KEYTAKEAWAYS

- MYX Finance Growth: MYX soared 1,388% in one week, hitting $18.52 before correcting to $17.98, placing it among the top 50 cryptocurrencies by market cap.

- Innovative Mechanisms: MYX Finance introduces the Matching Pool Mechanism (MPM) and Price Protection to deliver a CEX-like trading experience with decentralized security.

- Utility of MYX Token: Beyond investment, MYX powers governance, liquidity incentives, and fee discounts, making it central to MYX Finance’s ecosystem growth.

CONTENT

MYX Finance surges 1,388% in a week, reaching $18.52 before correcting. Discover how MYX, its tokenomics, and unique mechanisms are reshaping decentralized derivatives trading.

LATEST PRICE TREND ANALYSIS OF MYX

Over the past week, MYX has experienced explosive growth, soaring by 1,388.56% within just seven days and reaching a new all-time high of $18.52 on September 10. Meanwhile, the market capitalization of MYX Finance climbed to $3.55B, placing it among the top 50 cryptocurrencies.

This sharp surge was largely fueled by strong retail interest and technical momentum. However, as prices climbed rapidly, many investors began taking profits, which led to a subsequent price pullback.

At present, MYX has slightly corrected to $17.98, down about 6.96% from its record high.

WHAT IS MYX FINANCE?

MYX Finance is a decentralized derivatives exchange (DEX) built on Arbitrum and Linea. It introduces a unique Matching Pool Mechanism (MPM) that enables traders to efficiently match long and short orders, helping reduce slippage risks.

On MYX Finance, users can trade perpetual contracts using USDC as margin, with leverage of up to 50x. The platform also provides deep liquidity pools for popular pairs like ETH/USDT and BTC/USDT. In addition, users can earn annual percentage returns (APR) from staking assets supplied to liquidity pools.

While MYX Finance was initially deployed on BNB Chain, by early July 2025 it had expanded to Linea and Arbitrum mainnets. This shift lowered gas fees and broadened support for multi-chain assets in perpetual trading. The roadmap further reveals plans to expand into the Solana ecosystem.

As an emerging DeFi protocol, MYX Finance became the 15th project to launch through a decentralized exchange initial DEX offering (IDO). Its native token MYX debuted on May 6, 2025, via PancakeSwap, with an initial price of just $0.009.

Even before its IDO, MYX Finance demonstrated strong momentum. The platform had accumulated nearly 200,000 wallet addresses, processed over $47 billion in trading volume, and reached a total value locked (TVL) of $4.2 billion. Moreover, the project secured backing from top-tier investors, including HashKey Capital, HongShan Capital, Consensys, and Hack VC.

>>> More to read: What is Linea (LINEA)? A Complete Guide

HOW DOES MYX FINANCE WORK?

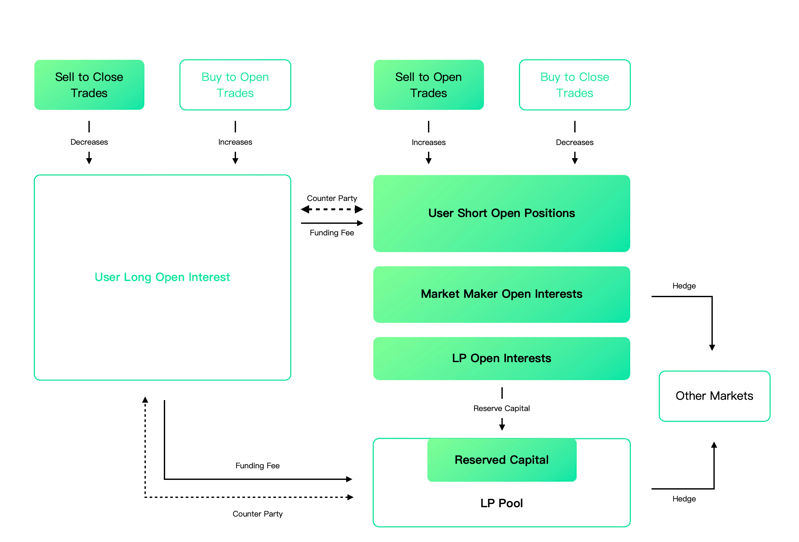

MYX Finance operates with a unique model that leverages liquidity pools (LP) as counterparties to user trades. Instead of relying on traditional order books, the system enables efficient matching of long and short positions, ensuring sufficient liquidity and a smooth trading experience.

(source: myx.finance)

✅ Matching Pool Mechanism (MPM)

The core innovation of MYX Finance lies in its Matching Pool Mechanism (MPM). This system eliminates slippage by internally matching trades, giving users a CEX-like liquidity experience while remaining fully decentralized. Liquidity providers (LPs) play a key role in this design.

- How It Works: LPs hold collateral assets (e.g., BTC or USDC) to support trades and absorb potential risks arising from imbalances between long and short positions.

- Market Balancing: To maintain an approximate 50:50 ratio of open interest, LPs temporarily take the opposite side when the market skews heavily toward longs or shorts, rebalancing once new traders enter.

- Fees and Risks: LPs earn hourly funding fees from traders, incentivizing them to stabilize markets. Risk is minimized when market positions are balanced, but if positions diverge too much, LPs may choose to hedge exposure via external venues.

- Auto-Deleveraging (ADL): When LPs hit maximum capacity, MYX Finance activates its ADL system to automatically close profitable positions, reducing systemic risks from unbalanced open interest.

✅ Price Protection Mechanism

To ensure fairness, MYX Finance integrates a strict price protection system powered by PYTH oracles. This prevents trades from being impacted by sudden slippage or abnormal price movements.

- Price Oracle: All trades on the platform rely on PYTH oracles, ensuring accurate and transparent pricing.

- Price Delay: Network congestion or latency may cause small differences between the “broadcast” and “execution” price, which can either benefit or disadvantage traders.

- Order Types: Market orders guarantee execution but not the final price. Limit orders guarantee the price but not execution.

- Tolerance Settings: Traders can define a “price tolerance threshold.” If the market moves beyond it, the order is automatically canceled to prevent unexpected losses.

👉 In short, MYX Finance combines its innovative Matching Pool Mechanism (MPM) with a robust Price Protection framework, allowing users to trade perpetuals confidently while enjoying deep liquidity and minimized risk.

>>> More to read: What is Crypto Swing Trading? Pros & Cons Explained

WHAT IS MYX?

MYX is the native token of MYX Finance, serving as the backbone for governance, incentives, and liquidity within the ecosystem. By holding the token, users are no longer just passive investors — they actively participate in the protocol’s operations and share in its growth.

✏️ Core Use Cases of MYX:

- Liquidity Provision: Users who supply capital to the protocol’s liquidity pools contribute to the ecosystem’s depth and stability, earning rewards in MYX tokens.

- Governance: Holders of MYX have voting rights on key proposals within the protocol, influencing decisions such as fee structures, new features, and future development directions.

- Incentives: MYX can be used across the platform for trading fee discounts, access to exclusive features, and as rewards for users providing liquidity to the protocol.

🪙 MYX Tokenomics

The total supply of MYX Finance tokens is capped at 1,000,000,000 MYX, with details as follows:

- Token Name: MYX Finance

- Symbol: MYX

- Blockchain: Binance Smart Chain (BSC)

- Standard: BEP-20

- Total Supply: 1,000,000,000 MYX

- Maximum Supply: 1,000,000,000 MYX

- Contract Address: 0xD82544bf0dfe8385eF8FA34D67e6e4940CC63e16

🔍 Token Distribution

The allocation of MYX tokens is designed to balance community growth, ecosystem incentives, and investor support:

- Ecosystem & Community: 54.7%

- Team & Strategic Advisors: 20%

- Institutional Investors: 17.5%

- Initial Liquidity: 4%

- Binance Wallet IDO: 2%

- Reserve for Future: 1.8%

MYX FINANCE | FAQ

Q: What is MYX?

A: MYX is the native token of MYX Finance, a decentralized derivatives exchange (DEX) designed to deliver a CEX-like trading experience. It leverages its unique Matching Pool Mechanism (MPM) to support perpetual contract trading while offering advantages such as zero slippage, high leverage, low fees, and cross-chain trading capabilities.

Q: How does MYX Finance work?

A: At its core, MYX Finance operates through the Matching Pool Mechanism (MPM). Unlike traditional order book models, MPM relies on a shared liquidity pool that efficiently matches long and short positions, ensuring sufficient liquidity.

Q: How can I buy MYX?

A: You can purchase MYX through multiple channels, including centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Q: Is investing in MYX risky?

A: Yes. As with any cryptocurrency investment, there are risks involved. MYX is no exception. Investors should always conduct thorough research and assess their own risk tolerance before making investment decisions.