KEYTAKEAWAYS

CoinW: Elevate Your Cryptocurrency Trading with Innovative Features for Precision and Control. Unleash Efficiency and Confidence.

- KEY TAKEAWAYS

- COINW: PIONEERING PRECISION IN CRYPTOCURRENCY TRADING WITH TRAILBLAZING FEATURES

- 1. MERGE AND SPLIT: TAILORING YOUR TRADING EXPERIENCE

- 2. TRAILING STOP: PRECISION IN RISK MANAGEMENT AND PROFIT OPTIMIZATION

- 3. ONE-CLICK TO REVERSE: SWIFT RESPONSES TO MARKET SHIFTS

- 4. TWO-DIRECTION MECHANISM: NAVIGATING BOTH SIDES OF THE MARKET

- 5. PRE-TAKE PROFIT/STOP LOSS: STRATEGIC POSITION MANAGEMENT FROM THE START

- 6. ONE-CLICK TO LIQUIDATE: EFFORTLESS POSITION LIST MANAGEMENT

- DISCLAIMER

- WRITER’S INTRO

CONTENT

COINW: PIONEERING PRECISION IN CRYPTOCURRENCY TRADING WITH TRAILBLAZING FEATURES

In the dynamic realm of cryptocurrency trading, the ability to navigate swiftly and strategically is paramount. CoinW, a trailblazer in the crypto exchange landscape, introduces a suite of features tailored to elevate your trading experience—Split/Merge, Trailing Stop, One-Click to Reverse, Two-Direction Mechanism, Pre Take Profit/Stop Loss, and One-Click to Liquidate. Each of these features is meticulously designed to provide users with unprecedented control, efficiency, and flexibility in managing their positions.

1. MERGE AND SPLIT: TAILORING YOUR TRADING EXPERIENCE

CoinW‘s innovative Merge feature simplifies position management when multiple orders share the same trading pair, leverage, and direction. Seamlessly consolidating these orders into a singular entity with an average opening price and recalculated liquidation price, Merge frees traders from the complexities of individual cost calculations.

On the flip side, the Split option grants users unparalleled independence in position control, allowing distinct opening and liquidation prices for each position even within the same trading parameters. This duality empowers traders to adapt their strategies with ease, emphasizing simplicity in decision-making.

2. TRAILING STOP: PRECISION IN RISK MANAGEMENT AND PROFIT OPTIMIZATION

Enter CoinW‘s Trailing Stop—a powerful tool exclusively dedicated to closing existing positions. Whether in a long or short position, this feature dynamically adjusts the stop price, aligning with market movements. This strategic modification ensures swift execution at the prevailing market price, providing traders with a sophisticated approach to limiting losses and maximizing profits as market conditions evolve.

Example: The long position closed in a favorable direction

- Position: Long position 1BTC & Opening price $30,000

- Set Trailing Stop as follows: Trigger price 32,000 & 5% pullback rate

- At this time, as long as the latest market price continues to rise to 32,000, the trailing price will start trailing, and in the continuous rise, when the system receives a 5% price pullback, the system will automatically close the position at the market price.

Calculation:

- Assume that the market price has been rising after triggering 32,000, reaching 35,000

- At this time, the trailing price has also tracked to 35,000*(1-5%)=33,250

- However, after 35,000, the price stopped to rise and began to fall in the opposite direction. Since the trailing price never moves back when the market moves in a non-favorable direction, the trailing price remains at 33,250

- If the market price falls from 35,000 to 33,300 and then starts to rise again, the trailing stop order will not be executed, because the pullback rate has not reached 5%

- If the market price falls from 35,000 to 33,250 or below, the trailing order will be automatically closed at 33,250

- At last, the transaction price is 33,250, which is a stop loss compared to the highest point of 35000, but it is profitable compared to the opening price of 30,000.

- Closing the position in time before predicting a sharp fall not only locks in profits but also relatively maximizes profits when the direction is favorable.

3. ONE-CLICK TO REVERSE: SWIFT RESPONSES TO MARKET SHIFTS

For situations demanding rapid responses to market reversals, CoinW introduces the game-changing One-Click to Reverse function. Designed to save valuable time, this feature allows users to seamlessly reverse positions with a single click, ensuring they stay ahead of evolving market dynamics and capitalize on potential opportunities.

Example:

Users predict that the market price will rise to open a long position, but after opening the position, they find that the market not only does not rise but has a tendency to plummet.

The user has two choices: 1. the margin is enough to continue to carry the order, or 2. to open a short position in reverse to make a profit (if there is no one-click reverse function, the user has to manually close the long order first and then go to the place where the order is placed to place a new short order, which will take some time).

With the one-click reverse function, when the click is clicked, the system will close the current position at a millisecond speed, and then generate a reverse short position with the same leverage and the same amount.

4. TWO-DIRECTION MECHANISM: NAVIGATING BOTH SIDES OF THE MARKET

CoinW’s Two-Direction Mechanism adds a revolutionary dimension to trading by enabling the simultaneous holding of both long and short positions within the same trading pair. This unique capability provides traders with enhanced flexibility and risk management, allowing them to navigate both bullish and bearish movements concurrently.

Example:

The user opens a long position first, but the market price falls after the long position is opened but the user does not want to close the position immediately and turn the unrealized loss into an actual loss.

Therefore, after the user opens a short position in the same trading pair and places an order for a short position, it can be seen as the estimated liquidation price of the original long position has become, or the estimated liquidation price of the newly opened short position.

At this time, the loss of long positions and the profit of short positions are balanced, so there is no risk of liquidation. According to the subsequent market changes, users can first close the profitable positions at the right time.

If the losses of the losing positions have reached their own tolerance range or you have already made a profit, you can choose to close the losing position, or if you feel that the amount of loss still does not meet your requirements, you can re-open the hedging order and choose to continue to carry the order.

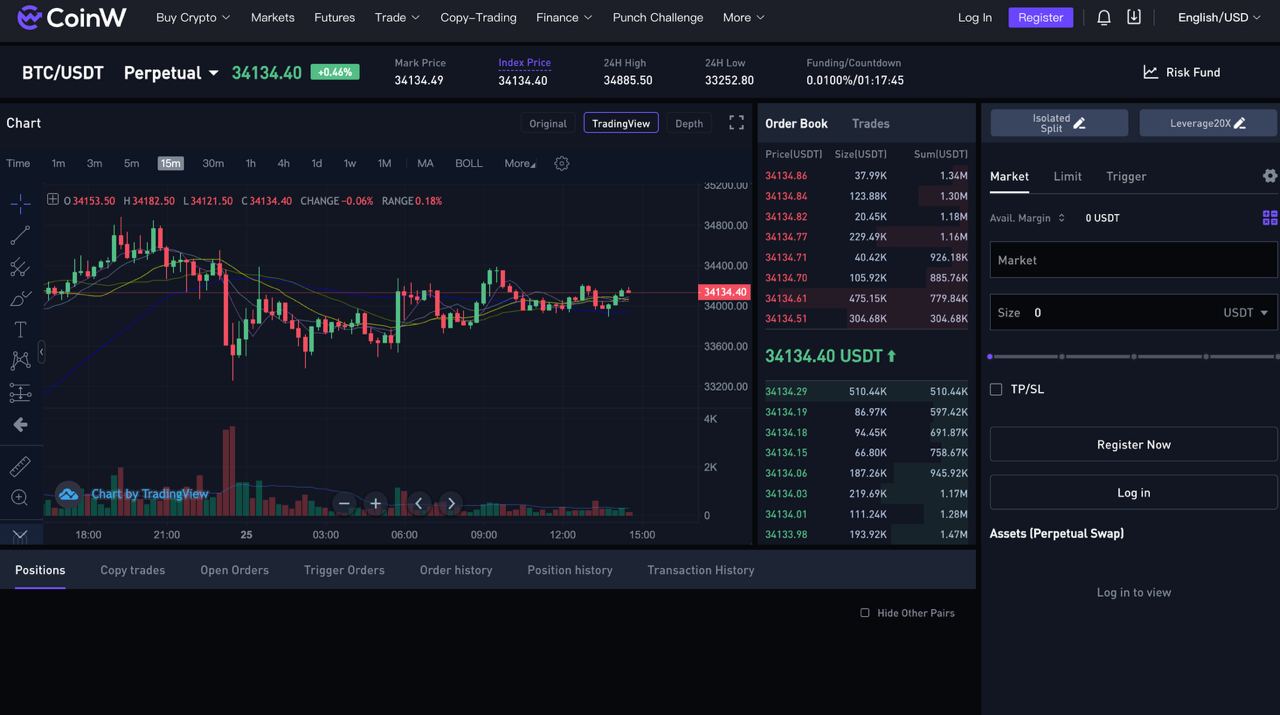

5. PRE-TAKE PROFIT/STOP LOSS: STRATEGIC POSITION MANAGEMENT FROM THE START

With the Pre-Take Profit/Stop Loss feature, CoinW empowers users to set desired take profit and stop loss prices before initiating opening orders. This proactive approach eliminates the need for post-opening market monitoring, enhancing efficiency and enabling strategic decision-making from the outset.

6. ONE-CLICK TO LIQUIDATE: EFFORTLESS POSITION LIST MANAGEMENT

Streamlining position list management, CoinW‘s One-Click to Liquidate feature offers the convenience of swiftly organizing positions in a single click. Say goodbye to tedious manual operations—this functionality simplifies the process, enabling users to take control of their portfolios with speed and convenience.

Example:

The user is in the same trading pair, or multiple trading pairs, and has many existing positions, and the positions are currently profitable. If the user wants to quickly convert the floating profit of all positions into actual profits, he/she can directly operate the one-click function to close the position. According to the latest market price, all positions are unified and closed at the market price.

Unleash Control, Efficiency, and Innovation on Your Trading Journey with CoinW

Embark on a trading journey where control, efficiency, and innovation converge. CoinW‘s suite of features is poised to transform your approach, providing the tools needed to navigate the complexities of cryptocurrency markets with confidence and precision. Elevate your trading experience with CoinW—where every feature is crafted to empower you in the ever-evolving world of cryptocurrency trading.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!