KEYTAKEAWAYS

- Political Impact & Market Confidence: Trump's return and pro-crypto stance triggered a 40% Bitcoin surge to $99,655, while attracting $4B+ in institutional investments through ETFs within two weeks of the election.

- Infrastructure Evolution: The launch of Bitcoin and Ethereum spot ETFs brought in $50B+ in months, while blockchain upgrades on Ethereum (Dencun) and Solana's growth created more efficient, accessible networks.

- Institutional Integration: Traditional finance embraced crypto in 2024 through ETFs, stablecoin adoption ($190B market cap, $20T transaction volume), and long-term investment strategies, setting the stage for Bitcoin's potential rise to $200,000 in 2025.

CONTENT

From Trump to ETFs: Our in-depth crypto market analysis breaks down 2024’s defining moments in digital assets. See how institutional adoption and technological breakthroughs shape 2025’s outlook.

If you’ve been watching the crypto market in 2024, you’ve probably noticed something different – the wild price swings of previous years have given way to surprising stability.

Our latest crypto market analysis points to some major shifts: Wall Street giants are stepping in, blockchain tech is making real progress, and Trump’s return to presidency has sparked new market dynamics.

We’re also seeing clearer regulations finally taking shape. What does this all mean? You guessed it. Crypto is becoming a serious player in mainstream finance.

To give you the full picture, we’ve dug into reports and interviews from a16z, Coinbase and Glassnode, Forbes, MarketWatch, and Reuters to break down major events this year and where things are headed.

CRYPTO MARKET ANALYSIS OF 2024: 3 MAIN HIGHLIGHTS

1. Trump’s Pro-crypto Stance and Its Impact

Let’s dive into the biggest game-changer of 2024 – Trump’s return to the political stage and its massive impact on crypto.

Now this isn’t just another political event – it’s going to transform the entire crypto landscape. Trump didn’t just talk about crypto; he made bold promises to turn the U.S. into a global crypto hub and even suggested adding Bitcoin to national reserves.

That’s the kind of statement that makes markets move.

And move they did. Once the election results came in, Bitcoin shot up by 40% in a matter of weeks, even hitting an eye-popping $99,655 just two days ago.

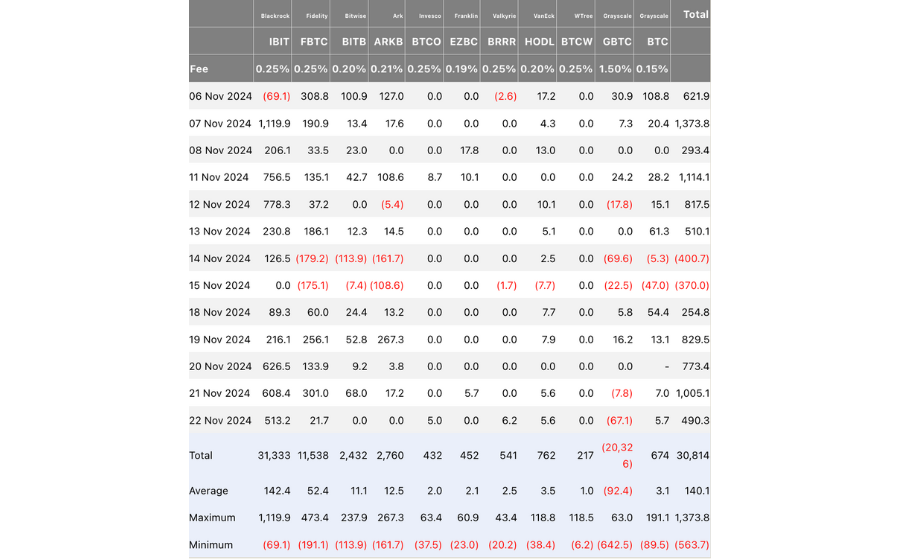

But here’s what’s really interesting – major players like BlackRock saw their Bitcoin ETFs explode with over $4 billion in new investments just two weeks after the election.

(source: Farside Investors)

But the impact goes way beyond just prices. Trump’s pro-crypto stance has lit a fire under the entire industry.

With more crypto-friendly faces in Congress and the promise of clearer regulations, both big institutions and everyday investors are feeling more confident about crypto’s future.

The best part? This might just be the beginning of a much bigger shift in how America approaches digital assets.

2. The ETFS

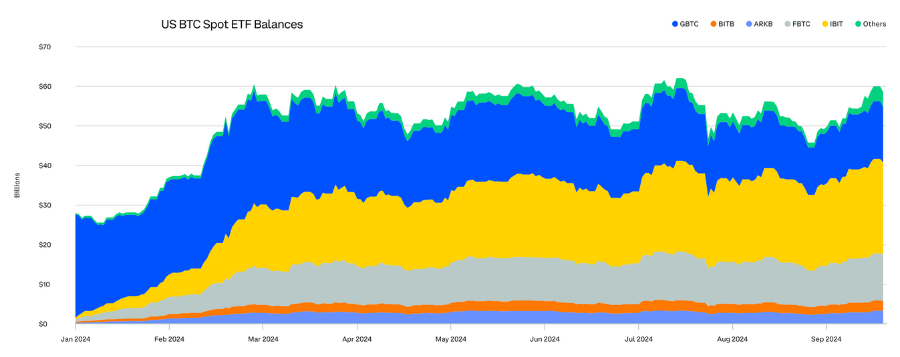

The second major shift we’re going to highlight in our crypto market analysis is: ETFs. They transformed how people invest in crypto. Bitcoin spot ETFs launched in January, followed by Ethereum in July.

This was huge because now anyone with a brokerage account could invest in crypto right through traditional market platforms, without dealing with the technical side of crypto wallets and exchanges.

BlackRock’s Bitcoin ETF took center stage, pulling in massive interest from Wall Street and retail investors alike. Their recent ETF options also gained serious traction, showing that investors were ready for more sophisticated crypto investment products.

This easier access didn’t just help cautious investors step into crypto – it opened doors for major institutions to increase their involvement.

The numbers speak for themselves: BTC spot ETFs alone pulled in over $60 billion in just months. Bitcoin and Ethereum have found their place in mainstream investment portfolios, while all this institutional money brought something the crypto market needed – stability and sustained growth.

(source: Glassnode)

This shift has reshaped how traditional finance views and handles crypto assets, creating a stronger connection between conventional investing and the crypto world.

3. Ethereum and Solana: Ecosystem Advancements

Now let’s look at the other two blockchain powerhouses – Ethereum and Solana.

Ethereum: First up, Ethereum hit a major milestone with its Dencun upgrade in March. The technical update tackled two of its biggest headaches: speed and cost.

By improving scalability and cutting down gas fees, the upgrade made Ethereum’s Layer 2 ecosystem more efficient than ever.

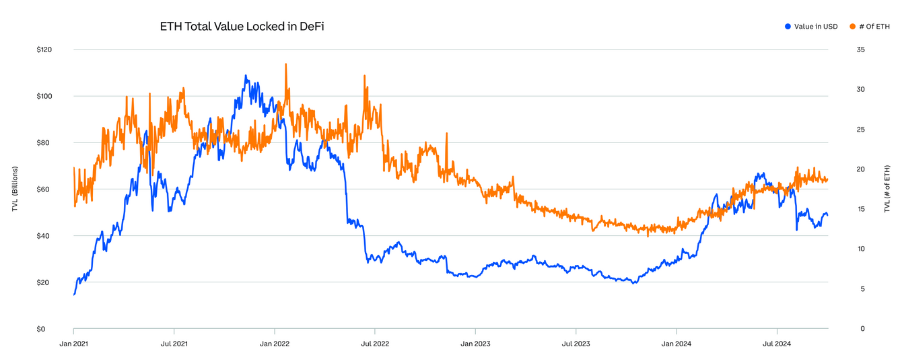

What happened next? Developers and users flocked to Ethereum’s DApps and DeFi projects because transactions became faster and cheaper.

The numbers showed just how much people trusted Ethereum’s future – staking hit all-time highs in Q3, and the value locked in DeFi protocols jumped 11% throughout the year.

(source: Glassnode)

This proved that Ethereum remained the go-to platform for serious blockchain development.

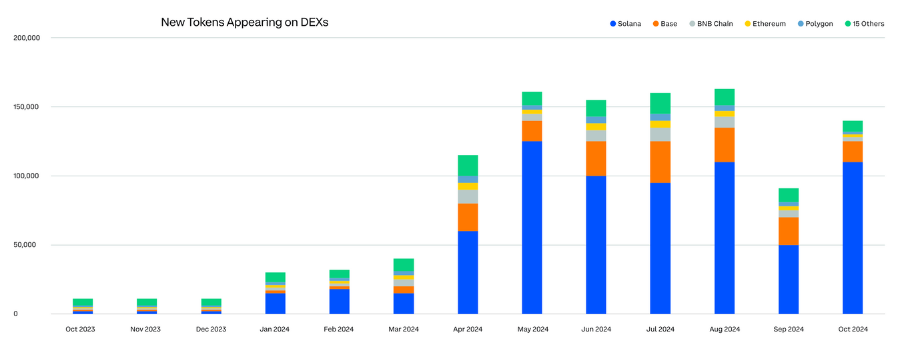

Solana: Meanwhile, Solana exploded onto the scene in its own unique way. With lightning-fast transactions and minimal fees, it became the new playground for crypto innovation.

The platform saw a wild surge in memecoins – names like $BOME and $SLERF became overnight sensations. And we’re not talking about small numbers here – token creation shot up 13 times compared to last year.

(source: Glassnode)

What’s really interesting is how these two blockchains carved out their own spaces.

Ethereum became the trusted platform for serious DeFi projects and institutional players, while Solana captured the excitement of retail traders and creative developers.

Both platforms showed us something important – there’s room for different approaches in crypto, whether you’re building long-term financial tools or launching the next viral token.

DRIVING FACTORS OF CRYPTO’S GROWTH IN 2024

2024’s crypto surge came from several powerful forces working together. Let’s break down what really moved the market this year.

First, big institutions stepped up their game in ways we’ve never seen before. While BlackRock and ARK Invest made headlines with their investments, their real impact went deeper – they brought stability to the market.

By focusing on long-term value instead of quick profits, they helped create an environment where mainstream investors finally felt comfortable entering the crypto space.

Second, stablecoins emerged as a major force, hitting $190 billion in market supply and processing an incredible $20 trillion in transactions. These aren’t just trading tools anymore, they’re revolutionizing how money moves across borders.

(source: DefiLlama)

Banks, businesses, and people worldwide are using stablecoins for faster, cheaper international payments.

Third, because of multiple blockchain advancements earlier mentioned in the crypto market analysis, DeFi platforms got more sophisticated.

Experimental tokens found their audience, and the whole ecosystem became more accessible to everyone from casual users to serious developers.

All these changes point to something bigger – crypto is evolving from a speculative market into a robust financial system. With stronger infrastructure, practical applications, and serious institutional backing, 2024 laid the groundwork for crypto’s next phase of growth.

CRYPTO MARKET ANALYSIS: PREDICTIONS FOR 2025

Looking ahead to 2025, all signs point to a transformative year in crypto. Here’s what the road ahead looks like.

Bitcoin’s Next Milestone

Bitcoin’s trajectory is aiming at the $200,000 mark. With ETFs paving the way and more institutions jumping in, we’re seeing a shift from speculative trading to serious long-term investment. Bitcoin is finally cementing its place in traditional investment portfolios.

Ethereum’s Expanding Role

Ethereum’s story is set to reach new chapters. The groundwork laid by Layer 2 solutions and improved scalability means we’ll likely see DeFi evolve in ways we haven’t imagined.

More importantly, Ethereum’s becoming more user-friendly, which could spark a wave of new applications in gaming, social platforms, and business solutions.

Solana’s Continued Rise

Solana’s momentum shows no signs of slowing. Its lightning-fast network has already proven perfect for creative projects and viral tokens.

In 2025, we might see Solana become the go-to platform for emerging blockchain industries, attracting both experimental projects and serious enterprise applications.

Stablecoins and Financial Integration

Stablecoins are positioned to bridge the final gaps between crypto and traditional finance. As more businesses recognize their potential for international payments, we’ll likely see deeper integration with existing financial systems. Clear regulations could finally arrive, opening doors for wider adoption.

The bigger picture? 2025 could be the year crypto stops being the “alternative” and becomes just another part of how we handle money and build technology. We’re moving toward a world where blockchain solutions are for everyone.

CRYPTO IN MAINSTREAM FINANCE

2024 reshaped crypto in ways few could have predicted.

Trump’s return sparked market confidence, ETFs opened new doors for investors, and blockchain technology hit major milestones through platforms like Ethereum and Solana. The real story unfolds as crypto secures its position in mainstream finance.

Read more: Trump’s Victory and Federal Reserve Rate Cuts: Impact on Bitcoin’s Fourth Halving Bull Run

Looking at multiple crypto market analysis for 2025, one of the consensus is continued growth.

Bitcoin approaches $200,000, blockchain ecosystems evolve, and institutional involvement deepens. The foundation stands ready, backed by proven technology and market maturity.

If anything, we’re witnessing a new chapter in financial history, and it’s going to be life-changing.

More articles about the crypto market:

- Crypto Bull Market 2024: What It is and When to Buy

- 2024 Crypto Market Predictions Backed by Technical Analysis

- 2024 Top 5 Crypto Market News Websites

- A Review of Crypto Market Trends in the First Half of 2024

FAQS

- How high will Bitcoin grow?

Analysts from the research firm Bernstein predict that Bitcoin could reach $200,000 as ETFs and institutional adoption continue to grow.

- When is the next crypto bull run?

While crypto is rallying now, analysts forecast the major bull run in 2025, with potential volatility until economic policies stabilize.

- How did Trump’s election affect Bitcoin’s price?

Bitcoin surged 40% after Trump’s win, reaching $99,655 within weeks.

- How did Solana perform in 2024?

Solana saw 13x growth in token creation, becoming a hub for memecoins like $BOME and $SLERF.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!