KEYTAKEAWAYS

- Crypto bull markets are driven primarily by global liquidity conditions, while narratives act only as catalysts that accelerate capital flows rather than create sustained demand.

- Viewing crypto as a non-cash-flow alternative asset clarifies why interest rates, liquidity, and risk appetite matter more than valuation models or traditional equity comparisons.

- A global asset rotation framework starts with macro drivers, cycle awareness, and U.S. monetary conditions before narrowing down to specific assets or market narratives.

- KEY TAKEAWAYS

- INTRODUCTION: STARTING FROM CAPITAL, NOT STORIES

- STEP ONE: STEP OUTSIDE CRYPTO AND MAP THE GLOBAL ASSET UNIVERSE

- WHY CRYPTO BELONGS TO ALTERNATIVE ASSETS, NOT TRADITIONAL RISK ASSETS

- LIQUIDITY AS THE CORE DRIVER OF CRYPTO PERFORMANCE

- STEP TWO: FOCUS ON MACRO DRIVERS BEFORE ASSET DETAILS

- STEP THREE: BUILD A CYCLE-BASED MENTAL MODEL

- CONCLUSION: A FRAMEWORK BEFORE A FORECAST

- DISCLAIMER

- WRITER’S INTRO

CONTENT

A macro-driven framework explaining how global liquidity, interest rates, and risk appetite shape asset rotation—and why crypto bull markets depend on capital, not narratives.

INTRODUCTION: STARTING FROM CAPITAL, NOT STORIES

This article marks the beginning of a new research series on global asset allocation and rotation. One of the most counterintuitive realizations after digging into this topic is also the most important: what ultimately determines a crypto bull market is not the emergence of new narratives.

Whether it is RWA, X402, or any other concept, these themes usually function as triggers rather than true drivers. They ignite attention, but they do not supply energy. The real fuel comes from capital. When liquidity is abundant, even weak narratives can be inflated into market-wide consensus. When liquidity dries up, the strongest stories struggle to sustain momentum.

This first part focuses on building the foundation: how to construct a global asset allocation and rotation framework that places crypto in its proper macro context. The second half of the framework will follow in a subsequent article.

