KEYTAKEAWAYS

- Bitcoin’s sharp crash followed Trump’s 100% tariff news, sparking insider trading rumors linked to massive pre-announcement short positions.

- Garrett Jin denied any ties to Trump, clarifying the fund’s actions were client-driven and research-based.

- The incident reignited debate on transparency, accountability, and regulatory oversight in large-scale crypto trading.

CONTENT

A detailed breakdown of the October 11 Bitcoin crash, the alleged pre-announcement short positions, and Garrett Jin’s public denial of insider trading ties to Donald Trump.

The latest market crash has reignited one of crypto’s most persistent fears — insider trading amid macroeconomic turmoil.

In the days leading up to the crash, crypto markets were already fragile. Volatility had been rising since early October, yet few anticipated the magnitude of the coming drop. Between October 9 and 10 (UTC+8), several monitoring accounts on X flagged unusually large BTC and ETH shorts across major derivatives platforms. These trades were opened discreetly but coincided suspiciously with upcoming political events on the U.S. calendar.

At that time, most traders assumed these were macro-hedging moves. In hindsight, however, they appeared almost perfectly timed. On-chain traces indicated that at least one newly created address — with minimal prior activity — had opened short positions worth tens of millions of dollars in BTC perpetual contracts. The same address later closed those positions at significant profit as the market collapsed.

What followed was a wave of speculation, accusations, and eventually, a public response from one of the whales at the center of it all — Garrett Jin.

This article mainly sorts out the course and current situation of this incident according to the timeline, and will continue to follow up.

THE NIGHT BEFORE THE ANNOUNCEMENT

On the night of October 10 (UTC+8), roughly 30 minutes before Trump’s televised statement, multiple platforms recorded sudden spikes in open interest and reversals in funding rates — both classic indicators of a coordinated short build-up. Within minutes of the tariff news going public, Bitcoin tumbled sharply, leading to one of the largest single-day liquidations in crypto history, with approximately $19 billion in leveraged positions wiped out across exchanges.

Some analysts estimated that the trader, or group of traders, behind these shorts earned between $88 million and $160 million from the move. Others suggested that an early-era Bitcoin whale might have deployed over $1.1 billion in BTC and ETH short exposure. These figures remain unverified, but the precision of the timing was enough to trigger outrage and widespread insider-trading allegations tied to the Trump announcement.

OCTOBER 11: THE CRASH AND THE ACCUSATIONS

As Trump’s 100 percent tariff declaration spread through global markets, risk assets across sectors slumped. Crypto bore the brunt of the shock. Bitcoin fell double digits within hours, followed by Ethereum, as billions in long positions were liquidated.

Soon after, social media erupted with conspiracy theories. Many claimed someone close to Trump — or with advance access to policy details — had shorted Bitcoin ahead of the announcement. Multiple outlets published stories referencing “Trump-linked insider shorts,” though no direct wallet address, institutional connection, or exchange verification supported the claims. What remained were three undeniable facts: timing, precision, and profit — the perfect mix to fuel suspicion.

OCTOBER 12: TRACING THE WHALE

By the weekend, blockchain sleuths began connecting dots.

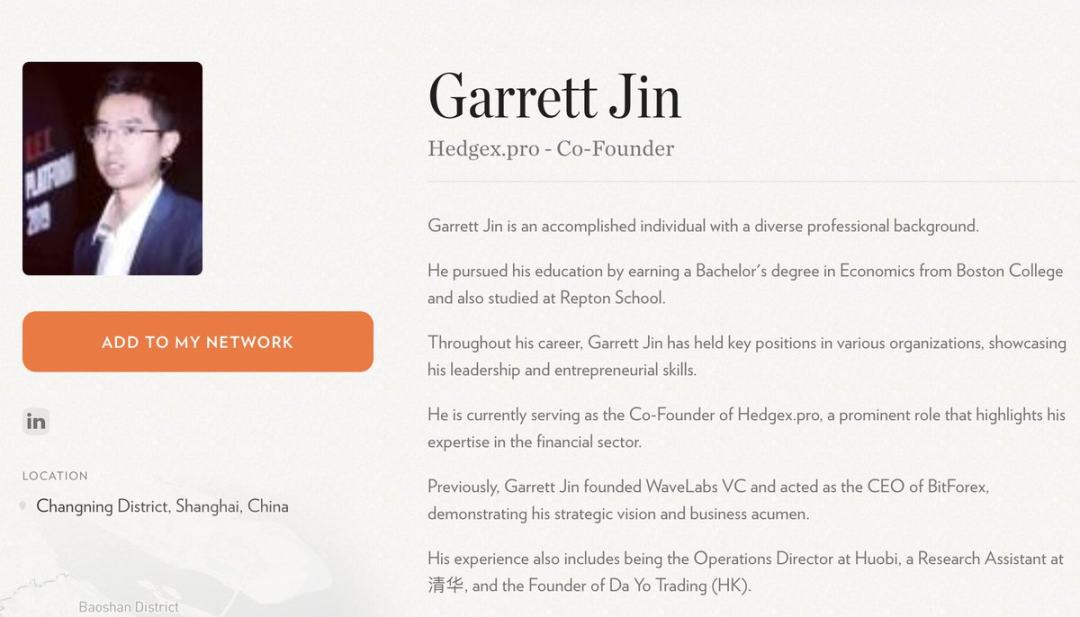

Threads emerged suggesting that the suspicious trades might be tied to Garrett Jin, a well-known whale who earlier in the year executed a $4.23 billion BTC-to-ETH rotation. His fund’s on-chain activity was extensive and publicly traceable, making him an easy suspect in the public narrative.

Screenshots of old transactions circulated widely, alleging Jin’s involvement in the short positions preceding the crash. Given his prior headline-making moves, particularly his massive rotation into ETH, Jin quickly became a focal point for criticism and accusations of market manipulation.

OCTOBER 13: GARRETT JIN BREAKS SILENCE

On October 13, Jin addressed the controversy in a post reported by Foresight News. He wrote:

“Hi, CZ — thank you for sharing my personal information. To clarify, I have absolutely no relationship with the Trump family or Donald Trump Jr. This is not insider trading. The fund in question doesn’t belong to me; it belongs to my clients. We operate validator nodes and provide them with internal research and insights.”

He went on to outline three upcoming points of discussion:

- His previously stated bearish thesis

- His view of the October 11 incident

- His thoughts on improving transparency and governance in the crypto industry.

Jin’s tone was composed yet firm, signaling his intent to reject the narrative of insider advantage and instead frame his activity as professional, research-based risk management.

A SHIFT IN PUBLIC SENTIMENT

Jin’s statement marked a turning point.

Until then, public opinion leaned heavily toward suspicion. After his clarification, some analysts revisited the data and found inconsistencies in the earlier claims. Several wallets attributed to Jin showed no link to the questioned exchange accounts, while others argued that the short positions could have been established by quantitative strategies responding to macro indicators, not leaked information.

Even so, the coincidence remained difficult to dismiss. The 30-minute gap between the trades and the announcement kept the debate alive. Critics argued that only those with prior knowledge could time it so precisely, whereas defenders maintained that professional funds often hedge before major policy events as part of standard practice.

THE CURRENT LANDSCAPE

As of mid-October, no official investigation or confirmation of insider trading has been announced. Neither regulators nor exchanges have issued statements regarding the case. The “Trump-linked whale” narrative remains circumstantial — a blend of timing anomalies, circumstantial evidence, and social-media amplification. Jin’s fund continues to operate, reportedly maintaining an ETH-heavy portfolio with derivative hedging strategies in place.

This episode has reignited the industry’s long-standing debate on transparency. Crypto’s pseudonymous culture enables massive financial movements without direct oversight, but it also obscures accountability. Regardless of who profited, the event underscores the need for better transparency in institutional crypto trading.

On the other hand, the whale at this address opened a $160 million BTC short order after making a profit, which attracted market attention.

WHERE IT GOES FROM HERE

Looking ahead, attention is likely to shift toward exchange transparency and disclosure standards. If Jin follows through with his promise to share insights into how institutional research funds hedge risk, it may shed new light on how professional crypto trading actually works. Conversely, if regulators decide to investigate pre-announcement trades — especially those within the half-hour window — the debate around insider information in crypto could finally evolve from speculation to formal inquiry.

For now, the market has regained partial stability. Bitcoin has recovered from its lows, and sentiment remains cautious yet resilient. Still, the shadow of those perfectly timed shorts lingers. Whether coincidence, intuition, or privileged access, one truth stands firm: in the world of crypto, timing can be everything — and sometimes, timing speaks louder than any explanation ever could.