KEYTAKEAWAYS

- Tether USDT offers stability in the volatile cryptocurrency market by maintaining a 1:1 value ratio with the US dollar, facilitating safe and seamless cross-border transactions.

- As a crucial bridge between fiat and digital currencies, USDT enables investors to manage market volatility effectively and conduct international transactions efficiently.

- Despite facing regulatory scrutiny, Tether's significant market cap and initiatives like Tether Edu highlight its commitment to transparency, education, and the future of digital finance.

CONTENT

Explore Tether USDT, the stablecoin revolutionizing digital transactions by maintaining parity with the US dollar, ensuring stability, and facilitating global transfers.

WHAT IS TETHER USDT?

Tether USDT is the world’s first fiat-backed stablecoin, introduced in 2014 by Bitcoin investor Brock Pierce, entrepreneur Reeve Collins, and software developer Craig Sellers under the name Realcoin. Issued initially via the Bitcoin protocol Omni Layer, USDT has since migrated to other blockchains, with most of its supply existing as ERC-20 tokens on Ethereum. It is also issued on several other blockchains, including TRON, EOS, Algorand, Solana, and OMG Network.

The circulating supply of this cryptocurrency is backed by an equivalent amount of US dollars held in designated bank accounts, making it a stablecoin designed to address the volatility of cryptocurrencies, unlike mainstream cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). This allows it to be used as a medium of exchange and a store of value without being speculative.

Stablecoins have various designs to maintain stability, and Tether USDT belongs to the fiat-collateralized stablecoin category, guaranteeing a 1:1 peg to the US dollar. It is designed to provide a bridge between fiat and cryptocurrency, offering users price stability and transparency. According to CryptoCompare data, 80% of Bitcoin transactions are completed in USDT, making stablecoins a major source of liquidity in the cryptocurrency market. Tether USDT is traded on numerous cryptocurrency exchanges, including Binance, CoinW, Bitfinex, and Kraken.

Tether USDT acts as a bridge between cryptocurrency and fiat currency, narrowing the gap between the two. It offers investors a simple way to obtain one-to-one trades with the US dollar without the inherent volatility of other cryptocurrencies.

With Tether USDT’s relatively stable nature, investors can hold digital assets similar to fiat currency while easily trading other tokens in the crypto market. Despite its risks, Tether USDT‘s key features have made it a popular token.

Key Features:

- 1:1 ratio (US dollar to USDT)

- Stability (as stable as the US dollar)

- Availability on different blockchains

- Different use cases compared to traditional cryptocurrencies

Tether USDT has become an indispensable trading tool in many major cryptocurrency exchanges and among a large number of cryptocurrency investors.

What is a Stablecoin?

The cryptocurrency market is highly volatile. For example, it’s common for Bitcoin (BTC), one of the most well-known cryptocurrencies, to fluctuate by over 10% within a day and over 100% within a month.

This leads to a question: if the value of virtual currencies is unstable, how can they be used as currency? Indeed, this is a valid concern.

Currently, we haven’t entered an era of exclusively using virtual currencies for transactions. Cryptocurrencies are still an emerging product, and we generally use government-issued currencies (fiat currencies) for most transactions, with many things priced in fiat currencies, especially the US dollar.

In this context, stablecoins have gradually gained popularity. They are a type of virtual currency and a hedging asset in the virtual currency market. There are many types of stablecoins, which take the form of cryptocurrencies to mimic the value of traditional fiat currencies like the US dollar or euro. They have the stable value of fiat currencies while allowing for rapid asset transfers like virtual currencies.

