KEYTAKEAWAYS

-

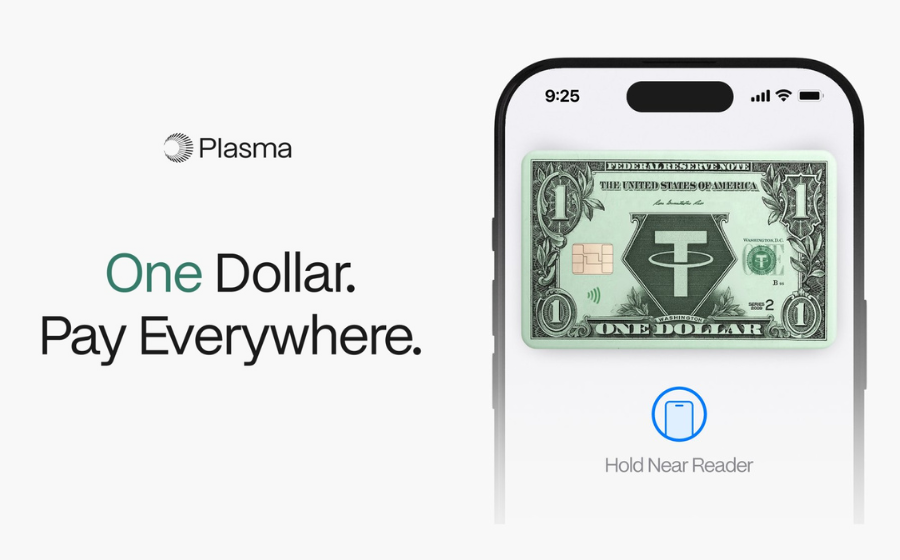

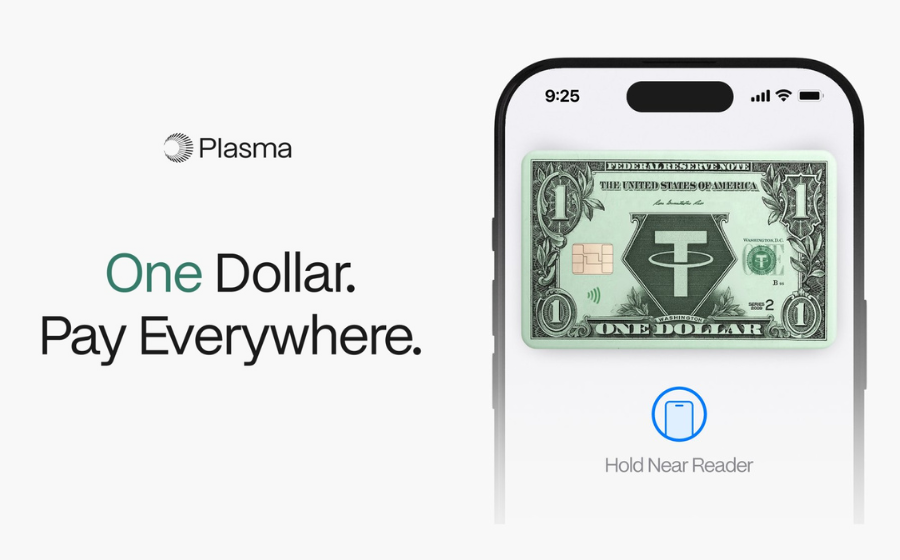

Plasma launches mainnet Beta with $2B stablecoin liquidity and zero-fee USDT transfers, aiming to challenge Tron, Solana, and Ethereum.

-

Backed by Tether, Founders Fund, and Binance, Plasma focuses on stablecoin payments with EVM compatibility and protocol-level fee abstraction.

-

Key risks include centralization, regulation, competition, and token economics; success depends on adoption and sustained user migration from existing networks.

CONTENT

According to official news, on September 25, 2025, the Plasma mainnet Beta program will officially launch. The team says this will be an important moment in the history of stablecoins: $2 billion in stablecoin liquidity will be pre-injected on chain at launch, and more than 100 DeFi protocols are ready to deploy at the same time.

For a new Layer 1, such a scale at the start is unusual. Media reports call it “a new network born for stablecoins.” Its biggest feature is zero-fee USDT transfers. When users send Tether through Plasma’s official entry, they no longer need the native token XPL to pay Gas. The fee is covered by the protocol. This “disappearing fee” experience is seen as a direct challenge to Tron, Solana, and Ethereum. Whether Plasma can reshape the stablecoin payment path will be revealed in the months after the mainnet goes live.

CAPITAL AND PEOPLE BEHIND PLASMA

Plasma’s founder Paul Faecks was a fintech entrepreneur. In 2024 he officially brought Plasma into the spotlight. After that, several major investors and institutions joined, giving the chain a strong foundation.

In May this year, Founders Fund announced a strategic investment. Founder Peter Thiel made a rare public statement, saying stablecoins need “new infrastructure,” and Plasma is such an attempt. This is not only financial support but also a strategic endorsement, which brought Plasma attention from the start.

Tether/Bitfinex support is even more important. As the largest stablecoin issuer, Tether CEO Paolo Ardoino has spoken in favor of Plasma many times, calling it “a key piece for mainstream adoption of stablecoins.” Tether is not only investing, but also making USDT the core asset of Plasma’s ecosystem. This means Plasma starts with the stablecoin leader already tied in.

On the user side, Binance cooperation gives Plasma a natural advantage for cold start. In August, Plasma and Binance Earn launched the first on-chain USD₮ yield product. It attracted over $1 billion in a short time, quickly reaching the cap. This move not only tested Plasma’s on-chain yield ability but also let millions of normal users “rehearse” the future Plasma experience without even noticing.

TECHNOLOGY AND EXPERIENCE: THE DISAPPEARANCE OF FEES

While many blockchains focus on TPS and block time, Plasma’s technology story feels more “user-centered.”

Plasma uses PlasmaBFT consensus, based on the HotStuff Byzantine fault tolerant protocol. Official tests show Plasma can process thousands of transactions per second, with block time under one second and confirmation delay at the second level.

The execution layer is based on the Rust Reth client, fully EVM-compatible. This means developers can move Ethereum apps with almost no code changes, and users can use them directly through MetaMask and other common wallets.

The real change in experience is Gas abstraction. With protocol-level Paymaster design, users do not need to pay XPL when sending USDT. The fee is covered by an official pool. In other words, on Plasma, users see zero-fee transfers.

For cross-border micro-payments, this detail removes the barrier completely: no need to hold extra tokens, no worry about Gas volatility, just click “send” and it is done. This is in sharp contrast with Ethereum’s high Gas and Tron’s resource freezing model.

THREE RIVALS IN THE SHADOW

The news of Plasma’s launch puts the spotlight again on three chains.

Tron is the most direct rival. For a long time, Tron has carried most of the world’s USDT transfers with very low cost. In early September, Tron announced a 60% cut in network fees, from 210 sun to 100 sun. Many media saw this as “a defensive move before Plasma goes live.” Tron clearly does not want to give up its low-fee moat.

Solana is known for high performance. With 0.4 second block time, very low fees, and thousands of TPS, it leads in speed. But Solana’s non-EVM ecosystem and past outages limit its adoption in stablecoin payments. Plasma hopes to attract Ethereum protocols by combining EVM compatibility with stablecoin optimization.

Ethereum is still the main place for stablecoin total supply. Its strength is security and ecosystem depth, but high fees and long confirmation time make it unsuitable for small and frequent payments. Plasma positions itself as “a fast channel designed for stablecoin payments,” not as an all-purpose chain competitor.

For users, the real question is: once the mainnet is live, will people move their daily USDT transfers from Tron or Solana to Plasma?

THE COLD START TEST

Plasma has prepared a grand script for its cold start.

The team says that on launch day, $2 billion in stablecoin liquidity will enter, 100 protocols will deploy, and users can use apps like Aave, Ethena, and Euler from the first day.

Ethena’s presence is a highlight. USDe, a yield-bearing dollar stablecoin, already has the “hold to earn” habit among Ethereum users. If Plasma can offer both zero-fee transfers and yield at the same time, it will greatly increase stickiness of funds on the chain.

But the real cold start test is user habits. Today, most cross-border payment users are used to Tron’s USDT channel. To move them to Plasma, fees alone are not enough. Full support from exchanges and payment platforms is needed. If Binance and other exchanges quickly add Plasma deposit and withdrawal, adoption could grow much faster.

RISKS AND QUESTIONS

In Plasma’s story, risks are still present.

First is decentralization. In the Beta phase, validators are only a few nodes chosen by the team. This helps efficiency but makes it easy for outsiders to call it “centralized.” The team promises to open node permissions gradually, but the timeline is unclear.

Second is regulation. Stablecoin payments face strong regulatory pressure. If Plasma wants to enter markets in Latin America, the Middle East, or Africa, it must deal with foreign exchange and payment licenses. Without local approval, its “global payment” goal may be blocked.

Third is competition. Tron already cut fees to show it will not sit still. Ethereum L2s keep lowering costs, and Solana keeps improving stability. Whether Plasma can keep its zero-fee model long term will depend on its subsidy system and network sustainability.

Last is token economics. XPL will need to support both staking rewards and ecosystem incentives after launch. If transaction volume is too low to offset inflation, XPL price may face selling pressure. The token’s stability is key for Plasma’s long-term survival.

Plasma’s story is still at the trailer stage.

It has strong investors: Founders Fund, Tether, Bybit. It has a wide network of partners: Binance, Aave, Ethena. It has clear product highlights: zero-fee transfers, second-level confirmation, EVM compatibility.

But after September 25, the market will only ask one question: will users really use it?

Plasma’s fate is not in announcements or countdowns, but in real data after launch: Will transaction volume grow? Will stablecoins stay on chain? Will protocols stay active?

If it succeeds, it may rewrite the stablecoin payment landscape. If it fails, it will become a case study about experience, capital, and competition.