KEYTAKEAWAYS

- Record highs in Japan’s 30-year and 40-year government bond yields indicate a reassessment of long-term sovereign risk premiums rather than a repricing of short-term policy rates.

- Expectations of fiscal stimulus and increased bond issuance, alongside gradual monetary normalization by the Bank of Japan, form the core backdrop to rising long-term yields.

- The yen’s continued weakness despite rate hikes highlights growing coordination challenges between fiscal policy, monetary tightening, and exchange-rate stability.

- KEY TAKEAWAYS

- A HISTORIC BREAK IN LONG-TERM YIELDS: STARTING WITH THE 30-YEAR JGB

- FISCAL CONSTRAINTS AND DEBT SUPPLY EXPECTATIONS

- MONETARY POLICY: NORMALIZATION GAINS SUBSTANCE

- EXCHANGE RATE RESPONSES AND POLICY COMPLEXITY

- CONSENSUS AND DIVERGENCE IN MARKET VIEWS

- CONCLUSION: A CHANGE BEING GRADUALLY PRICED IN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Japan’s 30-year government bond yield has risen to a record high of 3.45%, driven not by a single policy decision or short-term sentiment, but by the combined effects of fiscal expansion expectations, monetary policy normalization, and shifts in long-term risk preferences—signaling a structural repricing of Japan’s long-term interest rate framework.

A HISTORIC BREAK IN LONG-TERM YIELDS: STARTING WITH THE 30-YEAR JGB

In December, Japan’s government bond market experienced a development with clear structural significance.

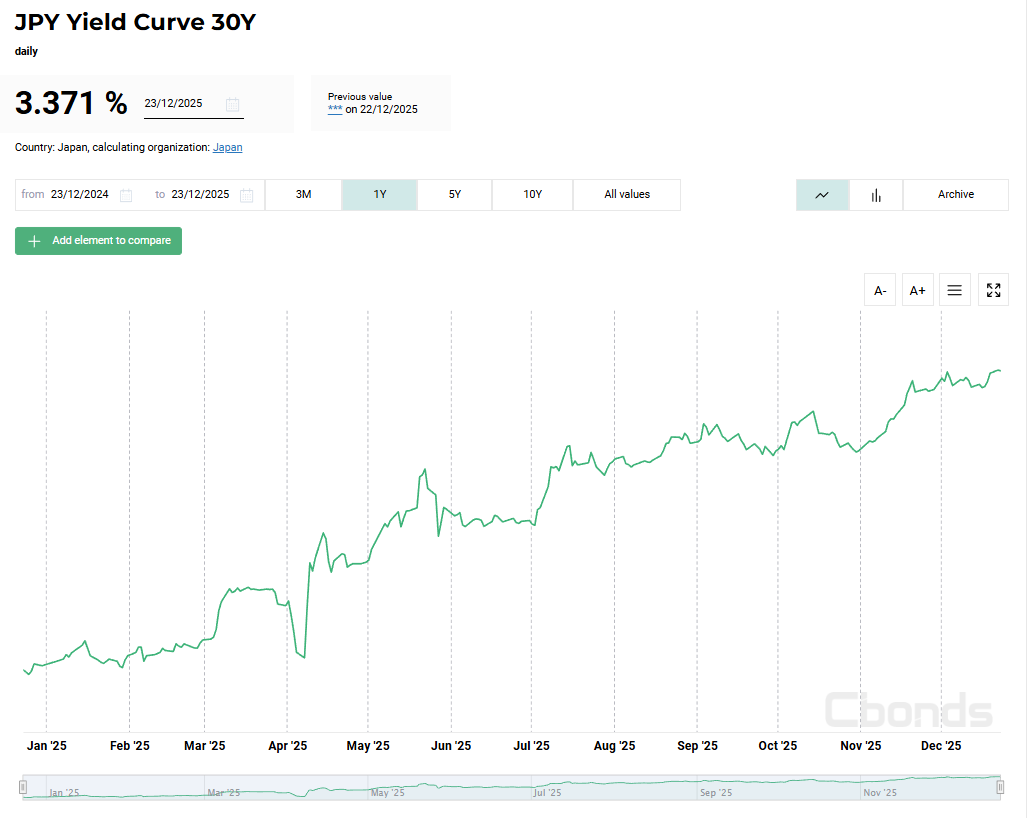

The yield on Japan’s 30-year government bond rose to approximately 3.45%, marking an all-time high. At the same time, the 40-year yield climbed to around 3.715%. This was not a single-day spike, but the continuation of a steady upward trend that began in early November. As yields rose, prices of ultra-long-dated bonds declined noticeably, and the far end of the yield curve shifted upward.

Notably, this adjustment was not concentrated in the short end of the curve. Instead, it was primarily observed in maturities of 30 years and beyond. Under the current policy framework, the Bank of Japan (BOJ) continues to exert strong influence over short-term interest rates. Movements at the long end, however, increasingly reflect market-driven pricing rather than direct policy guidance.

