KEYTAKEAWAYS

- BlackRock's Expansion into Cryptocurrency: As a global asset management leader, BlackRock is venturing into cryptocurrency, reflecting a strategic adaptation to the evolving financial landscape.

- Innovative Investment Approaches: BlackRock’s foray into blockchain technology signifies its commitment to staying at the forefront of financial innovation, diversifying its investment portfolio.

- Impact on the Financial Market: BlackRock's move into digital assets may signal new trends in asset management, potentially influencing the future direction of global financial investments.

- KEY TAKEAWAYS

- BLACKROCK, INC.

- BLACKROCK’S TOP 10 US STOCK HOLDINGS IN Q3 2023

- INVESTING IN BLACKROCK, INC. (BLK) – ADVANTAGES AND DISADVANTAGES

- BLACKROCK CEO: CRYPTOCURRENCY WILL “SURPASS” ANY INTERNATIONAL CURRENCY

- BLACKROCK BITCOIN ETF

- THE SIGNIFICANCE OF BITCOIN SPOT ETFS FOR INVESTORS

- THE ARK 21SHARES APPROVAL WILL BE KEY INDICATORS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

BlackRock is a globally renowned asset management company headquartered in New York, USA, founded in 1988 by seasoned financier Larry Fink.

When it comes to BlackRock, market investors often associate it with the massive influence the company wields in the fields of investment management and financial services. As one of the world’s largest asset management companies, BlackRock is a behemoth institution in the global financial system.

In recent years, BlackRock has garnered attention for expanding its business scope, venturing into the realms of cryptocurrency and blockchain technology. What prompted this financial giant to enter cryptocurrency, and what opportunities do they envision? Let’s delve deeper to understand further details of it.

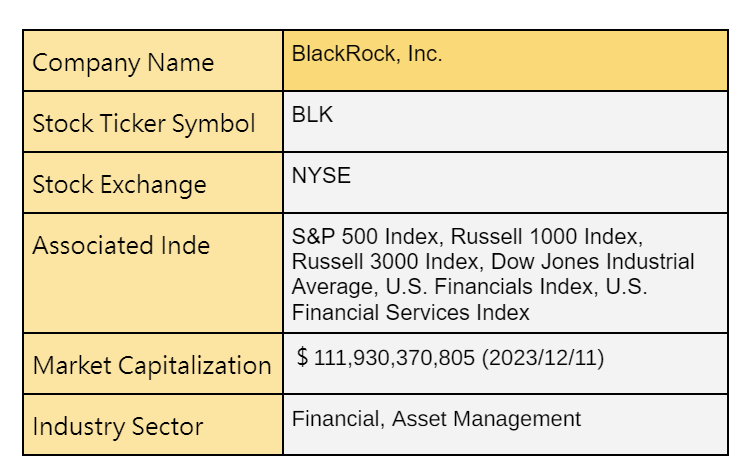

BLACKROCK, INC.

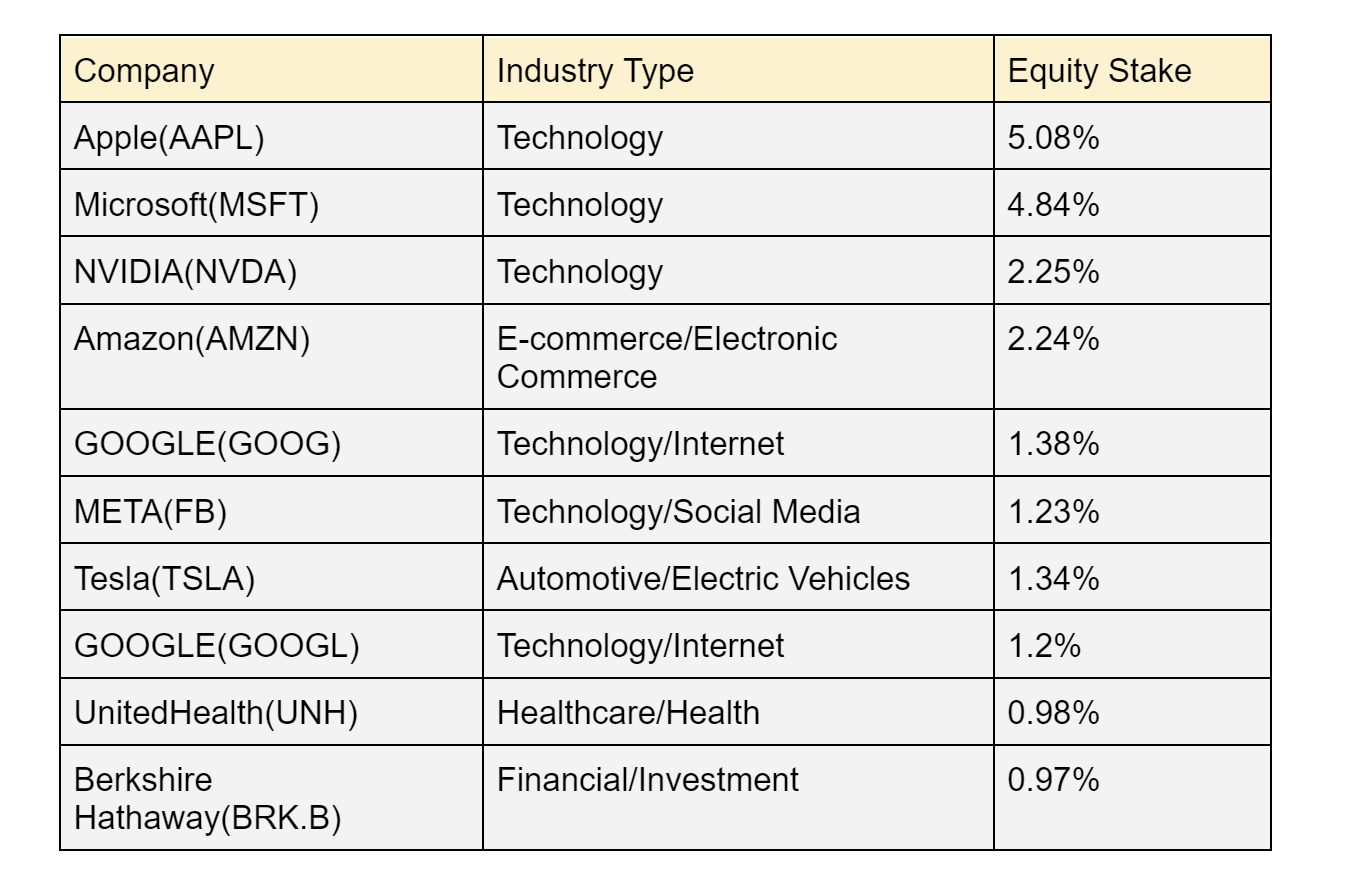

BLACKROCK’S TOP 10 US STOCK HOLDINGS IN Q3 2023

BlackRock manages a great deal of assets, totaling a staggering $9.1 trillion. The assets it invests in are highly diversified, catering to a wide range of clients, including retail investors and institutions.

BlackRock’s top eight holdings comprise the world’s most valuable and influential tech stocks, including Apple, Microsoft, NVIDIA, Amazon, Google, Meta, Tesla, and more. Among them, the market value of BlackRock’s holdings in Apple and Microsoft exceeds $160 billion each. Additionally, BlackRock holds both Class A and Class B shares of Google, with a combined carrying value of over $100 billion.

(Source: BlackRock)

INVESTING IN BLACKROCK, INC. (BLK) – ADVANTAGES AND DISADVANTAGES

Advantages:

- Global Largest Asset Management Company: BlackRock is one of the world’s largest asset management companies, possessing a massive scale of funds and a broad client base. It likely reflects investors’ strong confidence in its management capabilities.

- Product Diversity: BlackRock offers a diverse range of financial products, including ETFs, mutual funds, fixed-income, and risk management tools. It provides investors with opportunities for diversified investments across different categories, reducing risks.

- Technological Leadership: BlackRock is leading in the financial technology sector, utilizing advanced technology and data analytics to provide more effective investment solutions.

- Active Engagement in ESG Investments: BlackRock actively participates in Environmental, Social, and Governance (ESG) investments, which are increasingly emphasized in today’s investment environment.

Disadvantages:

- Market Monopoly Risk: As one of the largest global asset management companies, BlackRock faces the risk of market monopoly. It may subject it to stricter regulatory scrutiny and potential antitrust concerns.

- Dependency on Market Environment: BlackRock’s performance and profits are significantly influenced by market conditions, especially during periods of instability such as financial crises. It exposes it to the risk of revenue and stock price volatility.

- ETF Price Wars: BlackRock is a major participant in the ETF market, experiencing intense price competition. It could impact its management fees and revenue.

- Regulatory Risks: The financial industry is often subject to changes and adjustments in regulatory laws. It could potentially affect BlackRock’s business operations and profitability.

BLACKROCK CEO: CRYPTOCURRENCY WILL “SURPASS” ANY INTERNATIONAL CURRENCY

As one of the world’s largest asset management companies, BlackRock is actively entering the cryptocurrency field. It has applied for a Bitcoin spot ETF, “iShares Bitcoin Trust,” to the U.S. Securities and Exchange Commission (SEC). Undoubtedly, BlackRock’s move implicates a new wave of cryptocurrency ETFs, injecting strength into this market.

According to Larry Fink, CEO of BlackRock, an increasing number of clients are showing keen interest in digital assets. He believes cryptocurrencies have value in diversifying investment portfolios and predicts that cryptocurrencies will surpass any international currency.

However, things did not go as smoothly as the market imagined. BlackRock was rejected shortly after applying to the Bitcoin spot ETF to the SEC. However, the good news is that BlackRock resubmitted modified documents shortly afterward and reached a monitoring-sharing agreement with Coinbase.

Fink stated, ‘This is to make cryptocurrencies more democratic and reduce investor costs.’

Although Larry Fink refused to provide further details about the public application and did not comment on how regulatory agencies interpret the application, he does believe that products like Bitcoin can achieve what traditional ETFs did for the mutual fund industry. Suppose ETFs were a significant revolution for the mutual fund industry. In that case, BlackRock’s creation of more securitized assets and securities (such as Bitcoin) might lead to another revolutionary change in the financial sector.

BLACKROCK BITCOIN ETF

Looking back at the history, since 2013, multiple companies have submitted applications for the listing of cryptocurrency ETFs, including the persistent Grayscale Investments, which has continuously sought to transform its Bitcoin Trust Fund (GBTC) into a “Bitcoin Spot ETF,” but only to be repeatedly rejected by the U.S. Securities and Exchange Commission (SEC). As of 2023, the SEC has yet to approve any publicly traded Bitcoin ETF.

However, many investors are optimistic that BlackRock’s new ETF, the “iShares Bitcoin Trust,” could serve as a breakthrough for listing Bitcoin ETFs. Its assets primarily include Bitcoin held by Coinbase, which will act as the custodian for this trust, allowing investors to participate in Bitcoin trading easily.

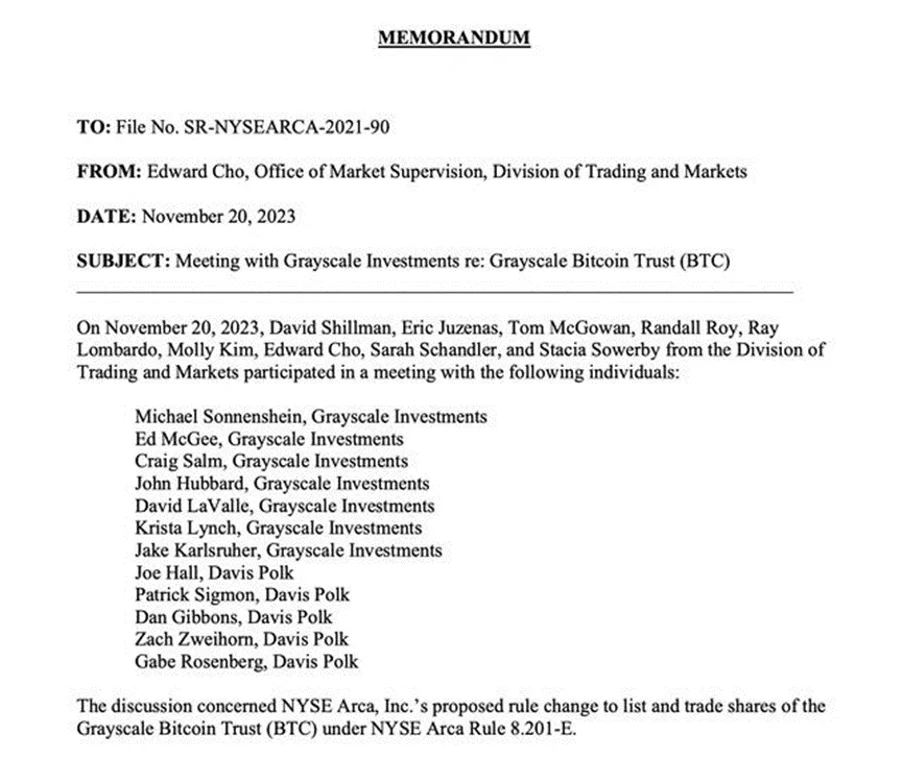

On November 24th, the U.S. Securities and Exchange Commission (SEC) official website disclosed two memoranda. One memorandum indicates that on November 20th, Eastern Standard Time, the SEC held discussions with Grayscale regarding the proposed rule changes for the listing and trading of the Grayscale Bitcoin Trust ETF.

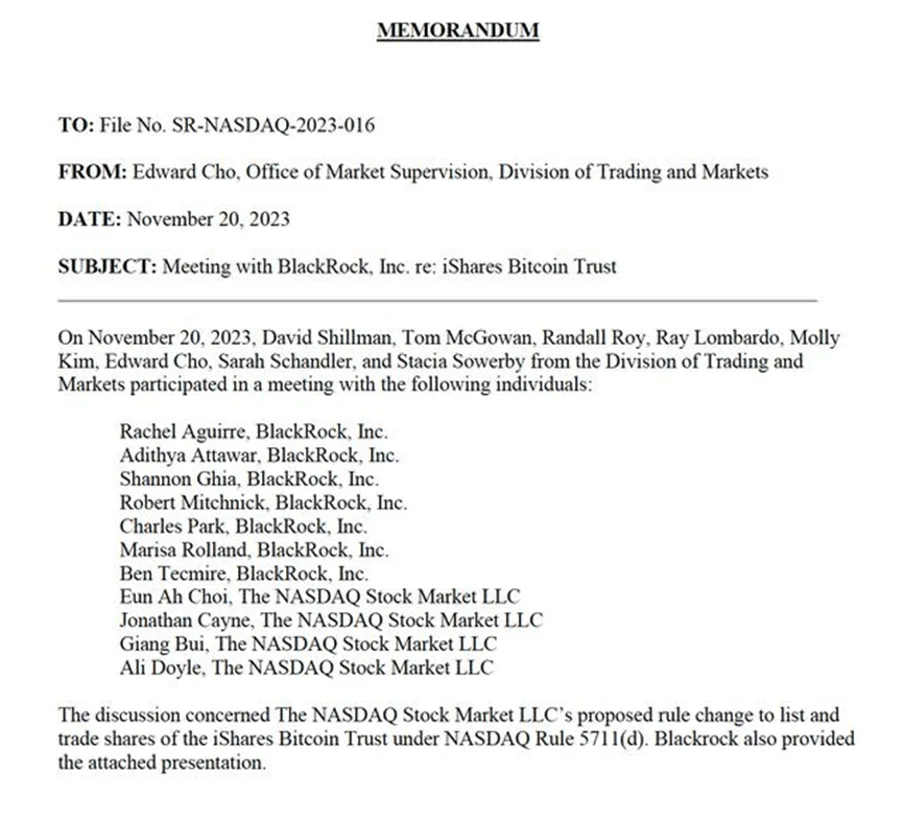

Another memorandum indicates that the U.S. Securities and Exchange Commission (SEC) discussed the listing and proposed rule changes for the iShares Bitcoin Trust ETF with BlackRock.

