KEYTAKEAWAYS

- Polymarket leads in liquidity through its structured rewards, focusing on real trading and compliance over speculative farming.

- Kalshi excels in regulatory strength, operating as the only fully licensed event exchange for real-money prediction contracts.

- Opinion Labs grows fast with gamified incentives, attracting Web3 users through weekly point pools and community-driven engagement.

CONTENT

Polymarket and Kalshi dominate prediction markets with liquidity and compliance, while Opinion Labs rises as the Web3-native contender driving incentive-based participation.

Prediction markets are transitioning from niche crypto experiments into a data-driven financial ecosystem. Over the past year, projects like Polymarket, Kalshi, and Opinion Labs have emerged as the leading players, each shaping the industry with a distinct strategy—decentralization, regulation, or gamified Web3 growth.

POLYMARKET — MATURITY WITH A STRUCTURED REWARD SYSTEM

Among all competitors, Polymarket stands out for its market depth and sophistication.

It remains the benchmark for liquidity, user experience, and professional trading activity. However, from a “farming” or airdrop standpoint, Polymarket is less accessible to casual users.

Following a regulatory fine from the U.S. CFTC in 2022, Polymarket suspended fiat deposits to rebuild within a compliant framework. Today, it focuses on institutional legitimacy rather than playful token incentives. There are no public point systems, social quests, or promotional airdrops.

Still, it would be inaccurate to claim Polymarket offers no incentives at all.

It operates a Liquidity Rewards Program that compensates users who place limit orders close to market mid-prices, earning USDC based on their contributions to liquidity.

This model prioritizes genuine trading and professional engagement over low-effort participation.

Polymarket rewards those who create real market depth instead of those who merely chase tokens.

The result is clear: in the past week alone, the platform recorded $1.062 billion in trading volume across 2.586 million transactions—demonstrating robust user demand and sustained confidence.

KALSHI — REGULATION AS A STRATEGIC EDGE

Kalshi represents the other side of the spectrum: a fully licensed U.S. event exchange regulated by the CFTC. It allows participants to trade outcomes on inflation, interest rates, and elections, making it the first legally recognized event futures platform in America.

Its advantage lies in its regulatory clarity and access to fiat payment systems. However, this compliance-first model comes without tokens or Web3-style reward structures. Instead, Kalshi attracts market makers and professional traders through volume-based rebates and liquidity incentives, echoing the mechanics of traditional exchanges.

This approach may seem less exciting to the crypto community, but it provides the foundation for long-term scalability. Over the same seven-day period, Kalshi reported $950 million in trading volume, slightly behind Polymarket, yet led the field in transaction count with 3.575 million trades.

Together, Polymarket and Kalshi now form a duopoly, capturing nearly the entire market. By comparison, smaller players such as Limitless ($21.93 million weekly volume) and Myriad ($3.85 million) remain marginal.

