KEYTAKEAWAYS

- Bitwise’s onchain vault represents a new model for institutional DeFi adoption, where asset managers design and oversee strategies while user funds remain fully non-custodial and onchain.

- Morpho’s over-collateralized lending infrastructure is increasingly positioning itself as core financial plumbing capable of supporting conservative, cash-management-style yield strategies.

- The move highlights how DeFi’s next growth phase is likely to be driven less by speculative leverage and more by integration with institutional mandates, compliance expectations, and real-world asset strategies.

CONTENT

Bitwise’s launch of a non-custodial onchain vault on Morpho signals a structural shift toward institution-grade DeFi, blending transparent blockchain execution with professional risk management.

FROM ETFS TO ONCHAIN YIELD

The boundary between traditional crypto asset management and decentralized finance narrowed meaningfully this week when Bitwise Asset Management announced the launch of its first onchain vault through Morpho, positioning the product as a non-custodial, USDC-based strategy targeting yields of up to 6% via over-collateralized lending markets.

Unlike earlier institutional forays into DeFi that relied on opaque wrappers, third-party custody, or indirect exposure through structured products, Bitwise’s vault keeps assets fully onchain and non-custodial at all times, while centralizing strategy design and real-time risk management under a familiar institutional brand, a combination that reflects how professional allocators increasingly want exposure: programmable transparency paired with accountable governance.

