KEYTAKEAWAYS

-

A significant portion of CVC investments in Southeast Asia, particularly the top 20 deals, were in Indonesian startups, followed by Singaporean and Filipino startups.

-

The article introduces the concept of venture studios, where corporations invest in and actively participate in startup projects, giving the corporations full control over projects.

-

Singapore is highlighted as a leader in venture studios in the Asia-Pacific region, with initiatives like the Corporate Venture Launchpad 2.0 encouraging companies to establish new ventures through partnerships with designated venture capital studios.

-

Singapore's focus on industrial transformation and the development of innovation ecosystems, such as the Jurong Innovation District, is discussed as a means to drive economic growth and innovation.

-

Singapore's Budget 2023 includes tax credit incentives for R&D and technology investment. However, the country is also under pressure from BEPS 2.0, which aims to introduce a minimum effective tax rate for large multinational enterprises.

- KEY TAKEAWAYS

- INTRODUCTION

- “VENTURE STUDIO” BECOMES A NEW INNOVATION MODEL FOR ENTERPRISES

- TWO VENTURE STUDIO TYPES: INDEPENDENTLY OWNED AND OPERATED BY CORPORATIONS

- SINGAPORE IS LEADING VENTURE STUDIOS IN ASIA

- SINGAPORE UTILIZES VENTURE CAPITAL STUDIO TO FACILITATE CORPORATE REINVENTION

- SINGAPORE EMPHASIZES THE NEED FOR ENTERPRISES TO TRANSFORM FROM DIGITAL TO FULL-FLEDGED

- LONG-TERM GOAL: TO SUPPORT THE TRANSFORMATION AND UPGRADING OF FOREIGN-INVESTED ENTERPRISES THROUGH PRIVATE CAPITAL

- DISCLAIMER

- WRITER’S INTRO

CONTENT

INTRODUCTION

500 Startups is an example of a successful venture capital studio in Southeast Asia. The global venture capitalist has a strong presence in Southeast Asia and has helped incubate hundreds of startups in the region. Through its accelerator program and seed-stage investments, 500 Startups has helped create jobs and drive economic growth in countries such as Indonesia, Thailand, and Vietnam. Another venture capital studio making a positive impact in Southeast Asia is Venturra Capital, a Jakarta-based early-stage financing and business advisory firm for new entrepreneurs in Southeast Asia, which has supported new ventures to launch and scale up. One of the businesses it worked with is Sociolla, an Indonesian e-commerce platform that has raised more than $40 million. In addition to providing capital and resources, enture studios also help foster an entrepreneurial culture in Southeast Asia, such as nurturing a new generation of tech talent and entrepreneurs who can drive innovation in the region. Other venture studios in Southeast Asia include Menyala, Spartan Labs, Wavemaker Impact, Ecoxyztem, SCB 10X, and BCG Digital Ventures, and the model is already multiplying in Southeast Asia.

In light of global challenges such as soaring inflation and global monetary tightening, Southeast Asia’s corporate venture capital (CVC) deal volume peaked at US$1.469 billion (62 deals) in Q1 2022. It began to decline due to the changing environment, culminating in a deal value of US$562 million (31 deals) in Q4 2022. The average deal size dropped significantly from US$24 million (Q1) to US$15 million (Q2) and US$8 million (Q3) but rebounded to US$18 million in Q4, underscoring a negative shift in investor sentiment and risk aversion. A closer look at the top 20 rounds of CVC participation shows that 56% (US$1.056 billion) of investments were in Indonesian startups, 37% (US$692 million) were in Singaporean startups, and 7% (US$127.5 million) were in Filipino startups. Among them, the first five rounds of funding related to Indonesian startups accounted for 38% (US$708 million) of the total funding (US$1,875.5 million) of the top 20 companies, demonstrating that Indonesia has become a significant country for CVC investing due to the advantages of the digital economy and the demographic dividend.