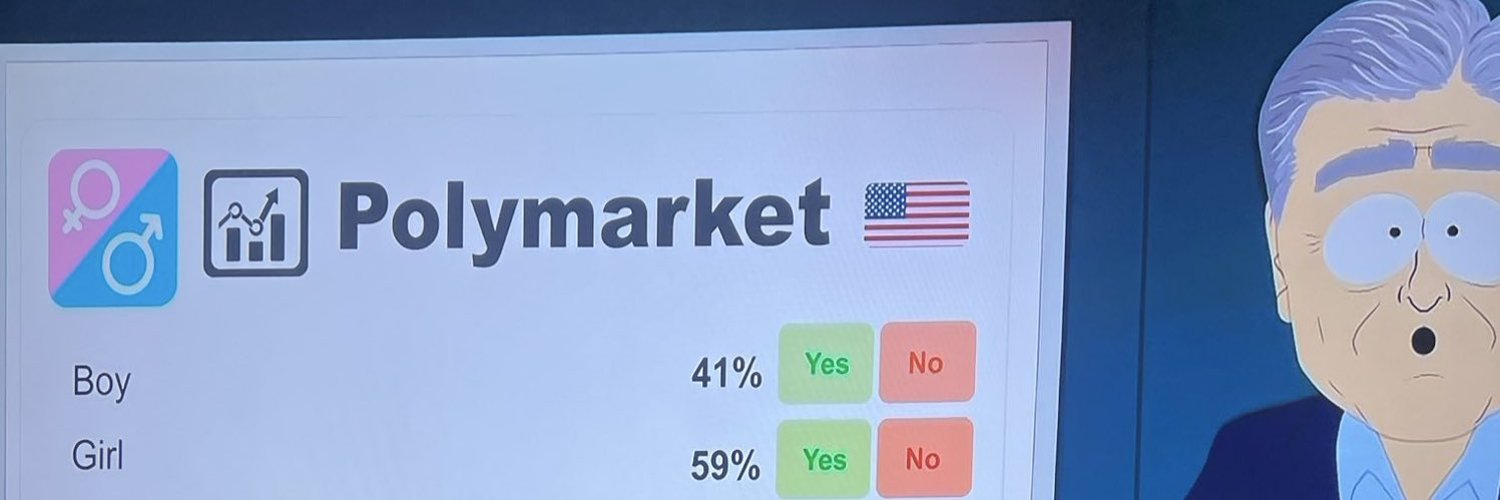

OPINION LABS — THE WEB3 INCENTIVE ENGINE

While Polymarket and Kalshi compete for institutional dominance, Opinion Labs represents the Web3-native evolution of prediction markets. Backed by Binance Labs, it focuses on building engagement through structured incentive systems rather than fiat or compliance pathways.

Opinion Labs distributes weekly point pools to participants, rewarding users for consistent interaction and community activity. This approach creates strong early-stage participation while maintaining accessible entry barriers.

During a recent two-hour limited invitation campaign, the project drew over 140,000 traders and generated $25 million in trading volume—an impressive figure for a platform still in testing. Although the exact conversion of points into tokens remains undisclosed, weekly snapshots suggest a sustainable model designed to reward real engagement rather than short-term speculation.

The platform’s UX continues to improve, addressing bugs such as decimal input issues during order placement. Still, its direction is evident: Opinion Labs aims to transform active participation into meaningful ownership.

THE EMERGING DUOPOLY

The data reveal a consolidated market structure:

Trading Volume (Past Week):

Polymarket – $1.062 billion

Kalshi – $950 million

Limitless – $21.93 million

Myriad – $3.85 million

Number of Trades (Past Week):

Kalshi – 3.575 million

Polymarket – 2.586 million

Limitless – 378,000

Myriad – 66,000

Together, Polymarket and Kalshi dominate the field, symbolizing two opposing yet complementary visions. Kalshi anchors the regulated Web2 front, while Polymarket defines the decentralized Web3 edge. Opinion Labs, meanwhile, bridges both with gamified incentives and community-driven liquidity.

THREE FACTORS THAT DEFINE LONG-TERM WINNERS

Regulatory credibility determines the ceiling—projects that can legally handle real money will scale sustainably, and Kalshi leads here.

Liquidity depth defines truth—deep markets produce meaningful forecasts rather than speculation, an area where Polymarket excels.

Incentive design determines speed—balancing accessibility and anti-sybil mechanisms drives community growth, a model Opinion Labs currently executes best.

LOOKING AHEAD

The prediction market sector is entering a defining era where compliance, liquidity, and incentives intersect.

Kalshi will continue expanding as the institutional gateway; Polymarket will likely reintroduce fiat rails and explore token governance; and Opinion Labs will refine its point system into a durable economic layer.

Within a year, these paths will begin to converge. Three years from now, prediction markets may evolve into a hybrid model—regulated at the surface yet decentralized in function—where information itself becomes the world’s next major tradable asset.

The duopoly is already here. The only question now is who will define the value of truth.