KEYTAKEAWAYS

- Dynamic production-based collateral gives on-chain assets financing attributes rather than treating them solely as trading instruments.

- Custody and risk-control frameworks are the core logic enabling banks to accept crypto assets as collateral.

- Global experimentation and institutional exploration coexist, but price volatility and regulatory uncertainty remain major challenges.

CONTENT

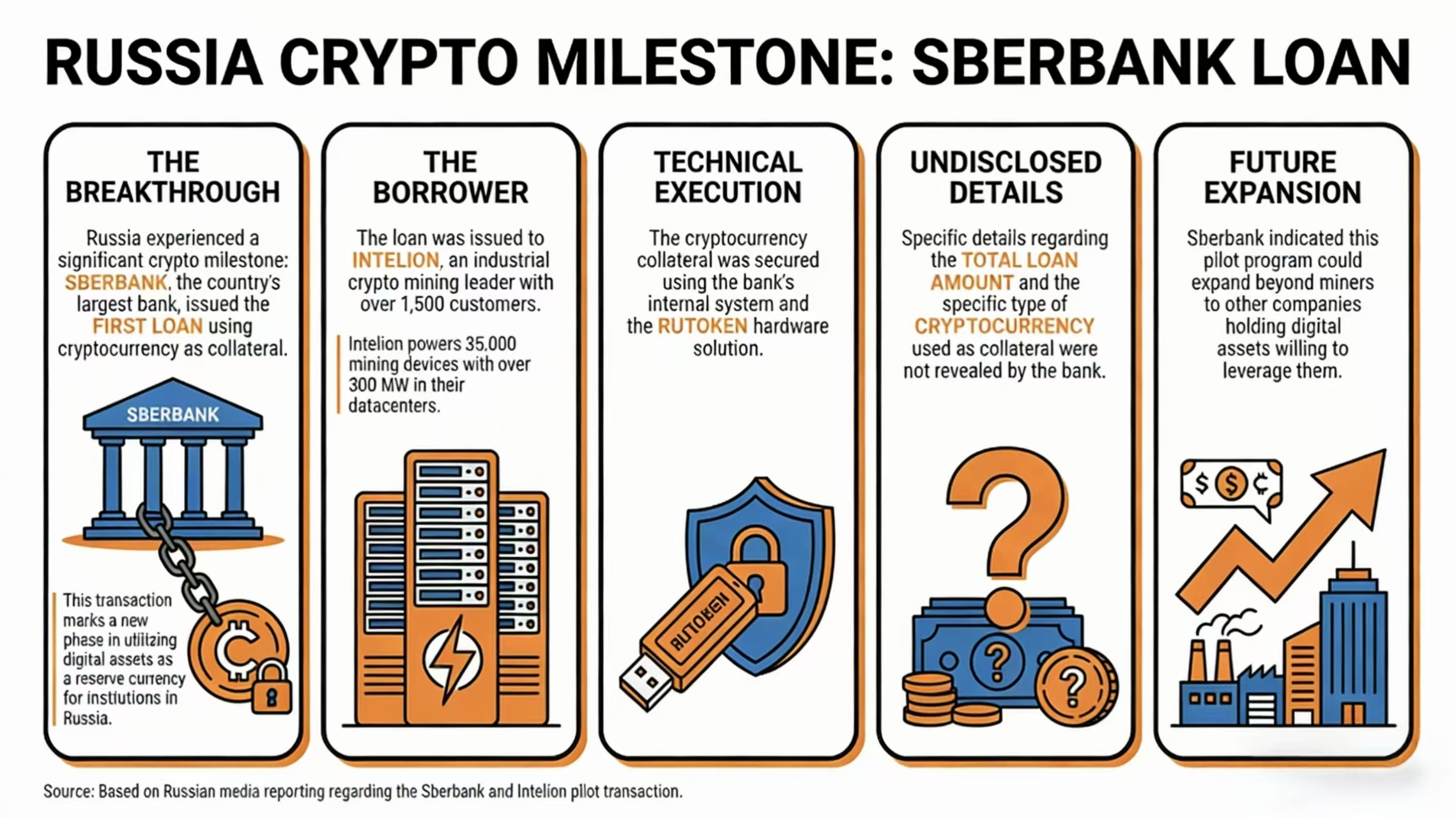

On December 28, 2025, Russia’s largest bank, Sberbank, issued a pilot loan to Bitcoin mining firm Intelion Data using dynamically produced crypto assets as collateral, marking the first on-chain asset creditization practice within Russia’s traditional banking system.

ASSETS ARE MORE THAN JUST DIGITAL TOKENS

Historically, crypto assets have played a limited role in mainstream financial systems, primarily serving as trading instruments. Investors bought and sold them to profit from price volatility, but such assets lacked the measurable and stable cash-flow characteristics required by banks for credit assessment.

Sberbank’s pilot loan introduces a critical shift. Instead of relying on static token holdings, the loan is collateralized by dynamically produced Bitcoin generated through mining operations. The mining output becomes the credit backing, linking the collateral directly to real economic activity and ongoing production.

This structure transforms on-chain assets from price-driven speculative instruments into cash-flow-linked credit claims. Even amid Bitcoin’s price volatility, mining output remains traceable, auditable, and measurable on-chain. This predictability aligns more closely with traditional banking risk models, which prioritize visibility into income generation and repayment capacity.

Importantly, this development is not merely a product innovation. It represents an extension of conventional lending frameworks. Traditional collateral typically consists of fixed assets or stable operating income. On-chain asset collateral introduces real-time, dynamic, and transparent economic value, offering banks new tools for risk pricing and credit evaluation.

Figure 1: Core framework and execution details of Sberbank’s crypto-collateralized lending pilot

CASH FLOW AND CREDIT BECOME QUANTIFIABLE

At the heart of bank lending decisions lie three variables: repayment capacity, collateral liquidation value, and risk exposure management. While traditional assets benefit from mature valuation and liquidation systems, on-chain assets have long been excluded due to price volatility and operational complexity.

When specific conditions are met, however, on-chain assets can gradually acquire credit attributes acceptable to banks. The first condition is predictable cash flow. Mining enterprises can estimate production volumes and revenue based on historical output data, hash rate projections, and operational costs.

Second is auditable ownership. On-chain records provide transparent and verifiable proof of income attribution, enabling banks to confirm that mining rewards or protocol revenues belong to the borrower. Third is a controllable liquidation mechanism. Through custody and enforcement arrangements, banks can ensure collateral recovery in the event of default.

Sberbank’s pilot loan is structured around these principles, establishing a quantifiable credit foundation for on-chain assets. Unlike speculative exposure to price movements, this credit derives from real, traceable economic activity. As a result, on-chain assets begin to exhibit a “lendable” profile recognized by the banking system.

Figure 2: Conceptual model of on-chain asset creditization

CUSTODY CREATES THE SAFETY NET

Whether banks accept on-chain assets ultimately depends on custody and risk control. Sberbank employs its proprietary custody solution, Rutoken, to manage collateral assets. This system ensures that collateral cannot be freely transferred during the loan term and maintains clear audit trails and enforceable liquidation procedures.

This custody approach mirrors how banks manage traditional collateral such as equities or bonds, rather than relying on automated liquidation mechanisms common in decentralized systems. Custody allows banks to monitor asset movements precisely, execute recovery procedures upon default, and comply with regulatory requirements.

Beyond risk mitigation, custody infrastructure forms the backbone of on-chain asset lending. Standardized custody solutions could eventually enable large-scale integration of crypto assets into bank balance sheets and provide replicable operational models for other financial institutions.

GLOBAL BANKS ARE TESTING THE WATERS

While this marks a first within Russia’s banking system, global practices indicate that on-chain assets are steadily approaching the boundaries of traditional credit markets. As of the third quarter of 2025, Bitcoin-backed loan balances on Coinbase exceeded USD 1 billion, reflecting strong institutional demand for crypto-collateralized financing.

In the United States, at least six banks offer BTC-backed loans to institutional clients, typically with loan-to-value ratios ranging from 50% to 70%. These conservative parameters reflect banks’ efforts to balance volatility risk while exploring crypto-backed credit products.

In Asia, Japan’s Mitsubishi UFJ Financial Group (MUFG) has expanded crypto custody and lending services for institutional clients, with custody assets exceeding JPY 500 billion. European financial hubs such as Switzerland and Luxembourg have clarified the legal status of digital assets, enabling banks to custody and legally process on-chain collateral.

These cases demonstrate that on-chain asset creditization is moving from the periphery toward the core of financial systems. Sberbank’s pilot aligns with this global trend, offering valuable operational insights for Russian financial institutions.

ON-CHAIN INCOME CAN ALSO BE FINANCED

Mining output represents only the starting point. Other on-chain assets with financing potential include proof-of-stake (PoS) staking yields, where nodes generate predictable and auditable income streams; decentralized exchange fee revenues, which provide traceable cash flows from protocol activity; and NFT royalty income derived from secondary market transactions.

By the third quarter of 2025, total DeFi collateralized debt reached approximately USD 41 billion, growing 37% year-over-year, with centralized platforms accounting for a significant share. This growth reflects increasing market recognition of on-chain credit instruments and validates the financing potential of blockchain-based economic activity beyond speculation.

DUAL ADVANCEMENT OF RISK MANAGEMENT AND REGULATORY CLARITY

While the creditization of on-chain assets holds significant potential, price volatility remains the primary risk. Sharp fluctuations can trigger cascading liquidations and undermine loan portfolio stability, while valuation and audit frameworks are still insufficiently standardized, raising the bar for bank-level risk management. To mitigate these risks, banks typically apply lower loan-to-value ratios than for traditional assets, implement automatic liquidation thresholds, and dynamically adjust lending models based on market depth and liquidity. Sberbank’s pilot has already adopted parts of this framework, indicating that on-chain asset lending is feasible within a controlled risk environment, though further optimization remains necessary.

At the same time, regulatory clarity is a prerequisite for long-term sustainability. Sberbank’s management has emphasized that the loan is a pilot program, with the bank working closely with the central bank to refine the regulatory framework. Key areas include the legal status of pledged assets, the enforceability of liquidation mechanisms, compliance with capital requirements, and asset custody and client protection. Without clear institutional support, even willing banks would struggle to scale such products sustainably.

Overall, the creditization of on-chain assets follows a gradual trajectory: initial pilots validate operational processes and risk controls, regulatory frameworks then define standards and boundaries, and finally lending products expand across banking systems to corporate and retail lines. This progression marks the genuine realization of on-chain credit—where creditworthiness is grounded in predictable cash flows rather than price movements, custody and risk controls form the foundation of bank participation, and regulatory coordination ensures long-term viability.

Read More: