KEYTAKEAWAYS

- The Limits of Traditional Portfolios vs. the Power of Concentration Traditional 60/40 portfolios protect wealth — not grow it. Concentrated, high-conviction bets drive exponential returns.

- Volatility and Leverage: The Engines of Crypto Wealth Crypto’s extreme volatility and leverage create rapid wealth opportunities unseen in traditional markets.

- Absolute Conviction and Timing Are Everything Success in crypto demands unshakable belief and the courage to act when opportunity arises. Whether an institutional investor or an individual trader, those who move decisively on conviction — not hesitation — are the ones who make history.

CONTENT

Image Source: TOKEN2049

BREAKING DOWN TRADITIONAL INVESTING DOGMA:WHY A 60/40 PORTFOLIO WON’T MAKE YOU RICH

The traditional 60/40 stock/bond portfolio is designed to preserve value, not create it. This diversification strategy spreads money across multiple assets, reducing risk while also limiting your potential for exponential returns. For cryptocurrency investors seeking life-changing returns, this conventional wisdom is outdated.

Image Source: TOKEN2049

IS IT RISK DIVERSIFICATION OR OVERKILL?

What is the truth about diversification? It’s a strategy designed for those who don’t know the ropes. Investors who truly understand the market focus on in-depth research and heavily invest in the opportunities they believe in most.

Thrive Capital exemplify this approach—they invested all of their capital in OpenAI and achieved tremendous success. This concentrated investment strategy can thrive in a high-risk, high-reward environment, provided you have a deep understanding of your investment objectives.

THE POWER OF CONVICTION: HISTORICAL SUCCESS STORIES

History is replete with examples of how concentrated investing created enormous wealth. Stanley Druckenmiller’s accurate judgment on the British pound led to a daring short position that yielded a lucrative profit.

A 24-year-old fund manager invested billions in Intel and achieved impressive returns. These legendary stories demonstrate how deep market insight and decisive action can create enormous wealth.

While diversified investing undoubtedly yields stable but limited returns, concentrated investing in the best targets combined with leverage can achieve exponential growth. Investing 100% of your funds in an asset that rises by 90% and applying appropriate leverage can yield returns of 200% or even more. The key lies in understanding which assets will rise.

ADVANTAGES OF CRYPTOCURRENCY: WHY THIS MARKET CREATES MILLIONAIRES

The emergence of cryptocurrency shone a light on the potential for class reversal. Even in the early days of cryptocurrency, even small startups could turn tens of millions or even billions of people into millionaires overnight.

Even in today’s market, returns remain more attractive than those from other financial derivatives.

VOLATILITY AND LEVERAGE: THE WEALTH ACCELERATION FORMULA

Cryptocurrency has historically created more millionaires than any other asset class. This is due to its unique market characteristics: cryptocurrency’s volatility far exceeds that of traditional assets like gold and stocks, offering investors greater profit potential.

Through instruments like perpetual futures, investors can obtain extremely high leverage, further amplifying returns. This combination of high volatility and leverage makes it possible to rapidly accumulate wealth.