How I Turned a Directional Quant Model Into a Real Trading System

STEP ONE: STEP OUTSIDE CRYPTO AND MAP THE GLOBAL ASSET UNIVERSE

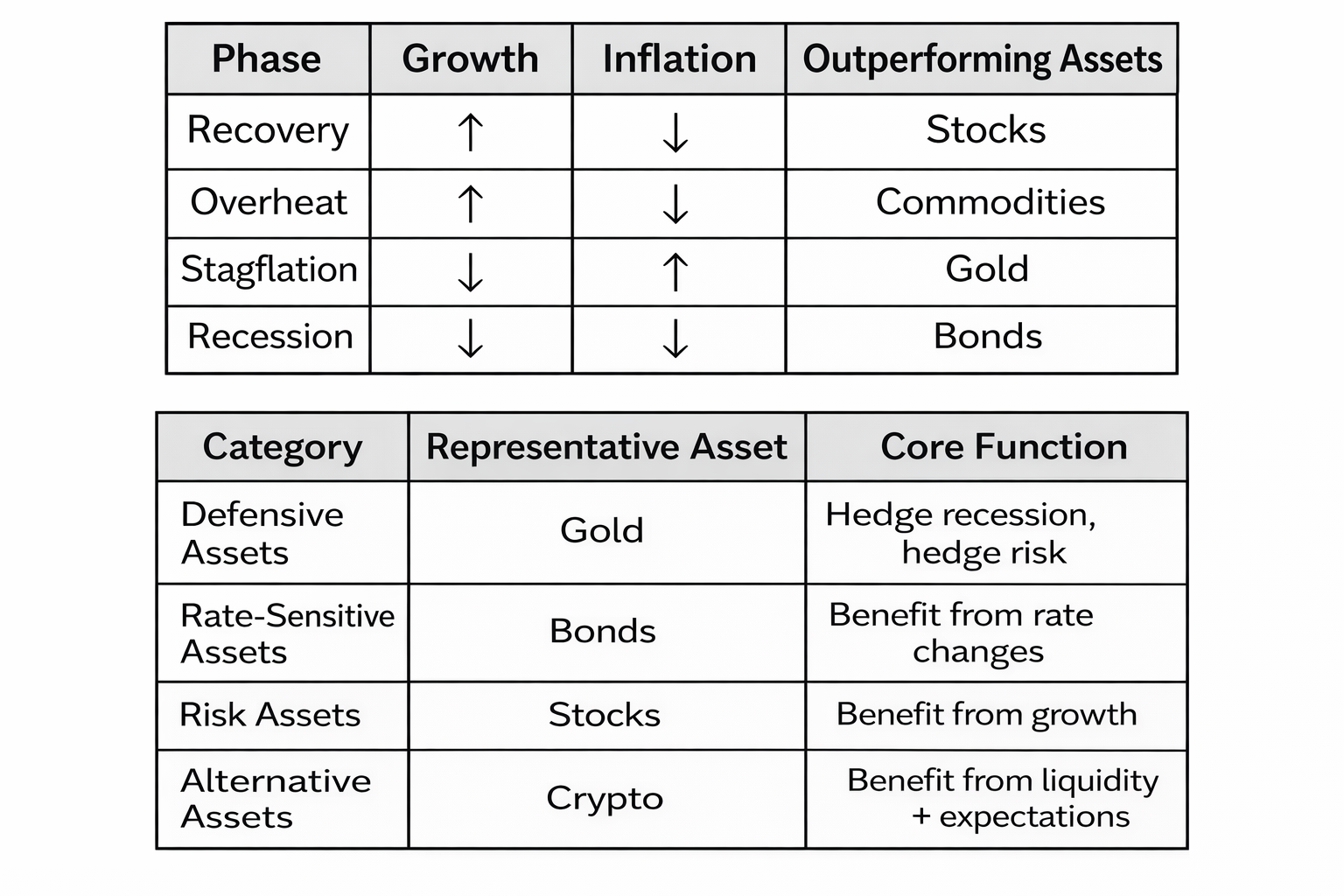

The first step is to deliberately step outside the crypto market and build a panoramic view of global assets. Traditional classifications—stocks, bonds, commodities—are useful, but they are not sufficient for understanding capital rotation across cycles.

Instead, assets can be grouped by the role they play at different stages of the economic and liquidity cycle. What matters is not whether an asset is labeled “equity” or “commodity,” but what it feeds on and what it is vulnerable to. Some assets thrive on falling real rates, others on inflation uncertainty, and others on outright risk aversion.

Constructing an “asset universe map” does not require deep expertise in every market. What it does require is an intuitive understanding of each asset’s dependencies: what conditions support it, and what conditions undermine it. This mental map becomes the reference system for all later decisions.

Within this framework, crypto deserves special treatment.

WHY CRYPTO BELONGS TO ALTERNATIVE ASSETS, NOT TRADITIONAL RISK ASSETS

Crypto is often grouped with equities—especially U.S. tech stocks—because their price movements are highly correlated. On the surface, this classification makes sense. Crypto exhibits extreme volatility, high beta, and sharp drawdowns, all of which resemble risk assets.

However, correlation alone does not define economic nature.

From a capital-structure perspective, equities have cash flows. Companies generate earnings, distribute dividends, and can be valued using discounted cash flow models or valuation multiples. Even when prices deviate from fundamentals, the anchoring logic remains cash-flow-based.

Crypto assets operate under a fundamentally different logic. They do not generate dividends, and they do not have intrinsic cash flows that can be discounted. As a result, traditional valuation frameworks simply do not apply.

Instead, crypto behaves as a pure liquidity-sensitive asset. Price performance is overwhelmingly driven by capital inflows and outflows rather than by changes in fundamental productivity. Narratives help explain why money moves, but they do not determine whether money moves.