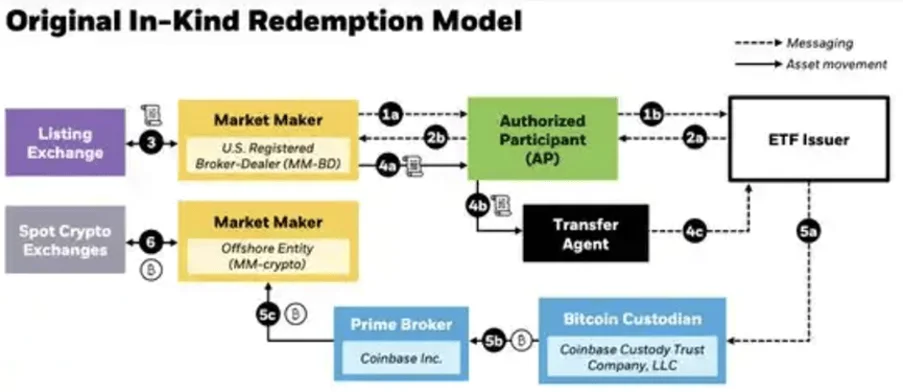

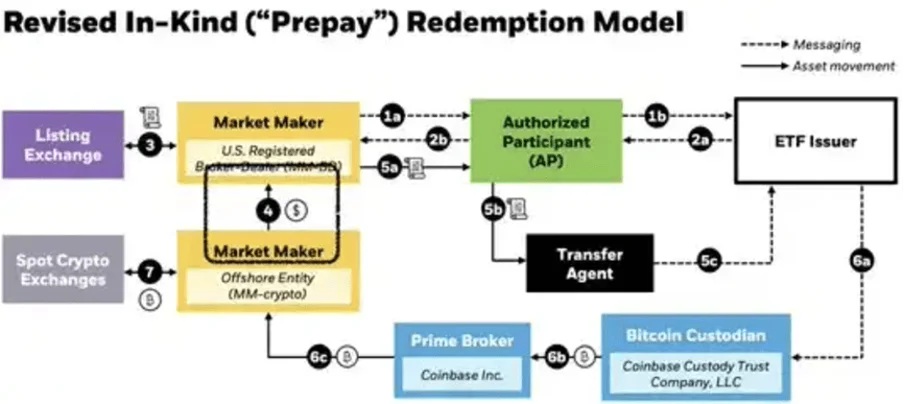

In this context, the memorandum with BlackRock shows a two-page PowerPoint presentation prepared by the company. It illustrates two methods of ETF redemption: the In-Kind Redemption Model and the In-Cash Redemption Model. The In-Kind Redemption Model implies that the final redemption involves the Bitcoin holdings of the ETF, while the In-Cash Redemption Model involves replacing Bitcoin holdings with equivalent cash.

As of December 2023, according to a report by The Block, the SEC has been in discussions with well-known investment firms, including BlackRock and Fidelity, regarding the technical details of a potential Bitcoin ETF tied to a spot trading platform. It might indicate that the SEC is nearing a decision on approving such a product.

Furthermore, on December 5, 2023, investment giant BlackRock (BLK) disclosed in a new filing submitted to the U.S. Securities and Exchange Commission (SEC) that the company had secured $100,000 in “seed funding” for its proposed Bitcoin (BTC) exchange-traded fund (ETF). The document states, “Seed capital* investors agreed to purchase $100,000 worth of shares on October 27, 2023, and delivered 4,000 shares (‘Seed Shares’) at $25 per share on October 27, 2023.”

Vivian Fang, a finance professor at Indiana University, mentioned that asset management firms such as BlackRock and Fidelity have recently met with the SEC to discuss the redemption process for a spot Bitcoin ETF. From an investor’s perspective, there is no distinction between cash and revised physical modes. Regardless of the chosen mode, investors can still receive cash refunds when redeeming shares.

*Seed capital represents initial funding seed investors provide to create units for the ETF foundation, enabling shares to be issued and traded on the public market.

THE SIGNIFICANCE OF BITCOIN SPOT ETFS FOR INVESTORS

The introduction of a Bitcoin spot ETF has a significant impact on investors. Firstly, this type of ETF combines traditional financial instruments with the cryptocurrency market, providing investors a more convenient way to participate in Bitcoin investments. Secondly, the structure of the ETF allows investors to engage in Bitcoin investment without the need to own or manage Bitcoin directly, lowering technological barriers and offering a more liquid investment option. Additionally, the launch of a Bitcoin spot ETF contributes to price discovery and transparency in the market, providing investors with more accurate market information.

In light of BlackRock actively applying for a Bitcoin ETF, investors may consider that with the approval of a Bitcoin spot ETF, the market could potentially see a substantial influx of capital. ETFs, touted as traditional financial investment products, emphasize risk diversification and convenient investment tools. With the advent of a Bitcoin ETF, it remains to be seen whether the market will shift its focus towards this “innovative ETF,” potentially bringing forth more investment opportunities.

THE ARK 21SHARES APPROVAL WILL BE KEY INDICATORS

Finally, what investors are most eager to know is when the Bitcoin ETF will actually go public. From the ETF application process, the maximum duration is 240 days, during which the SEC must make a final decision, whether to approve or reject. Taking the fastest-progressing ARK 21Shares Bitcoin ETF as an example, reviewing its application process suggests that a final decision will likely be reached around mid-January of the coming year. It’s essential to emphasize that the decision on the ARK 21Shares Bitcoin ETF may serve as a crucial indicator for Bitcoin ETFs. The pivotal point is on January 10, 2024, marking the final deadline for approving the ARK 21Shares Bitcoin ETF. If rejected, ARK 21Shares will have to go through the process again, initiating a lengthy 240-day review, similar to what they were rejected in 2022. A more profound impact is that if the ARK 21Shares Bitcoin ETF is rejected, subsequent applications from other companies are also likely to face challenges. Even financial giant BlackRock may not be exempt, as the SEC will not allow any institution to gain a significant first-mover advantage. If one is approved, others are likely to follow suit. Therefore, investors need to closely monitor the developments of ARK 21Shares from the end of 2023 to the beginning of 2024, as this may affect the exact listing time and schedule for the BlackRock Bitcoin ETF.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!