KEYTAKEAWAYS

- YALA turns Bitcoin into a productive DeFi asset by allowing users to mint YU, a BTC-collateralized stablecoin, without selling their BTC holdings.

- The protocol features modular infrastructure—a Notary Bridge, Pro Mode, and stability mechanisms—to support cross-chain yield strategies and risk-adjusted DeFi participation.

- YALA token powers governance and incentives through staking, stability pool rewards, and veYALA voting, aligning long-term user incentives with protocol sustainability.

CONTENT

YALA is a DeFi protocol that unlocks Bitcoin’s liquidity through a BTC-backed stablecoin, enabling lending, staking, and governance across decentralized ecosystems.

WHAT IS YALA?

YALA is a next-generation DeFi protocol designed to bridge Bitcoin’s massive liquidity into the broader decentralized finance ecosystem. While Bitcoin (BTC) has long served as a store of value and a tool for peer-to-peer transactions, it has historically been excluded from more advanced DeFi use cases like lending, liquidity mining, or yield strategies.

YALA changes that narrative through its core innovation: the creation of YU, a Bitcoin-collateralized stablecoin. Users can deposit BTC into the protocol and mint YU—without having to sell their Bitcoin. This unlocks capital efficiency, allowing users to earn yield, provide liquidity, or participate in other DeFi strategies while maintaining full ownership of their BTC.

Introducing $YALA – the native governance and utility token of Yala

It activates idle Bitcoin by bridging BTC liquidity via its stablecoin $YU into DeFi and real-world use cases.

— Yala (@yalaorg) July 17, 2025

The protocol is designed with a modular, cross-chain architecture that supports UTXO-based assets, enabling seamless integration with various DeFi applications. YALA aims to make Bitcoin truly interoperable across decentralized ecosystems, without relying on centralized intermediaries.

Security, decentralization, and sustainability are foundational principles of YALA. By enabling trustless access to liquidity and cross-chain DeFi participation, the protocol positions Bitcoin as a core building block of the next generation of decentralized finance.

Since launching its mainnet on May 16, 2025, YALA has demonstrated remarkable early traction. Within just two months, the protocol has reached over $211 million in Total Value Locked (TVL) and minted more than 122.5 million YU tokens. This strong momentum underscores market confidence in YALA’s innovative model and its role in expanding Bitcoin’s utility in DeFi.

>>> More to read: What is DeFi?

HOW THE YALA PROTOCOL WORKS

Breaking Down the Core Infrastructure Behind YALA

The YALA ecosystem is built on a three-part infrastructure that works in harmony to unlock Bitcoin’s utility in DeFi. Each component plays a specific role in transforming BTC into a productive asset, while maintaining the protocol’s stability and capital efficiency.

✅ Notary Bridge

The Notary Bridge acts as the entry point into the YALA ecosystem. It uses cryptographic signatures to mint yBTC, a tokenized version of Bitcoin native to YALA.

Once BTC is bridged and represented as yBTC, users can:

- Mint YU, the protocol’s stablecoin

- Deploy YU across various DeFi protocols

- Participate in YALA’s native yield strategies

This process allows Bitcoin to become an active, yield-generating asset without sacrificing its underlying ownership.

✅ Pro Mode

For users with higher risk tolerance, YALA offers a feature called Pro Mode.

In Pro Mode, users can:

- Deposit yBTC into YALA Vaults

- Connect to external Bitcoin Layer 2 protocols like Ethena and Babylon

- Access advanced strategies such as liquid staking or yield aggregation

This mode unlocks enhanced returns while leveraging cross-protocol liquidity—making it ideal for power users who seek more aggressive strategies.

✅ YU Stability Mechanism

To ensure YU maintains its soft peg to the U.S. dollar, YALA deploys a combination of smart-contract-based mechanisms:

- Liquidation System: When a user’s collateral ratio falls below the required threshold, their position is automatically liquidated to protect YU’s value.

- Peg Stability Module (PSM): Enables low-slippage swaps between YU and other stablecoins, creating arbitrage opportunities that naturally reinforce the peg.

- Interest Rate Control: The protocol implements stability fees to suppress excessive minting or incentivize debt repayment—modulating YU’s supply based on market conditions.

These systems work together to ensure YU remains stable, even under market stress.

