KEYTAKEAWAYS

-

In December 2025, JPMorgan Chase & Co. brought its deposit-backed token JPMD into live operation on Base, marking the first time a major global bank’s balance-sheet deposits operated on a public blockchain.

-

Unlike stablecoins, deposit tokens represent direct claims on regulated bank deposits, embedding on-chain settlement within existing supervisory, accounting, and audit frameworks at a potential trillion-dollar scale.

-

Together with the launch of MONY, JPMorgan’s tokenized money market fund, these developments show RWA evolving from tokenization experiments into continuously operating, institution-controlled blockchain financial infrastructure.

- KEY TAKEAWAYS

- BANK DEPOSITS MOVE ON-CHAIN IN DECEMBER 2025

- WHY DEPOSIT TOKENS MATTER MORE THAN STABLECOINS

- SCALE MAKES THE DIFFERENCE

- MONY BRINGS YIELD ON-CHAIN

- RWA DATA SHOWS A SHIFT FROM PILOT TO OPERATION

- THE MACRO BACKDROP FOR INSTITUTIONAL ADOPTION

- FROM TOKENIZATION TO FINANCIAL INFRASTRUCTURE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

JPMorgan moves bank deposits on-chain as JPMD goes live on Base and launches the MONY tokenized money market fund, signaling RWA’s shift from pilots to institutional-grade blockchain financial infrastructure.

BANK DEPOSITS MOVE ON-CHAIN IN DECEMBER 2025

Until recently, real-world asset (RWA) adoption on public blockchains was largely confined to tokenized Treasuries, money market funds, and structured investment products, while commercial bank deposits—the most systemically important and heavily regulated form of money—remained firmly inside closed banking systems; this boundary was broken in December 2025, when JPMorgan Chase & Co. confirmed that its deposit-backed token, commonly referred to as JPM Coin (JPMD), had entered live operation on Base, the Ethereum Layer-2 network developed by Coinbase.

Unlike prior internal ledger experiments, JPMD on Base supports real institutional settlement activity, allowing whitelisted clients to conduct on-chain payments, margin settlement, and collateral movements, marking the first time a major global bank’s balance-sheet deposits have operated in a public blockchain environment rather than a closed or permissioned network.

WHY DEPOSIT TOKENS MATTER MORE THAN STABLECOINS

For years, stablecoins have served as the primary form of on-chain cash, yet for regulated financial institutions they remain structurally separate from the banking system, raising ongoing questions around issuer credit, reserve transparency, and regulatory treatment; deposit tokens differ fundamentally because they represent direct claims on commercial bank deposits, fully embedded within existing supervisory, accounting, and audit frameworks.

In JPMorgan’s case, this distinction is not theoretical: according to disclosures published on November 12, 2025, JPMD on Base entered production use with initial trial transactions involving Mastercard, Coinbase, and B2C2, while supporting 24/7 on-chain settlement, demonstrating that deposit-backed money can function as a live settlement asset on a public blockchain rather than a conceptual pilot.

SCALE MAKES THE DIFFERENCE

The systemic significance of deposit tokenization becomes clearer when viewed through balance-sheet data rather than blockchain narratives.

According to JPMorgan Chase’s 2024 Form 10-K, as of December 31, 2024, the bank reported total deposits of USD 2,406,032 million, equivalent to USD 2.406032 trillion, meaning that even a limited migration of deposit-based settlement activity to blockchain infrastructure would eclipse the scale of most existing on-chain RWA products.

For context, while tokenized Treasuries and money market funds have grown rapidly, their combined on-chain value remains measured in tens of billions, whereas commercial bank deposits operate at the trillion-dollar level within the global financial system.

MONY BRINGS YIELD ON-CHAIN

Deposit tokens address settlement, but yield remains a separate challenge; this gap was addressed on December 15, 2025, when JPMorgan Asset Management announced the launch of My OnChain Net Yield Fund (MONY), the firm’s first tokenized money market fund issued on public Ethereum.

According to the official announcement, MONY is a 506(c) private fund available to qualified investors, with assets invested exclusively in U.S. Treasuries and Treasury-backed repurchase agreements, and an initial seed investment of USD 100 million provided by JPMorgan itself, allowing investors to hold yield-bearing dollar assets directly on-chain under a fully regulated structure.

RWA DATA SHOWS A SHIFT FROM PILOT TO OPERATION

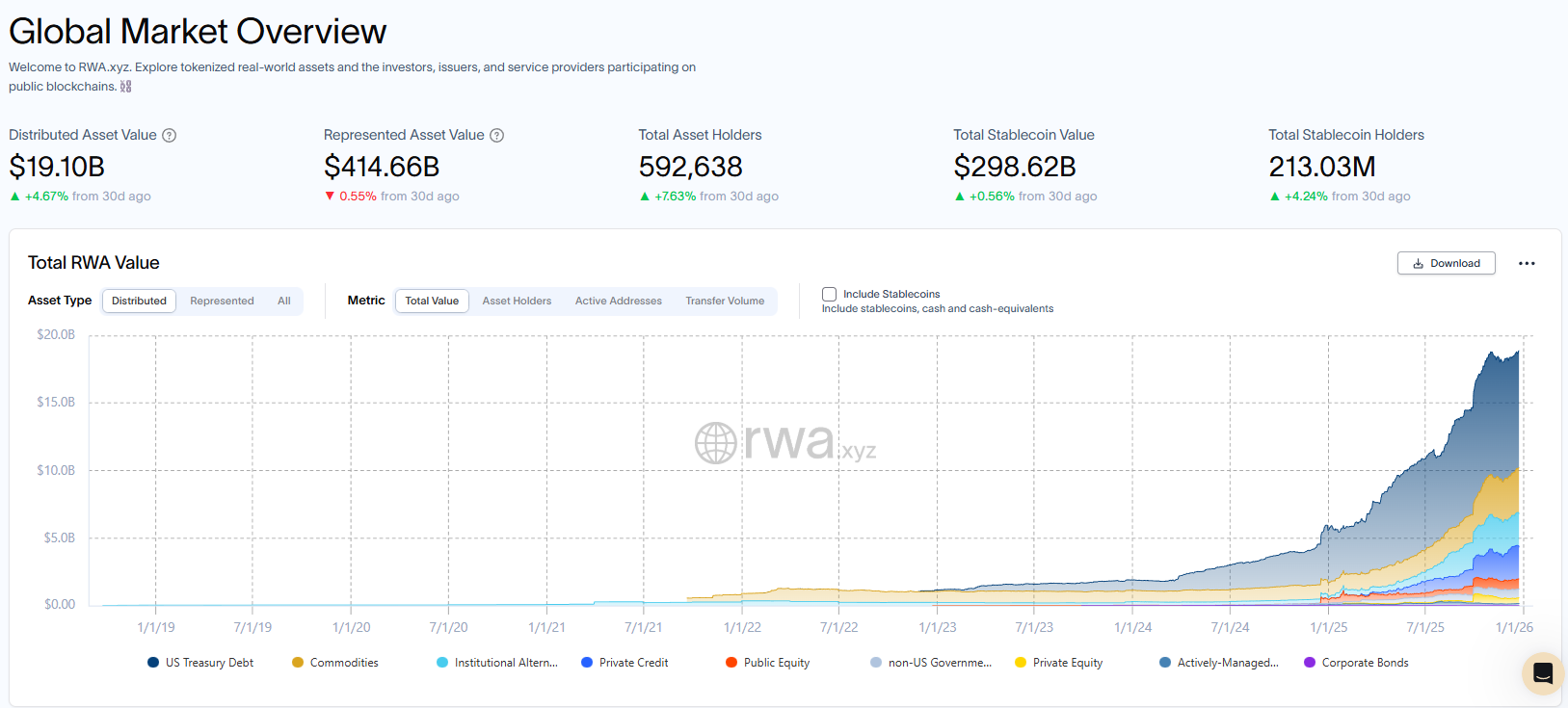

Quantitative data reinforces the view that RWA has moved beyond proof-of-concept.

According to RWA.xyz, as of December 25, 2025, the platform reports a Distributed Asset Value of USD 19.10 billion, a Represented Asset Value of USD 414.66 billion, and 592,638 total asset holders, providing a verifiable snapshot of the on-chain RWA market at that point in time.

Focusing specifically on government debt, the same dataset shows that Tokenized Treasuries reached a total on-chain value of USD 9.00 billion, across 62 assets and 59,214 holders, with a 7-day annualized yield of 3.82%, positioning them as a credible on-chain equivalent to traditional cash-management instruments.

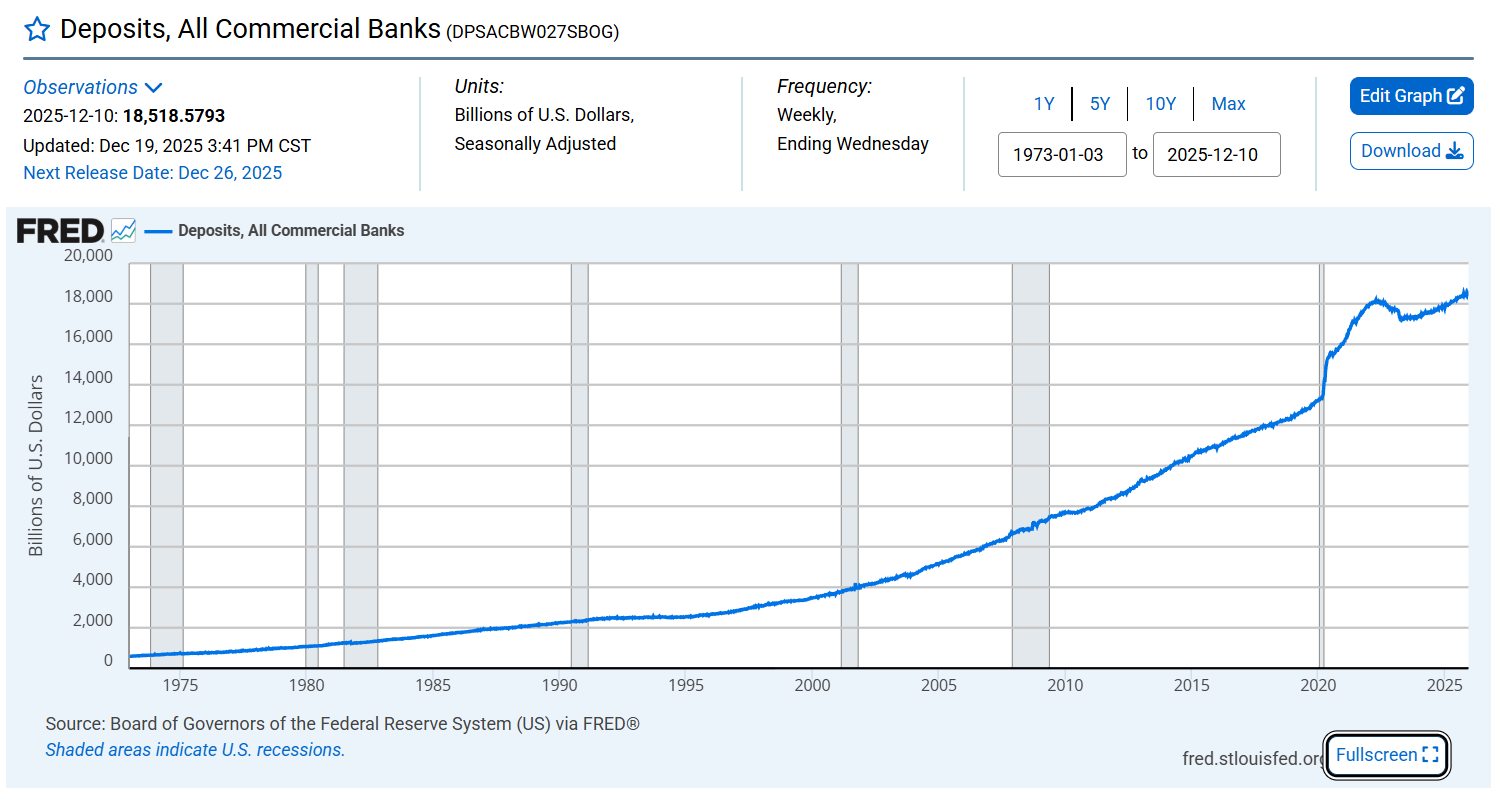

THE MACRO BACKDROP FOR INSTITUTIONAL ADOPTION

The broader banking environment helps explain the timing of this shift.

According to the Federal Reserve’s H.8 statistical release, as of December 10, 2025, total deposits across all U.S. commercial banks stood at USD 18,518.5793 billion, or USD 18.5185793 trillion, underscoring the scale of the settlement and liquidity systems now being examined for efficiency gains through blockchain-based infrastructure.

In this context, the emergence of deposit tokens and on-chain money market funds reflects less a technological experiment and more a structural response to the operational demands of large financial institutions.

FROM TOKENIZATION TO FINANCIAL INFRASTRUCTURE

Viewed together, JPMD and MONY form a coherent institutional blueprint rather than isolated product launches: deposit tokens transform bank liabilities into 24/7 on-chain settlement instruments, while tokenized money market funds provide regulated, low-risk yield within the same blockchain environment, supported by an expanding pool of tokenized Treasuries that can function as collateral and liquidity buffers.

Between November and December 2025, these developments collectively signal a transition for RWA—from assets that can be tokenized, to assets that can operate continuously as part of a public-blockchain financial system, under institutional control and regulatory oversight.

Read More:

JPMorgan MONY: institutional cash goes on-chain

Institutions Blur DeFi and TradFi as Capital Markets Move On-Chain