KEYTAKEAWAYS

- Crypto market cap fell by $800B in Q1 2025 as policy uncertainty, hacks, and tightening liquidity triggered a sharp cooldown in investor sentiment.

- Spot trading volumes dropped over 13%, while mid-sized exchanges like Gate and MEXC gained market share with new features and better user engagement.

- Regulation and security dominated Q1. OKX earned EU approval, Binance secured $2B investment, and Bybit’s hack exposed ongoing risks in centralized platforms.

- KEY TAKEAWAYS

- A SHIFT IN MACRO SENTIMENT, PRICES PULL BACK QUICKLY

- TRADING ACTIVITY SLOWS, SPOT TRADING HIT THE HARDEST

- BIG PLAYERS SEE SMALL DROPS, MID-SIZE EXCHANGES GAIN GROUND

- DERIVATIVES TRADING TRENDS REFLECT CAUTIOUS SENTIMENT

- EXCHANGE TOKENS SHOW MIXED RESULTS

- COMPLIANCE BECOMES THE NEW BATTLEGROUND

- A NEW PHASE BEGINS, WITH FEWER PLAYERS AND CLEARER RULES

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In Q1 2025, the crypto market entered a correction phase. Prices, trading volumes, and investor enthusiasm declined, while regulation, platform security, and compliance reshaped the competitive landscape among leading exchanges.

A SHIFT IN MACRO SENTIMENT, PRICES PULL BACK QUICKLY

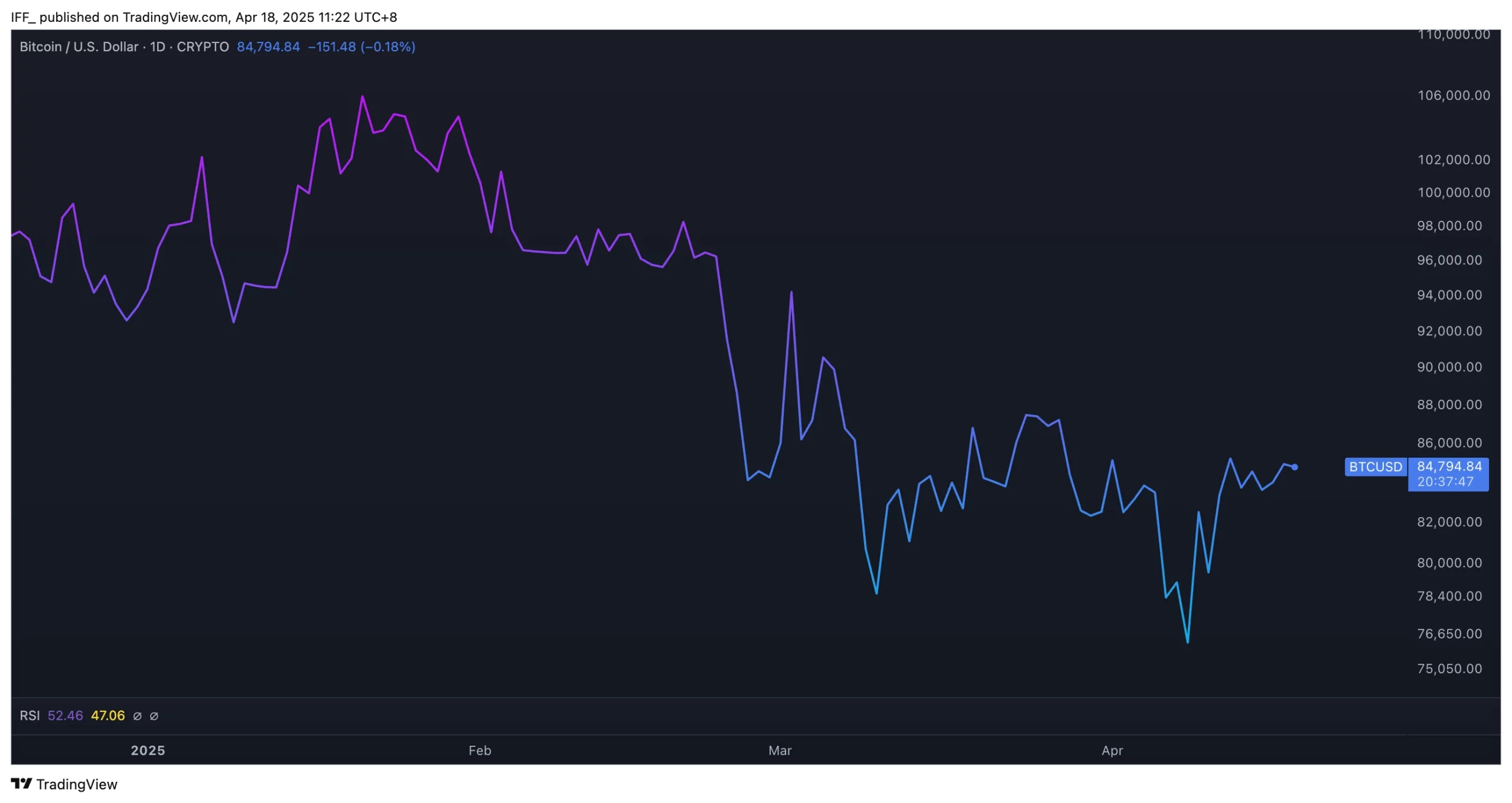

In early 2025, the crypto market quickly cooled down from the frenzy of the previous quarter. Just three months earlier, Bitcoin had broken through the $100,000 mark. AI tokens, meme coins, and other trendy assets were all over social media. Many investors were chasing quick profits in projects with little or no fundamentals.

But when the new year began, the global environment changed.

The most noticeable event was Donald Trump being sworn in as President of the United States in mid-January. While he had previously shown some support for crypto, his new administration gave no clear signals about future crypto policies. That silence alone created uncertainty.

On January 21, the U.S. SEC announced the creation of a special task force focused on crypto regulation. Many saw this as a sign that strict oversight would come soon. Investors quickly moved from optimism to caution, and capital began to flow out of the market.

At the same time, the European Central Bank hinted that interest rate hikes might return. Higher rates usually lead to lower risk appetite. Crypto, seen as a high-risk asset, was hit by both shrinking liquidity and falling valuations.

Then came a major blow: In March, Bybit was hacked, losing over $1.5 billion worth of Ethereum. It was the largest single-platform hack in crypto history, and it shook trust in centralized exchanges.

With all these events combined, the total crypto market cap dropped from $3.5 trillion to $2.7 trillion in just one quarter—a 22.8% loss. Bitcoin fell from $108,000 to $86,000. Ethereum lost more than 30% of its value. The short but intense bull run was clearly over.