>>> More to read: What is a Cross-chain Bridge

WHAT IS YU “STABLECOIN”?

Inside the Dual-Token System of YALA

The YALA protocol adopts a dual-token model composed of:

- YU: A Bitcoin-collateralized stablecoin soft-pegged to the U.S. dollar

- YALA: A governance and utility token that powers the protocol

📌 Unlocking Bitcoin’s DeFi Potential

YU is designed to give Bitcoin holders access to DeFi without having to sell their BTC. By depositing BTC into the YALA protocol, users can mint YU and unlock liquidity, all while maintaining exposure to Bitcoin’s long-term price appreciation.

This unlocks a major use case for BTC—transforming it from a passive store of value into an active participant in DeFi strategies like lending, staking, or liquidity provision.

📌 How YU Maintains Stability

To ensure stability, YU relies on an overcollateralization mechanism. This means users must deposit more BTC than the dollar value of the YU they mint. For example, to mint 50 YU, a user might need to deposit $80 worth of BTC.

This built-in buffer protects the system from volatility and maintains the peg, even during sudden price swings.

The protocol uses a Loan-to-Value ratio (LTV) to define how much BTC is needed relative to the YU minted. These LTV parameters are initially set by the YALA Foundation, with future adjustments governed by the community via a DAO.

📌 Risk-Aware Adjustments

YALA introduces dynamic LTV ratios based on user behavior. For example:

- A user who simply mints YU may receive a higher LTV (e.g., 80%).

- A user who mints YU and then restakes it on platforms like Babylon may receive a lower LTV (e.g., 70%), reflecting the added risk to the system.

This approach allows YALA to support advanced DeFi strategies while still managing systemic risk carefully.

📌 Takaful Insurance for Risky Actions

To further protect the protocol, users who engage in higher-risk actions such as restaking must purchase insurance through YALA’s native Takaful module.

This insurance mechanism is designed to:

- Cover BTC price fluctuations

- Prevent unexpected liquidation events

- Reduce systemic risk across the protocol

By tying risk exposure to insurance requirements, YALA ensures YU remains a stable and reliable asset within the DeFi ecosystem.

>>> More to read: What is WLFI? Inspired by Trump, Powered by USD1

WHAT IS YALA?

YALA is the native crypto asset of the Yala ecosystem. It serves both as a utility token for protocol-level financial activities and as a decentralized governance instrument that empowers the community to guide the platform’s future.

📌 Core Utilities of YALA

-

Stability Pool Rewards

When users deposit YU stablecoins into the protocol’s stability pool to help cover potential bad debt, they earn YALA token rewards. In addition to incentives, these participants can also receive liquidation profits when collateral is claimed during under-collateralized events.

-

Staking for Cross-Chain Security

Staking YALA helps secure the protocol’s cross-chain validator network. This mechanism protects the YU stablecoin infrastructure and aligns economic incentives with network integrity.

-

Governance Participation

By locking YALA, users receive veYALA (vote-escrowed YALA), which grants governance rights. Holders of veYALA can vote on key proposals, adjust protocol parameters, and influence future YALA token issuance schedules.

📌 Transition Toward Decentralized Governance

In its early stages, YALA primarily functions as a reward and utility token. Over time, its role will gradually shift toward community-driven governance. As the protocol matures, governance will become the foundation of decision-making—allowing YALA holders to shape upgrades, manage incentives, and realign priorities based on evolving needs.

Active governance participation via veYALA helps ensure that control over the protocol remains decentralized, transparent, and aligned with the community’s interests.

📌 Additional Incentives for Stability Pool Contributors

Users who contribute YU to the protocol’s stability pool are not only supporting the health of the ecosystem—they’re also directly incentivized. These participants receive:

- YALA token rewards

- A share of liquidation collateral

- Portions of stability fees paid by other users

This creates a powerful feedback loop where community members are rewarded for helping preserve the stability and sustainability of the protocol.

