KEYTAKEAWAYS

- Precautionary U.S. military and personnel moves in the Middle East increased geopolitical risk premiums, driving gold and silver to record levels while supporting Bitcoin’s rebound.

- Bitcoin’s rally was amplified by liquidation of bearish derivatives positions, reinforcing its role as a liquidity-sensitive macro hedge rather than a pure risk asset.

- The durability of BTC’s upside will depend on whether escalation pressures energy markets and the dollar, or instead sustains global demand for non-sovereign hedges.

CONTENT

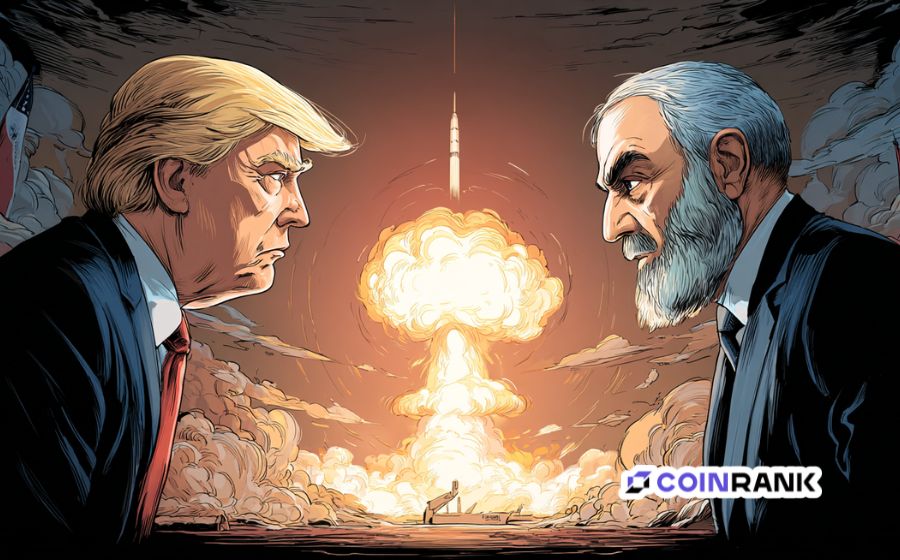

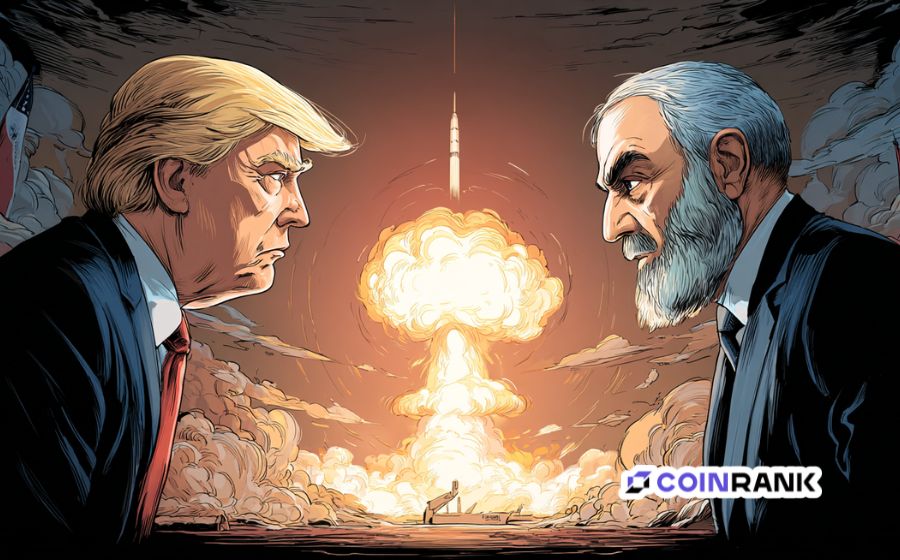

Rising U.S.–Iran tensions have pushed traditional hedges to record highs and lifted Bitcoin toward $97,000, highlighting how geopolitical risk is being priced across macro assets.