TRADING ACTIVITY SLOWS, SPOT TRADING HIT THE HARDEST

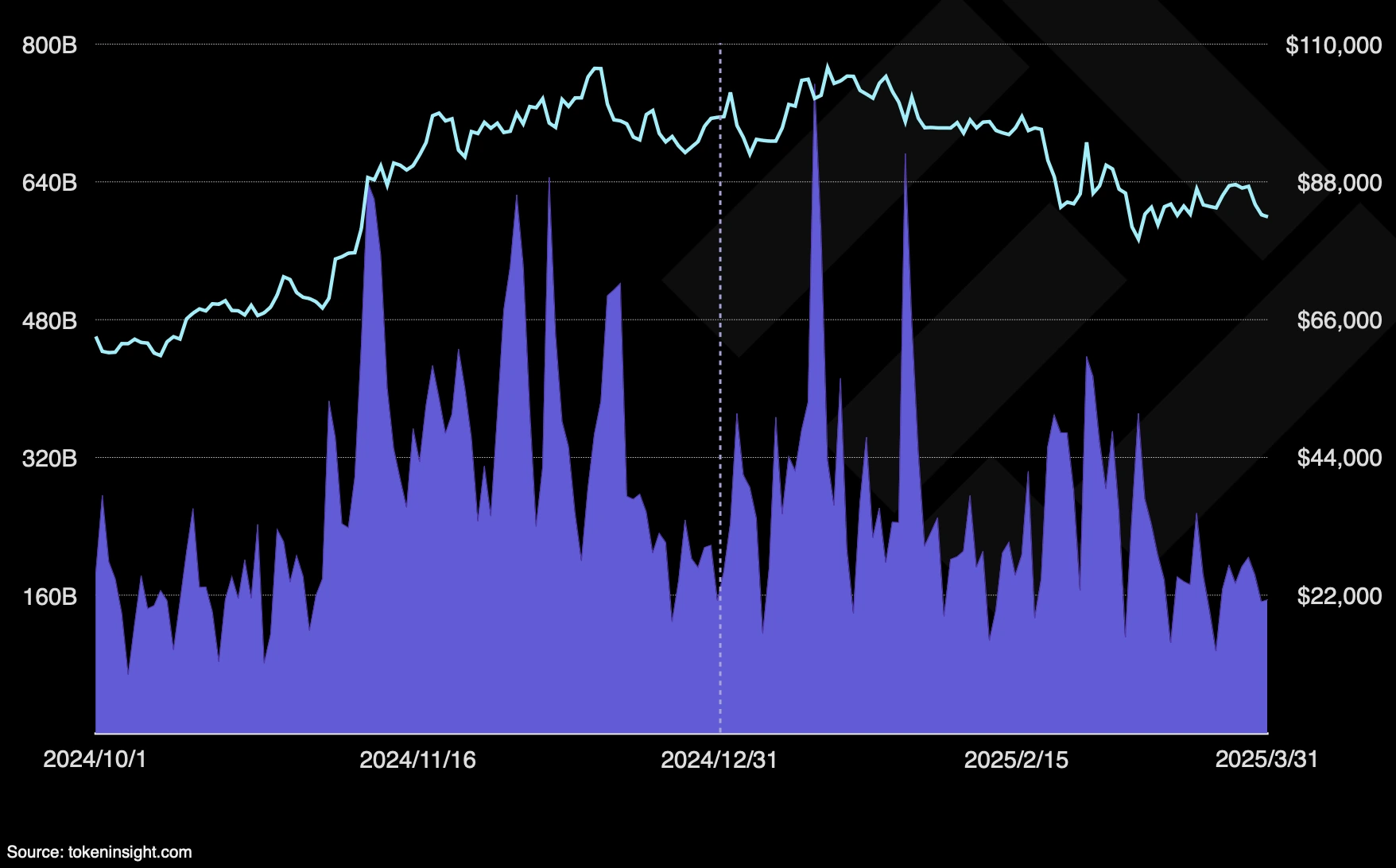

As prices fell, trading behavior changed. According to TokenInsight, the top 10 crypto exchanges recorded $22.99 trillion in total trading volume in Q1 2025, down 12.53% from the previous quarter.

Spot trading—buying and selling actual crypto assets—saw the biggest drop. Total spot volume fell from $5.3 trillion to $4.6 trillion, a decline of 13.1%. Spot markets are usually where regular investors operate. When confidence weakens, these retail users are often the first to leave.

In contrast, derivatives trading dropped less, down only 8.6% to $20.97 trillion. Derivatives traders are often professionals or short-term speculators. They care more about volatility and trading opportunities than long-term trends.

Even so, trading across the board slowed down. The market entered a state of hesitation. Many were afraid to buy more, but also reluctant to short. Liquidity shrank, and prices became less volatile. The market was cooling down, searching for new balance.