The functions of stablecoins include:

- Reducing transaction time and enabling quick currency exchange

- Lowering transaction costs and frictional fees

- Offering low volatility, making them suitable for value storage

- Serving as a basic unit for measuring value

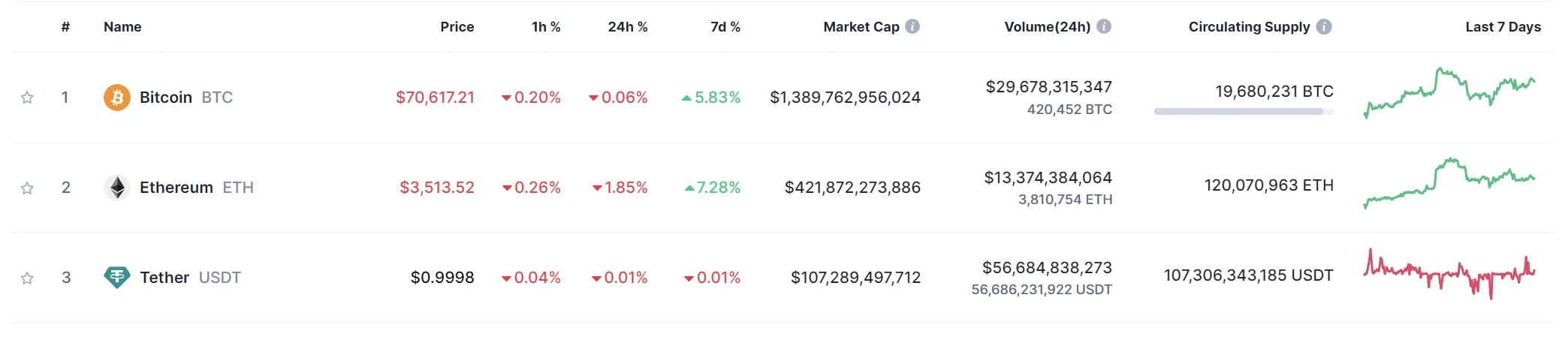

Currently, stablecoins have a significant presence in the global cryptocurrency market:

- Tether USDT has a market size of over $100 billion, making it the third-largest cryptocurrency with the highest daily trading volume globally.

- USD Coin has a market size of $32 billion, ranking as the seventh-largest cryptocurrency with daily trading volume among the top 10.

(Source:CoinMarketCap)

>>> More to Read : What Is Stablecoin ? Stable Virtual Assets

The Two Types of USDT

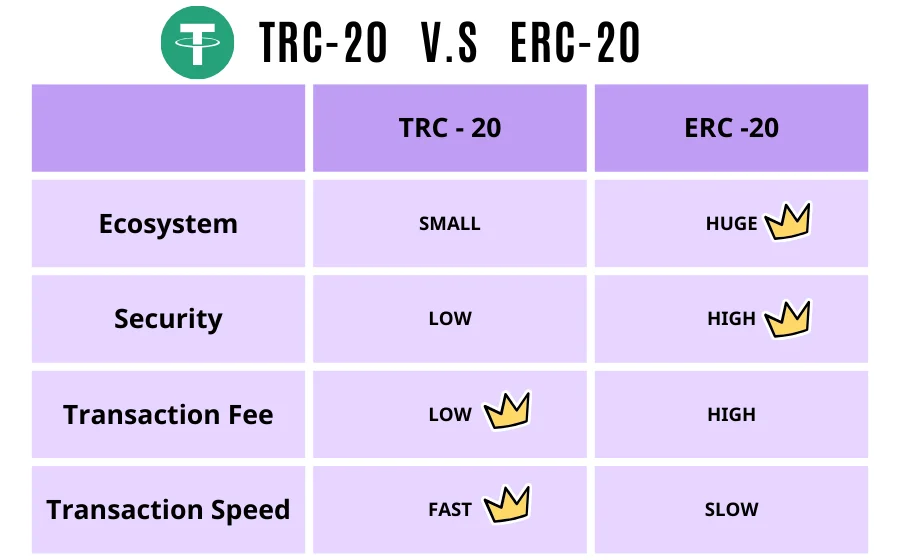

Due to its widespread use, USDT is issued on various mainnets, resulting in different network forms of USDT, such as Ethereum’s ERC20 USDT and Tron’s TRC20 USDT, among others. It’s important to pay attention to the type of mainnet when trading.

