KEYTAKEAWAYS

- America's Strategic Shift from "Regulatory Siege" to "National Reserve"

- Belarus' "Mining to Save the Country" Experiment Under Energy Dilemma

- Crypto Geopolitics and Energy Power Rewoven

- KEY TAKEAWAYS

- AMERICA’S STRATEGIC SHIFT FROM “REGULATORY SIEGE” TO “NATIONAL RESERVE”

- BELARUS’ “MINING TO SAVE THE COUNTRY” EXPERIMENT UNDER ENERGY DILEMMA

- DISSECTING GLOBAL INDUSTRY CHAIN CHANGES AMID MINING MACHINE ROARS

- CAN MINING BECOME A DRIVER OF ENERGY TRANSITION?

- CRYPTO GEOPOLITICS AND ENERGY POWER REWOVEN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In March 2025, the global cryptocurrency sector welcomed two major announcements: After Trump declared XRP, ADA, and even SOL would be included in the crypto strategic reserve, aiming for “crypto hegemony”; Belarus President Lukashenko ordered power grid upgrades and vigorous development of cryptocurrency mining, attempting to convert excess electricity into digital gold. Sovereign nations accelerating their deployment in the crypto economy further reveals the deep entanglement of energy, finance, and geopolitics in the digital era.

AMERICA’S STRATEGIC SHIFT FROM “REGULATORY SIEGE” TO “NATIONAL RESERVE”

On March 2, Trump posted on social media, “After years of suppression by the Biden administration, the U.S. cryptocurrency reserve will elevate the status of this critical industry, which is why my digital asset executive order directs the Presidential Working Group to advance cryptocurrency strategic reserves including XRP, SOL, and ADA. I will ensure America becomes the world’s cryptocurrency capital. We are making America great again!” This decision is interpreted as a precautionary measure against the decline of dollar hegemony—by incorporating cryptocurrencies into the reserve system, the U.S. is attempting to open a new battlefield beyond the central bank digital currency (CBDC) race to consolidate its financial discourse power.

Solana ecosystem DEX Titan founder Chris Chung stated, “It’s clear that U.S. President Trump is now the driving force behind crypto market trends. He’s definitely showing favoritism toward certain crypto tokens. But I believe the U.S. government’s vote of confidence may accelerate the approval of altcoin ETFs, including Solana, XRP, and other tokens waiting for SEC decisions.”

Trump’s statement quickly triggered a strong market reaction. Solana ecosystem DEX Titan founder Chris Chung said: “It’s obvious that Trump is now a key driver of crypto market trends. He’s clearly favoring certain crypto tokens, but more importantly, this vote of confidence from the U.S. government may accelerate the approval process for altcoin ETFs, including Solana, XRP, and other tokens awaiting SEC decisions.”

This statement reveals the dual objectives of Trump’s policy: On one hand, attracting Wall Street capital to flow back by supporting specific cryptocurrencies and revitalizing the domestic mining industry; on the other hand, using crypto reserves as a strategic chip to counterbalance the rapid expansion of China’s digital yuan in cross-border payments.

BELARUS’ “MINING TO SAVE THE COUNTRY” EXPERIMENT UNDER ENERGY DILEMMA

The path to digital monetization of excess electricity. “We have surplus electricity, so let it produce cryptocurrency!” Lukashenko clearly instructed at a new government meeting. According to Belarus Energy Ministry data, the country’s electricity price is only 1/3 of the EU average, and 30% of electricity capacity sits idle annually due to weak industrial demand. The government plans to invest $500 million by 2026 to upgrade 5,700 kilometers of power grid, while allocating areas around three nuclear power plants in the north to build large mining farms, aiming to attract global mining enterprises.

Financial breakthrough under the shadow of sanctions. Since the 2020 political crisis, Belarus has suffered multiple rounds of Western sanctions, severely hindering traditional cross-border payment channels. In response, the country is advancing on two fronts: earning “hard currency” Bitcoin through mining while accelerating the development of a CBDC platform based on Hyperledger Fabric, attempting to bypass the SWIFT system with the digital Belarusian ruble. Experts believe this “mining farm + digital currency” combination may provide a new economic survival template for sanctioned countries.

DISSECTING GLOBAL INDUSTRY CHAIN CHANGES AMID MINING MACHINE ROARS

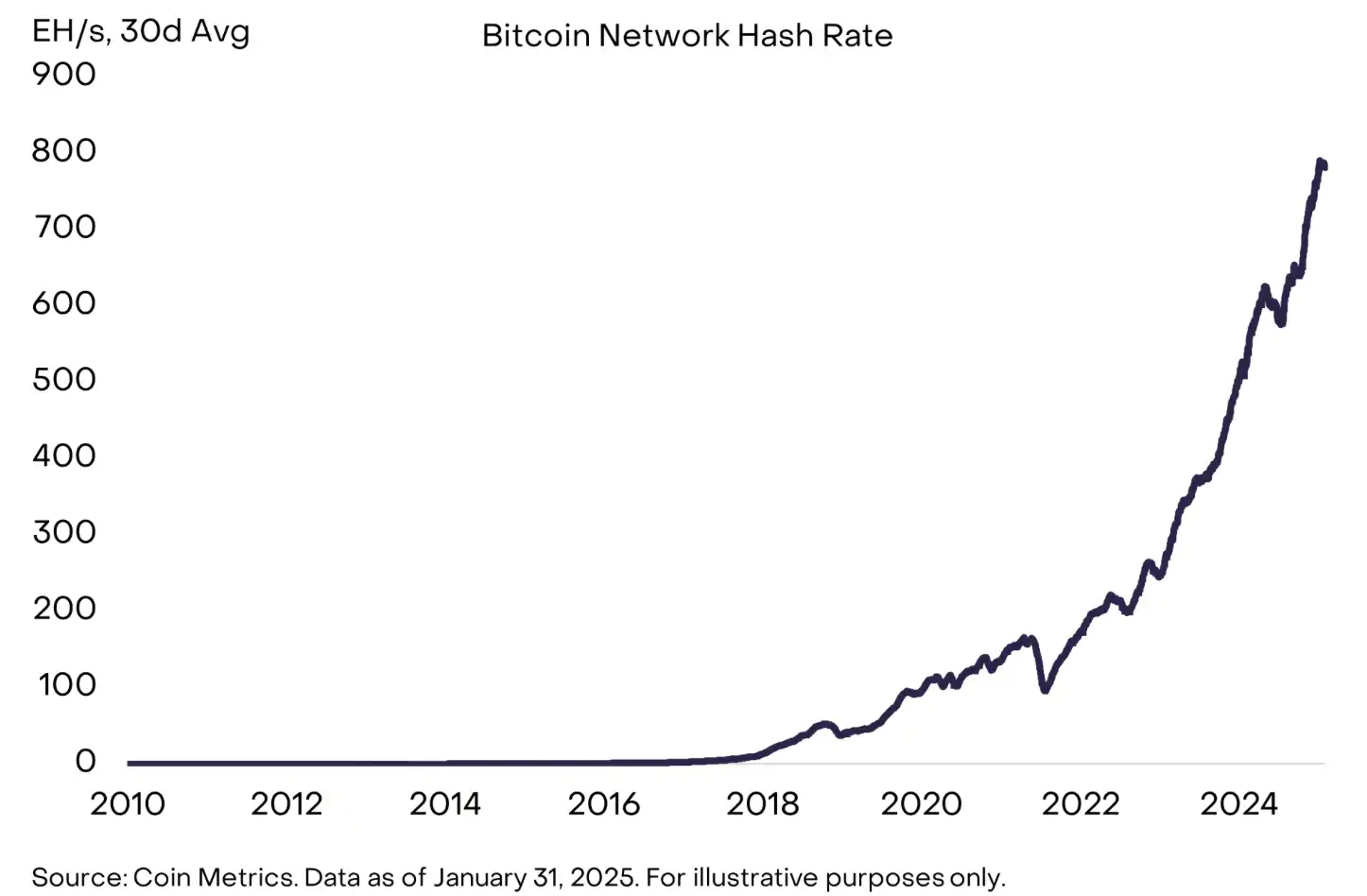

According to Grayscale’s report, global Bitcoin miners’ annual revenue exceeded $23 billion in 2025, but the industry is undergoing structural reshuffling. Mining companies’ cost polarization is significant: North American listed mining companies have a per-coin production cost of about $34,000-$59,000, while Belarus mining farms leveraging cheap energy are expected to compress costs below $20,000. This cost difference is catalyzing a “hashpower migration wave”—large numbers of mining machines are moving from high-electricity-price Europe to Central Asia and Eastern Europe.

AI and mining represent the power game of data centers. “Future mining farms are not just computing power factories, but infrastructure builders for the AI revolution.” Mining giants like Core Scientific have signed long-term contracts with AI companies to redirect idle computing power toward machine learning training. The underlying logic of this transformation lies in the fact that while Bitcoin mining machines’ ASIC chips specialize in hash calculations, their supporting cooling systems, power facilities, and land resources perfectly match the core requirements of AI data centers.

CAN MINING BECOME A DRIVER OF ENERGY TRANSITION?

Although the Bitcoin network consumes 175 TWh of electricity annually (0.2% of global use), Grayscale data shows its clean energy usage rate (54%) far exceeds traditional industries. Belarus’s case is even more symbolic—80% of the country’s electricity comes from nuclear and natural gas, with mining farms directly consuming redundant grid power, avoiding resource waste caused by “abandoned electricity.” Meanwhile, U.S. mining company Crusoe Energy generates electricity for mining by capturing associated methane from oil fields, reducing 500,000 tons of CO2 equivalent emissions annually.

Bitcoin mining’s unique attributes (interruptible, location flexible) are reshaping the energy market. In Texas, mining farms participate in grid regulation as “elastic loads,” smoothing the volatility of wind and solar generation; in Africa, off-grid mining farms combined with renewable energy projects create economic value for remote areas. Lukashenko’s decision may reveal a future scenario: mining will become a standard configuration in national energy strategies.

CRYPTO GEOPOLITICS AND ENERGY POWER REWOVEN

As Trump’s reserve plan meets Belarus’s mining blueprint, a global resource redistribution centered on cryptocurrency has already begun. Policy makers are starting to realize: computing power is power, electricity is currency. Potential new models that may emerge include:

- “Energy-Computing Power” Alliance: Oil-producing countries cooperating with mining enterprises to transform resource endowments into digital assets;

- Reserve Currency Multipolarization: Sovereign nations increasing the proportion of crypto reserves, impacting the IMF’s Special Drawing Rights system;

- Carbon Credit Mining: Mining farms obtaining dual benefits (block rewards + carbon credits) through carbon capture technology.

However, risks also follow like shadows: excessive concentration of computing power may threaten Bitcoin’s decentralization ideal; sovereign nations’ entry may politicize the crypto market. The only certainty is that cryptocurrency is no longer a geek’s toy but has become a new chessboard for great power games.

From Trump’s Washington to Lukashenko’s Minsk, policy makers are trying to forge cryptocurrency into a strategic weapon for the new era. This concerns whether humanity can find the golden balance point between economic growth, environmental protection, and financial stability amid the dual waves of energy revolution and digital revolution. Perhaps as Satoshi Nakamoto envisioned: the real currency war will ultimately be decided on the blockchain.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!