BIG PLAYERS SEE SMALL DROPS, MID-SIZE EXCHANGES GAIN GROUND

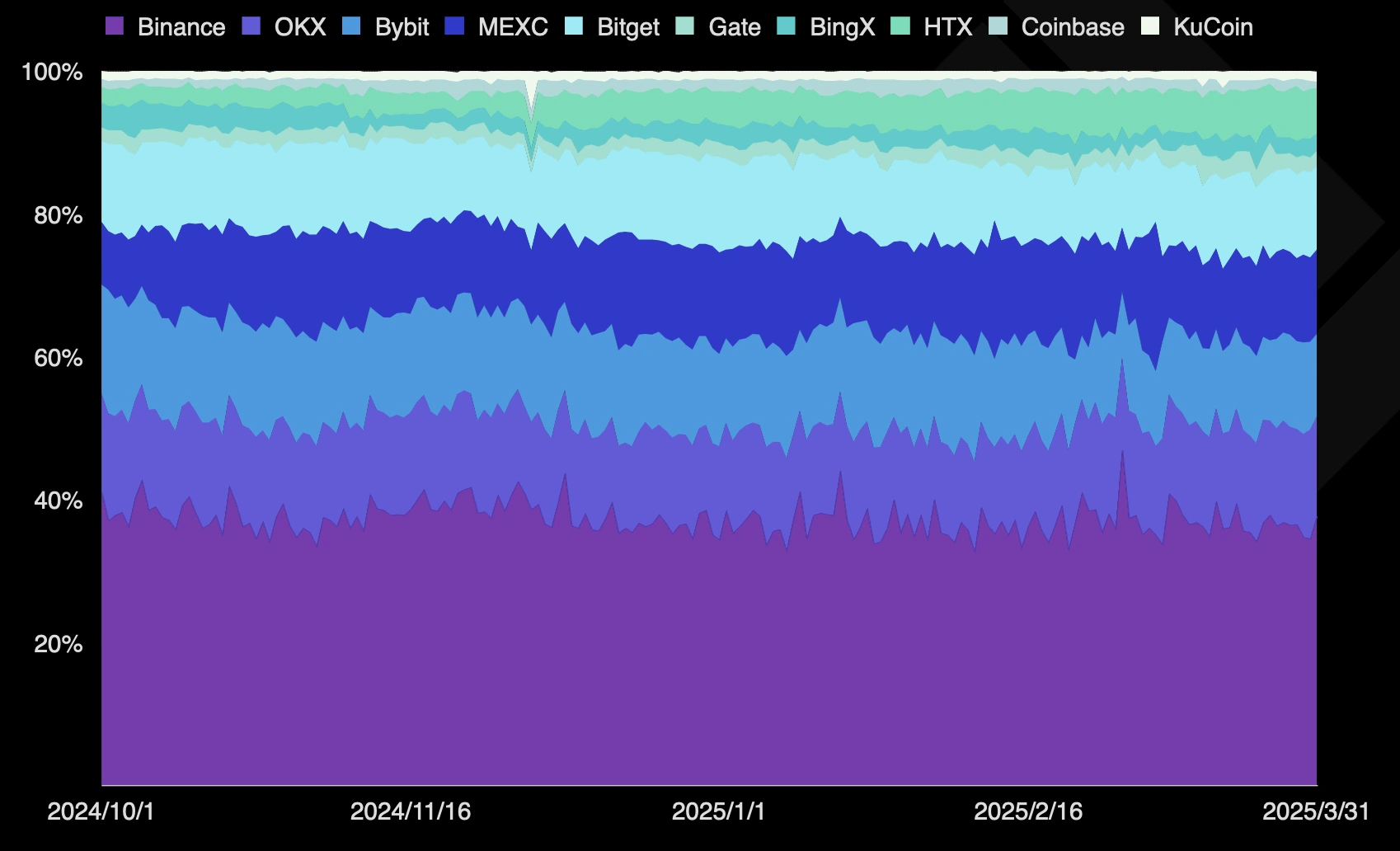

As trading volumes declined, exchange rankings began to shift.

