KEYTAKEAWAYS

- Polymarket’s legality is not determined by whether the site is accessible, but by how local regulators classify event contracts—as derivatives or gambling—and whether the platform holds the required authorization.

- Extensive geoblocking across major jurisdictions reflects risk management rather than explicit illegality, highlighting that the absence of a ban does not equal legal certainty.

- As daily trading volumes exceed $700 million, enforcement incentives increase, making any answer to where Polymarket is legal time-sensitive and likely to narrow rather than expand in the near term.

CONTENT

Where is Polymarket legal is an enforcement-driven, jurisdiction-specific question shaped by regulatory classification, platform geoblocking, and rising scrutiny as prediction market volumes scale into the hundreds of millions of dollars.

INTRODUCTION

WHY PEOPLE ASK WHERE IS POLYMARKET LEGAL

When readers search where is polymarket legal, they are rarely asking an abstract legal theory question; instead, they want a practical answer about access, risk, and enforceability. In prediction markets, legality is not defined by whether a website loads in a browser, but by whether local law classifies event contracts as regulated derivatives or as gambling, whether the operator is licensed or exempt, and whether enforcement has already established boundaries. This makes the question operational rather than philosophical, and it explains why simple country lists are usually misleading.

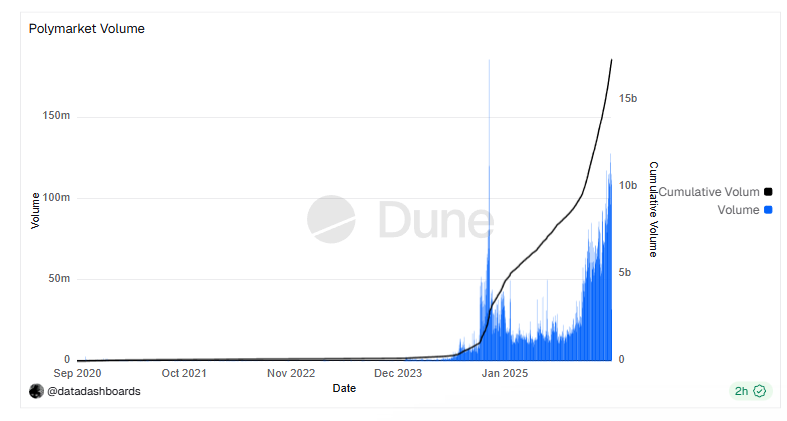

The urgency around where is polymarket legal has intensified because prediction markets have moved from experimental tools to systems with measurable economic and social impact. In 2025 and early 2026, industry reporting showed daily trading volumes reaching approximately $ 701.7 million in mid-January, with peak days exceeding $ 800 million. At that scale, regulators no longer view prediction markets as curiosities; they become consumer-facing financial products whose outcomes can influence expectations, narratives, and behavior. As a result, enforcement incentives increase even if the underlying technology has not changed.

This shift also explains why platforms themselves have become more conservative. Polymarket’s extensive geoblocking across dozens of jurisdictions signals not just technical policy but legal risk assessment. For users, the key takeaway is that where is polymarket legal cannot be answered without considering platform restrictions, regulatory classification, and enforcement history together, because legality in practice is defined by how these layers interact.

WHY LEGALITY IS JURISDICTION-SPECIFIC

Another reason where is polymarket legal is difficult to answer cleanly is that prediction markets sit at the intersection of multiple legal regimes that were not designed with decentralized or crypto-native products in mind. Financial regulators may focus on derivatives law, gambling authorities may apply betting statutes, and consumer-protection agencies may intervene when products reach mass adoption. Each framework produces a different outcome, and jurisdictions prioritize them differently.

This fragmentation means that a product can be accessible in one country while being blocked in another without any change in underlying mechanics. It also means legality can shift over time as enforcement priorities evolve. A market tolerated at low volume may attract scrutiny once it reaches hundreds of millions of dollars in daily turnover. For this reason, where is polymarket legal should be treated as a time-stamped, enforcement-driven question rather than a permanent status.

WHERE IS POLYMARKET LEGAL IN PRACTICE

HOW GEOBLOCKING DEFINES OPERATIONAL LEGALITY

Any practical analysis of where is polymarket legal must start with Polymarket’s own access controls. The platform publicly discloses geoblocking across major jurisdictions including the United States, the United Kingdom, France, Germany, Italy, Singapore, and other regions with strong gambling or derivatives enforcement. These restrictions indicate where Polymarket has decided that legal uncertainty or licensing risk outweighs the benefit of offering access.