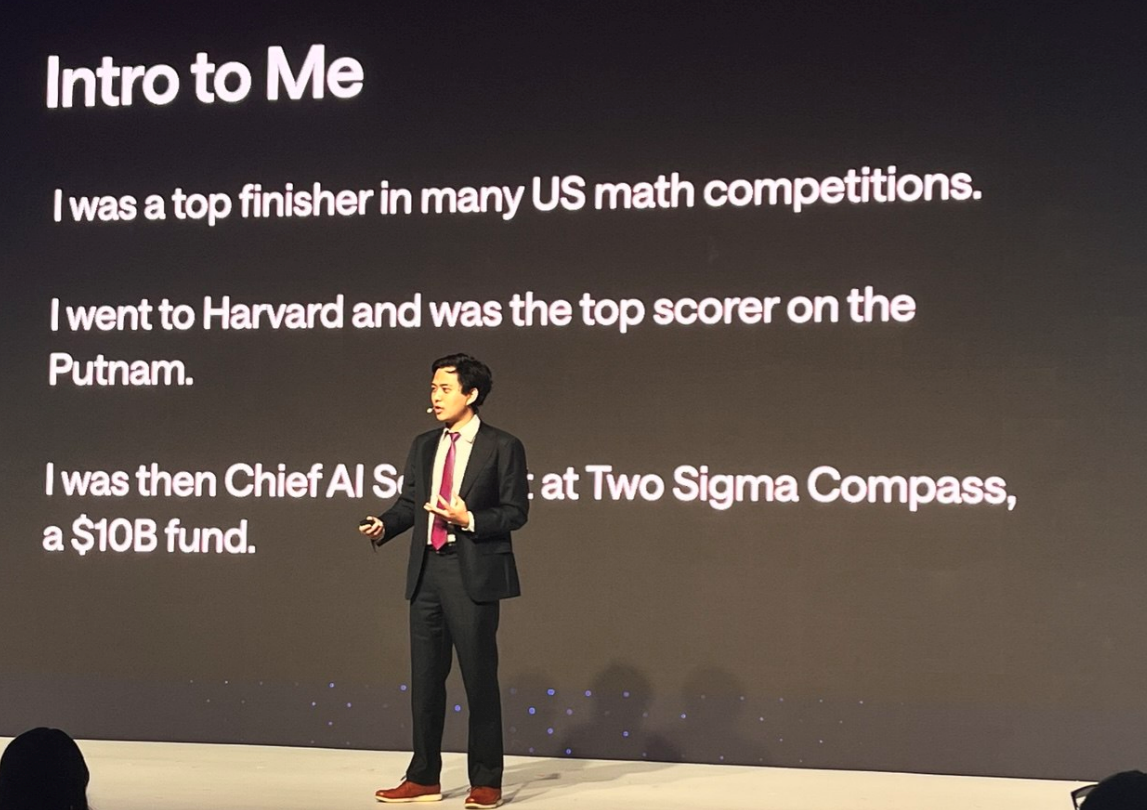

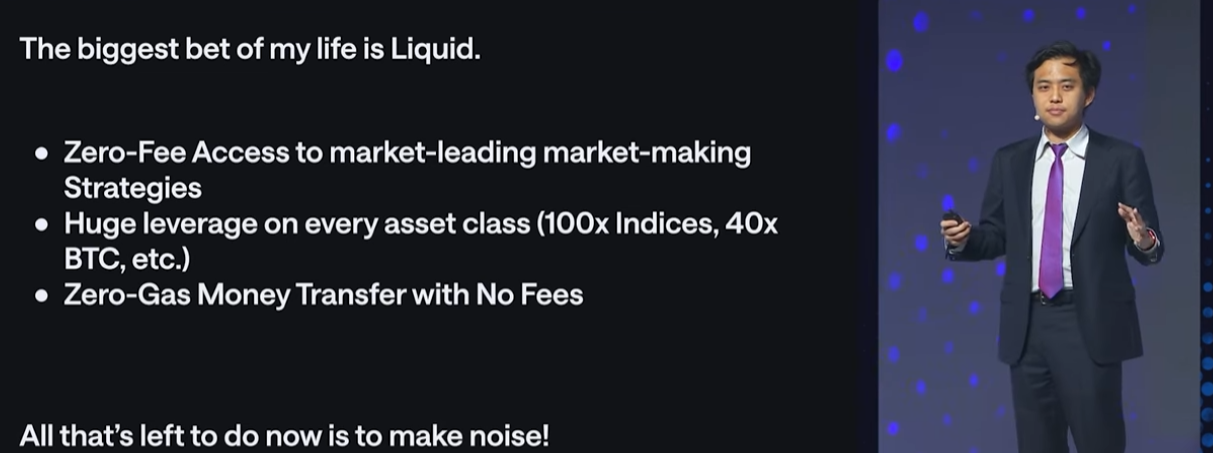

REAL-WORLD PROOF: FRANKLYN WANG, FOUNDER OF LIQUID

The founder’s decision to leave a stable job to establish Liquid embodies the importance of believing in and seizing opportunities. The team recognized the enormous potential of cryptocurrency and implemented a zero-FIA market-making strategy and high-leverage operations in record time.

This was not just a business decision, but a firm belief in the future of cryptocurrency. The team’s rapid growth proves that with the right timing and strategy, the cryptocurrency market can create amazing value.

Image Source: TOKEN2049

FROM STRATEGY TO ACTIONA:THE THREE PILLARS OF CRYPTOCURRENCY WEALTH CREATION

Success in cryptocurrency requires three fundamental commitments: trust your judgment, deeply research investment targets, and concentrate resources on your highest-conviction opportunities.

Traditional diversification strategies may suit investors seeking stability, but for those wanting exponential growth in the cryptocurrency market, concentrated investing combined with leverage is the more effective path.

Conclusion: Fortune favors the brave

Franklyn Wang said: Believe in yourself, believe in your team, and believe that the future of cryptocurrency will win, create your own “sensational effect.” Remember: in this market full of opportunities, the biggest risk is never taking action, but making decisions in hesitation.

Conventional investment wisdom was built for a different era and different goals. In the cryptocurrency era, the rules have changed—and those who recognize this will reap the wealth of their knowledge.

The choice is yours: follow the crowd and earn mediocre returns, or take calculated risks and build generational wealth.