useful to construct a systematic scoring model for short-, medium-, and long-term indicators. Each metric — funding rates, open interest, ETF flows, macro factors, liquidity concentrations, heatmap levels — carries a different weight depending on the timeframe.

Short-term structures, such as heatmap liquidity or intraday OI changes, should receive heavier weighting in a 7-day outlook. Medium-term analysis must rely more on ETF holdings and macro trends. Long-term projections require structural demand, regulatory clarity, and supply-side factors such as halvings and broader adoption.

With the proper scoring distribution, Bitcoin’s behavior becomes quantifiable rather than interpretive. The current configuration scores mildly negative on the short-term scale: not outright bearish, but tilted downward due to weakening long interest, minimal ETF participation, and clear overhead liquidity resistance.

Read More:

The Rate-Cut Path Signals a Stronger Macro Cycle for Bitcoin Ahead