KEYTAKEAWAYS

- Binance remains a major liquidity hub, but its dominance in price discovery and derivatives trading is facing structural challenges.

- On-chain platforms like Hyperliquid are gaining traction by prioritizing transparency, verifiability, and public market infrastructure.

- The real competition is shifting from volume and fees to who defines the future trading model of crypto markets.

CONTENT

An in-depth analysis of Binance’s shifting dominance as on-chain platforms like Hyperliquid reshape price discovery, liquidity flows, and the future structure of crypto trading.

For years, Binance has been widely regarded as the “No.1 Exchange in the Crypto Universe.”

It became a label deeply embedded in retail investors’ minds — almost unquestioned.

Yet recently, I’ve begun to grow increasingly skeptical of this long-standing narrative.

There is no doubt that, backed by its vast ecosystem spanning public blockchains, wallets, incubation programs, and venture capital networks, Binance remains the most influential platform in today’s crypto industry in terms of overall reach.

But the real question worth reexamining lies elsewhere — at the very core of what an exchange is meant to do.

In trading itself.

Especially in high-volume, high-fee, price-defining arenas such as the derivatives market,

does Binance still firmly sit at the top?

Does it still possess an unshakable advantage over its competitors?

And beyond pure trading volume, in key areas of innovation and specialized market segments, are there now players that are beginning to outperform Binance?

This question is not driven by any single short-term data point.

Rather, it stems from a series of seemingly minor developments over the past months — each insignificant on its own, but together, gradually reshaping my understanding of Binance’s true position in the market.

DERIVATIVES TRADING VOLUME UNDER PRESSURE

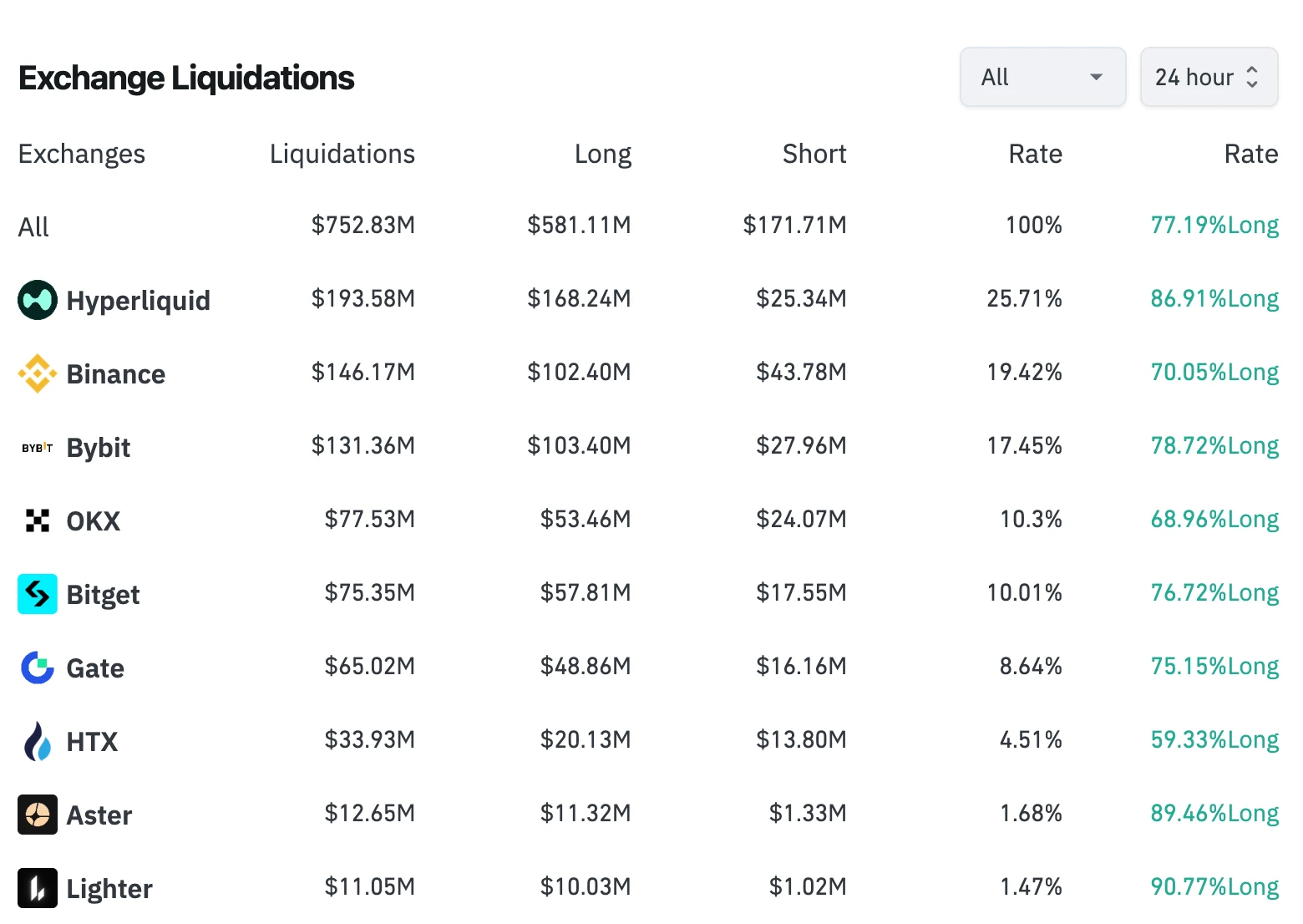

One of the clearest signals of shifting market dynamics has emerged in recent periods of high volatility.

Over the past few days, Hyperliquid has overtaken Binance in liquidation volume.

As shown in recent data, over the past 24 hours, Hyperliquid recorded approximately $193 million in liquidations, compared to $146 million on Binance.

There is, however, an important caveat.

Binance’s liquidation data feed is subject to a rate limit of at most one update per second. As a result, platforms such as Coinglass may experience minor delays when capturing real-time figures.

That said, based on market observations and trader behavior, a clear trend is emerging:

✏️ an increasing number of large traders are choosing to open positions on Hyperliquid.

Representative examples include well-known figures such as “Mach Big Brother,” the “1011 insider whale,” James Wynn, AguilaTrades, “CZ’s counterpart,” the “14-win streak whale,” Gambler@qwatio, Low-Stack Degen, and several other high-profile accounts.

▶You may dismiss them as pure gamblers.

▶But where the gamblers go, liquidity follows.

▶And liquidity is the lifeblood of any exchange.

📌Why Is This Shift Happening?

The underlying reason lies in structural differences between centralized and on-chain trading systems.

Compared with centralized exchanges — which inevitably face ongoing concerns about “black-box operations” — Hyperliquid executes all orders, trades, liquidations, and settlements on-chain.

➤ This architecture provides built-in advantages in terms of:

- Transparency

- Verifiability

- Perceived fairness

Every transaction is publicly auditable.

Nothing happens behind closed doors.

This stands in sharp contrast to traditional CEX models, where users must ultimately trust the platform’s internal matching and risk-management systems.

📌 A Case That Still Lingers in the Market’s Memory

In the first half of last year, a prominent industry veteran — someone who had previously founded several well-known projects — suffered a targeted liquidation on a major centralized exchange (not Binance).

The losses reportedly exceeded $100 million.

Despite repeated inquiries, the platform never disclosed detailed information regarding its internal order-matching logic or liquidation mechanisms.

- No transparent records.

- No independent verification.

- No accountability.

Incidents like this continue to shape how large traders evaluate counterparty risk — and reinforce the appeal of fully on-chain trading venues.

>>> More to read: CZ Under Fire as Binance Listing Controversy Resurfaces

SLOWING MOMENTUM IN NEW ASSET LISTINGS

Over the past year, compared with several second-tier exchanges, Binance has noticeably tightened its pace of official token listings.

Instead of frequent direct listings, much of the early-stage experimentation has been shifted to Binance Alpha. However, the post-listing performance of many Alpha projects has been underwhelming.

Following the surge of Chinese meme tokens, Alpha’s strategic focus has increasingly tilted toward the BSC ecosystem. After the “10.11 incident,” controversies surrounding Binance’s listing practices continued to intensify, prompting renewed scrutiny across the industry.

✅ Ecosystem Shifts: From Solana to Bybit?