This structural pattern suggests that markets are reassessing not the near-term path of monetary policy, but the risk compensation embedded in Japan’s long-term sovereign debt.

Figure 1. Japan 30-Year Government Bond Yield Historical Chart, source: TradingEconomics

FISCAL CONSTRAINTS AND DEBT SUPPLY EXPECTATIONS

A key driver behind the rise in long-term yields lies on the fiscal side.

According to publicly available information, Japan plans to issue approximately ¥29.6 trillion in new government bonds in fiscal year 2026 to support its budget. While senior government officials have emphasized fiscal discipline and denied plans for irresponsible bond issuance or tax cuts, the bond market has remained cautious.

This caution reflects deeper concerns that extend beyond a single fiscal year. Investors are increasingly focused on Japan’s long-term fiscal trajectory:

- Japan’s government debt stock is already among the highest globally.

- Fiscal stimulus has become structurally embedded amid slowing economic momentum.

- Ultra-long bonds are particularly sensitive to supply dynamics and changes in expectations.

Within this context, rising long-term yields should not be interpreted as outright rejection of fiscal policy. Rather, they reflect investors’ demand for additional risk premium to compensate for longer debt cycles and heightened uncertainty surrounding fiscal sustainability.

MONETARY POLICY: NORMALIZATION GAINS SUBSTANCE

Alongside fiscal developments, changes in the BOJ’s policy stance have played an important role.

The BOJ has raised its policy rate from 0.5% to 0.75%, the highest level in nearly three decades. In recent communications, the governor has emphasized that underlying inflation is steadily approaching the 2% target and that monetary normalization still has room to proceed.

The significance of this shift lies less in the size of the individual rate hike and more in the direction it signals. For decades, Japanese markets operated under the assumption that ultra-low interest rates were effectively permanent. Current policy signals are gradually eroding that assumption.

It is also important to note that while the BOJ continues to use multiple tools to influence the yield curve, its ability to directly control ultra-long maturities is considerably weaker than at the short and medium end. This helps explain why recent volatility has been concentrated in 30-year and longer tenors rather than short-term rates.

Figure 2. Japan Government Bond Yield Curve by Maturity, source: Cbonds

EXCHANGE RATE RESPONSES AND POLICY COMPLEXITY

In theory, higher interest rates tend to support a country’s currency. In practice, however, the yen has remained relatively weak following Japan’s rate hikes.

This outcome does not necessarily imply policy failure. Instead, it reflects the interaction of multiple offsetting forces:

- The pace of rate hikes has been gradual and measured.

- Fiscal expansion expectations have counterbalanced tightening effects.

- Higher yields abroad continue to attract global capital.

Against this backdrop, Japanese officials have repeatedly stated that they are closely monitoring exchange-rate movements and stand ready to act if volatility becomes excessive. These statements underscore the growing complexity of the current policy environment, where monetary tightening, fiscal expansion, and exchange-rate stability must be managed simultaneously.

CONSENSUS AND DIVERGENCE IN MARKET VIEWS

While market commentary does not point to a single unified conclusion, several areas of consensus have emerged.

First, most analyses agree that the recent rise in ultra-long yields is driven primarily by fiscal expectations rather than monetary tightening alone. Markets are reassessing debt issuance scale and fiscal sustainability more than near-term policy rates.

Second, there is broad agreement that the BOJ has entered a phase of genuine—albeit gradual—monetary normalization. The direction of policy is clear, even if the pace remains cautious.

Third, linkages between the bond market, foreign exchange dynamics, and policy expectations are strengthening. The yen’s muted response to rate hikes has reinforced investor caution and added complexity to risk assessment.

Finally, historical comparisons have begun to surface. Some commentators have drawn parallels with fiscal stress episodes in other advanced economies, not as predictions of crisis, but as reminders that long-term capital is highly sensitive to policy consistency and debt trajectories.

CONCLUSION: A CHANGE BEING GRADUALLY PRICED IN

Based on currently available information, Japan is not facing an imminent debt or financial crisis. Fiscal and monetary policies remain within established frameworks, and overall market functioning remains orderly.

At the same time, it is increasingly clear that the long-standing assumption of a permanently low-interest-rate environment in Japan is being reassessed by the market.

Record highs in 30-year and 40-year government bond yields are not isolated anomalies. They represent the pricing-in of longer-term questions by global capital:

- Can Japan continue to finance its debt at exceptionally low costs over the long run?

- Can fiscal expansion and monetary normalization coexist sustainably?

- In a changing global rate environment, does Japan’s sovereign risk premium require adjustment?

These questions will not be answered quickly. But they are already being reflected, incrementally and methodically, in asset prices.

Read More:

After Japan’s Rate Hike, Crypto Analysts Call the Bottom

Why Japan’s Rate Hike Won’t Derail the Crypto Bull Market