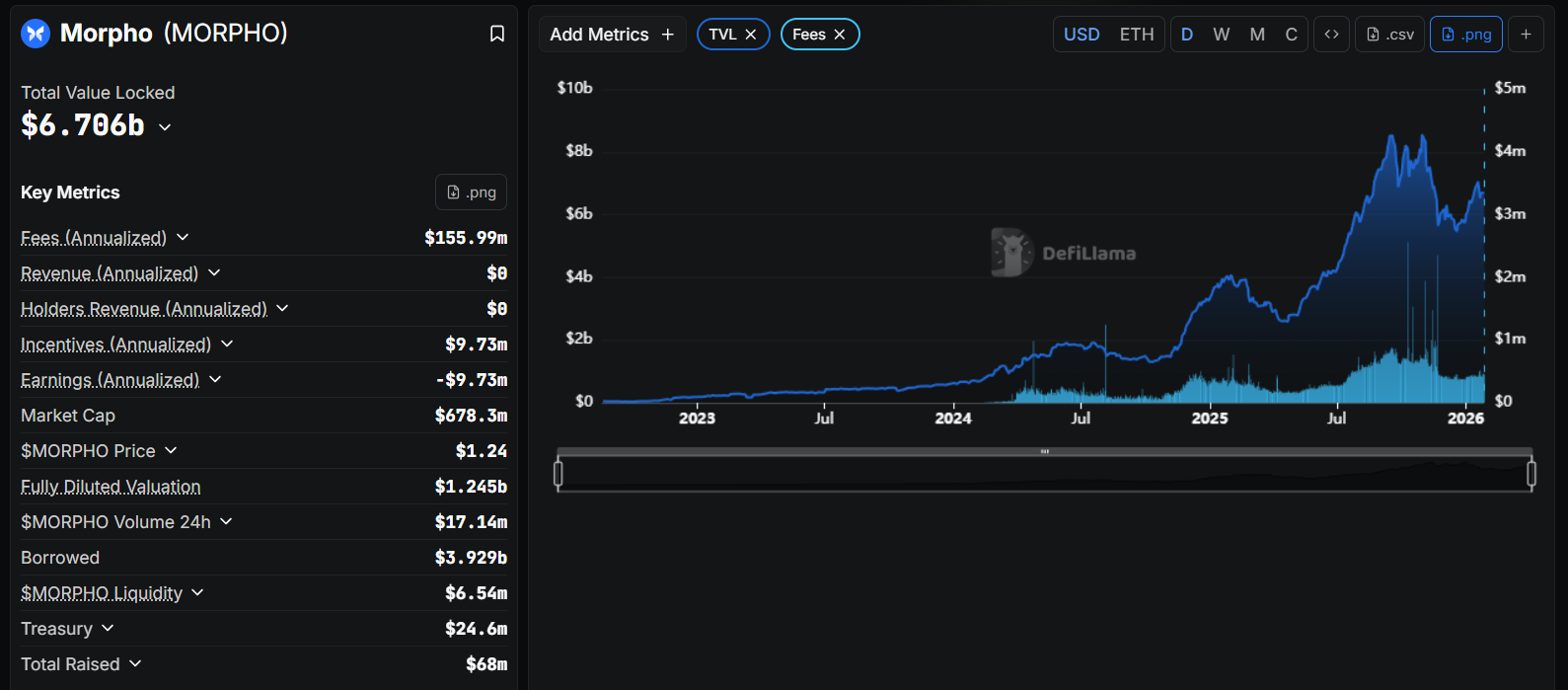

WHY MORPHO IS BECOMING INFRASTRUCTURE

Morpho’s selection as the execution layer is not incidental, as the protocol has steadily repositioned itself from a yield-optimization tool into a modular lending backbone capable of supporting institution-grade strategies without sacrificing DeFi’s core primitives.

According to public protocol data and reporting by The Block, Morpho’s architecture allows capital to be routed into over-collateralized lending pools with configurable parameters, minimizing reliance on reflexive leverage and reducing exposure to liquidation cascades that have historically deterred institutional capital from onchain credit markets.

By anchoring the initial vault to USDC and conservative collateralization thresholds, Bitwise is implicitly acknowledging that institutional adoption of DeFi will begin not with exotic yield, but with predictable cash-management-style returns that resemble money-market or repo-like behavior, only executed on public blockchain rails.

INSTITUTIONAL DEFI WITHOUT CUSTODY RISK

What distinguishes this launch from earlier “CeFi-meets-DeFi” experiments is the deliberate avoidance of custody intermediation, a design choice shaped by the post-2022 regulatory environment in which asset segregation, transparency, and operational control have become non-negotiable for fiduciaries.

Bitwise’s role as strategy manager, rather than asset holder, mirrors how traditional asset managers oversee mandates without directly holding client funds, while Morpho’s smart contracts enforce execution rules onchain, creating a separation of duties that aligns closely with expectations from regulators, auditors, and institutional investment committees.

In this sense, the vault does not attempt to make DeFi simpler by abstracting it away, but instead makes it investable by framing it in structures that institutions already understand, where risk is defined, monitored, and constrained rather than hidden behind yield narratives.

THE SIGNAL FOR RWA AND BEYOND

Bitwise executives have already indicated that the onchain vault model is intended to expand beyond USDC lending to additional stablecoins, crypto assets, and eventually real-world-asset strategies, a roadmap that mirrors broader industry momentum toward tokenized credit, treasuries, and onchain collateral management.

As highlighted in recent coverage by CoinDesk and The Block, institutional interest in RWA-linked DeFi has accelerated alongside clearer regulatory frameworks in jurisdictions such as the EU and Hong Kong, where onchain transparency is increasingly viewed as complementary rather than antagonistic to compliance.

If successful, Bitwise’s Morpho vault may come to be seen less as a yield product and more as a prototype for how asset managers interface with decentralized protocols in the future, not by replacing banks or funds, but by turning DeFi into a programmable extension of modern asset management infrastructure.

A QUIET BUT STRUCTURAL SHIFT

While the headline yield of up to 6% will inevitably draw attention, the deeper significance of Bitwise’s move lies in what it suggests about the next phase of DeFi’s evolution, where growth is driven less by speculative leverage and more by integration with institutional balance sheets, mandates, and risk frameworks.

By choosing a non-custodial, over-collateralized, and transparently governed design, Bitwise is effectively testing whether DeFi can function as a trust-minimized financial substrate rather than a parallel casino, a distinction that will shape how capital flows into the sector over the next market cycle.

If that experiment succeeds, Morpho’s role may ultimately resemble that of core financial plumbing rather than a standalone protocol, quietly reinforcing the idea that institutional DeFi adoption is not about reinventing finance overnight, but about making decentralized systems legible, accountable, and durable enough to matter.

Read More: