KEYTAKEAWAYS

- Prioritize income growth: Increase your main income for more investment, favoring steady growth through consistent investing in diversified assets like index funds.

- Adopt an investor mindset: Distinguish between investing and trading, and prioritize research, patience, and consistency over quick gains.

- Asset Allocation: Diversify your stock portfolio by not putting all your eggs in one basket. Consider spreading your investments across different sectors and price ranges.

- KEY TAKEAWAYS

- INTRODUCTION

- UNDERSTANDING THE BASICS

- STRATEGY 1: PICK WINNING STOCKS

- STRATEGY 2: PLAY THE LONG GAME OR SHORT GAME?

- STRATEGY 3: KNOW YOUR RISK LEVEL

- STRATEGY 4: BUY-AND-HOLD

- STRATEGY 5: GET PAID WITH DIVIDENDS

- STRATEGY 6: DON’T PUT ALL YOUR EGGS IN ONE BASKET

- STRATEGY 7: SMART TOOLS MAKE SMART INVESTORS

- STRATEGY 8: LEARN TO MANAGE YOUR RISK

- WHY INVEST IN THE STOCK MARKET IN INDIA?

- TAKING THE FIRST STEP TOWARDS FINANCIAL GROWTH

- INVESTOR QUIZ: DISCOVER YOUR INVESTING STYLE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Unlock the secrets of India’s stock market with this beginner’s guide. Learn 8 proven strategies to make money through smart investing, tailored specifically for the unique dynamics of the Indian financial landscape.

INTRODUCTION

UNDERSTANDING THE BASICS

The stock market might seem like a complex beast, but at its core, it’s simply an online marketplace where you can buy tiny ownership pieces (shares) of real companies. You might hear on the news that “the market was up today.” This usually refers to how a group of major companies, like the S&P 500 or the Dow Jones, are doing overall. Think of it like a report card for the whole market, indicating whether things are generally good or bad that day. This guide is your cheat sheet to understanding this exciting world, even if you’re a complete beginner.

Let’s break it down

- Owning a slice: Each share is like a miniature ownership stake in a company. The more shares you own, the bigger your “slice of the pie.”

- Why companies sell shares: Companies sometimes need extra cash to grow, so they sell shares to investors.

- Investing for growth: People buy these shares (often via online trading platforms nowadays) because they believe the company will do well in the future. If the company thrives, the value of those shares (like a rare baseball card) might increase, allowing investors to sell them for a profit.

FUNDAMENTAL STRATEGIES FOR MAKING MONEY IN STOCKS

Investing in the stock market can be a compelling way to grow your wealth over time. However, navigating the complexities of the market can be daunting, especially for beginners.

- Knowing The Indian Stock Market Landscape:

The Indian stock market is primarily regulated by the Securities and Exchange Board of India (SEBI). SEBI plays a vital role in protecting investor interests and fostering a fair and transparent market environment.

In addition, there are two prominent stock exchanges operate in India:

These exchanges list thousands of companies across various sectors, providing investors with a diverse range of investment opportunities.

The Nifty 50 and Sensex are two key benchmark indices that track the performance of the Indian stock market. Next, let’s get into practical strategies for making money in the Indian stock market.

STRATEGY 1: PICK WINNING STOCKS

Identifying high-potential stocks requires a combination of thorough research and sound judgment. Here are some crucial criteria to consider:

Fundamentals are your friends: Focus on a few key metrics to understand a company’s financial health and make comparisons:

- Revenue and Earnings Growth: Look for companies with consistent growth patterns over several quarters or years.

- Debt-to-Equity Ratio: A low ratio suggests the company isn’t overly reliant on debt. A high ratio could signal potential financial trouble.

- Profit Margins: Compare a company’s margins to its competitors. High margins indicate it effectively controls costs.

- Price-to-Earnings Ratio (P/E): This tells you if a stock might be undervalued or overvalued compared to its earnings.