A recent public dispute further highlighted these tensions.

Not long ago, Anatoly Yakovenko, co-founder of Solana, openly criticized Binance on X and was subsequently unfollowed by Changpeng Zhao.

Yet this incident merely amplified a narrative that had already been circulating in the market:

- many projects from the Solana ecosystem are gradually shifting toward Bybit for listings and liquidity support.

- If this trend continues, Binance’s traditional dominance in primary listings and price discovery may no longer remain unchallenged.

✅ Traditional Assets: A New Battleground

More importantly, as crypto-native assets remain in a prolonged downturn, the industry has begun to treat tokenized traditional assets — including equities and precious metals — as the next major growth frontier.

On this front, Binance’s progress appears relatively slow.

Compared with Hyperliquid and several highly aggressive centralized exchanges such as Bitget and Gate, Binance has moved more cautiously.

Last Monday, Binance launched its first stock-linked perpetual contract, Tesla (TSLA), followed shortly by Intel (INTC) and Robinhood (HOOD).

While this marked a meaningful step, competitors were already moving far more aggressively.

From tokenized stocks to precious metals, from indices to commodities, rival platforms have rapidly expanded their product coverage — effectively launching an early race for future users.

✅ Hyperliquid’s Structural Advantage

On the decentralized side, Hyperliquid has advanced even further.

Through its HIP-3 open architecture, the platform enables highly flexible, customized market creation. This has allowed it to list dozens of traditional-asset-linked instruments, including pre-IPO exposure to companies such as OpenAI and Anthropic.

More importantly, these products are not merely symbolic.

They have already accumulated substantial trading volume.

In recent periods, traditional-asset-linked markets have accounted for nearly half of Hyperliquid’s top-volume rankings — signaling genuine user demand rather than speculative experimentation.

✅ Implications

Taken together, these developments suggest that Binance’s long-standing advantage in asset expansion and market leadership is facing structural pressure.

While Binance still retains enormous brand strength and infrastructure depth, its more conservative approach to new listings and traditional-asset integration may gradually weaken its first-mover edge — especially in an environment where innovation speed is increasingly decisive.

WHAT HAS REALLY CHANGED?

When viewed together, the current evidence still falls short of proving that Binance has “lost its throne.”

Binance remains the most important liquidity hub in the crypto market.

But the real issue is not whether any second-tier exchange can temporarily overtake Binance in market share.

🔍 The real warning sign is this:

Binance is facing sustained structural challenges on the very battlefield that matters most — trading itself.

🚩 From Market Share to Narrative Power

What Binance is gradually losing is not volume.

It is something far more subtle:

the power to define what an exchange is.

For a long time, Binance’s dominance went far beyond liquidity.

It shaped industry consensus:

- Where price discovery happened

- Where institutional capital flowed

- Where new assets should be tested first

- Where “real markets” were formed

By default, the answer was always Binance.

🚩 A Shift in Trader Priorities

That consensus is now being quietly reshaped.

More and more high-net-worth traders are placing:

verifiability, fairness, and traceability

above brand reputation and fee discounts.

As price discovery increasingly migrates on-chain,

and as experimental markets move from opaque backends to transparent, auditable mechanisms,

trading behavior itself is being reorganized.

Platforms like Hyperliquid are not competing with Binance in the traditional sense.

They are redefining the infrastructure of trading.

🚩 From Competition to Paradigm Shift

This is what makes the current challenge fundamentally different.

In the past, Binance faced rivals that played the same game:

faster matching, deeper liquidity, lower fees.

Today, it is facing something else entirely:

a potential shift in market paradigm.

One where:

- Trust is built through code, not reputation

- Fairness is enforced by transparency, not policy

- Price discovery happens in public, not behind closed systems

This is not a battle between exchanges.

It is a battle between trading models.

🚩 The Question Binance Must Confront

Binance is still powerful.

Still dominant.

Still central.

But dominance alone is no longer sufficient.

🔍The critical question now is:

How deep is Binance’s moat in a world where trust is being rebuilt on-chain?

If exchanges are no longer defined by who controls the biggest black box,

but by who operates the most credible public infrastructure,

then Binance may need to rethink not just its strategy —

but its identity.