KEYTAKEAWAYS

- Starknet scales Ethereum using off-chain computation and zk-STARK proofs, enabling faster, cheaper transactions without compromising on Layer 1 security.

- The STRK supports governance, future staking, and transaction fees—forming the backbone of Starknet’s decentralized infrastructure.

- With 50.1% of the initial STRK supply allocated to its foundation, Starknet aims to evolve into a fully decentralized public good over time.

CONTENT

STRK is the native token of Starknet, a Layer 2 solution using STARK proofs to scale Ethereum with low fees, high throughput, and strong decentralization goals.

WHAT IS STRK?

Starknet is a Validity Rollup Layer 2 scaling solution designed to bring high throughput and low gas fees to Ethereum—without compromising on Layer 1 security. Instead of executing heavy computations on Ethereum mainnet, Starknet shifts these operations off-chain and proves their validity using cryptographic STARK proofs. This dramatically improves efficiency and reduces costs.

Think of it like solving a Sudoku puzzle: verifying a correct solution is much faster than solving it from scratch. Starknet leverages this concept to optimize blockchain scalability.

You’ve been waiting for it, it’s officially live.

Xverse now supports Starknet.

Bitcoiners can easily jump into Starknet, straight from the leading Bitcoin wallet.pic.twitter.com/tie2Tqs6ET

— Starknet 🐺🐱 (@Starknet) July 1, 2025

Operating as a permissionless Layer 2 network on Ethereum, Starknet uses one of the most scalable and secure proof systems available—STARKs. Smart contracts on Starknet are written in Cairo, a Turing-complete language purpose-built for generating STARK proofs, offering developers both flexibility and performance.

At the heart of this ecosystem is STRK, the native token powering the Starknet protocol. It plays a key role in governance, staking, and potentially in future network operations (which we’ll explore further in the next sections).

>>> More to read: What is USD1? A Complete Guide

HOW DOES STARKNET WORK?

As a Layer 2 network, Starknet enhances Ethereum’s scalability by processing transactions off-chain and settling them on Ethereum mainnet. It achieves this by batching thousands of transactions into a single data structure called a “proof”—which is then submitted to Ethereum as one succinct transaction. This significantly boosts throughput (transactions per second) while drastically reducing per-transaction costs.

At the core of Starknet is its proprietary proof system known as zk-STARK—short for “zero-knowledge Scalable Transparent Argument of Knowledge.” This system verifies the correctness of transactions without revealing any sensitive information, offering both enhanced security and improved privacy.

Starknet is powered by two key components: the Sequencer and the Prover. The Sequencer executes transactions and proposes new blocks at a pace far exceeding that of Ethereum nodes. The Prover, on the other hand, generates cryptographic proofs that mathematically guarantee the validity of those blocks—eventually anchoring them on Ethereum for final settlement.

While STARK technology is already mature and secure, Starknet is still evolving into a fully decentralized public good, much like Ethereum itself. This transition involves open governance, decentralized infrastructure, and community-driven development—goals championed by the Starknet Foundation and the STRK token.

The Starknet Foundation is an independent, non-profit entity created to steward the network’s growth. It was launched with 50.1% of the initial STRK token supply, ensuring that sufficient resources are allocated to maintain, develop, and scale the Starknet ecosystem as a public utility.

>>> More to read: What is VELO? Deep Dive into Velo Protocol

WHAT IS STRK?

STRK is the native cryptocurrency of Starknet, the Ethereum Layer 2 network designed for scalable and secure on-chain applications. As the core utility and governance asset of the Starknet ecosystem, STRK plays a vital role in the network’s long-term decentralization and operational framework.

Here’s how STRK is intended to be used:

- Governance: STRK is primarily designed to serve as a governance token. Holders can vote on or delegate votes for improvement proposals that affect the evolution of the Starknet protocol.

- Staking: In the future, key services such as sequencing and data availability may require STRK staking to operate securely and reliably.

- Transaction Fees: While Starknet currently uses ETH to pay for gas fees, developers plan to enable STRK as an alternative payment method for transaction fees in the future.

📌 STRK Tokenomics

The initial supply of STRK is capped at 10 billion tokens. Notably, STRK does not have a hard supply limit, and as of November 2023, the minting rate for new tokens has not been finalized.

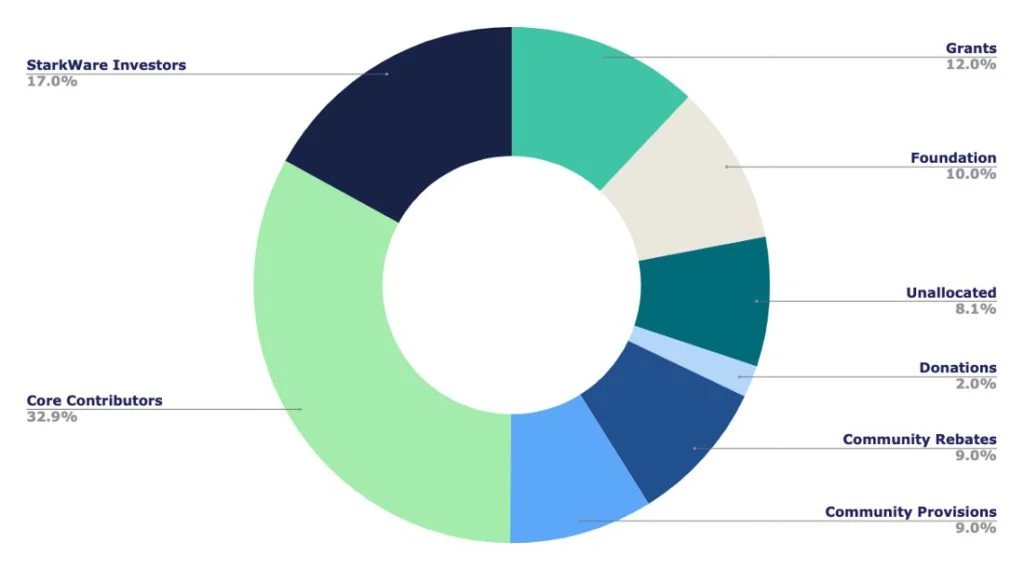

The token distribution for the initial 10 billion STRK is as follows:

- 17% allocated to StarkWare investors—the core development company behind Starknet

- 32.9% allocated to core contributors, including StarkWare employees, advisors, and developer partners

- 50.1% allocated to the Starknet Foundation, designated for grants, research funding, community incentives, governance initiatives, and long-term ecosystem reserves

This distribution structure reflects Starknet‘s vision to progressively decentralize governance and resource management, while empowering builders, users, and community stakeholders over time.