Geoblocking does not necessarily mean a jurisdiction has explicitly declared Polymarket illegal. In many cases, it reflects the absence of a clear authorization pathway. In regulated markets, legality is often defined by permission rather than prohibition, meaning a product can be unlawful simply because it lacks the required license. This distinction is central to understanding where is polymarket legal, because the absence of a ban does not equal legal certainty.

As prediction markets scale, conservative access policies become rational. Enforcement actions can impose penalties, disrupt payment rails, and create reputational damage that far exceeds potential revenue from a single country. Polymarket’s restrictions therefore function as a compliance strategy designed to preserve long-term operational stability.

A JURISDICTION SNAPSHOT WITH A CORE TABLE

To make where is polymarket legal actionable without over-claiming, the most honest snapshot is to show where the platform itself restricts access and what that usually implies, while avoiding unsupported claims that accessibility equals legality.

|

Jurisdiction |

Access status |

Practical implication |

|

United States |

Blocked |

Prior federal enforcement makes the U.S. the defining restricted market |

|

United Kingdom |

Blocked |

Strong gambling licensing and enforcement sensitivity |

|

France, Germany, Italy |

Blocked |

Event wagering commonly treated as regulated gambling |

|

Singapore |

Blocked |

Strict controls on unlicensed betting and financial products |

|

Higher-risk jurisdictions |

Blocked |

Sanctions, AML, or compliance exposure |

This table should be read as an operational baseline, not a definitive legal map. For readers researching where is polymarket legal, it highlights a structural asymmetry: it is easier to document where a platform does not operate than to prove explicit authorization elsewhere.

THE U.S. REGULATORY STORY SHAPING GLOBAL LEGALITY

WHY THE 2022 CFTC ACTION STILL MATTERS

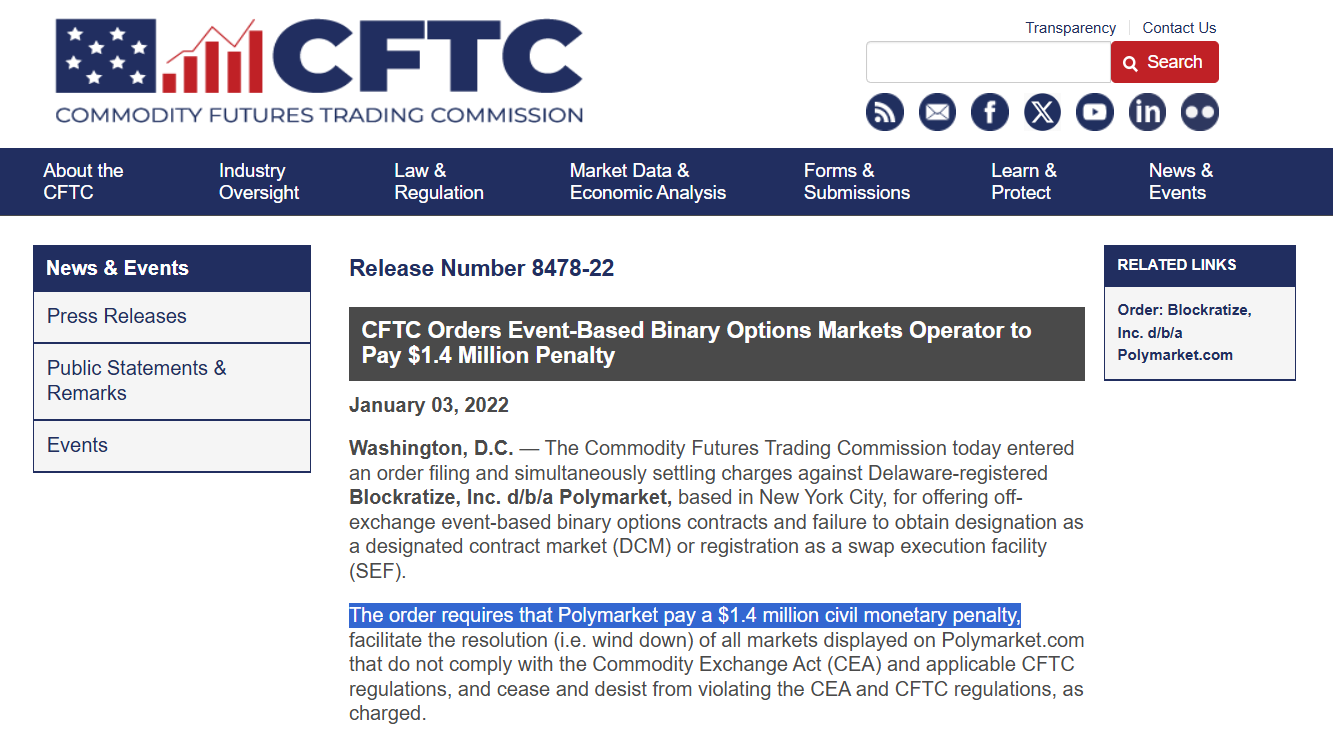

The United States remains central to the global answer to where is polymarket legal because U.S. regulatory decisions influence banking access, stablecoin rails, and institutional counterparties worldwide. In January 2022, the U.S. Commodity Futures Trading Commission issued an enforcement order against Polymarket, imposing a $ 1.4 million civil monetary penalty and requiring the platform to cease offering certain event-based contracts to U.S. users.