TRC20-USDT refers to the US dollar stablecoin issued on the TRON network; ERC20-USDT refers to the US dollar stablecoin issued on the Ethereum network. The US dollar stablecoins issued on TRC20 and ERC20 are the same, but using TRC20 to trade USDT on the TRON network usually has lower transaction fees.

Differences between TRC20 and ERC20:

- TRC20 tokens are issued on the TRON blockchain, while ERC20 tokens are issued on the Ethereum blockchain.

- TRC20 uses different technologies and rules, and is generally cheaper than ERC20.

- TRC20 and ERC20 tokens cannot be converted to each other.

HOW DOES TETHER USDT WORK?

The official whitepaper states that each Tether USDT is equivalent to 1 US dollar and is fully backed by Tether’s reserves. This is why it’s called a “stablecoin.” But how does this work behind the scenes?

When you purchase USDT with 1 dollar, Tether Limited deposits that dollar into a designated bank account as a reserve. Conversely, when you exchange USDT back into dollars, the company withdraws the equivalent amount from the reserves and destroys the corresponding USDT. This ensures that the total amount of issued USDT always matches the total dollar reserves.

In essence, Tether Limited acts as an intermediary, providing us with a “dollar token” that can be used in the cryptocurrency world. This model is popular in cryptocurrency exchanges, especially during periods of market volatility, as Tether offers a relatively stable reference point for value.

However, there are still doubts and questions. Despite Tether Limited’s insistence that each Tether USDT is backed by a dollar, there is still skepticism in the market about the authenticity and adequacy of its reserves. One key question is: if everyone wants to exchange their USDT for dollars, does the company really have enough cash to support it?

This reminds us of an important concept: the value of money is based on widespread trust. Currently, the market recognizes the value of Tether USDT, but if trust is damaged, the value of USDT could also be severely impacted.

IS TETHER USDT SAFE?

Tether USDT, one of the most popular stablecoins, is widely used in the cryptocurrency market, yet it is associated with several risks and uncertainties.

Risk 1: Lack of Transparency in Financial Data

In 2021, Tether reached an agreement with the New York Attorney General to disclose its reserve data. However, the provided information lacks formal audit confirmation and detail. Less than 4% of Tether’s reserves are in actual cash, while about 65% are classified as commercial paper, details of which are undisclosed.

Risk 2: Concerns Over Reserve Adequacy

According to data from Deltec Bank, Tether’s foreign currency increased by $600 million in the first nine months of 2020, while its issued USDT increased by $5.4 billion, nearly seven times the difference. Most of Tether’s other reserves, such as mortgage loans and Bitcoin investments, are illiquid assets, which means Tether might struggle to pay out in the event of a large-scale redemption, leading to price drops or even a collapse.

Risk 3: Regulatory Issues

Tether’s custodian bank, Deltec, does not purchase investor protection insurance like Federal Deposit Insurance Corporation (FDIC) or Central Deposit Insurance Corporation (CDIC). If Tether experiences massive theft or loss, investors may have difficulty obtaining compensation. Although Tether claims to have registered an MSB license, it lacks strict financial regulation, posing operational risks.

Despite its significant role in the crypto market, investors should be wary of USDT’s risks and opacity and carefully consider these potential risks before using it.

More to Read

- What is USD Coin (USDC)?

- What Is Stablecoin ? Stable Virtual Assets

- Ethena’s New Stablecoin Revolution

FAQS

- What is Tether USDT?

Tether USDT is a fiat-backed stablecoin, designed to maintain a 1:1 value ratio with the US dollar for stability.

- How does Tether USDT work?

Tether USDT works by keeping an equivalent amount of US dollars in reserve for each USDT issued, ensuring a stable value.

- Is Tether USDT safe?

Tether USDT carries risks, including transparency concerns, reserve adequacy doubts, and regulatory issues, making its safety a topic of debate.

▶ Buy USDT at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!