Read Between the Lines: Go beyond basic numbers.

- Company reports and filings: Look for positive forward-looking statements in earnings announcements. Read 10-K and 10-Q filings for detailed financial information.

Some companies in India that fall into the criteria of being top growth stocks or fastest growing companies include:

- Zomato

- Adani Green Energy

- L&T Infotech

- Trent

- Adani Enterprises

- Tata Consultancy Services Ltd

- Infosys Ltd

- Hindustan Unilever Ltd

- Reliance Industries Ltd

- HDFC Bank Ltd

These companies have been identified as top growth stocks or fastest growing companies based on their sales compounded annual growth rate (CAGR) and their potential to generate significant returns for investors.

STRATEGY 2: PLAY THE LONG GAME OR SHORT GAME?

Align your investment strategy with your financial goals and risk tolerance:

- Long-Term: Buy and hold stocks for years, letting your investments grow over time.

- Short-Term: Buy and sell quickly, aiming to make money from price swings (riskier!).

Investment Strategies: Benefits and Risks

| Strategy | Benefits | Risks |

|---|---|---|

| Long-term |

|

|

| Short-term |

|

|

STRATEGY 3: KNOW YOUR RISK LEVEL

Before venturing into the market, self-awareness is key. Understanding your risk tolerance and trading personality is crucial.

Ask yourself:

- Are you comfortable with frequent trades and potential volatility?

-

-

- If you answered yes, you might be the Aggressive type of investor: Take bigger chances on stocks that could have big upswings (but also big downswings).

-

- Do you prefer a more hands-off approach, focusing on long-term holdings?

-

- If yes, you should follow more Conservative tactics: Choose stable companies, even if growth is slower.

Or, head to our quiz to find out what type of investor you are in 3 minutes.

STRATEGY 4: BUY-AND-HOLD

Buy-and-hold is a passive investment strategy where an investor purchases financial assets, such as stocks or ETFs, and holds them for a long period, regardless of short-term market fluctuations. This approach is based on the belief that the value of the investments will increase over time.

Buy-and-hold investors do not sell after a decline in value, do not engage in market timing, and do not believe in calendar effects such as Sell in May. The strategy is often recommended for individuals seeking long-term returns and has been praised by legendary investors like Warren Buffett and Jack Bogle. Here’s a breakdown of its core principles:

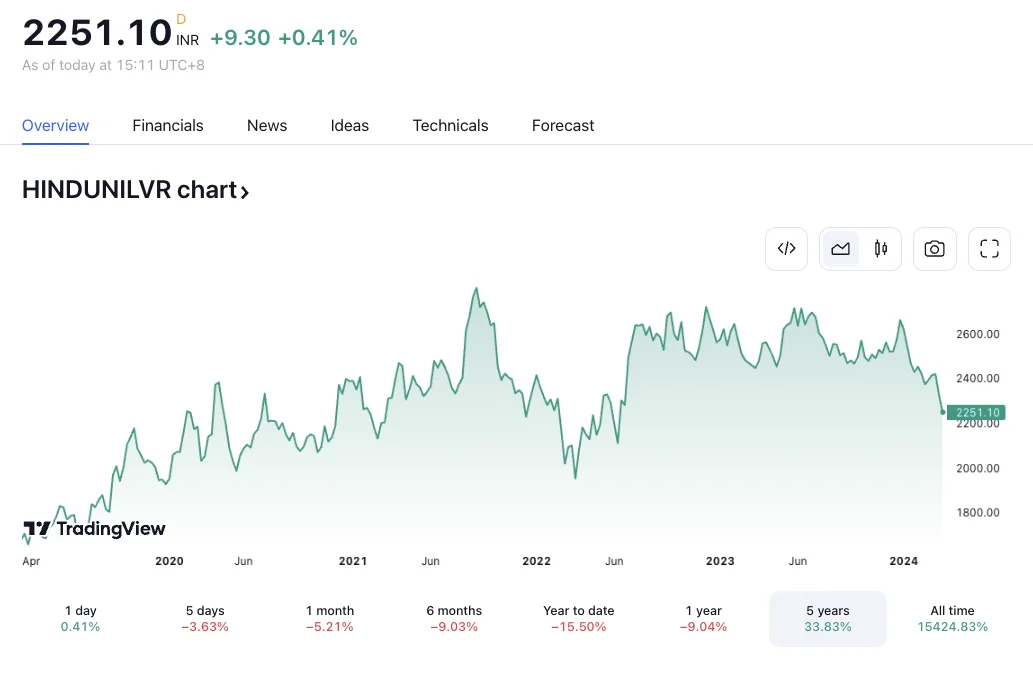

Source: TradingView

Invest in well-established companies:

- Look for companies with a solid track record, strong financial performance, and a history of innovation.

- Companies like Hindustan Unilever Limited (HUL) or Nestle India (NESTLE) have a long history of consistent growth and brand recognition in the Indian market.

Don’t panic and sell during market downturns:

- The stock market is cyclical, and historically, long-term investors who held through market fluctuations have been rewarded.

- For instance, if you had bought and held shares of Infosys (INFY) during its early growth phases, you would have seen tremendous growth despite market fluctuations. *(Infosys has demonstrated strong historical performance, with a one-year share price return of 88.94% and an impressive three-year share price return of 306.41%.)

STRATEGY 5: GET PAID WITH DIVIDENDS

Dividends are payments made by a company to its shareholders as a reward for investing in the company. These payments can be in the form of cash or additional shares of stock. Dividends are typically distributed from the company’s profits and are approved by the company’s board of directors. They provide investors with a source of income and can indicate that a company is financially stable and profitable

The dividend growth strategy focuses on companies with a history of consistently increasing their dividend payouts. This strategy is suitable for investors seeking regular income alongside long-term capital appreciation.

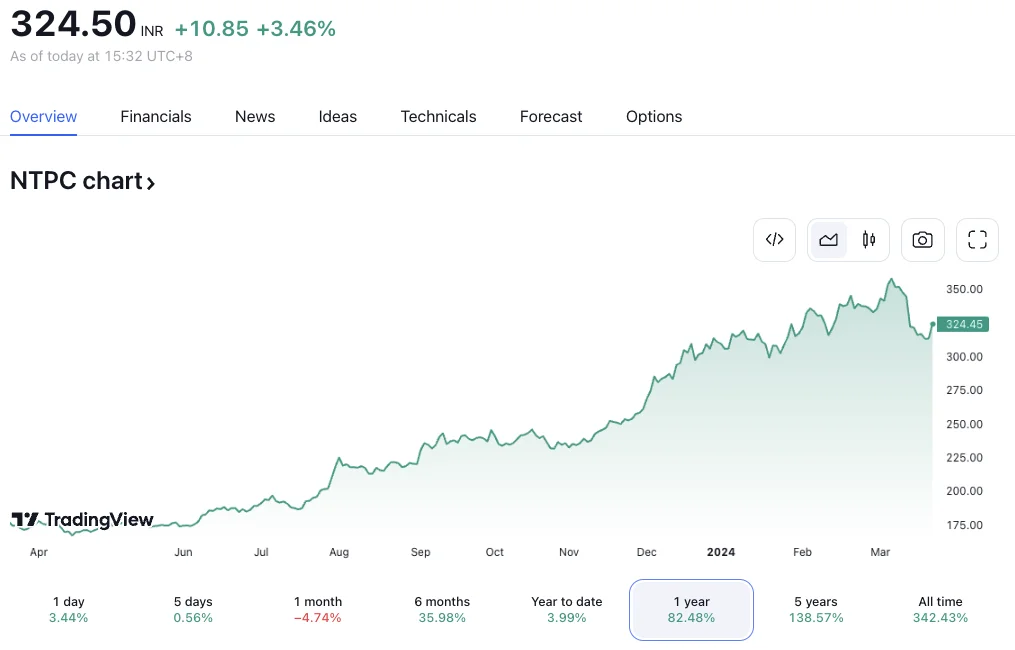

Source: TradingView

- Seek companies with a consistent dividend growth record: Look for companies in sectors known for dividend growth, like utilities (e.g., NTPC Limited – NTPC) or consumer staples (e.g., Hindustan Unilever Limited – HUL). These companies often have a history of raising their dividends year after year, even during economic downturns.

- Reinvest dividends to accelerate growth: Consider companies like Tata Consultancy Services (TCS) or Sun Pharmaceutical Industries Ltd. (SUNPHARMA), both known for consistent dividend payouts and growth. Reinvesting their dividends means:

-

- More Shares: You automatically increase your ownership stake in the company.

- Compounding Growth: Over time, those extra shares themselves start earning dividends, leading to even faster growth.

STRATEGY 6: DON’T PUT ALL YOUR EGGS IN ONE BASKET

Diversification is a crucial risk management strategy. It involves spreading your investments across various asset classes and sectors to minimize the impact of a downturn in any single area.

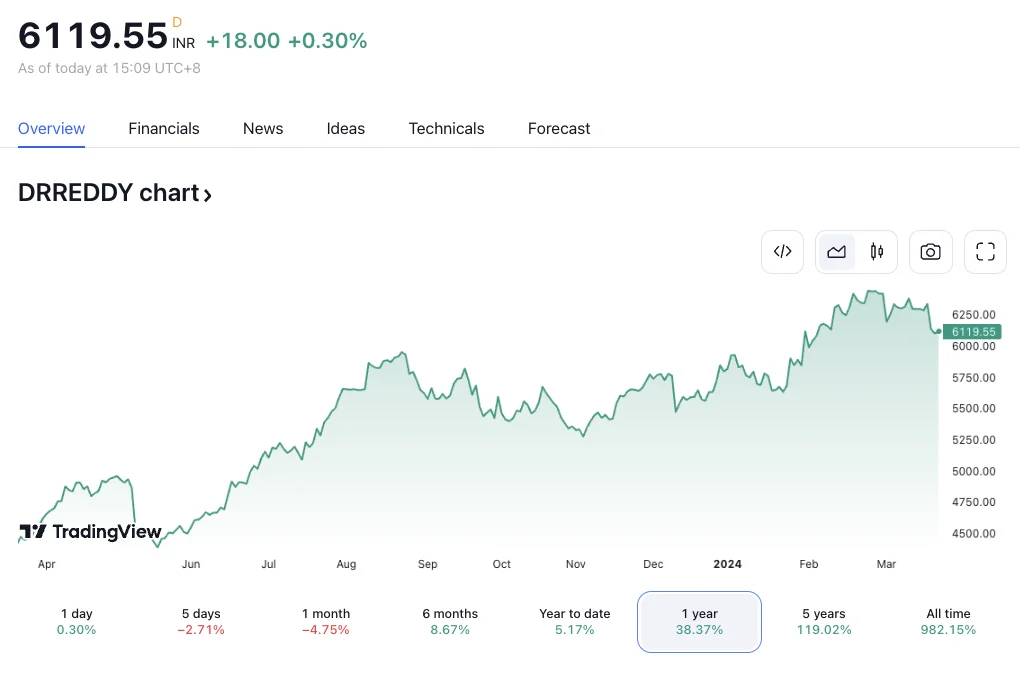

Source: TradingView

- Invest across different sectors: Don’t concentrate your investments in just one industry. For example, if the IT sector experiences a slump, having investments in healthcare (e.g., Dr. Reddy’s Laboratories Ltd. – DRREDDY) or financials (e.g., HDFC Bank – HDFC) can help offset potential losses.

- Consider asset allocation: Include various asset classes in your portfolio beyond stocks. Bonds can provide stability during market downturns, while Real Estate Investment Trusts (REITs) like IndiGrid (IndiGrid InvIT) can offer income and diversification.

Meanwhile, you should also be aware of:

- Overdiversification: While diversification is crucial, spreading your investments too thinly across numerous uncorrelated assets can dilute potential returns. Aim for a balance between diversification and concentrated positions in high-conviction stocks.

STRATEGY 7: SMART TOOLS MAKE SMART INVESTORS

Equipping yourself with the right tools can enhance your investment journey:

- Utilize online resources: Leverage online platforms such as Fidelity, WeBull, Charles Schwab, Ally Invest, Empower, and FundRise to research companies, analyze market trends, and stay informed.

- Stay updated with market news: Remain informed about current events and economic factors that may impact the market. Platforms like AlphaSense offer comprehensive features for stock and investment research.

- Leveraging CoinRank.io: CoinRank.io offers a comprehensive suite of investment insights and resources. These include:

-

- Latest tech trends pertinent to the market: Stay ahead of the curve by exploring CoinRank.io’s analysis of the top five tech trends expected to shape the market in 2024.

- Key financial number and highlights: Access financial statements, key metrics, and expert ratings to make informed investment decisions.

- Educational insights: Explore articles, tutorials, and webinars covering various investment topics, from fundamental analysis to portfolio management.

STRATEGY 8: LEARN TO MANAGE YOUR RISK

Investing involves risk, but understanding and applying risk management techniques can significantly minimize those risks. Here’s how to protect your money:

- Don’t Try to Time the Market: No one can consistently predict short-term highs or lows. Instead of trying to guess the optimal moment, focus on investing for the long term. This allows you to ride out temporary market fluctuations and benefit from potential growth.

- Set Realistic Limits: It’s easy to get caught up in excitement. Before investing, determine how much risk you’re comfortable taking. Start with small investments and gradually increase them as your knowledge and experience grows. If in doubt, seek guidance from a reputable financial advisor.

- Embrace Stop-Loss Orders: A stop-loss order automatically sells a stock when it falls below a pre-set price. This tool helps limit losses if a stock takes an unexpected downturn.

- Be Aware of Your Limits: It’s easy to get overconfident! Do your research, start small, and don’t be afraid to ask for advice from a financial professional.

WHY INVEST IN THE STOCK MARKET IN INDIA?

The Indian stock market has emerged as a dynamic and promising avenue for wealth creation. With a rapidly growing economy, a young and tech-savvy population, and a slew of government initiatives aimed at boosting the capital market, India offers a compelling investment landscape for both domestic and international investors.

Here are some key factors highlighting the potential of the Indian stock market:

- Economic Growth: India is projected to be the world’s fastest-growing major economy in the coming years, fueled by factors like a large domestic market, rising disposable incomes, and increasing urbanization. This economic expansion is expected to translate into growth opportunities for listed companies, potentially leading to higher stock prices.

- Demographic Advantage: India boasts a young and growing population, with a median age of 28. This demographic dividend is expected to fuel consumption and economic activity, creating a fertile ground for businesses and potentially positive returns for investors.

- Government Initiatives: The Indian government has implemented various reforms aimed at attracting foreign investments and stimulating the capital market. These initiatives include simplifying investment regulations, promoting ease of doing business, and encouraging digitalization of financial services.

These factors, along with the sheer size and diversity of the Indian stock market, make it a potentially lucrative investment destination for beginners and experienced investors alike.

However, it is crucial to remember that the stock market is inherently volatile, and success requires a combination of knowledge, discipline, and a long-term perspective.

TAKING THE FIRST STEP TOWARDS FINANCIAL GROWTH

The Indian stock market presents a compelling opportunity for wealth creation, fueled by a growing economy, a young population, and government initiatives. By taking the first step and educating yourself, you can begin your journey towards long-term financial growth.

Bridging the Gap: How Much Can You Earn and Is It Good for Earning Money?

While we’ve covered the core concepts, you might be wondering about the potential returns and suitability of the stock market for making money. Here’s a quick breakdown:

How much you can earn from the share market is highly variable and depends on several factors:

- Investment strategy: Long-term investors aiming for steady growth can expect different returns compared to short-term traders focused on capitalizing on market movements.

- Company selection: Investing in well-established companies with strong fundamentals and growth potential can significantly impact your returns.

- Market conditions: Overall market trends and economic factors can influence stock prices and your returns.

There’s no guaranteed formula for earning a specific amount in the stock market. However, history suggests that the stock market has the potential to outperform other asset classes like fixed deposits or savings accounts over the long term.

Is the share market good for earning money?

The share market can be a good avenue for earning money, but it’s not without risks. Here’s a balanced perspective:

- Potential for high returns: The stock market offers the potential for significantly higher returns compared to traditional savings vehicles.

- Risk of loss: Stock prices can fluctuate, and there’s always the possibility of losing money on your investments.

- Requires knowledge and discipline: Successful investing involves understanding the market, researching companies, and managing your risk tolerance.

The key takeaway is that the share market can be a powerful tool for wealth creation, but it’s not a get-rich-quick scheme. By educating yourself, making informed decisions, and adopting a long-term perspective, you can increase your chances of success in the Indian stock market.

INVESTOR QUIZ: DISCOVER YOUR INVESTING STYLE

This quiz will help you identify your potential investing style based on your risk tolerance and time horizon. There are no right or wrong answers, so be honest with yourself!

Instructions:

For each question, choose the answer that best reflects your preferences.

- How comfortable are you with potential losses in your investments?

a) I can stomach short-term losses if there’s a chance of higher returns. (1 point)

b) I prefer investments with a history of steady growth, even if the gains are moderate. (3 points)

c) I’m very cautious and prioritize minimizing risk over maximizing gains. (5 points)

- Imagine you have extra money to invest. How soon would you need access to it?

a) I’m looking to grow my wealth over a long period (5+ years). (3 points)

b) I might need the money within a few years for a major purchase. (1 point)

c) I may need the money within the next year for short-term goals. (5 points)

- How much time are you willing to dedicate to actively managing your investments?

a) I’m comfortable researching and monitoring my investments regularly. (1 point)

b) I’d prefer a more hands-off approach with minimal ongoing management. (3 points)

c) I have limited time and prefer a set-it-and-forget-it investment strategy. (5 points)

- How do you react to sudden market fluctuations?

a) I can stay calm and focused on my long-term goals even during downturns. (3 points)

b) I might get nervous and consider selling my investments if the market dips. (1 point)

c) Market volatility stresses me out, and I’d prefer to avoid it altogether. (5 points)

- Which of these statements best describes your investment goals?

a) Maximize my potential returns, even if it means taking on more risk. (1 point)

b) Grow my wealth steadily over time and achieve my long-term financial goals. (3 points)

c) Preserve my principal investment and avoid any potential losses. (5 points)

Scoring:

Add up your points from each question.

- 5-10 points: You might be a Long-Term Investor. You prioritize steady growth and are comfortable with a buy-and-hold strategy.

- 11-15 points: You might be a Balanced Investor. You value a mix of growth and stability, seeking moderate risk with a mid-term horizon.

- 16-25 points: You might be a Risk-Averse Investor. Your primary concern is preserving your capital, and you prioritize low-risk investments with shorter time horizons.

Remember: This quiz is a starting point. Consider your personal financial situation, risk tolerance, and investment goals before making any investment decisions. Consulting with a financial advisor can be extremely helpful for creating a personalized investment strategy.

Whether you’re a seasoned trader or just researching how to make money in the stock market as a beginner, here are more market insights to equip you with the knowledge and tools to consistently identify market-beating stocks and build a profitable portfolio over the long term.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!