Figure: Top 10 Active CVCs in Southeast Asia

Source: Stryber

Source: Stryber

“VENTURE STUDIO” BECOMES A NEW INNOVATION MODEL FOR ENTERPRISES

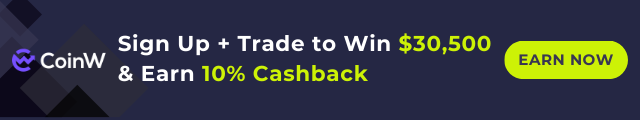

Over the past few decades, corporate innovation has evolved using many approaches and frameworks that have appeared and disappeared over time. Traditionally, large-scale innovation has been driven by the research and development(R&D) departments of large firms, which have invested significant amounts of money and human resources in R&D to ensure that the learning curve at the forefront of technology and market mastery is smoothed out and that market share can be strengthened through economies of scale. Large companies have this competitive advantage in an era of global division of labor and monolithic technological development.

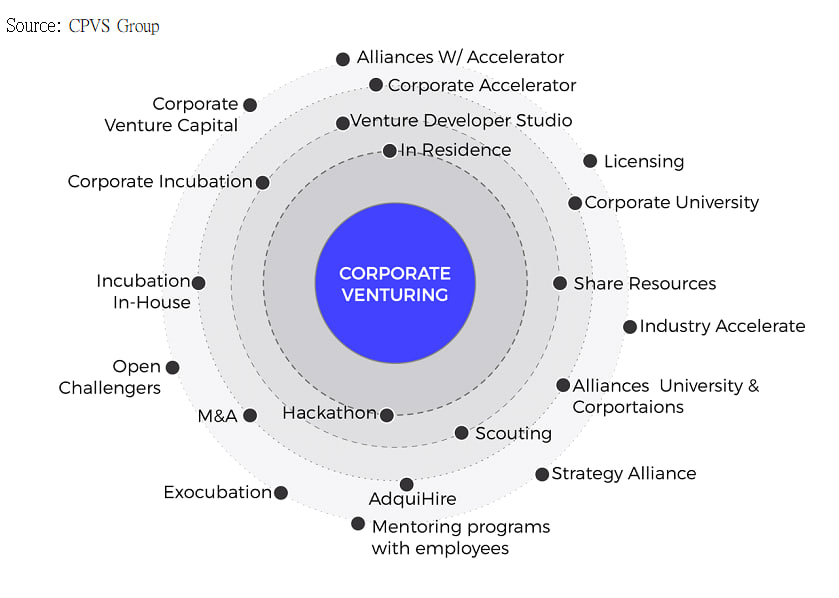

However, since the 1990s, rapid changes in consumer preferences, the emergence of multiple digital technologies, and the rise of venture capital have changed the way companies innovate: As many of the digital technologies and talents came from outside the company, companies started to build up their innovation ecosystems and shifted from “internal innovation” to “open innovation,” such as joint ventures, strategic investments, mergers and acquisitions(M&A), and venture building. Among them, venture building has been an emerging mode of corporate innovation in recent years. Unlike incubators or accelerators, venture studios , belonging to the branch of the corporations, invest capital in a startup project and willing to offer more strategies and resources to startups Venture studios will decide whether or not to launch an innovation project; then, studios assign an internal team (e.g., technicians, consultants, marketing, sales, etc.) to be involved in all project management and operation aspects giving the corporations full control over projects.

Figure:Various Modes of Innovation in Firms as Observed by Real Impacts

Source: Stryber

Corporate venture capital has become a complementary form of cooperation between corporations and startups. The problem with traditional in-house entrepreneurship is that new ventures are entirely money-spinning units. In addition to the difficulty of estimating the return on investment, it is also easy to affect the allocation of resources to other departments, leading to the dilemma of “neither fish nor fowl.” Through collaboration with corporations, new ventures can obtain capital and a large validation site, and with the help of corporations’ acumen in market, industry, and technology. They can reduce the risk of taking a wrong path. The proper percentage of investment can also reduce the cost of capital for entrepreneurs. For new business units, spin-offs can reduce the resistance to innovation within the existing organization. After the spin-off, the startups have to be responsible for their own operating losses, which is beneficial to continuous innovation in the long run. For enterprises, the convergence of technologies has led to explosive and wide-ranging innovations, with various technologies generating different applications or even becoming new technologies.Furthermore, the integration of software and hardware makes it difficult for many enterprises to cope with it at a time. Many external innovation utilities help enterprises avoid becoming the laggards of transformation and even grasp the second growth curve under the premise of new business materialization.

TWO VENTURE STUDIO TYPES: INDEPENDENTLY OWNED AND OPERATED BY CORPORATIONS

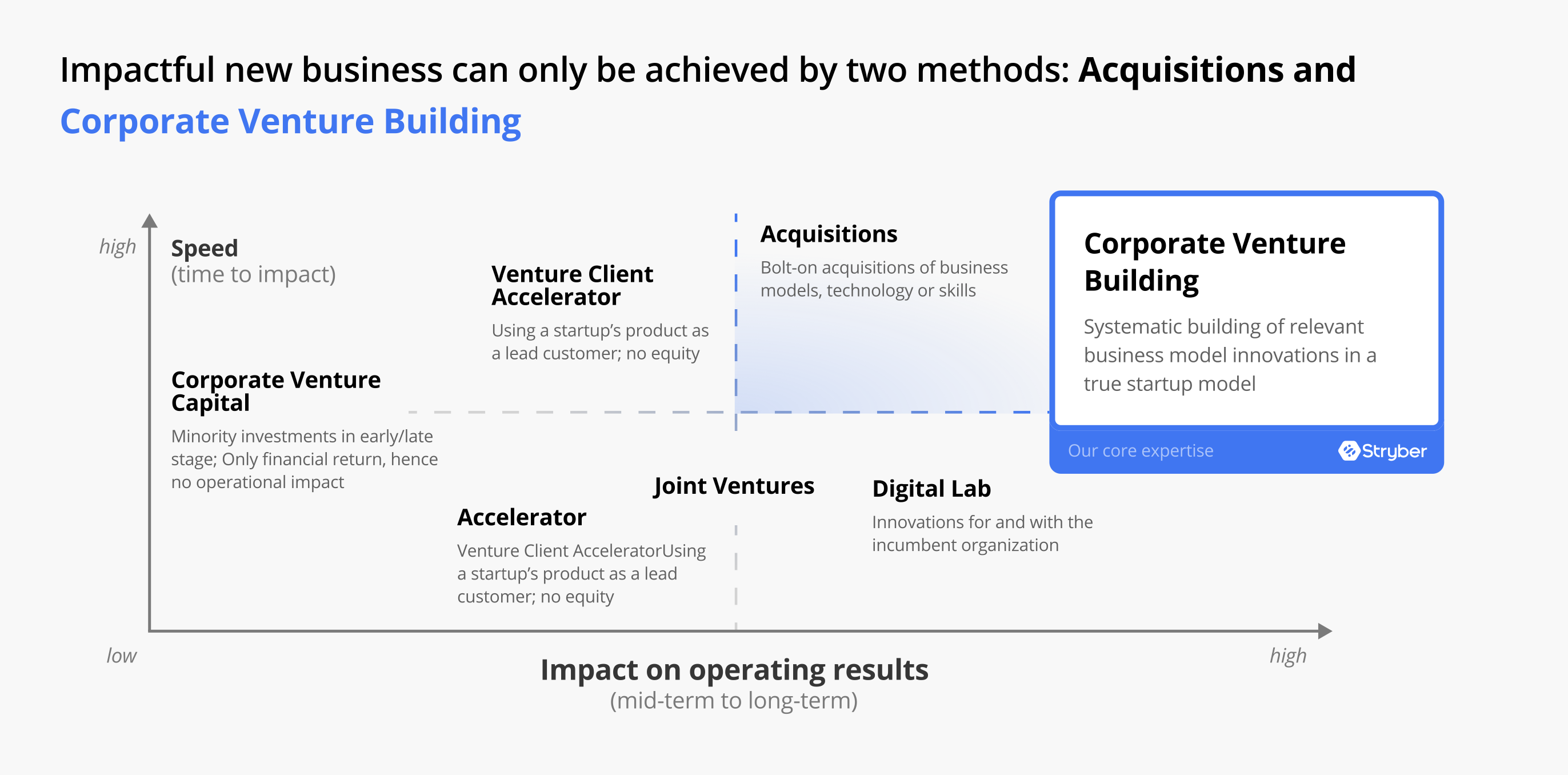

Venture studios are categorized into two types, the most common of which are independently owned and operated by corporations. Independently owned studios provide all the resources for a new venture, such as a technical assistance team, strategic planning, and investment capital. Independently owned studios tend to be externally funded and have several general partners(GPs), with the most famous examples being Expa and Rocket Internet from Europe. In contrast to the former, venture studios operated by corporations are also known as corporate venture studios, which often partners with the CVC department of a large corporation to provide talent, capital, and strategic direction. The CVC department typically provides the initial capital and strategic direction for a partnered venture studio, while the studio offers the talent, process coaching, and expertise to “produce” the startup.

Typical Operation Flow of Venture Capital Studios

Source: CPVS Group

Source: CPVS Group

However, why do large enterprises have to adopt this mode of cooperation? As we all know, enterprises have to innovate internally and externally, and external innovation commonly involves the establishment of investment units, direct investment, venture capital, private equity, Fund of Funds(FoF), the establishment of enterprise accelerators, and so on, which are all means of innovation. Large corporations are also trying to set up internal accelerators for new businesses. These accelerators are often effective in extending the competitive advantage and technology development of the original business, but, as predicted by the Innovator’s Dilemma, they often encounter difficulties in commercialization and over-innovation of the business which may be affected by the original business, leading to budget cuts or even project shutdowns. The corporate venture studio helps organizations build new businesses by separating them from the core business, which allows startup teams to find a market being fit in an uncertain environment, accelerating the benefits of innovation by introducing an agile culture. Well-known corporate venture studios include Citi’s D10X, Alphabet’s X, and Moonshot Factory.

SINGAPORE IS LEADING VENTURE STUDIOS IN ASIA

While the corporate venture model proliferates in Europe and the Middle East, it has yet to be utilized on a large scale in the Asia-Pacific region. Innovation and startups in Southeast Asia have naturally become a focus of attention in Asia due to the rapid growth of the region’s digital economy. The Corporate Venture Launchpad, launched in May 2021 by the Singapore Economic Development Board(EDB), has already yielded considerable results, with companies from various industries such as Bosch, BASF, Olam, OCBC, Keppel Land, Standard Chartered Bank, Schneider, etc., having started to set up various new businesses. It is easy to see that foreign companies in Singapore are becoming a significant source of innovation, as the country’s vast network of connections, global resources, and mastery of digital technology have brought Singapore’s already vibrant creative energies to the next level of innovation.

Now in its 2.0 version, Corporate Venture Launchpad 2.0 is a S$20 million program that aims to help companies establish new ventures in Singapore by partnering with EDB-designated venture capital studios. The program is divided into two phases, the first of which is a “Proof of Concept,” which will provide companies with 50% of the grant amount that is used to cover the cost of each Proof-of-Concept(up to a maximum of SGD500,000) by using a methodology so called “SPRINT.” “SPRINT” is originally proposed by Google Ventures, the approach is based on design thinking to enable users to solve problems efficiently in a specific timeframe while responding to a specific business problem through user-centered design, prototyping, and validation with real users. The second phase, named Venture Initiation, is the implementation phase, where new business ventures provide new products or services, and the EDB’s investment unit may invest in these ventures to accelerate their growth while sharing the entrepreneurial risks associated with the startup of a company’s stand-alone new business. This will encourage Singapore’s local, family-owned, and foreign companies to develop new ventures outside their own businesses, providing them with a continuous source of innovation and strengthening the country’s innovation ecosystem.

SINGAPORE UTILIZES VENTURE CAPITAL STUDIO TO FACILITATE CORPORATE REINVENTION

There are three types of participants in Singapore’s venture capital program: startups, corporations, and consulting firms. Unlike the typical accelerator model, Singapore’s startups usually spin-off from a company’s business unit or external startups. The technology is then fast-tracked to commercialization through designated venture capital advisory firms (McKinsey, BCG, FutureLabs, Rainmaking, Mach49). In the process, the company can not only provide capital but also leverage the assistance of external investment institutions, which can be regarded as a kind of “externalization of internal entrepreneurship” mode of operation. If the new venture can enter the market and establish an initial source of customers, it can be further considered for scaling up. The company retains control of the new venture through majority shareholding. It can receive financial rewards when the new venture goes public or earn profits without going public, which is quite flexible. The mechanism is facilitated by Singapore’s Economic Development Board(EDB).

Figure: Among hundreds of ways for enterprises to innovate, venture capital studios are gradually becoming mainstream.

Source: CPVS Group

So far, 40 companies have used this mechanism to conduct external business innovation. As Singapore is one of the more technologically advanced economies in Southeast Asia, foreign and local companies can take advantage of the favorable business environment, abundance of digital talent, and friendly tax regime to invent.

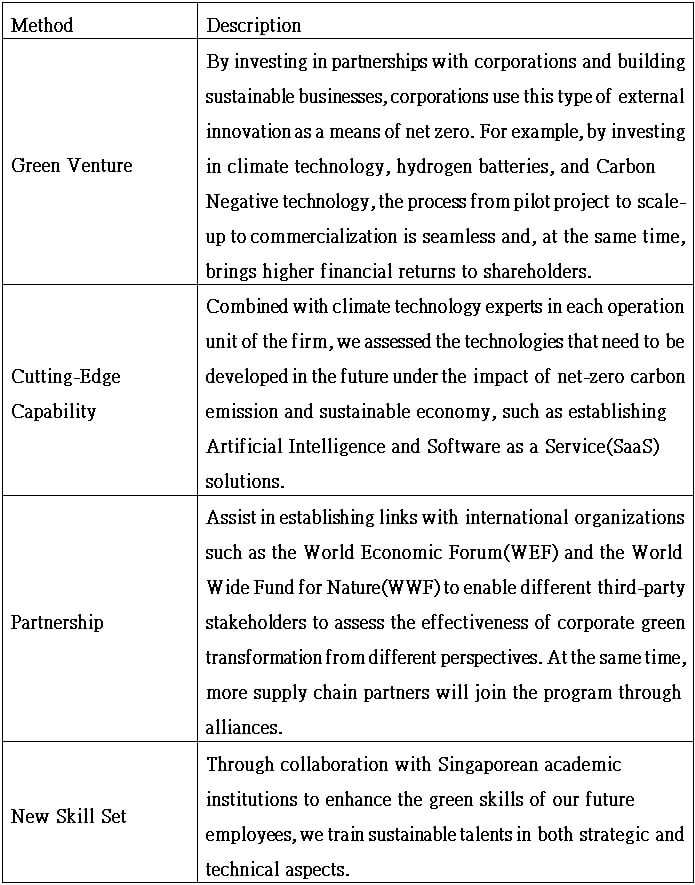

For instance, German automaker Bosch has set up a Grow 2.0 Innovation Hub to help Singaporean startups make good use of Internet of Things(IoT) technology to digitize their business. The startup AquaEasy, assisted by Bosch’s IoT solutions team, uses sensors and algorithms to increase the acreage of the farmer’s field. Another famous case is the establishment of GrowthWorks by P&G. The United States FMCG company encourages its internal team to start and spin off its business through technical counseling and providing US$12 million capital. With the dividends of the Southeast Asian market size, P&G hopes to raise three unicorns within ten years. All of this is made possible by collaborating with a corporate venture studio. Another similar case is BCG Venture Studio, the corporate venture studio of BCG, whichIt has recently established an Asian Climate & Sustainability Hub(CSH) in Singapore and is helping companies conceive projects in four ways, as the table analyzed below.

Table. BCG Climate & Sustainability Hub Key Layouts

Source: BCG Digital Ventures

Source: BCG Digital Ventures

The foreigner-first approach can drive innovation in Singapore’s local enterprises. Although the country’s industrial composition is dominated by the service sector, which accounts for nearly 70% of GDP, with retail sales, business services, finance, and insurance as the main items, they still need innovation to grow new branches from old trunks; the other 30% is made up of manufacturing industries, with food manufacturing, precision manufacturing, and aerospace as the mainstays. These industries also need to find new growth curves, especially as they are facing the restructuring of their value chains due to the growthof digital and green technologies, making it even more urgent for time-honored brands to evolve. Singapore enterprises also confront upstream and downstream pressures, and establishing ecosystems is an appropriate response. For one thing, they can consolidate upstream supply chain partnerships and enhance product competitiveness. At the same time, downstream enterprises can strengthen value chain benefits through technology integration and value-added functions to meet the challenges of an ever-changing market.

SINGAPORE EMPHASIZES THE NEED FOR ENTERPRISES TO TRANSFORM FROM DIGITAL TO FULL-FLEDGED

The subsidies that businesses receive also affect their willingness to innovate and their ability to collaborate with startups. Recently, Singapore unveiled its Budget 2023, titled “Moving Forward in a New Era,” which announced many measures to boost economic development, enhance the skills and expertise of the workforce, strengthen social cohesion, and promote the country’s resilience. Government spending is expected to reach S$104.2 billion(US$78.1 billion), with an overall budget deficit of S$400 million(US$299 million) in 2023, or 0.1% of national GDP. Meanwhile, the country expects its economic growth to slow down, with statistics suggesting it will be between 0.5% and 2.5% in 2023, and, external factors such as the ongoing Russia-Ukraine conflict and the economic downturn in the US and Europe will significantly impact global trade which causeSingapore’s inflation rate is expected to remain high, at least through the first half of 2023. At the same time, this year’s budget focuses on innovation across industries, a departure from 2022, which only emphasized corporate investment in digitalization and operational optimization. Although the government has long pledged to invest S$25 billion from 2021 to 2025 to encourage research and technological innovation and has even launched the Industry Transformation Roadmap(ITP), the country’s businesses and government need a more comprehensive operational strategy because of the impact of the external environment, especially in the light of the fact that ASEAN, while currently a major location for international companies, it also brings intense competition for technology and talent, which is undoubtedly a major challenge for Singapore and also are market entry opportunities for startups.

Apart from the macroeconomic impact and the need for industrial restructuring, geopolitical stability has a considerable effect on Singapore as well, especially on the development of key industries, the survival of small and medium-sized enterprises(SMEs), and the issue of foreign investment. Now that the United States has decided to take the lead over China in specific technologies, especially in critical industries such as semiconductors and green energy, it has banned the flow of high-end chips and talent to China and formed alliances to stifle China’s development of these technologies while China is building its own system of technological plus market autonomy. A race for leadership in key technologies is spreading globally and is difficult to negotiate in the current situation . This puts Singapore in a dilemma, as China has long been a major investor in the country and is expanding into countries like Indonesia and Vietnam, while the United States is making a solid return for Asia through the Indo-Pacific Economic Framework and is asking many ASEAN countries to take a stand. In addition, after China’s recent “laser incident” with the Philippines in the South China Sea and the “hot air balloon incident” with the United States, it seems that the ASEAN countries have begun to consider striking a balance between economic development and national defense, which makes it even more challenging for Singapore to maintain its neutrality, especially balancing trade dependence and attracting foreign investment.

As a result, the careful planning of each industrial zone and the key industries to locate in Singapore has become one of the ways to promote transformation in the country. Among all the initiatives to transform the manufacturing sector, Jurong Innovation District(JID), a 600-hectare-plus area in Singapore’s Western Corridor, has attracted much attention. Advanced Remanufacturing and Technology Center(ARTC), a division of the Agency for Science, Technology and Research(A*STAR), has partnered with more than 60 of the world’s leading corporations to build demonstration factories and high-tech industrial parks of the future through public-private partnerships using technologies such as the Internet of Things(IoT), Artificial Intelligence(AI), and Augmented Reality(AR)., A*STAR has launched a 15,000-square-foot Smart Demonstration Factory in the Jurong Innovation District, where companies across industries and value chains can collaborate to develop and test advanced manufacturing technologies. Currently, R&D players in Singapore are entitled to a 100% tax deduction on R&D projects, subject to conditions, and an additional 150% tax deduction on related staff costs and consumables. Under its Budget 2023, the government provides a 400% tax deduction on the first S$400,000(US$298,000) of consumables and staff costs incurred in qualifying R&D projects to encourage companies to invest heavily in R&D activities. Under the intellectual property rights component, a 100% tax deduction is available for capital expenditure on qualifying IPRs according to the current tax rules. Also, a 200% tax deduction is available for the first S$100,000(US$74,600) of qualifying IP license expenditure.

However, while the 2023 budget proposes a number of tax credit incentives, Singapore has also come under pressure from BEPS 2.0, announcing that it will introduce a minimum effective tax rate of 15% from January 1, 2025, for large multinational enterprises (MNEs) headquartered in Singapore. BEPS 2.0 is a global tax framework that aims to reduce the impact of base erosion by ensuring a fairer distribution of tax rights among large multinational corporations through a set global minimum tax rate. As multinationals take advantage of loopholes in tax rules and shift profits to jurisdictions where tax rates are low or non-existent, resulting in a reduction in national tax revenues, Organization for Economic Co-operation and Development(OECD) introduced BEPS 2.0. Singapore will require multinationals with combined annual revenues of €750 million(US$851 million) or more to pay a 15% tax rate on profits earned in the jurisdictions in which they operate, but the profits related to startups shall not apply to it. These measures will help Singaporean companies innovate and allow venture studio startups more opportunities to collaborate with companies.

LONG-TERM GOAL: TO SUPPORT THE TRANSFORMATION AND UPGRADING OF FOREIGN-INVESTED ENTERPRISES THROUGH PRIVATE CAPITAL

In addition to investing in digital technology and strengthening R&D, leveraging external capital is an increasingly important way for companies to transform businesses. Heliconia Capital, a Temasek-owned investment entity, is one of the companies helping with this, providing equity financing to SMEs and assisting in transforming investee companies from operations to market development. To date, Singapore has invested US$1 billion to support the transformation of SMEs, investing in about 60 Singaporean companies, and US$2 billion in additional investment after witnessing the satisfying results from earlier financing. With 50% of these portfolio companies acquiring new capabilities and expanding beyond Singapore, the government intends to allocate an additional US$150 million to invest in potential SMEs through the SME Co-Investment Fund. It also plans to catalyze an additional US$300 million in private investment.

By 2022, Singapore attracted US$22.5 billion in fixed asset investment, driven by the electronics industry. Despite global headwinds, the electronics industry accounts for two-thirds of all Singapore’s fixed asset investment commitments at tht time.. These investments are expected to create 17,113 jobs when fully implemented over the next few years. Significant investments include UMC’s US$5 billion plant, which is scheduled to begin production of 22- and 28-nanometer wafers in 2024, accelerating the development of automotive electronics and 5G in the region, and Korean chemical manufacturer Cariflex’s US$350 million investment in the world’s largest polyisoprene latex plant in Singapore, which can be used in high-value medical products such as surgical gloves and condoms; PALL, a global supplier of filtration, separation, and purification products headquartered in the United States, is investing US$100 million in a manufacturing plant in Singapore, which is due to be completed in late 2023-early 2024, and is expected to more than double the filtration, separation, and purification supplier’s current production capacity; GOOD Meat, the artificial meat division of the United States food technology company Eat Just, is also planning to set up a meat production plant in Singapore, which is expected to be able to produce tens of thousands of pounds of lab-grown meat per year; and finally, Hilleman Laboratories, a vaccine research organization headquartered in Delhi, India, established a 30,000-square-foot manufacturing facility in February 2022, which, together with its existing R&D facility in Biopolis, will combine to form Singapore’s first vaccine manufacturing hub.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!