KEYTAKEAWAYS

- Kalshi Prediction Market lets users trade real-world event outcomes through simple Yes/No contracts priced between USD 0 and USD 1.

- As a CFTC-regulated platform, Kalshi Prediction Market offers legal U.S. access, strong transparency, and institutional-grade trading tools.

- By aggregating collective intelligence, Kalshi Prediction Market turns uncertainty into market-driven probability signals across finance, politics, sports, and more.

CONTENT

Kalshi Prediction Market is the first federally regulated U.S. prediction market, enabling transparent Yes/No trading on real-world events with CFTC oversight and probability-based pricing.

WHAT IS KALSHI PREDICTION MARKET?

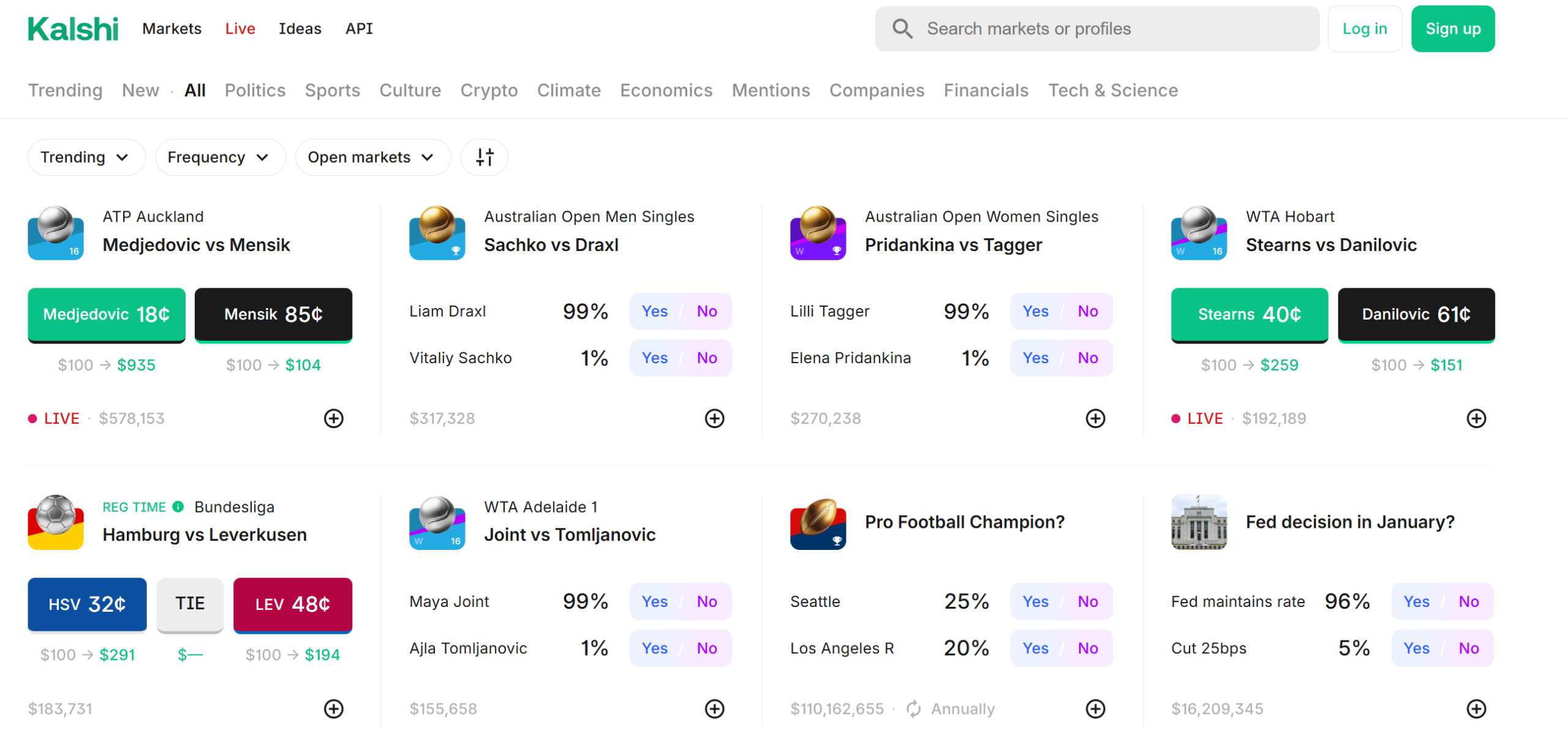

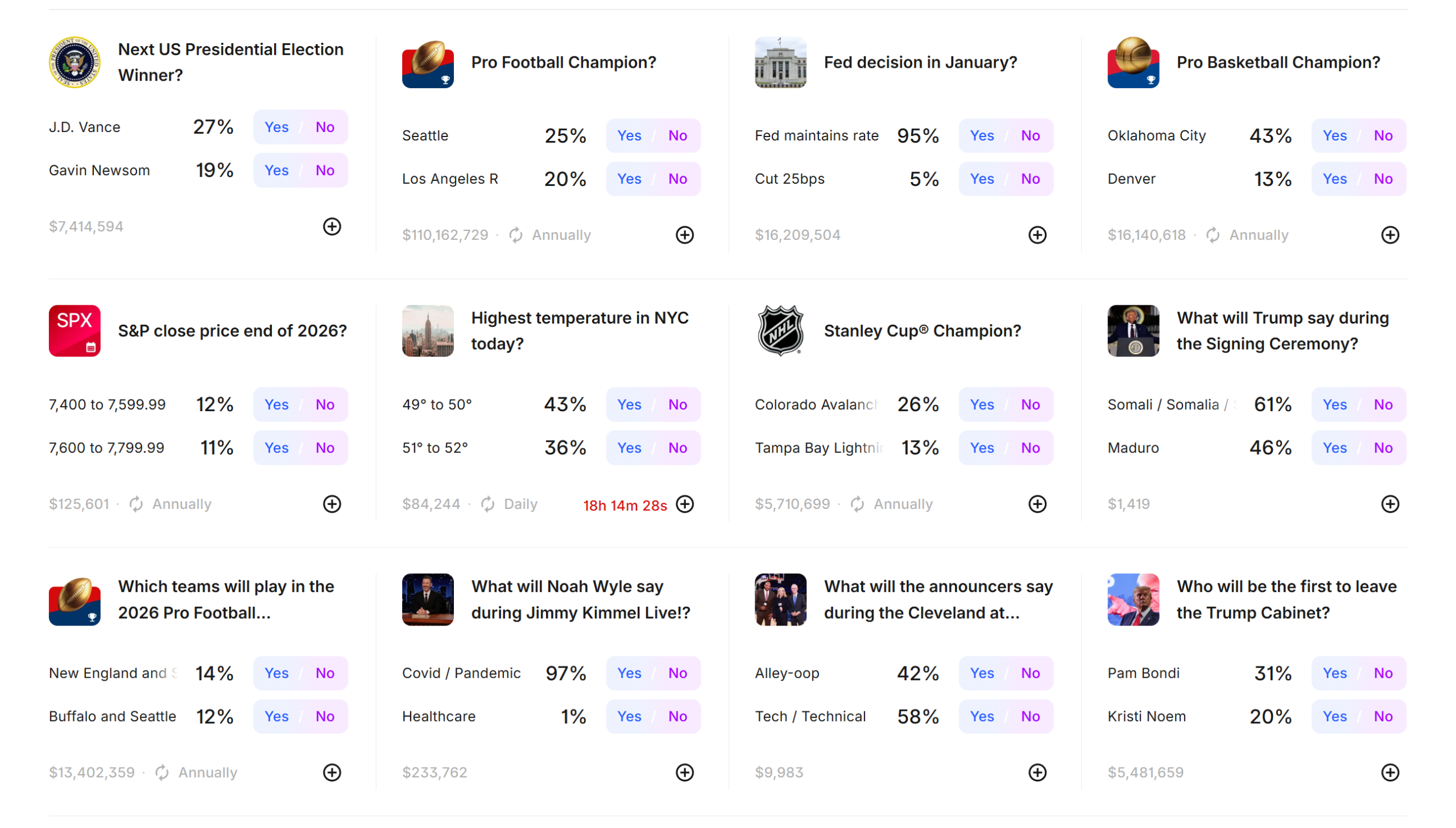

Kalshi Prediction Market is the first federally regulated prediction market in the United States, operating as a centralized platform that allows users to take positions on the outcomes of real-world events. Rather than trading traditional financial assets, Kalshi enables markets to directly price whether a specific event will occur.

The scope of events available on Kalshi Prediction Market is broad and spans multiple real-world domains, including weather, politics, economics, finance, and certain public or entertainment-related topics. Examples include whether a particular policy will pass, whether a company will enter bankruptcy, or whether a predefined economic indicator will reach a certain level. As long as an event has a clearly defined and verifiable outcome, it can potentially be listed on Kalshi.

➤ Official website: https://kalshi.com/

🔍 How Do Event Contracts Work?

At the core of Kalshi Prediction Market is its use of event contracts. Each event is structured around two opposing outcomes:

- Traders who believe the event will occur can buy a Yes contract

- Traders who believe the event will not occur can buy a No contract

Each contract is priced between USD 0 and USD 1. This price reflects the market’s real-time assessment of the probability that the event will occur. For example, if a Yes contract is trading at USD 0.70, the market is effectively assigning a 70% probability to that outcome.

Once the event’s result is officially determined, Kalshi Prediction Market settles all open positions according to predefined rules. Contracts tied to the correct outcome are settled at USD 1 per contract, while contracts tied to the incorrect outcome expire worthless. The payoff structure is binary, transparent, and directly linked to the final result of the event.

Overall, Kalshi Prediction Market transforms real-world uncertainty into a structured, tradeable market. By allowing participants to express views on concrete outcomes—within a federally regulated framework—Kalshi turns collective judgment into probability-based pricing, offering a unique way to engage with risk, information, and expectations surrounding real-world events.

>>> More to read: What is Polymarket? Web3 Prediction Market

KEY FEATURES OF KALSHI

Kalshi Prediction Market is best known for its simple and intuitive Yes/No contract structure, allowing participants to take clear positions on event outcomes without complex payoff formulas. This design lowers the learning curve while keeping market signals transparent and easy to interpret.

✅ The platform supports a broad range of event categories, covering both traditional and emerging markets, including:

- Finance: Federal Reserve interest rate decisions, recession probabilities

- Politics: election-related and policy-driven outcomes

- Sports: match winners and tournament results

- Entertainment: major awards such as the Oscars and the Grammy Awards

- Crypto: crypto-related events tied to market or protocol outcomes

- Real-World Assets (RWA): real-economy–linked event contracts

✅ Beyond market diversity, Kalshi Prediction Market differentiates itself through a combination of regulatory clarity and trader-focused features. Its key advantages include:

- Full legal availability across the United States

- Interest on cash balances, offering up to 4% annualized yield

- Relatively high liquidity with tight bid–ask spreads, reducing execution friction

From a trading infrastructure perspective, Kalshi Prediction Market provides tools typically seen in mature financial venues rather than casual prediction platforms:

- Support for limit orders and a live order book

- Mobile trading functionality for managing positions on the go

- Competitive fee structure with low per-contract maximum exposure, lowering entry barriers

✅ In late 2025, Kalshi further expanded its ecosystem with the launch of Kalshi Research, an initiative dedicated to academic analysis of prediction market accuracy. According to published findings, Kalshi’s markets have often demonstrated stronger predictive accuracy during highly volatile events when compared with traditional forecasting approaches—highlighting the informational value embedded in Kalshi Prediction Market pricing.

>>> More to read: What Is a Prediction Market: How Markets Turn Uncertainty Into Usable Knowledge

KEY CONSIDERATIONS BEFORE USING KALSHI

While Kalshi Prediction Market offers a regulated and accessible way to trade outcomes of real-world events, users should carefully consider several important factors before getting started.

1️⃣Regulatory Compliance and U.S. Focus

Under the oversight of the CFTC, Kalshi Prediction Market is fully legal and available across the United States. However, access may be restricted or unavailable in many international jurisdictions. Before registering, users should verify local regulations based on their location and confirm their eligibility to participate.

2️⃣Market Volatility

Event contract prices can fluctuate rapidly between USD 0.01 and USD 0.99 in response to breaking news and shifts in market sentiment. While this volatility can create attractive profit opportunities, it also introduces the risk of significant losses—especially during fast-moving events such as elections or major economic announcements.

3️⃣Liquidity Differences Across Markets

Highly followed markets—such as Federal Reserve rate decisions, major elections, or high-profile tournament outcomes—typically benefit from deep liquidity and tight bid–ask spreads. In contrast, niche or less popular events on Kalshi Prediction Market may experience lower trading volume, which can reduce execution efficiency when entering or exiting positions.

4️⃣Settlement and Verification Risk

Event outcomes are settled using trusted public sources, such as official government data or designated authorities like NCAA.com. Kalshi’s regulated structure minimizes dispute risk, but rare delays or clarification periods may still occur. As a result, users should carefully review the settlement rules for each market before trading.

5️⃣Research and Informed Decision-Making

Although prices on Kalshi Prediction Market aggregate collective intelligence and have often proven highly accurate, they can occasionally diverge from underlying fundamentals. Conducting independent research on the event itself remains essential for improving decision quality and achieving long-term success.

>>> More to read: What is Oracle in Crypto?

The year of prediction markets

Thank you for a historic 2025 pic.twitter.com/VaGqw3bvC0

— Kalshi (@Kalshi) December 31, 2025

CONCLUSION

By 2026, Kalshi Prediction Market has successfully transformed prediction markets from a niche, experimental concept into a mainstream and federally regulated asset class. Supported by the regulatory safeguards of the CFTC framework, Kalshi enables users to trade real-world event outcomes in a compliant and transparent manner, with trading volumes in several key categories surpassing those of competing platforms.

Whether used to hedge macroeconomic risk, trade the outcomes of major sporting events, or forecast cultural and public-interest developments, Kalshi Prediction Market provides a clear, efficient, and verifiable set of tools that convert collective market intelligence directly into price signals.

As the platform continues to expand its partnerships—such as integrations with CNBC ticker symbols—and as academic research increasingly validates the superior accuracy of prediction markets, Kalshi Prediction Market is redefining how markets express uncertainty. Viewed more broadly, Kalshi’s evolution reflects a deeper shift toward the democratization of finance, where prediction itself is becoming an asset that can be rationally priced and openly accessed.