Binance remained the leader, with a 36.5% market share. But that was slightly down from 37.9% in Q4 2024. Growth was slowing.

Meanwhile, smaller exchanges like Gate and MEXC saw noticeable gains. Gate’s share rose from 3.34% to 5.41%. MEXC grew from 12.47% to 13.06%. These platforms improved their products, supported more niche tokens, and attracted traders looking for faster service and more trading options.

MEXC also launched its DEX+ service in Q1, responding to growing interest in decentralized trading. That helped boost its brand, especially after the Bybit hack increased concerns over centralized security.

The exchange market is no longer dominated by just one player. Smaller platforms are growing fast by offering new features and better user experiences.

DERIVATIVES TRADING TRENDS REFLECT CAUTIOUS SENTIMENT

Even though overall activity declined, derivatives markets showed some surprising changes.

By the end of Q1, total open interest—meaning active derivative positions—fell from $121.45 billion to $83.39 billion, a 31.3% drop. This suggests that traders were holding positions for shorter periods and reducing risk.

However, the total cumulative open interest for the quarter actually increased to $9.9 trillion, up 13.8%. That means traders were still very active, just more cautious. They were using short-term trades and quick leverage strategies instead of big long-term bets.

Binance stayed at the top of the derivatives market, followed by OKX. MEXC rose from 8.2% to 12.5% market share, thanks to new trading products and better user tools.

Derivatives data is often a good way to read market sentiment. In Q1, it showed that traders were nervous—but still trading. Just with faster, safer strategies.