CFTC Orders Event-Based Binary Options Markets Operator to Pay $1.4 Million Penalty | CFTC

This action established a precedent that prediction markets structured as binary outcome contracts can fall under commodities regulation even when framed as informational tools. For Polymarket, it explains why the United States remains blocked years later. More broadly, it signaled to other regulators that prediction markets were no longer too small to matter.

For anyone asking where is polymarket legal, this history shows that legality is defined through enforcement, not theoretical argument. Civil penalties and cease-and-desist orders reshape platform behavior regardless of philosophical debates about information value.

WHY RE-ENTRY REMAINS UNCERTAIN

Reports later indicated that Polymarket explored pathways back toward the U.S. market under federal oversight, which illustrates why where is polymarket legal is not static. However, U.S. law is fragmented. State-level gambling authorities retain power, particularly in sports-related markets.

In January 2026, a Massachusetts judge ruled that Kalshi could not operate a sports-prediction market in the state, demonstrating that federal derivatives framing does not automatically override state enforcement. This fragmentation explains why platforms remain cautious even when federal engagement progresses.

https://www.reuters.com/site-search/?query=kalshi&offset=0

WHY LEGALITY DEPENDS ON CLASSIFICATION

DERIVATIVES VERSUS GAMBLING AS THE CORE DIVIDE

At the center of where is polymarket legal is a classification fork. If prediction markets are treated as derivatives, they fall under frameworks emphasizing registration, disclosure, and surveillance. If treated as gambling, they fall under licensing regimes focused on consumer protection.

This divide matters because a product can be lawful under one framework and unlawful under the other. Regulators tend to apply gambling frameworks most aggressively to sports markets, but as volumes grow, even political or economic markets attract scrutiny. With daily volumes reaching $ 701.7 million and peak days above $ 800 million, classification questions become higher-stakes.

For readers, the insight is that legality is less about whether prediction is socially valuable and more about whether the contract type fits into an existing regulatory category.

WHY BROAD GEOBLOCKING IS RATIONAL

Given classification uncertainty, broad geoblocking can be a rational equilibrium. Enforcement risk rises with scale, and the downside of misclassification often outweighs the upside of marginal access. As a result, platforms prefer to narrow their legal surface area.

This dynamic reinforces why where is polymarket legal is often answered indirectly. Accessibility may simply indicate that enforcement has not yet occurred, not that explicit authorization exists. Responsible analysis therefore avoids publishing definitive “legal country lists” without licensing evidence.

THE DATA BEHIND REGULATORY ATTENTION

WHY RECORD VOLUMES CHANGE ENFORCEMENT INCENTIVES

The data explains why regulators are paying attention now. Industry reporting shows prediction markets reaching approximately $ 701.7 million in daily volume in mid-January 2026, with peak days exceeding $ 800 million. At this scale, markets influence behavior and narratives, raising concerns about manipulation and consumer harm.

This helps explain why enforcement often accelerates once volume crosses certain thresholds. For users asking where is polymarket legal, the implication is that legality can tighten as markets grow, even if products remain unchanged.

HOW INSTITUTIONAL INTEREST RAISES THE STAKES

Institutional attention further increases scrutiny. When major financial actors treat prediction markets as alternative data or infrastructure, regulators become less tolerant of gray-zone operation. This pressure typically leads to stricter access controls and clearer compliance boundaries.

As a result, the answer to where is polymarket legal tends to narrow rather than expand in the short term, even as global demand grows.

LEGALITY FOLLOWS ACCESS, CLASSIFICATION, AND ENFORCEMENT

A PRACTICAL ONE-SENTENCE ANSWER

In 2026, the most accurate answer to where is polymarket legal is that it is legally offered only where Polymarket chooses not to geoblock and where local regulators have not classified its event contracts as unlicensed gambling or non-compliant derivatives.

WHY THIS ANSWER IS UNLIKELY TO STAY STATIC

Because enforcement priorities evolve with scale and political attention, any answer to where is polymarket legal should be treated as time-sensitive and jurisdiction-specific rather than permanent.

Read More: