KEYTAKEAWAYS

- Weekly jobless claims dropped to 218,000, underscoring labor market resilience and challenging the assumption that the Federal Reserve will cut rates aggressively in the near term.

- Stronger labor data reduced the likelihood of rapid policy easing, keeping Treasury yields firm and delaying liquidity support, complicating the outlook for both equities and digital assets.

- Bitcoin reacted with choppy trading, as initial optimism faded when slower rate-cut expectations took hold, showing how macroeconomic data continues to shape crypto market sentiment.

CONTENT

U.S. jobless claims fell to 218,000, signaling labor market resilience. This delays aggressive Fed rate cuts and weighs on Bitcoin, highlighting the macro-crypto connection.

THE DATA FROM THE LABOR DEPARTMENT

The U.S. Department of Labor released its latest jobless claims data yesterday, offering a timely snapshot of the labor market’s condition.

Seasonally adjusted initial claims for unemployment benefits registered 218,000, down from a revised 232,000 the previous week. The four-week moving average, which smooths short-term volatility, declined slightly to 237,500, while continuing claims dipped by 2,000 to 1.926 million. The insured unemployment rate remained steady at 1.3%.

Together, these figures highlight a labor market that has not yet cracked under tighter monetary policy. While hiring momentum has cooled in broader payroll data, the weekly decline in jobless claims suggests employers are not accelerating layoffs.

In fact, the persistence of low claims contrasts with earlier weak payroll figures, complicating the narrative of a rapidly deteriorating economy.

IMPLICATIONS FOR RATE CUT EXPECTATIONS

The stronger-than-expected jobless claims data prompted markets to reassess Federal Reserve policy expectations.

Weak payroll numbers earlier in the month had fueled speculation that the Fed would need to accelerate interest-rate cuts. Investors assumed policymakers would act swiftly to prevent a deeper slowdown.

However, yesterday’s release told a different story.

Fewer Americans filing for benefits signaled labor market resilience, supporting wages and raising the risk of inflation remaining sticky. As wage growth is a key inflation driver, the Fed will likely exercise caution. Rather than cutting rates aggressively, officials may opt to wait for further confirmation that inflation is returning to target. Futures markets adjusted quickly, trimming expectations of rapid easing in favor of a slower, more measured path.

Moreover, the narrative of a “soft landing” gained traction.

If the labor market continues to hold up, the Fed can prioritize inflation control without triggering widespread job losses. Yet this also implies rate cuts, while still likely, could be postponed or delivered in smaller increments than previously anticipated.

MARKET REACTIONS AND BITCOIN’S PERFORMANCE

Markets moved immediately after the jobless claims release.

U.S. Treasury yields firmed as traders priced out some aggressive rate-cut bets, while the dollar found support from stronger relative yield expectations. Equities delivered a mixed performance, reflecting the tension between economic resilience and the possibility of delayed policy relief.

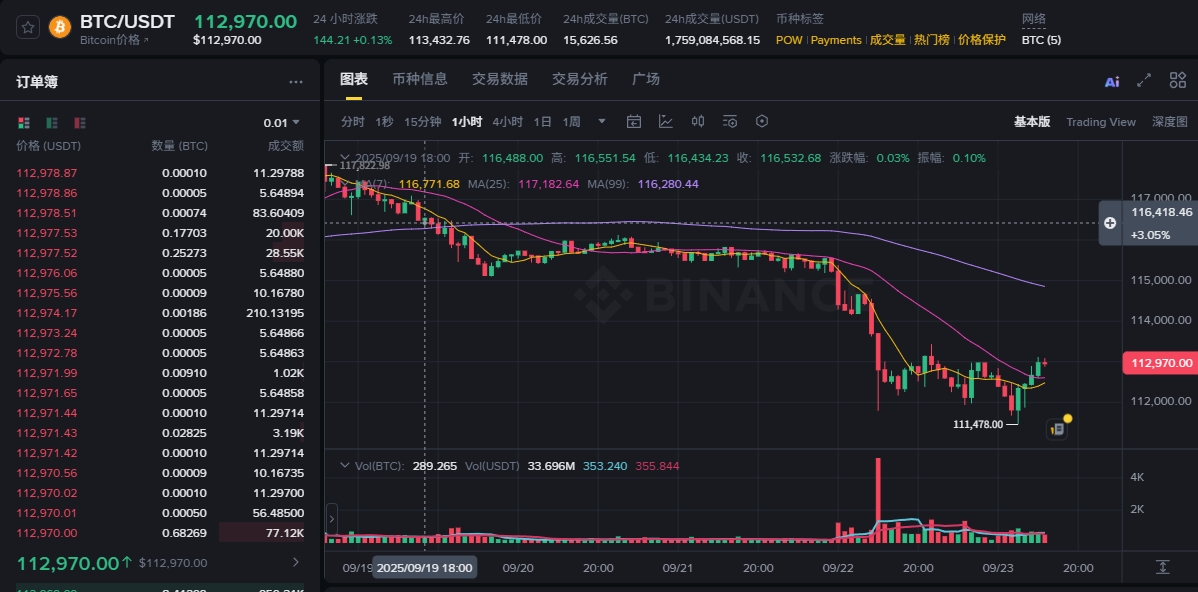

Bitcoin mirrored this push and pull.

Initially, BTC ticked higher, as traders focused on the broader stability implied by the data. But as the implications for monetary policy became clearer, those gains faded. The prospect of slower liquidity support weighed on sentiment, leaving Bitcoin trading unevenly for the remainder of the session.

This dynamic is familiar. Bitcoin often reacts positively to signs of economic stability, but when stability translates into prolonged tighter policy, the tone shifts. In this case, labor market strength reinforced the idea that aggressive rate cuts will not arrive as quickly as some had hoped.

THE BROADER MACRO NARRATIVE

Yesterday’s report also needs to be understood in the context of recent mixed signals.

August’s nonfarm payrolls rose by only 22,000, raising concerns of stagnation. Yet the decline in jobless claims suggests layoffs remain muted. This divergence points to an economy where hiring has slowed dramatically but companies remain hesitant to cut staff, perhaps remembering the difficulty of rehiring during the pandemic recovery.

For policymakers, this divergence is critical. If job creation falters while layoffs remain low, the U.S. economy may drift into a lower-growth but still-tight labor market. Such an environment complicates the Fed’s mission: inflation may prove sticky even as growth cools. This makes the timing and pace of rate cuts even more dependent on inflation trends, with labor data serving as supporting evidence.

WHY CRYPTO INVESTORS SHOULD CARE

For crypto markets, the connection between labor data, monetary policy expectations, and Bitcoin is clear.

Rate cuts serve as liquidity injections, lowering the opportunity cost of holding BTC and typically weakening the dollar—conditions that often support digital assets.

But when labor market strength delays those cuts, the bullish narrative weakens. This does not automatically signal bearish conditions, but it does imply that momentum in crypto will depend more on adoption, institutional flows, and on-chain activity rather than macro liquidity alone. Without imminent policy easing, investors may need to adjust expectations for a slower grind higher instead of a rapid rally.

In the short term, Bitcoin may remain sensitive to every piece of incoming macro data, consolidating within ranges as traders reassess. Inflation readings will become especially important: if price pressures ease, the case for earlier cuts strengthens, potentially reigniting crypto enthusiasm. If inflation stabilizes or rises, however, yesterday’s claims may mark the start of a longer narrative in which the Fed adopts a slower, more deliberate approach.

CONCLUSION

The drop in jobless claims to 218,000 underscored a resilient U.S. labor market, challenging assumptions that the Fed would rush into easing. For policymakers, the data supports a more cautious approach to rate cuts, balancing inflation control with economic stability. For Bitcoin, the outcome is nuanced: stability reduces recession risks but delays the liquidity tailwinds that often drive digital-asset rallies.

As always, macro data remains a powerful force shaping Bitcoin’s trajectory. Employment figures, inflation, and monetary policy do not exist in isolation; they ripple through traditional markets and digital assets alike. For crypto investors, recognizing these interconnections is essential to navigating the months ahead.