This is why crypto is better understood as a non-cash-flow alternative asset that sits at the extreme end of the risk preference spectrum. It performs best when liquidity is abundant and risk appetite is elevated, and it underperforms when capital prioritizes safety and yield.

LIQUIDITY AS THE CORE DRIVER OF CRYPTO PERFORMANCE

Once crypto is framed as a liquidity asset rather than a valuation asset, its behavior across cycles becomes easier to interpret.

In equity research, price targets often come from a structured process: forecasting future revenue, applying a valuation multiple, and discounting the result back to the present. This approach works because the asset itself generates measurable economic output.

Crypto does not offer this anchor. Its upside depends on whether new capital is willing to enter the market and accept higher prices. That capital almost always comes from outside the crypto ecosystem—from equities, credit, or cash that has become idle due to falling yields.

This is why understanding the source and timing of liquidity flows matters more than tracking individual protocols or narratives. When capital begins searching for higher volatility and higher convexity, crypto becomes one of the most attractive destinations. When capital prioritizes preservation, crypto is usually the first asset to be reduced.

In short, liquidity is the decisive variable. Everything else is secondary.

STEP TWO: FOCUS ON MACRO DRIVERS BEFORE ASSET DETAILS

The second pillar of the framework is macro analysis. Rather than starting with asset-specific research, it is more efficient to first identify the variables that move all assets together.

At the highest level, five macro indicators play a central role:

- Interest rates, especially the distinction between nominal and real rates

- Inflation measures such as CPI and PCE

- Economic growth indicators like PMI and GDP trends

- System-wide liquidity, often reflected in central bank balance sheets and money supply

- Risk appetite, commonly proxied by volatility indices and credit spreads

Many crypto participants pay close attention to Federal Reserve meetings, but often focus only on headline rate decisions. Institutional capital, however, places greater emphasis on real rates—nominal rates adjusted for inflation—because they determine the true opportunity cost of holding non-yielding assets.

Inflation data is widely discussed in crypto circles, but liquidity and risk appetite receive far less attention. This is a blind spot. Money supply dynamics and volatility regimes often explain broad market behavior long before narratives emerge.

A useful mental model is a simple transmission chain:

Inflation pressures influence interest rates.

Interest rates affect liquidity conditions.

Liquidity conditions shape risk appetite.

Risk appetite drives asset prices.

Understanding where the economy sits within this chain provides far more insight than analyzing assets in isolation.

STEP THREE: BUILD A CYCLE-BASED MENTAL MODEL

Economic cycles are a familiar concept, but they remain essential. At a very high level, cycles tend to alternate between expansion and contraction, easing and tightening.

In simplified terms, the pattern often looks like this:

Periods of monetary easing favor risk assets, including crypto and small-cap equities.

Periods of monetary tightening favor defensive assets such as cash, government bonds, and gold.

This framework is not meant to be mechanically applied. Each asset reacts differently depending on timing, expectations, and positioning. Still, having a cycle-based reference prevents emotional decision-making during regime shifts.

One important nuance is that cycles are not synchronized globally. The world does not move as a single economy.

The United States may be transitioning from late-cycle high rates toward easing as growth momentum slows. Japan may be cautiously exiting decades of ultra-loose policy. China continues to navigate a low-inflation structural adjustment, while parts of Europe struggle with stagnation.

Despite this divergence, the U.S. remains the anchor. Dollar liquidity and U.S. interest rates still exert the strongest influence on global capital flows. For that reason, any global asset rotation framework should start with the United States and expand outward.

CONCLUSION: A FRAMEWORK BEFORE A FORECAST

This first half of the framework emphasizes structure over prediction. The goal is not to forecast short-term price movements, but to understand the forces that make certain assets viable at specific moments in time.

By reframing crypto as a liquidity-driven alternative asset, focusing on macro drivers before narratives, and grounding decisions in cycle awareness, investors can avoid many common analytical traps.

The next article will build on this foundation and move deeper into capital flow sequencing, real-world indicators, and how to identify when liquidity is genuinely transitioning toward high-risk assets.

The above viewpoints are referenced from @Web3___Ace