>>> More to read: What is Tokenomics? A Comprehensive Guide

YALA TOKENOMICS

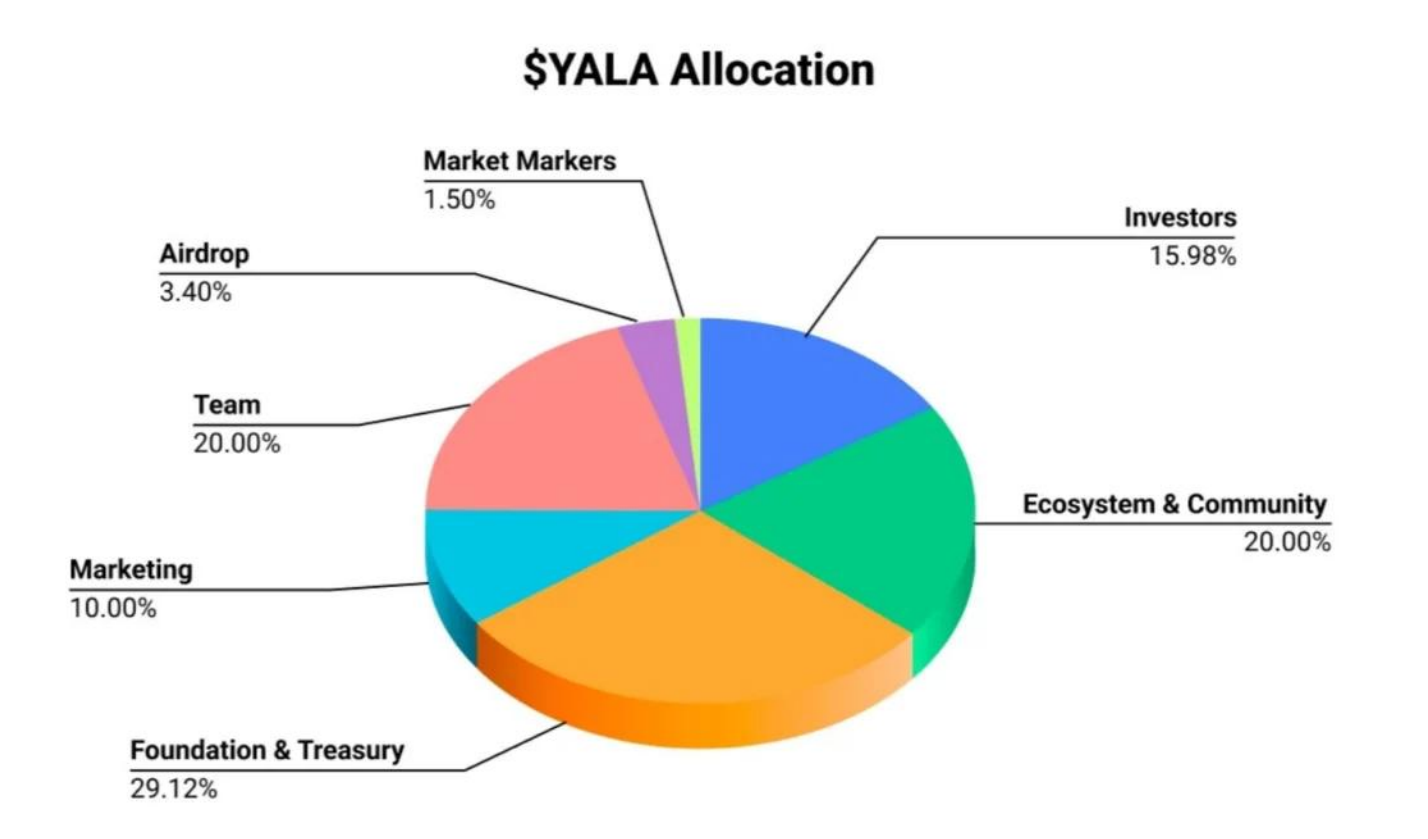

➤ Total / Max Supply: 1,000,000,000 YALA

🪙 Token Allocation

-

Investors (15.98%)

1-year lock, followed by 18-month cliff unlock; remaining 55% released linearly over 24 months.

-

Ecosystem & Community (20%)

Incentives for protocol growth and user engagement.

-

Foundation & Treasury (29.12%)

30% unlocked at TGE; 1-year lock, then 36-month linear vesting.

-

Marketing (10%)

20% distributed at TGE; 14% locked for 1 year, then 24-month vesting.

-

Team (20%)

Reserved for contributors, with long-term vesting (specifics not disclosed).

-

Airdrop (3.4%)

Fully unlocked at TGE for early adopters and key contributors.

-

Market Makers (1.5%)

Vested per terms in liquidity agreements.