KEYTAKEAWAYS

- A bear market is confirmed when major crypto prices drop over 20% for at least two months, often lasting 1-2 years with deep losses.

- Signs of a bear market include falling trading volume, extreme fear in sentiment indicators, and reduced investor participation.

- Strategies like dollar-cost averaging (DCA) and asset reallocation toward stablecoins and top-tier cryptocurrencies can help mitigate losses and prepare for recovery.

CONTENT

Recently, the cryptocurrency market has experienced a significant decline. Major cryptocurrencies have dropped sharply, with Bitcoin falling over 25% from its recent high. Ethereum and other top altcoins have seen even larger losses, while many small-cap tokens have lost more than half their value. This widespread downturn has raised concerns among investors: Are we entering a new crypto bear market?

(Source:Tradingview)

This article aims to analyze the current market situation, review past bear market characteristics, and discuss investment strategies to help investors navigate this phase. Whether you’re an experienced crypto holder or a newcomer, understanding bear market cycles and how to respond to them is essential.

CURRENT MARKET ANALYSIS

Price Trends of Major Cryptocurrencies

In recent months, the cryptocurrency market has shown a clear downward trend. Bitcoin has fallen over 30% from its recent high, breaking multiple key support levels. Ethereum has dropped nearly 40%, falling below important price zones identified by technical analysts. Most major altcoins have seen losses between 50% and 70%.

This decline is not just a short-term fluctuation but has continued for weeks, suggesting a structural market shift rather than a temporary correction.

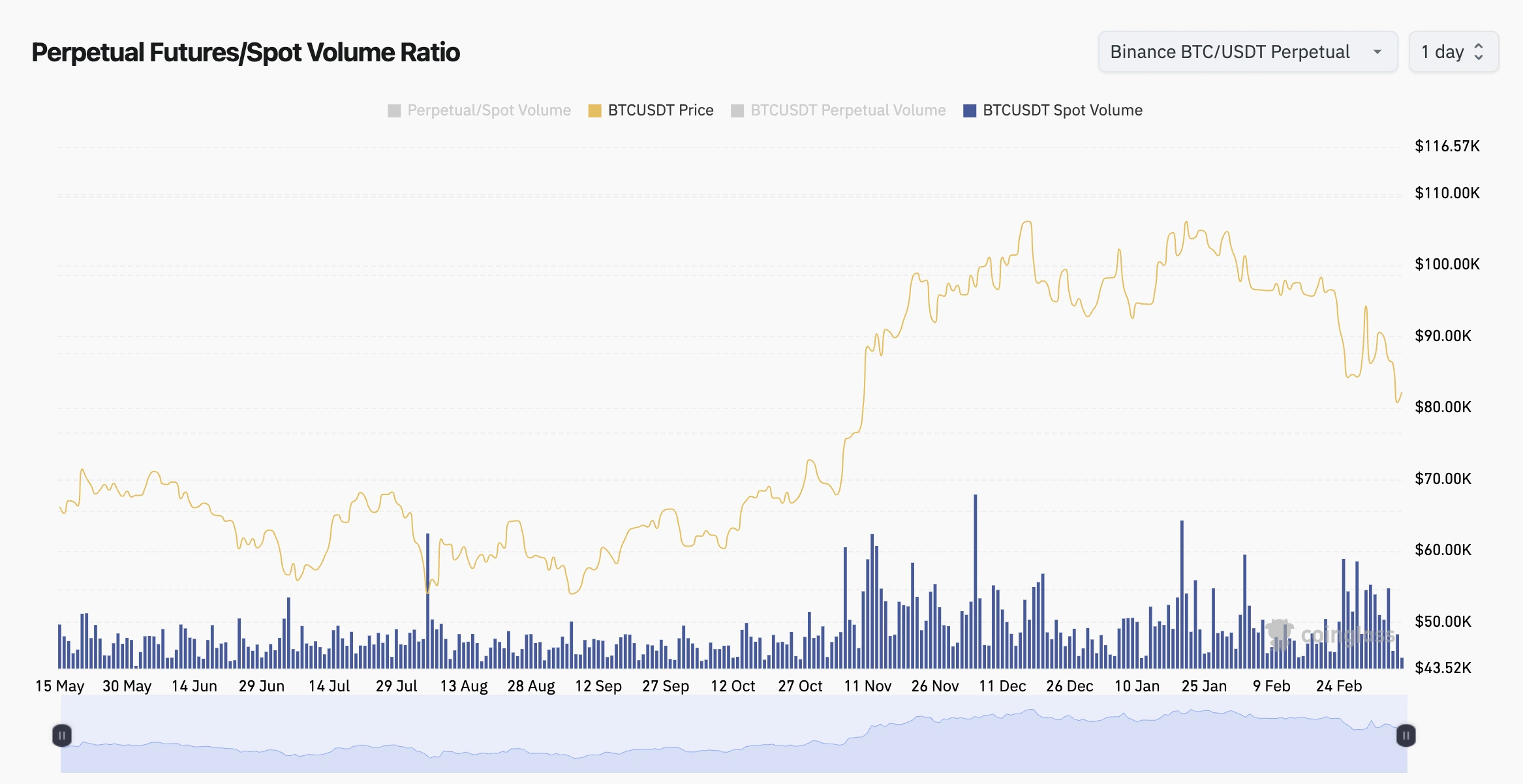

Trading Volume and Market Liquidity

Trading volume has also changed significantly. At the beginning of the decline, volume spiked as investors panic-sold their holdings. However, as the downtrend continued, overall trading volume decreased. This is a typical bear market characteristic—investor interest fades, and new capital inflows slow down.