STATE OF PLAY

In mid-January 2026, markets are reacting not to a declared war plan but to a fast-moving escalation cycle in which Washington has taken visible precautionary steps while keeping its public messaging deliberately ambiguous: the U.S. has begun withdrawing or advising the evacuation of some personnel from key Middle East locations, including Al Udeid Air Base in Qatar, which the Financial Times notes hosts around 10,000 troops, and Reuters also reported precautionary personnel withdrawals as regional tensions rose and Iranian officials warned that neighboring states hosting U.S. forces could face retaliation if Washington strikes.

The most important signal for investors is that these are not “headline-only” developments; moving people and assets is operationally expensive and rarely done for optics alone, yet it also falls short of confirming an imminent strike, meaning the market is pricing an elevated probability distribution rather than a single outcome.

WHY THIS SHOWS UP IN PRICES

When geopolitics shifts from background noise to an actionable tail risk, the first and cleanest reaction usually appears in assets that price uncertainty directly, and that is exactly what played out this week: Reuters reported that on January 14, 2026, spot gold hit a record $4,639.42/oz and spot silver broke $90/oz for the first time, moves Reuters tied to a combination of rate-cut expectations and geopolitical uncertainty, while a day later Reuters noted gold eased on profit-taking and a “softer tone” as Trump indicated a wait-and-see posture on Iran.

That sequence matters because it illustrates the current regime: traders are willing to pay up for hedges while the situation looks open-ended, but they will also fade panic quickly when language shifts toward de-escalation.

WHERE BITCOIN FITS IN THIS REGIME

Bitcoin’s response is often mischaracterized as either “pure risk asset” or “pure safe haven,” when the more accurate description is that it behaves like a liquidity-sensitive macro asset whose short-term path depends on whether the dominant transmission channel is fear (which can strengthen the dollar and tighten financial conditions) or hedging demand (which can push investors toward non-sovereign stores of value); in this episode, Bitcoin moved higher alongside the broader “macro hedge” bid, with Bloomberg reporting BTC rose as much as 3.9% to $97,694 on January 14, 2026, its highest intraday level since mid-November, and that the rally erased more than half a billion dollars in bearish crypto options positioning.

THE KEY QUESTION: “WILL HE STRIKE?” IS LESS TRADEABLE THAN “WHAT KIND OF ESCALATION?”

The market-relevant question is not whether a strike happens in the abstract, but what type of escalation would occur and what it would imply for oil, the dollar, and global liquidity, because those variables dominate Bitcoin’s near-term direction even when the narrative is “digital gold”; a limited, time-bounded operation that avoids energy disruption can paradoxically be absorbed quickly—especially if it is paired with expectations of easier monetary policy—while a scenario that threatens regional energy flows or triggers broader retaliation can tighten risk conditions in a way that pressures leveraged positioning across all markets, including crypto, regardless of long-term store-of-value narratives.

WHAT TO WATCH IN THE NEXT HEADLINE CYCLE

The most reliable way to read whether the market is shifting from “risk premium” to “break-glass crisis” is to watch whether precautionary moves expand into sustained force-posture changes and whether official messaging converges across agencies, because isolated steps can reflect prudence while coordinated posture changes typically signal higher intent; in the current reporting, Reuters emphasized precautionary withdrawals in response to Iranian warnings, while the Financial Times and AP focused on personnel being advised to leave Al Udeid and on Washington’s efforts to reduce exposure to potential retaliation, which together describe a posture of preparing for volatility without committing publicly to action.

BOTTOM LINE

Whether Trump “will” strike Iran cannot be answered with certainty from public information, but markets are already treating the probability as non-trivial, which is why traditional hedges like gold repriced to records and why Bitcoin was able to participate in the macro bid up toward the $97k area; the next move in BTC is likely to depend less on a single headline and more on whether escalation increases the odds of oil disruption and dollar strength (typically negative for liquidity-sensitive assets) or instead reinforces the case for hedges in a world of political and monetary uncertainty (which has, at times, supported BTC alongside gold).

Read More:

Israeli Airstrikes on Iran Shake the Cryptocurrency Market

Binance Co-CEO Yi He’s Account Hack Exposes Critical Security Risks Behind Meme-Coin Manipulation