EXCHANGE TOKENS SHOW MIXED RESULTS

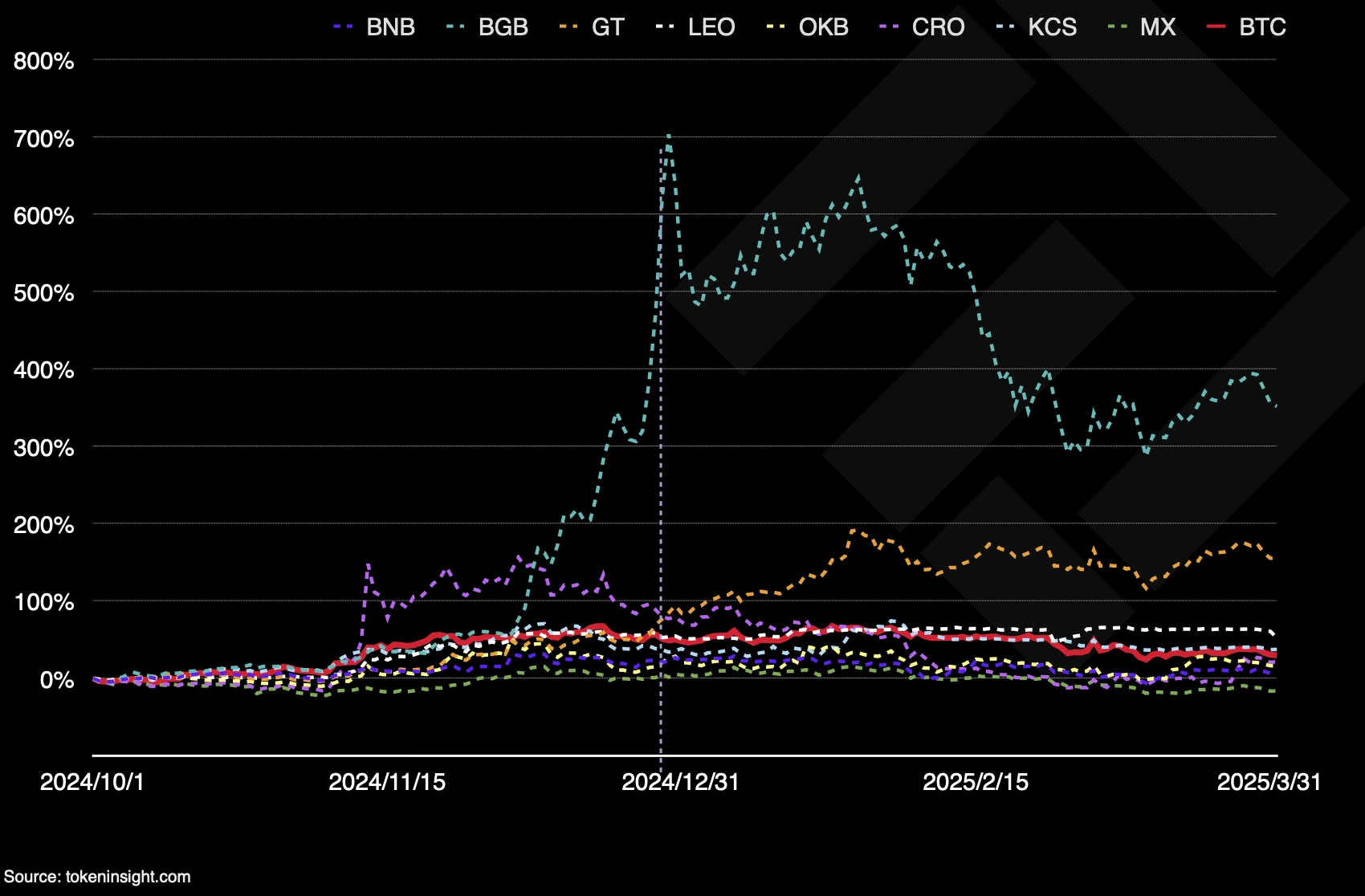

Exchange tokens are often seen as a way to measure a platform’s health and growth.

In Q1 2025, these tokens didn’t all move the same way. Gate’s GT token rose 34%, the best performer of the group. Its price increase matched Gate’s rising market share and user growth.

BNB, Binance’s token, fell 11.9%. It remains the largest exchange token by market cap, but growth expectations seem to be slowing.

CRO, from Crypto.com, had the worst performance, down 27.9%. The platform’s activity declined, and its brand impact weakened. It also lacked new products or major updates this quarter.

This shows that the market is no longer treating all platform tokens the same. Investors are starting to judge them by fundamentals—real user growth, revenue, and product innovation.

COMPLIANCE BECOMES THE NEW BATTLEGROUND

Beyond prices and trading data, regulation became a major theme this quarter.

The SEC’s creation of a crypto enforcement team showed that U.S. authorities are getting serious. Stablecoins, derivatives, and data privacy are all likely to face stricter rules soon. Any platform operating in or serving the U.S. market will need to rethink its strategy.

In Europe, the MiCA regulation is moving forward. OKX became one of the first exchanges to receive a full MiCA license, giving it legal access to the entire EU. This is a major step toward regulated crypto in Europe.

Binance also announced a $2 billion investment from Abu Dhabi’s sovereign wealth fund MGX. That deal reflects growing interest from global capital in compliant, stable crypto platforms.

The new competition isn’t just about user numbers or trading depth. Now, it’s also about regulatory strength, legal structure, and operational risk control. Compliance is no longer optional—it’s essential for survival.

A NEW PHASE BEGINS, WITH FEWER PLAYERS AND CLEARER RULES

Q1 2025 wasn’t the end—it was a turning point. The market cooled quickly. Prices corrected, and hype faded. But not everything stopped.

Some exchanges grew. Some tokens gained value. Some users stayed active. They adjusted, adapted, and kept building.

Looking ahead, many uncertainties remain. Geopolitical risks could rise. Interest rates might continue to climb. And U.S. policy on crypto is still unclear.

But one thing is certain: The crypto market is moving toward a more stable, regulated, and institutional phase. There will be fewer gamblers, more builders, and clearer expectations.

In this “quiet period,” real innovation and infrastructure are taking shape. When the next bull market comes, it will be led by those who kept working when the crowd left.