KEYTAKEAWAYS

-

Jay Chou’s lost Bitcoin case exposes the hidden risks of celebrity crypto custody, where trust often replaces legal and technical protection.

-

The incident highlights how private key control, not ownership claims, ultimately determines asset security in the crypto world.

-

From NFTs to futures trading, stars’ experiences reveal a recurring lesson — fame cannot replace due diligence or decentralized safety practices.

CONTENT

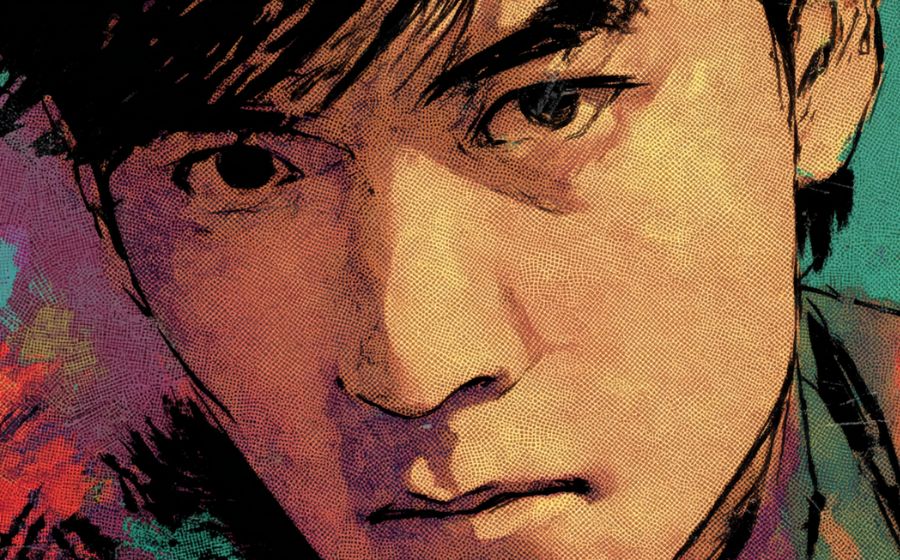

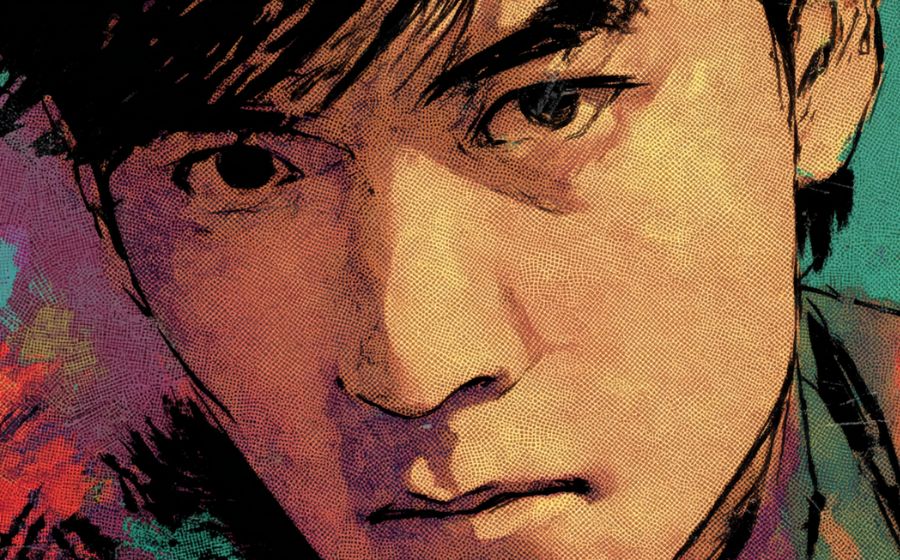

“Has anyone seen this magician who made himself disappear? You think I’m not a magician too? Show up soon, or you’re done.” On the night of October 15, 2025, Jay Chou’s furious Instagram post, accompanied by a photo of his longtime friend magician Eric Tsai (蔡威泽), went viral across social media. Behind those words was a shocking revelation: Chou had entrusted tens of millions in Bitcoin to Tsai’s care, only to find his account “locked” and his friend gone without a trace.

The public drama between two once inseparable friends opened a window into one of crypto’s least discussed dangers — the fragile trust behind private asset custody and the thin line between faith and fraud.

THE MAGICIAN’S TRUST GAME: FROM STAGE PARTNERS TO BITCOIN CUSTODY

Jay Chou and Eric Tsai’s friendship ran deep. Tsai, a Taiwanese magician who once appeared on America’s Got Talent, became a fixture in Chou’s life — a regular guest on his travel show J-Style Trip and a performer on his world tours. Their bond was brotherly, built on years of collaboration and mutual trust. So when Chou explored crypto investments in 2024, he naturally turned to Tsai for guidance.

Tsai claimed to have “considerable blockchain experience” and proposed managing Chou’s Bitcoin portfolio personally. The arrangement reportedly involved over NT$100 million (around USD 3–5 million) in Bitcoin, managed under Tsai’s full control. Their agreement was verbal, rooted entirely in trust, with no written contract or third-party verification — a critical flaw that would later prove catastrophic.

In crypto, this kind of “friend custody” isn’t rare. Many wealthy individuals fascinated by digital assets prefer to delegate management to trusted acquaintances. It feels safe — until it isn’t. The very convenience of informal delegation often conceals deep structural risks that become visible only when things go wrong.

RED FLAGS: FROM “ACCOUNT LOCKED” TO COMPLETE DISAPPEARANCE

The first signs of trouble emerged in early 2025. Tsai told Chou that his Bitcoin account had been “locked due to security issues,” temporarily freezing withdrawals. He promised to resolve it soon but later began making excuses — claiming he was short on money, overwhelmed by debt, and asking for patience.

Weeks turned into months. By summer, Tsai’s phone was off, his social media accounts inactive, and his last public statement — a black-and-white post reading “leaving social media temporarily, no replies during this period” — became a digital farewell note. Rumors soon spread that he had fled abroad, possibly to Southeast Asia.

When Chou finally lost patience in October, his public “missing person” posts broke the internet. What began as private trust between brothers had turned into a public scandal. The situation worsened when media outlets mistakenly used another magician’s photo, forcing that individual to issue public clarifications. The entire incident became a cautionary tale about misplaced trust — and a reminder that even global celebrities are not immune to crypto’s hidden hazards.

THE RISKS OF CUSTODIAL TRUST: WHY EVEN STARS GET TRAPPED

Jay Chou’s case highlights a systemic problem: legal and technical blind spots around crypto custody. In many jurisdictions, including Taiwan and mainland China, cryptocurrency investment and custody operate in gray areas. Virtual currency activities are often deemed illegal financial operations, meaning disputes receive no protection under financial law.

Without formal contracts or licensed custodians, legal recourse becomes nearly impossible. Bitcoin’s nature compounds the risk — it’s immutable and fully controlled by private keys. Once a private key is lost or misused, ownership effectively vanishes. As the saying goes in crypto, “Not your keys, not your coins.”

In Chou’s case, because Tsai held the private keys, Chou had no real control over his assets. Even if he pursued legal action, tracing and recovering the funds would be extraordinarily difficult due to crypto’s pseudonymity and cross-border nature. Reports suggest Chou’s legal team has already initiated proceedings, but success remains uncertain.

This is not the first celebrity crypto disaster. Chou’s own PhantaBear NFT collection, launched in 2022, sold out 10,000 pieces in 40 minutes, generating over 62 million RMB. Yet within months, its floor price collapsed by over 96% during the bear market, leaving holders with massive losses.

Other stars have had similar fates. Taiwanese rapper Jeff Huang (黃立成) reportedly gained over USD 44 million trading Ethereum futures on Hyperliquid before losing it all — and more — after leveraged liquidations wiped out his positions. In contrast, singer JJ Lin adopted a more cautious strategy, focusing on top-tier projects like BAYC while supporting Chou’s ventures, mitigating losses through diversification.

These stories share a pattern: celebrity investors, lured by hype and personal networks, often underestimate crypto’s technical and legal complexity. Fame may open doors in entertainment, but it offers no protection in blockchain finance.

IN THE BLOCKCHAIN WORLD, TRUST MUST BE BUILT ON CODE

Jay Chou’s saga is more than gossip — it’s a profound lesson about the limits of human trust in decentralized systems. In crypto, “code is law,” and emotions cannot replace verifiable control. The strongest form of magic in this world is not creating wealth, but safeguarding it.

When personal trust collides with blockchain’s hard rules, only those who prioritize security and autonomy can survive. Cold wallets, multi-signature accounts, and institutional-grade custodianship exist for a reason — they transform blind faith into verifiable safety.

As of this writing, Eric Tsai remains missing, and Chou has engaged lawyers to pursue recovery. Whether the Bitcoin can ever be reclaimed remains uncertain, but one thing is clear: the incident has shaken both fans and investors alike.

In the end, Jay Chou’s “locked Bitcoin” story reminds everyone of a brutal truth — in crypto, overtrust can be the most dangerous illusion. The future of this industry depends not just on innovation and returns, but on building a foundation of security, transparency, and enforceable accountability.