(Source:Coinglass)

Liquidity has also dropped. The bid-ask spread has widened, and large orders now have a bigger impact on market prices. Additionally, the total value locked (TVL) in decentralized finance (DeFi) protocols has fallen, showing a decline in user participation.

(Source:Defillama)

Market Sentiment Indicators

The Crypto Fear & Greed Index has been in the “Extreme Fear” zone for several weeks, reaching its lowest level in nearly a year. Discussions about crypto on social media have significantly decreased, and Google searches for crypto-related topics have declined.

(Source:Coinglass)

These indicators suggest that market sentiment has turned from optimism to deep pessimism, a common sign of a bear market.

Retail Investor Behavior

Among retail investors, the number of new wallet addresses has dropped, and active addresses are decreasing. Social media analysis shows fewer discussions about “HODLing” (long-term holding) and more about “selling” and “bear markets.”

Small investors are reducing their crypto holdings, indicating that they are becoming more risk-averse and no longer aggressively buying as they did in the bull market.

WHAT IS A BEAR MARKET?

Technical Definition of a Crypto Bear Market

Technically, a bear market is defined as a period where major cryptocurrencies decline more than 20% from their peak and stay low for at least two months. A stricter definition would require a 70%+ drop lasting over a year.

A bear market is not just about price drops. It reflects a combination of market trends, investor sentiment, and fundamental changes in the industry. It is a natural part of market cycles.

Key Characteristics of a Bear Market

A typical crypto bear market has the following traits:

- Continuous price declines – Prices make lower highs and lower lows, with weak and short-lived recoveries.

- Declining trading volume – Market activity slows, and trading volume remains low, especially during rebounds.

- Negative market sentiment – Social media discussions drop, and negative opinions dominate.

- Project development slows down – Funding becomes harder, teams cut staff, and project progress slows.

- Lower media coverage – Both traditional and crypto-focused media reduce coverage, and fewer new investors enter the market.

These characteristics don’t appear all at once but develop over time, shaping the bear market landscape.

Differences from Traditional Market Bear Trends

Crypto bear markets share some similarities with traditional stock market bear trends, such as long-term price declines, reduced trading activity, and investor pessimism. However, key differences exist:

- Larger declines – Crypto bear markets often see 70%-90% drops, while stock market bear markets usually decline 20%-50%.

- Shorter cycles – Crypto bear markets typically last 1-2 years, while stock market bear markets can last for several years.

- Faster recoveries – After a bear market, crypto prices often hit new all-time highs much faster than traditional markets.

INVESTMENT STRATEGIES FOR A BEAR MARKET

Benefits of Dollar-Cost Averaging (DCA)

One of the best strategies during a bear market is Dollar-Cost Averaging (DCA):

- Invest a fixed amount at regular intervals (weekly or monthly) without worrying about timing the market.

- Buy more when prices are low and less when prices are high.

- Reduces emotional decision-making and helps avoid panic-selling or FOMO (fear of missing out).

- Over time, helps achieve a reasonable average cost.

Studies show that in volatile markets, DCA often outperforms market timing strategies, making it a great approach for bear markets.

Adjusting Your Asset Allocation

Your portfolio should be different in a bear market compared to a bull market:

- Increase exposure to top-tier cryptocurrencies – Bitcoin and Ethereum tend to perform better than smaller altcoins in bear markets.

- Reduce high-risk, low-liquidity altcoins – Small-cap tokens often suffer the biggest losses.

- Focus on utility-based tokens – Projects with real use cases and stable revenue tend to be more resilient.

- Use stablecoins strategically – Holding stablecoins can help preserve capital and earn yield while waiting for better opportunities.

A well-balanced portfolio can protect capital while positioning for the next bull market.

CONCLUSION

Bear markets can be challenging, but they also offer great opportunities. For long-term investors, bear markets provide the chance to accumulate quality assets at lower prices. They also test an investor’s patience and strategy.

History shows that every crypto bear market is eventually followed by a new bull run, with prices reaching new highs. While it’s impossible to predict exactly how deep or long the current downturn will last, smart risk management, a solid investment strategy, and the right mindset can help investors navigate this phase successfully.

Whether in a bear or bull market, the fundamental principles of investing in crypto remain the same:

- Understand what you invest in

- Manage risk properly

- Think long-term

- Adapt your strategy based on market conditions

With these principles in mind, investors can survive the bear market and prepare for the next growth cycle.

Also Read:

Crypto Bear Market – What Causes It and Investment Advice During Recessions

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!